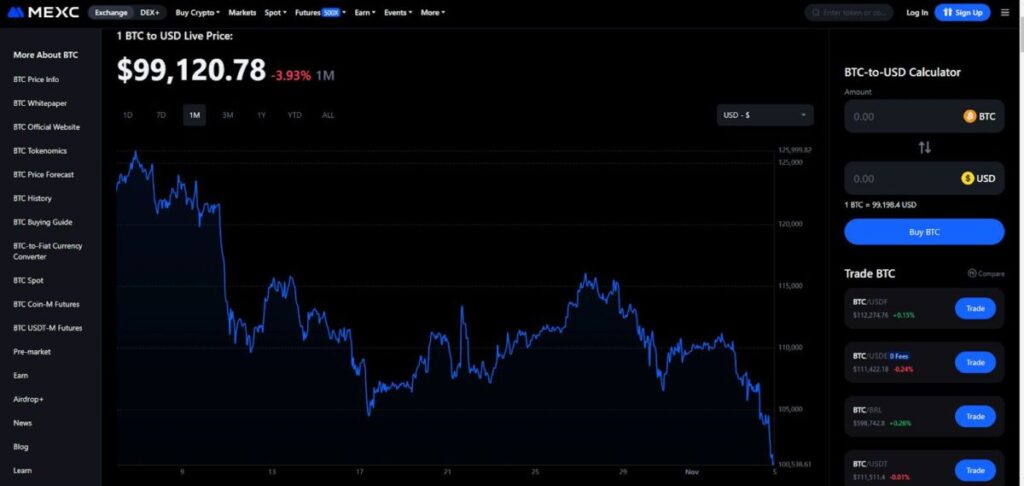

This week, the risks of falling bitcoin (BTC) below $100,000 increased. On the MEXC exchange MEXC the night before, the largest digital currency dropped to 101,200 USDT, whereas on November 2 it traded above 111,000 USDT.

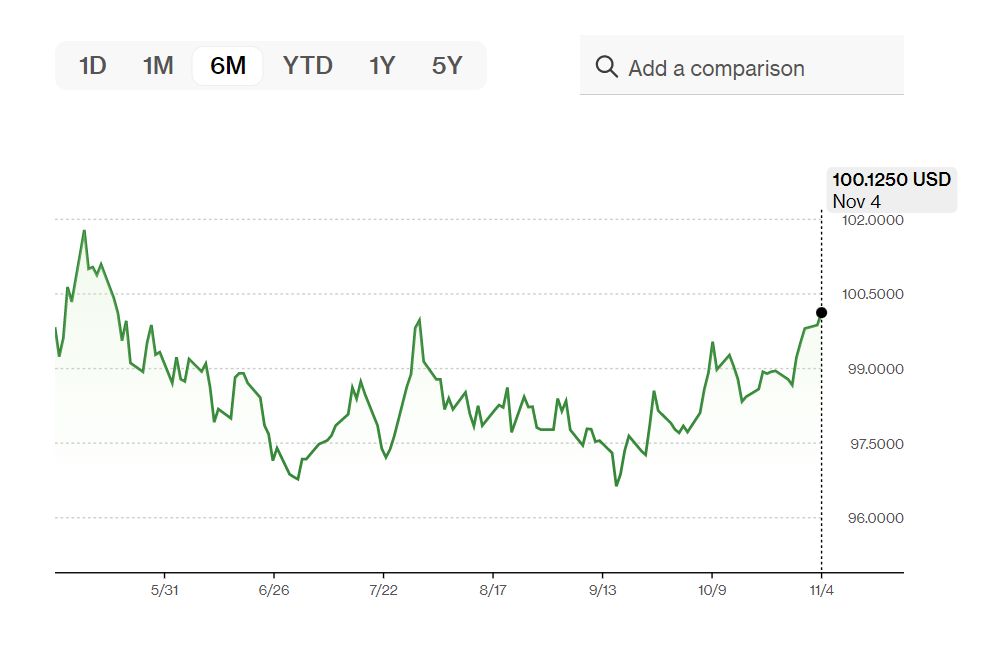

- Such a strong retreat of bitcoin indicates a redistribution of capital in favor of traditional assets. The US dollar index (DXY) on Wednesday rose to its highest level since July 31, 2025.

According to Bloomberg, the US currency has been gradually strengthening since mid-October, indicating investors’ desire to hedge risks amid global economic and political uncertainty.

The positive effect of the recent Fed rate cut turned out to be short-lived. The growth of digital currencies was quickly replaced by a fall in their value. However, in parallel, against the background of the weakening of the BTC rate, panic sentiments intensified on social networks.

Traders who are afraid of a $100,000 drawdown are aggressively selling cryptocurrency.

- Usually during such periods, the local bottom is reached, and after that medium and large addresses – sharks and whales resume shopping at comfortable prices.

1. Bitcoin has entered the oversold zone

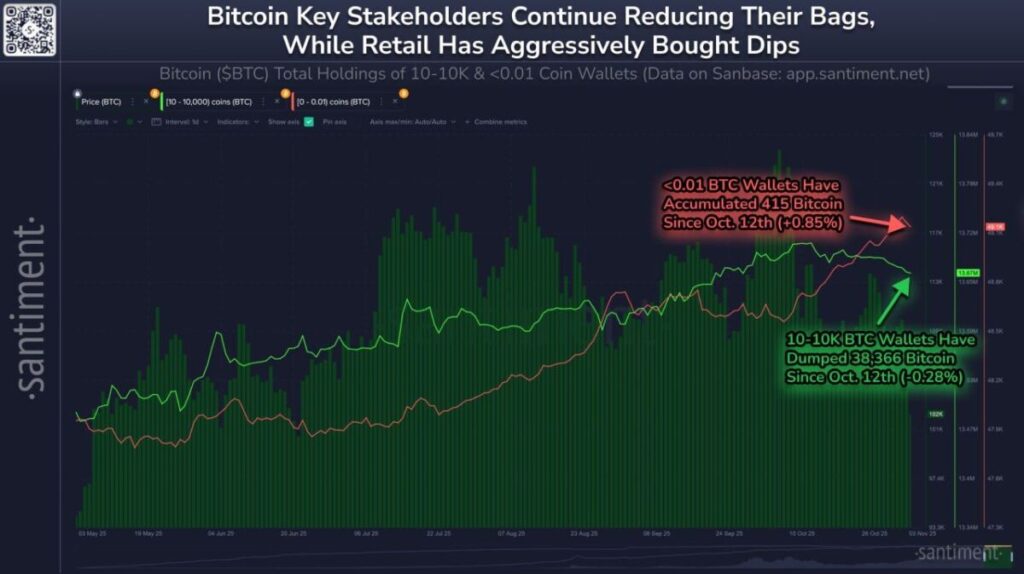

The relative strength index RSI in the middle of this week fell below 15, which indicates the entry of the asset into the oversold zone. Whales and sharks were on the list of the most active sellers in the second half of October.

According to Santiment, addresses with a balance of 10 to 10,000 coins have sold about 38,366 coins over the past two weeks.

- Since the end of August, whales and sharks have purchased 110,010 BTC. Their swims provoked an increase in the value of the digital currency. But then it was these cohorts of investors who began to take profits.

Whales earned $272 million following the October dumping. Now whales and sharks in total control 13.68 million coins, which is 68.62% of the market supply of digital currency.

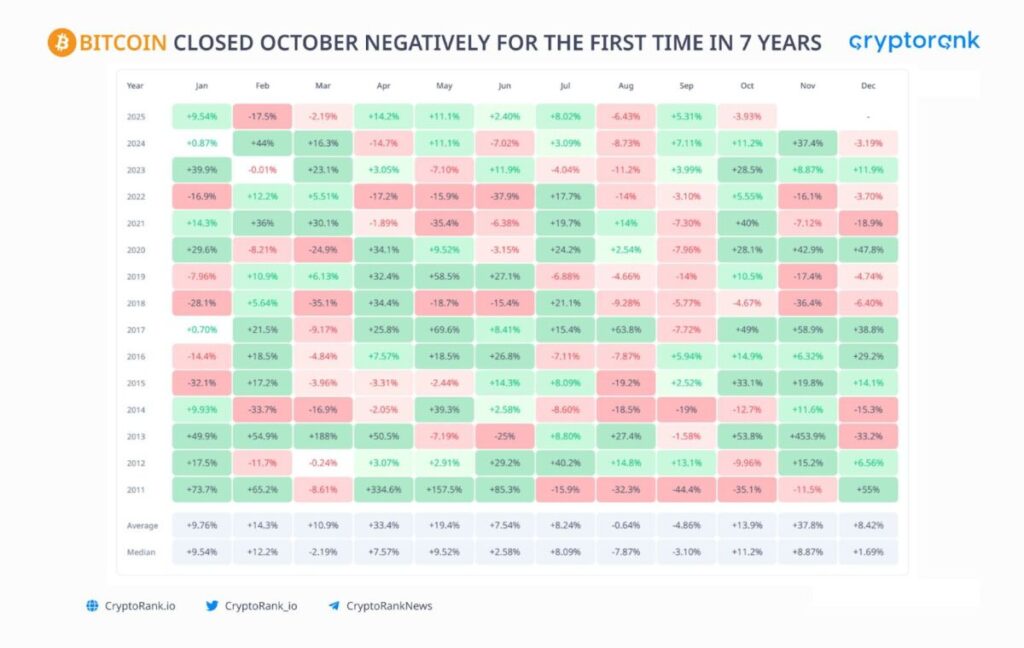

Sales at the end of the month led to the fact that October 2025 was the most unsuccessful for bitcoin since 2018.

In 2019-2024, October ended with the strengthening of the BTC rate. In general, 2025 became positive for bitcoin, but its retreat in October may signal the entry of the market into a long bear phase. Although another scenario cannot be ruled out, in which the leading cryptocurrency will restore lost positions and even update the historical maximum.

- Traditionally, November and December are the periods of the greatest activity in the cryptocurrency market, reminds the team of MEXC Research.

The return of whale support and the outflow of bitcoins from exchange wallets should stabilize the situation. Despite the weakening of the BTC rate, the trend for traders to switch to over-the-counter coin storage still dominates.

For six months, trading platforms left 208,980 BTC. bitcoin exchange balance has decreased by 1.08% since the beginning of May.

Small Addresses (less than 0.01 BTC) Shrimp now control 0.25% of the leading cryptocurrency s supply.

Since October 12, shrimp bought 415 BTC (+ 0.85%). Small investors acquire the asset in the expectation of a further increase in its value.

- However, the drop we have seen since the end of last month should force shrimp to quickly get rid of their coins, which will become prey for whales and sharks. It is usually at such moments that the market bottoms out, and after consolidation, the growth phase returns.

2. Bitcoin faced pressure and could sink below $100,000

Bitcoin faces the most difficult task task of holding positions in the region of $100,000. Pressing is likely to increase in the coming days if the coin cannot enlist additional support.

Last February, the WhaleMap team analyzing whale activity pointed to a BTC support zone in the range of $98,000 to $101,000. A large whale cluster formed here.

Initially, bitcoin could not break above $100,000 due to resistance from large investors who recorded profits when trying to coin close to this psychological mark.

But after bitcoin overcame such an important barrier, large investors who bought at prices ranging from $95,000 to $100,000, prepared to increase support for the cryptocurrency in the event of risks of its fall.

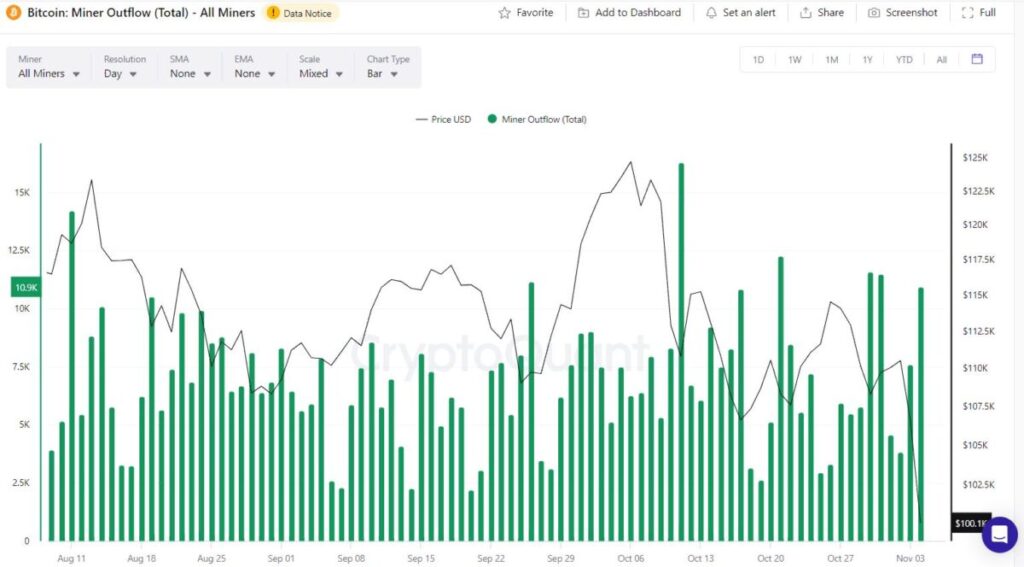

list of sellers was replenished by miners. According to the CryptoQuant platform in October the outflow of BTC from wallets affiliated with mining pools increased. Funds go to exchange addresses, which indicates preparation for cryptocurrency sales.

Miner reserves decreased until November 2, but after that they began to increase again. This suggests that the pools gradually curtail BTC sales.

- On social networks, users analyze the reasons for the collapse of bitcoin and assess its immediate prospects.

- Negative sentiment dominates Telegram, Reddit, X and 4Chat, which contributes to the gradual stabilization of the BTC rate.

- As soon as traders who fear a larger retreat of bitcoin leave the asset, the asset will be able to reach fundamental values in the current cycle and after a short time resume expansion.

Disclaimer: This information is not investment, tax, legal, financial, accounting, advisory or any other related services advice, nor is it advice to buy, sell or hold any assets. MEXC Training provides information for reference purposes only and is not investment advice. Please ensure that you fully understand all risks and exercise caution when investing. The platform is not responsible for users’ investment decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up