One week after Monad’s November 24 mainnet launch, the on-chain data presents a mixed picture: approximately $120 million in Total Value Locked (TVL), 153,000 active addresses within 24 hours of launch, and over 3.7 million transactions processed in the first day. While these metrics demonstrate real network activity, MON token has crashed 49% from its all-time high of $0.04876, currently trading around $0.025—raising critical questions about whether the network can justify its $2.5 billion fully diluted valuation.

BitMEX co-founder Arthur Hayes delivered a brutal assessment just days after launch, calling Monad “another bear chain” and predicting a “99% move down” for MON tokens. His criticism centers on a fundamental problem: despite strong first-day metrics, Monad exhibits classic “high FDV, low-float VC coin” characteristics that have historically preceded catastrophic crashes. Hayes characterized the project as vulnerable to a selloff once insider tokens unlock, describing it as venture capital hype rather than genuine adoption. With MON down double digits over the past week, his warning is resonating across crypto markets.

The Numbers: One Week Reality Check

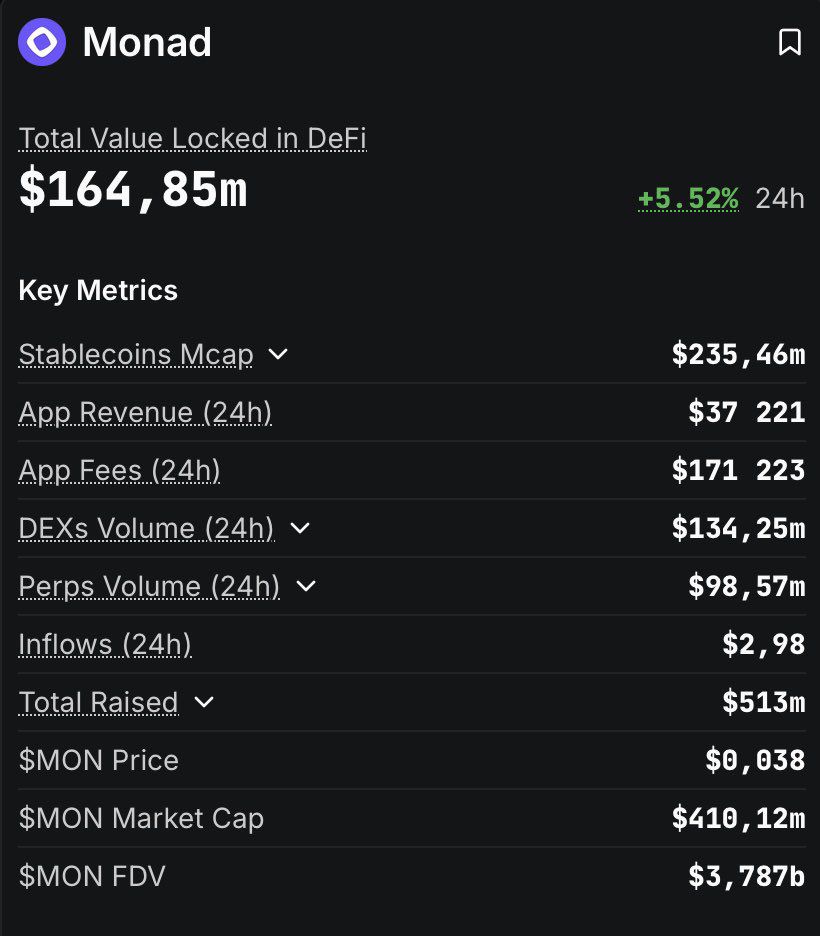

On-Chain Metrics (December 2, 2025):

– TVL: $169 million (verified by multiple sources)

– Launch Day Active Addresses:153,000 (first 24 hours)

– Launch Day Transactions: 3.7 million

– Contract Deployments: 18,000 in first 24 hours

– Validators: 200+ securing the network

– dApps Claimed: 240+ ecosystem applications

Price Performance:

– Current: $0.03

– All-Time High: $0.04876

– Change from ATH: -40%

– 24h Change: +22.22%

– 7-Day Change: +19%

– Coinbase Sale Price: $0.025 (returned to ICO price)

– Market Cap: ~$267-289 million (circulating supply)

– FDV: $2.5 billion

Critical Context:

Nansen analysts noted that Monad processed activity levels in 24 hours that most blockchains take a year to reach, with 153,000 active addresses and 18,000 contract deployments representing genuine developer interest. However, the 49% price collapse from ATH within one week signals severe market skepticism about sustainability.

The TVL of $120M places Monad mid-pack among new L1 launches—better than many failures, but far below successful precedents like Arbitrum ($200M+ in early weeks) or Optimism ($100M+ initially with faster growth trajectories).

Arthur Hayes’ “99% Crash” Thesis: The Full Case

BitMEX co-founder Arthur Hayes warned that Monad could plunge as much as 99%, calling it a high-FDV, low-float VC coin where token structure puts retail traders at risk. His prediction, delivered on Altcoin Daily just days after launch, represents one of the harshest assessments from a major crypto figure. His core arguments:

Tokenomics as Fatal Flaw:

Hayes focuses on Monad’s 100 billion total supply with only 10.83 billion (10.8%) currently circulating. With 50.6% of tokens locked until 2026-2029—including 27% for the team, 19.7% for investors, and 4% for treasury—the structure creates massive future selling pressure. Hayes argues projects with large gaps between FDV and circulating supply typically experience early price spikes followed by deep selloffs once insider tokens unlock

“Another Bear Chain“:

Despite acknowledging he bought some MON tokens, Hayes dismisses the network’s long-term viability. He stated that every coin gets an initial pump as people want to believe in the new Layer-1, but that doesn’t mean it will have any real use case . His comparison to failed high-FDV launches suggests Monad follows a predictable pattern of hype-driven speculation collapsing into reality.

Survivor Thesis:

Hayes named Bitcoin, Ethereum, Solana, and Zcash as the small group of protocols he expects to survive the next cycle [CoinMarketCap](https://coinmarketcap.com/currencies/monad/) , explicitly excluding Monad from this list. He argues most L1s fail because they cannot develop genuine use cases beyond initial marketing narratives.

Historical Precedent:

While Hayes doesn’t name specific comparisons to avoid legal issues, his analysis references the dozens of “Ethereum killers” that launched with billion-dollar valuations in 2021-2022, only to crash 85-99% when metrics failed to justify hype. Monad’s trajectory—strong launch metrics followed by immediate price weakness—mirrors these failures.

The Bull Case: First-Day Metrics Tell Different Story

Monad defenders counter Hayes with data showing exceptional launch performance:

Record-Breaking Launch Activity:

Analysts noted that Monad showed activity levels in 24 hours that most blockchains take a whole year to reach, with 153,000 active addresses and 18,000 contract deployments. These aren’t airdrop farmer metrics—18,000 smart contract deployments indicate real developer engagement.

TVL Growth Trajectory:

Monad ecosystem project FastLane announced its TVL surpassed 100 million dollars within 48 hours of launch , suggesting strong initial liquidity provider interest. Total network TVL reaching $120M within one week represents solid initial traction, particularly for a network launching during broader market weakness (Bitcoin down from $100K).

Technical Delivery:

Unlike vaporware projects, Monad’s mainnet is processing real transactions at scale. The 3.7 million transactions in 24 hours demonstrate the network can handle genuine load, while maintaining EVM compatibility allows seamless migration for Ethereum developers frustrated by gas fees.

Institutional Backing:

With $244M raised from Paradigm, Coinbase Ventures, Electric Capital, and others, Monad has runway to build regardless of token price. The Coinbase token sale raising $269M from 85,820 retail participants provides additional capital and distribution.

Price Action Context:

The return to $0.025 ICO price could represent equilibrium rather than failure. Many successful tokens (Solana, Avalanche) traded near ICO prices for months before ecosystem growth drove sustained rallies. Current price may offer long-term accumulation opportunity if fundamentals develop.

Community Sentiment: Deeply Divided

Bearish Camp (Arthur Hayes, Altcoin Sherpa):

Popular analyst Altcoin Sherpa suggested MON holders should have an exit plan, comparing it to failed launches like XPL and WLFI and warning price can go much lower . The sentiment reflects broader skepticism about high-FDV launches in late 2025.

Critics point to the $105M airdrop creating approximately $467 per recipient—amounts many consider insufficient after months of community engagement, generating disappointment that could suppress organic growth as participants move to more rewarding ecosystems.

Bullish Optimists:

Supporters highlight that FastLane’s $100M TVL in 48 hours, combined with 200+ validators and integrations with Chainlink, LayerZero, and PancakeSwap, provide infrastructure for sustainable growth. They argue judging a network after one week ignores that Avalanche, Polygon, and even Solana took quarters to gain momentum.

The fact that MON’s market cap stood at $499.53 million with TVL at $119.99 million as of November 26 gives a TVL/Market Cap ratio of 0.24—suggesting the protocol is valued at more than 4x the capital actually deployed, which bulls see as reasonable for a one-week-old network with strong technology.

On-Chain Reality:

Trading volume tells the real story. With 24-hour trading volume of $461 million as of December 2, MON maintains significant liquidity despite price weakness. This volume (1.7x daily market cap turnover) indicates genuine trading interest rather than complete abandonment.

What Matters Now: Critical 30-60 Day Window

The next eight weeks will determine whether Monad becomes a legitimate Ethereum competitor or validates Hayes’ bearish thesis. Key metrics to monitor:

TVL Growth Trajectory:

Monad needs TVL to reach $200-250M by end of December to demonstrate momentum. Stagnation below $150M would confirm lack of organic capital inflow beyond early speculation. Healthy networks see exponential TVL growth in weeks 2-8 as liquidity mining activates and real users arrive.

Daily Active Address Sustainability:

The 153,000 launch-day addresses represent a high bar. If daily active addresses stabilize at 30,000-50,000, that indicates genuine retention. Decline below 20,000 would confirm the airdrop farmer exodus hypothesis and validate Hayes’ criticism.

Token Unlock Schedule:

With first major unlocks beginning November 2026, Monad has roughly one year to build sufficient demand to absorb future supply. Projects that fail to establish product-market fit within 12 months typically cannot survive unlock events.

Killer App Emergence:

Monad desperately needs one breakout protocol—a native DEX exceeding $50M volume, lending market with $100M+ deposits, or viral NFT project. Without signature applications that only work on Monad’s high-TPS infrastructure, the network remains infrastructure seeking purpose.

Broader Market Context:

Hayes maintains a bullish outlook on crypto overall, driven by renewed monetary expansion and liquidity injections from governments. If his broader thesis proves correct and Bitcoin resumes its bull run, Monad could benefit from rising tide lifting all boats—though Hayes explicitly excludes Monad from his personal holdings beyond initial speculation.

Conclusion: Strong Launch, Uncertain Future

Arthur Hayes’ “99% crash” prediction is provocative but not yet validated by data. Monad’s first week shows genuine technical achievement—153,000 active addresses, 3.7 million transactions, and $120M TVL represent real economic activity, not vaporware. The network delivered on its technical promises, processing transactions at high speed while maintaining EVM compatibility.

However, the 49% price collapse from ATH within seven days signals severe market concern about sustainability. The return to $0.025 ICO price suggests investors view current fundamentals as matching, not exceeding, initial sale expectations—a bearish sign for a network that should be proving thesis rather than treading water.

Hayes’ core criticism—that Monad exhibits classic high-FDV, low-float tokenomics that have historically preceded crashes—remains unrefuted. The 10.8% circulating supply versus $2.5B FDV creates a powder keg that will detonate when 50.6% of locked tokens begin vesting in November 2026, unless Monad builds sufficient organic demand to absorb supply.

The next 60-90 days are make-or-break. If TVL exceeds $250M, daily users stabilize at 40,000+, and a killer app emerges, Hayes will look premature. If metrics stagnate and MON crashes below $0.020, his 99% prediction will seem conservative.

For traders, the prudent approach is watch-and-wait. Monad could become a legitimate Ethereum alternative if it executes on technical advantages and builds thriving ecosystem. Or it could join the graveyard of overhyped L1s that converted billion-dollar valuations into cautionary tales.

The market is watching. Monad’s team has 60 days to prove the doubters wrong—or validate the bears’ worst fears.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up