The crypto market is known for its high volatility. However, price swings don’t always come from internal crypto news. In fact, many of the biggest moves today are triggered by global macroeconomic developments.

1.Why Macro Matters for Crypto?

In the early days, when crypto was still small, macroeconomic news—especially from the U.S.—had limited impact. But as the industry grew and traditional financial institutions entered the space, the correlation increased significantly.

Institutions tend to apply the same models and investment logic they use in traditional markets. As a result, crypto now often moves in tandem with equities, particularly tech stocks. For Example :

- In mid-May 2025, softer-than-expected U.S. inflation data reignited rate-cut hopes, sending $BTC past the $103K mark as risk-on sentiment surged.

- When the Fed paused rate hikes in late July 2025, $BTC rebound ~0.4% to ~$118.5K—riding a broader risk-on wave ignited by strong tech earnings.

Looking at the chart we can see the impact each time a news release occurs.

2.Key Macroeconomic Indicators

2.1 Consumer Price Index (CPI) – Impact Level: High

CPI tracks changes in the prices of goods and services consumed by households. Rising CPI signals higher inflation, prompting central banks to tighten monetary policy by raising interest rates. This typically reduces investment and consumption, negatively impacting financial markets, including crypto.

2.2 Producer Price Index (PPI) – Impact Level: Medium

PPI measures changes in the cost of goods and services at the production and wholesale level. Rising PPI suggests higher input costs that may lead to inflation. Since PPI often moves before CPI, investors watch it closely to forecast inflation trends. A sharp increase in PPI can spook markets and trigger selloffs.

2.3 Gross Domestic Product (GDP)

- GDP Growth – Impact Level: High GDP represents the total value of goods and services produced in an economy. Growth signals expansion, while contraction signals recession. A strong GDP print supports equities and, by extension, risk assets like crypto. Weak GDP growth dampens sentiment and reduces capital inflows.

- GDP Growth Rate – Impact Level: High The year-over-year or quarter-over-quarter growth rate reflects the pace of economic expansion. A high rate boosts investor confidence, while a slowdown raises concerns about weaker demand and financial instability.

- GDP Structure – Impact Level: Low GDP is broken into sectors: Agriculture, Industry, Services, and Product Taxes. Changes in structure reflect long-term shifts in the economy. While relevant for economic development analysis, its short-term impact on crypto markets is relatively limited.

3.Interest Rates and Monetary Policy (FOMC)

3.1 Benchmark Interest Rate – Impact Level: High

The benchmark rate is the short-term lending rate set by central banks. Higher rates increase borrowing costs, reduce spending, and lower corporate profits. Risk assets, including equities and crypto, usually decline in response.

3.2 Interbank Lending Ceiling – Impact Level: Medium

This cap sets the maximum rate banks can lend to each other. Adjustments signal the central bank’s monetary stance—whether tightening or easing. These shifts influence liquidity across financial markets.

3.3 Reserve Requirement Ratio – Impact Level: Medium

When central banks raise reserve requirements, banks must hold more deposits and lend less. This drains liquidity from the system, putting pressure on both equities and crypto.

4.Inflation and Employment

4.1 Unemployment Rate – Impact Level: Low

A high unemployment rate signals economic weakness. While it reduces income and consumption, it also tempers inflation, often leading to looser monetary policy. The effect on markets can be mixed.

4.2 Average Income – Impact Level: Low

Rising average income suggests a healthier economy with more consumer spending and investment power. However, if wages rise too quickly, inflationary pressures may follow, leading to tighter policy.

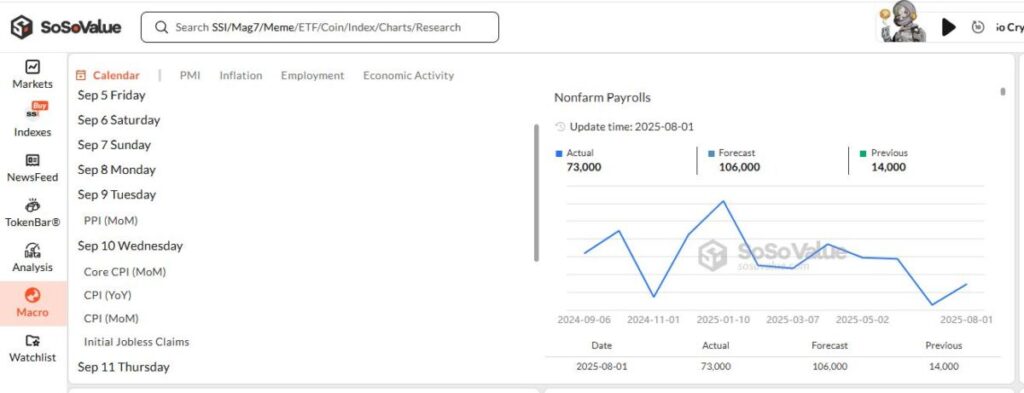

4.3 Nonfarm Payrolls (NFP) – Impact Level: Medium

NFP reports the number of jobs added or lost in the U.S. economy (excluding farm workers). Strong NFP data suggests a robust economy but can also raise inflation fears, pushing the Fed toward rate hikes. Weak NFP data signals economic slowdown, raising recession risks. Crypto markets often react sharply to NFP surprises.

5.How to Track These Indicators

Platforms like SoSoValue provide an easy-to-use dashboard under the “Macro” tab, listing major events such as CPI, PPI, NFP, and Initial Jobless Claims. Investors can view actual results vs. forecasts vs. previous data, along with trend charts to assess market implications quickly. You can also read the articles about the impact of each macroeconomic news on MEXC Learn.

6.Conclusion

Macroeconomic indicators like inflation, interest rates, GDP growth, unemployment, and NFP are tightly linked to financial markets. They reflect the health of the economy and shape investor sentiment in crypto.

The degree of influence depends on context: CPI and Fed rate decisions usually dominate, while GDP structure or unemployment may play a smaller role. Effective crypto investing requires watching multiple indicators together, understanding their relationships, and aligning with broader macro trends. Disclaimer: This content does not provide investment, tax, legal, financial, or accounting advice. MEXC shares information purely for educational purposes. Always DYOR, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up