ICOs remain one of the hottest topics in 2025, with projects continuously raising hundreds of millions of dollars in just minutes. From the explosive success of Pump.Fun and Plasma, to controversial token sales like Espresso, Theoriq, and the multi-fold pump of Momentum, ICO platforms are back in the spotlight.

Next-generation ICO platforms such as Echo, Legion, MetaDAO, and BuidlPad are leading this trend by implementing KYC, reputation-based allocation, Futarchy mechanisms, and Tiered FDV. These innovations balance investor interests with project stability.

1.From the 2017 ICO Boom to the 2021–2023 Downturn

ICOs started gaining traction around 2013 with pioneering projects like Mastercoin, but the real explosion came in 2017. At that time, any project with an Ethereum smart contract and a basic whitepaper could raise millions in minutes.

- Ethereum raised $18M in its 2014 ICO, while Tezos hit $232M in 2017.

- Total ICO fundraising in 2017 exceeded $5.6B across more than 1,000 projects.

However, this boom quickly raised concerns. With a lack of regulation, widespread fraud, no vetting process, and almost no post-sale liquidity frameworks, investors were largely “blind,” relying solely on hype and promising whitepapers.

- Over 80% of 2017 ICO tokens lost more than 50% of their value within 90 days of listing.

- Regulatory bodies like the SEC (US) and FCA (UK) classified many ICOs as unregistered securities, causing the model to collapse.

The market gradually shifted to more controlled fundraising models:

- VC Rounds or SAFTs (Simple Agreement for Future Tokens)

- IEO (Initial Exchange Offering) – tokens sold directly on exchanges

- IDO (Initial DEX Offering) – decentralized token sales on platforms like DAO Maker, Polkastarter, and BSCPad

MEXC remained one of the few exchanges running IEOs during this market adjustment. Its token sales often attracted retail investors due to fast listing and high post-sale liquidity.

By 2022–2023, interest in IDOs and IEOs had sharply declined due to:

- A bear market draining capital flows

- Retail investors losing confidence after numerous negative ROI projects

- Old launchpads stagnating, becoming “boring whitelist loops” with no new appeal

2.The Return of Next-Generation ICO Platforms

As the market entered a growth phase in 2024–2025, capital returned alongside new narratives like AI, RWA, Meme, and Stablecoins.

Next-generation builders realized that IDOs are still the best way to bootstrap communities—but they required strong improvements in mechanisms, experience, and trust.

After the dull “whitelist loops,” a new wave of launchpads emerged with clear innovations:

- Flexible KYC

- On-chain tasks and “yap-to-earn” campaigns to attract real users, not bots

Platforms like BuidlPad, Echo, Legion, and MetaDAO revived IDOs not just as token sales but as Community Growth Platforms, focusing on fair launches, anti-Sybil mechanisms, and prioritizing individual users over VC domination.

Three core factors driving the ICO revival:

Incentive Mechanisms

Instead of traditional whitelists, new launchpads use point systems, on-chain tasks, and veNFT airdrops to encourage genuine engagement and build sustainable communities.

- BuidlPad: “Buidl Points” system rewards users for participating in testnets, creating content, staking, or supporting projects, with KYC ensuring fairness.

- Legion: Legion Score (0–1000) combined with EigenTrust anti-Sybil rewards active users without requiring token stakes.

This makes users feel part of the project, not just early token buyers.

Higher Project Quality

Unlike 2021, when any project could IDO, the new wave prioritizes real products and clear narratives—from AI agents and DeFi infrastructure to professionally marketed meme projects—backed by strict vetting to reduce risk.

- Momentum ($MMT) on BuidlPad attracted thousands due to its Sui DEX with innovative liquidity and staking (ve(3,3) model) and strong community-driven media effects, achieving 1739% oversubscription and $10M raised (hard cap $4.5M).

- Recent top projects on BuidlPad saw average ROI of x5–x10 (e.g., Solayer ATH ~9.77x, Falcon Finance ~2.5x), reigniting retail interest in IDO trends.

- Echo stands out for high-quality deal flow from institutional partners, while MetaDAO focuses on Solana ecosystem pure community sales (no high FDV).

Trust Through On-Chain Transparency

Most new launchpads are fully on-chain—from vesting and token claims to performance tracking—allowing the community to monitor in real time and minimizing rug pull risks.

- Platforms often integrate audited smart contracts (Certik or PeckShield) and multisig escrow for user protection.

- BuidlPad implements refund policies if token prices drop below sale price within 30 days post-TGE.

- Echo emphasizes KYC/AML compliance to maintain institutional-grade transparency.

3.Notable ICO Platforms

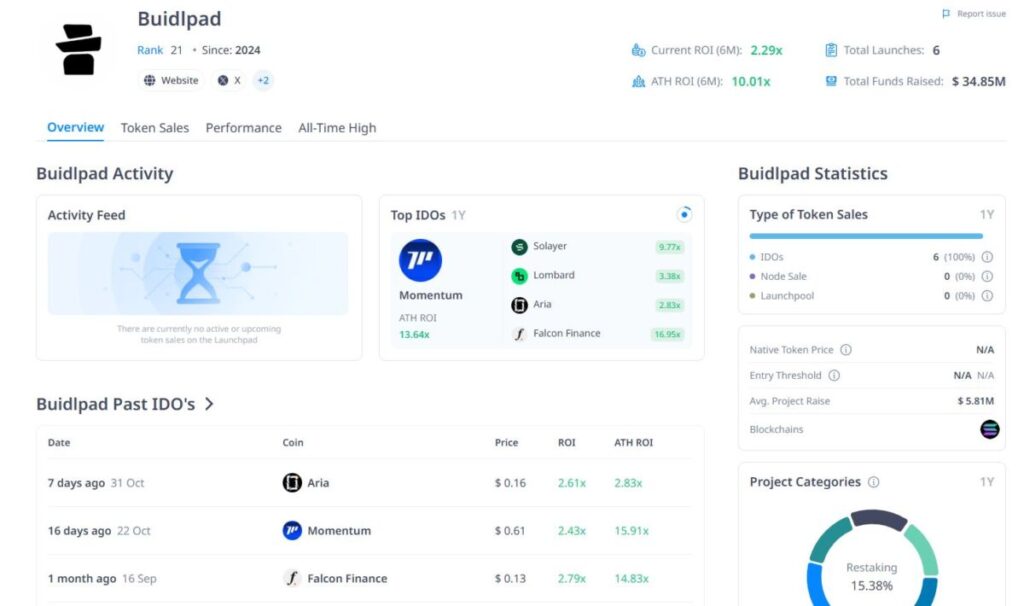

BuidlPad – Transparent, Community-Focused Launchpad

Launched in 2024, BuidlPad simplifies IDOs to give retail investors compliant access to vetted projects.

- Process: KYC + subscription → commit capital during sale → excess refunded automatically

- Tiered FDV applied in some sales to control demand and ensure fairness

Unlike complex platforms like MetaDAO or Legion, BuidlPad keeps it minimal but transparent—no points, no DAO treasury—focusing entirely on direct, fair experience.

- As of October 2025:

- $330M+ committed from 30,000+ KYC users

- Average ROI 6x ATH

- Total HODL TVL over $190M

Notable Projects:

- Falcon Finance (FF): Target $4M, raised $112.8M (28x oversubscribe), 8.3% supply for community, 100% TGE unlock, ROI 15–20x

- Lombard Finance (BARD): $6.75M raise on $450M FDV, focusing on Liquid BTC Staking, ROI 3x

- Sahara Labs AI: $10M raise, AI Gaming, ROI 4x

- Solayer Labs: $57M commit (5.5x oversubscribe), 200,000+ registrants, ROI 9.77x

- Momentum (MMT): $82.7M+ on $250–350M FDV, $500M TVL post-TGE, peak ROI 13.6x

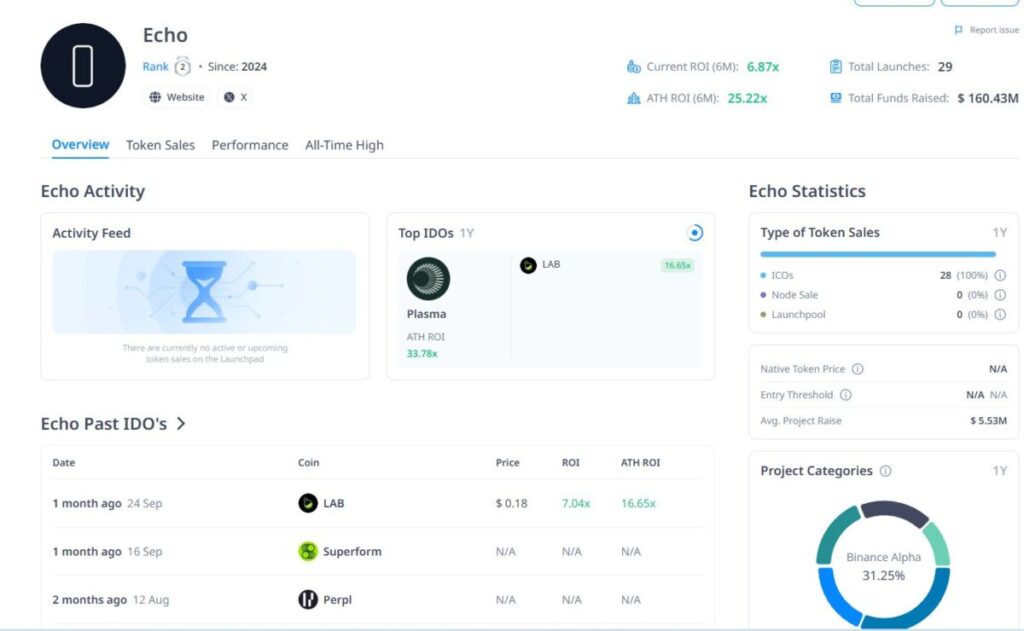

Echo – “ICO 2.0” for Compliance Era

Founded by Cobie and veteran KOLs, Echo quickly became a breakthrough 2025 ICO infrastructure platform with Sonar, a self-managed token sale tool.

- Unlike centralized launchpads or exchange IEOs, Echo provides infrastructure, letting teams configure sale models (Fixed Price, Auction, Vault/Credit), KYC via Echo Passport, and multi-chain deployment (Solana, Base, Hyperliquid, Cardano)

- Fast-growing thanks to infrastructure and compliance fees; acquired by Coinbase in October 2025 for $375M

- Sonar handles 10,000 sales simultaneously, supporting auctions, reward points, and flexible allocation—offering a classic ICO feel with compliance and on-chain transparency

Notable Sales:

- Plasma (XPL): $50M in 48h, ROI 33.78x

- LAB: DeFi analytics, ROI 14.53x

- MegaETH Labs: October 2025, FDV $400–1000M

- N1 Chain: $15M commit, ROI 6.22x

Total 2025 commitments exceeded $150M, average ROI 15x, making Echo the top choice for teams seeking self-managed, compliant, transparent sales.

Legion – Reputation-Based Allocation

Legion uses Merit and Legion Score rather than speed or size for allocation.

- Launched alongside Kraken in September 2025, allowing direct purchases via Kraken accounts, fully MiCA & AML compliant

- Legion Score (0–1000) calculated from on-chain activity, GitHub contributions, social engagement, and referrals

- Projects typically allocate 20–40% of supply to high-score users, remainder via FCFS or Lottery

- Focuses on real builders, contributors, and community, not bots or whales

Results:

- YieldBasis ($YB): $195M commit (98x oversubscribe), ROI 4x, FDV $200M

- Pulse No Limits: DePIN health, ROI 4.2x

- Almanak: AI Tokenized, ROI 3.5x

- Giza Tech: currently selling, FDV $150M

- Legion raised $250M+ in 2025, average ROI 4.5x, backed by VanEck, Kraken Ventures, Coinbase Ventures

- Pioneering the Reputation Economy, where early access is tied to on-chain contribution value rather than wallet size

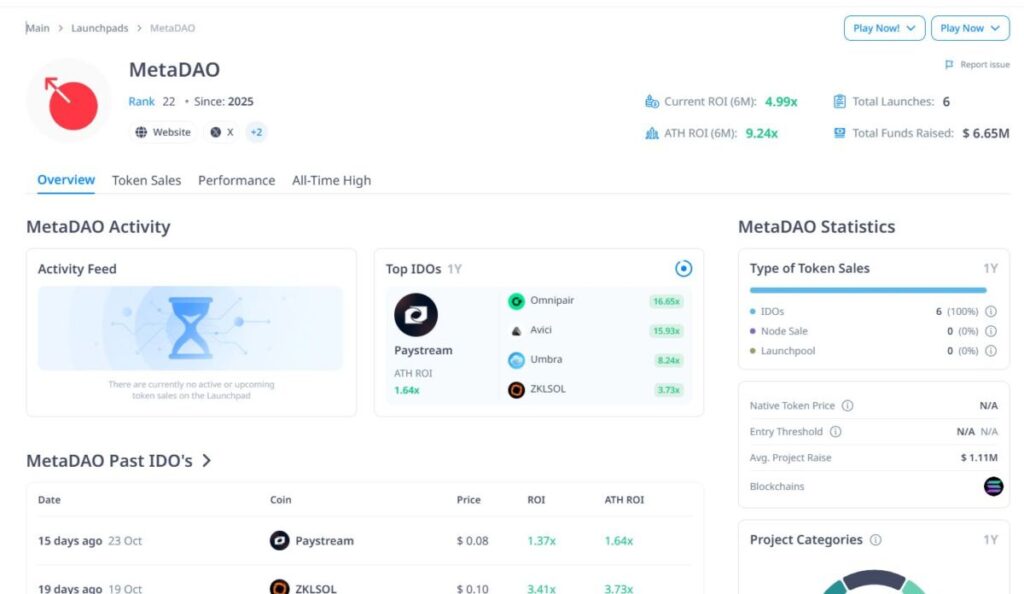

MetaDAO – Futarchy-Based Launchpad

MetaDAO uses Futarchy governance, letting the market decide how to allocate raised capital.

- Successful sales send all USDC into the DAO Treasury, where liquidity, buy-sell price, and trading behavior are auto-adjusted around a soft peg

- Reduces dump/pump risk, creating a Soft Band price stability from day one

Notable Projects:

- Umbra Privacy: October 2025, $150M commit, 10,000 users, ROI 7x

- Omnipair: Modular DEX, ROI 16x

- Avici Money: Decentralized banking, ROI 7x

- Loyal & ZKLSOL: ongoing sales, AI & yield security focus

- 2025 total commitments: $200M+, average ROI 8x ATH, protocol revenue $427K

- MetaDAO sets a new standard for self-regulating vesting and liquidity

4.Conclusion

The 2025 ICO comeback is no longer a race for Gas Wars or instant rug pulls. It marks a shift toward controlled, transparent fundraising. New platforms improve how projects reach investors and redefine ICO mechanics. While risks remain, new distribution models have evolved speculative hype into organized, community-driven capital raising.

Disclaimer:This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always DYOR, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up