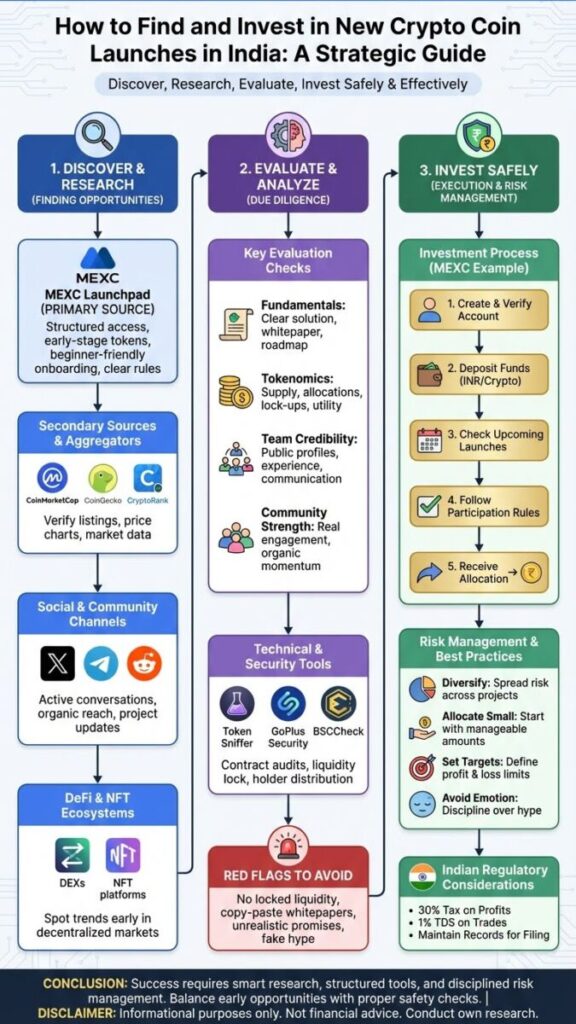

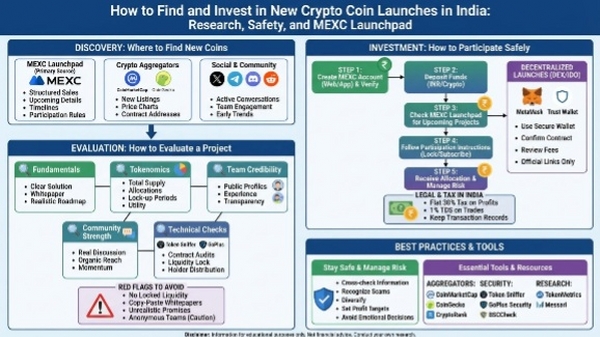

Finding new crypto coins early has become a major goal for many Indian investors. Early-stage tokens often carry higher risk, but they can also deliver the strongest gains when backed by solid fundamentals. The challenge is figuring out which projects are legitimate, how to identify them early, and how to invest safely. This guide breaks down the full process in a clear, beginner-friendly way while offering expert-level insight into how the industry works.

Table of Contents

Understanding New Crypto Coin Launches

What makes new coin launches appealing

New crypto launches offer something established tokens cannot: low entry prices and faster growth potential. When you enter before mass adoption, even small allocations can yield meaningful returns. Indian investors are especially active in this area because the market is global, accessible, and open 24/7.

Why finding new coins is difficult

The crypto space moves quickly. Hundreds of new tokens appear every month, and not all of them are worthy of attention. Information is scattered across many platforms, and investors often struggle to verify what is real and what is hype. This makes research and cross-checking essential.

What this guide will help you achieve

You will learn:

- Where new tokens come from

- How to discover early-stage projects

- How to evaluate them

- How to participate safely in new token launches in India

This full workflow gives you a reliable way to approach a market that is otherwise unpredictable.

How New Crypto Coins Are Launched

Different types of launches

New crypto tokens typically enter the market through a few common methods:

- Initial Coin Offering (ICO): The project sells tokens directly to early buyers.

- Initial DEX Offering (IDO): Tokens launch through decentralized platforms.

- Initial Exchange Offering (IEO): A centralized exchange facilitates the sale.

- Launchpad Sales: Investors gain early access through a curated token sale platform.

- Fair Launches: Tokens go live without private allocations or early investors.

Each method has its own level of risk and transparency. Launchpads have grown popular because they offer structure and basic screening.

Why launchpads matter

Launchpads showcase new tokens in a clean, organized format and give users clear rules for joining. This reduces confusion and gives investors a chance to review key information before committing funds.

Where to Find New Crypto Coins Before They Trend

MEXC Launchpad as your primary source

MEXC Launchpad is a widely used platform for accessing new crypto projects. Its listings often include trending, early-stage tokens, and the interface is beginner-friendly. Indian investors prefer MEXC because it supports simple onboarding and offers structured token sales that are easy to follow. While you should still do your own research, launchpads help streamline the discovery process.

- Upcoming project details

- Token sale timelines

- Participation requirements

- Project descriptions and allocation rules

It helps investors avoid guessing, which is common when projects launch independently. Once you understand how the platform works, it becomes one of the most reliable ways to track fresh opportunities.

Crypto data aggregators

Websites like CoinMarketCap and CoinGecko compile lists of newly added tokens. These lists offer:

- Price charts

- Market data

- Contract addresses

- Links to official pages

Aggregators are useful for finding tokens that have already launched or are gaining traction, but updates are not always instant. Use them as part of your verification process, not the only source of truth.

Blockchain and security tools

Tools such as Token Sniffer, BSCCheck, and GoPlus Security help you examine a token’s smart contract. They show:

- Whether the contract is verified

- Liquidity lock information

- Holder distribution

- Any high-risk functions

These checks help you avoid scams, rug pulls, and unfair token structures.

Social and community channels

Crypto communities are often the first to talk about new projects. Platforms to monitor include:

- Twitter/X

- Telegram groups

- Discord servers

- Reddit threads

Look for active conversations, meaningful updates, and a team that engages with users. Avoid projects that produce hype but have no substance.

DeFi and NFT ecosystems

New tokens frequently appear in decentralized markets before they reach mainstream exchanges. Watching activity on DEX platforms or upcoming NFT-related tokens can help you catch trends early. These signals work best when combined with proper research.

How to Evaluate a New Crypto Project

Understanding project fundamentals

Always begin with the basics. A legitimate crypto project should have:

- A clear explanation of what it solves

- A whitepaper that outlines the concept

- A realistic roadmap

- A plan for adoption and long-term development

Projects with vague promises or unclear goals often struggle to grow.

Examining tokenomics

Tokenomics reveals how value moves within a project. Pay attention to:

- Total supply

- Token allocations (team, investors, public sale)

- Lock-up periods

- Utility within the ecosystem

Healthy tokenomics help maintain price stability and prevent early investors from crashing the market.

Checking the team’s credibility

A strong team increases confidence. Look for:

- Public profiles

- Past achievements

- Industry experience

- Transparent communication

Anonymous teams are not automatically a red flag, but they require deeper examination.

Evaluating community strength

A growing, engaged community often signals strong interest. Look for:

- Real discussion, not bot activity

- Regular announcements

- Organic social reach

Momentum matters, especially in early-stage markets.

Conducting technical checks

Use available tools to review:

- Contract audits

- Liquidity status

- Holder composition

If a few wallets hold most of the supply, the project may be risky.

Red flags that should stop you immediately

Avoid projects with:

- No locked liquidity

- Copy-paste whitepapers

- Unrealistic return promises

- No working prototype or real team presence

Your safety comes first.

How to Invest in New Crypto Coin Launches in India

Step-by-step process

- Create a MEXC account: Visit MEXC website. Or you can download the MEXC app from the official MEXC download page and manage everything directly on your phone. Complete verification for full access to platform features.

- Deposit funds: Use supported INR payment routes or deposit crypto from another wallet.

- Check upcoming launches: Visit MEXC Launchpad to explore project details.

- Follow participation instructions: Some launches require locking tokens or joining subscription events.

- Receive your allocation: Allocated tokens appear in your account after the launch completes.

This process is simple once you follow it a few times.

Using wallets safely

If a project launches through a decentralized route, you may need wallets such as MetaMask or Trust Wallet. Always store recovery phrases offline and avoid connecting wallets to unknown websites.

Participating in decentralized launches

For IDOs or fair launches:

- Confirm the contract address

- Review gas fees

- Set reasonable slippage

- Double-check wallet safety

Buy only through the official links shared by the project.

Legal and tax considerations in India

Crypto profits in India are taxed at a flat 30 percent, and trades usually attract a 1 percent TDS deduction. Keep records of all transactions to simplify filing. While regulations may evolve, this structure applies today.

Managing risk effectively

Early-stage tokens can rise quickly but can fall just as fast. Protect yourself by:

- Allocating small amounts

- Diversifying across several projects

- Setting profit targets

- Avoiding emotional decisions

Long-term success comes from discipline.

Best Practices to Stay Safe

Cross-check information everywhere

Never trust a single platform. Compare details across:

- MEXC Launchpad

- Official project announcements

- Smart contract analysis tools

- Community discussions

This multi-source approach reduces your risk.

Recognize common scams

Be cautious if you see:

- Fake giveaways

- Impersonator accounts

- Websites with misspellings

- Pressure tactics like “buy now or miss out”

Take a moment to verify before taking action.

Maintain realistic expectations

Not every new token becomes a winner. Treat early-stage investing as a calculated risk, not a guaranteed shortcut to profit. The goal is to find quality projects, not to chase hype blindly.

Tools and Resources Indian Investors Should Use

Aggregator platforms

- CoinMarketCap

- CoinGecko

- CryptoRank

These platforms help verify listings and explore market data.

Security and audit tools

- Token Sniffer

- GoPlus Security

- BSCCheck

Use them to evaluate smart contracts and token risks.

Market research sources

- TokenMetrics

- Messari

- YouTube analysts and trusted X accounts

Follow analysts who provide real research rather than pure hype.

Tracking launch announcements

- MEXC announcements page

- Official project social media

- Community channels

Confirm all details through official sources.

Conclusion

Finding and investing in new crypto coin launches in India is absolutely possible, but success depends on smart research, structured tools, and disciplined risk management. MEXC Launchpad is one of the most reliable places to access early-stage projects, but it should be used alongside independent research and proper safety checks. With a balanced approach, Indian investors can explore early opportunities with more confidence and clarity.

FAQs

1. What is the safest way to find new crypto coins in India?

Using structured platforms like MEXC Launchpad combined with independent research and contract audits is the safest approach.

2. Can beginners invest in new token launches?

Yes. Launchpads simplify the process, but beginners should start small and learn how to evaluate projects properly.

3. How risky are new crypto coin launches?

They carry higher risk because early projects have limited track records. Always diversify and invest cautiously.

4. How do I know if a new crypto project is legitimate?

Check the team, tokenomics, contract audits, community activity, and project roadmap. Cross-verify information across multiple sources.

5. Do I need a wallet to join new launches?

For launchpad sales like those on MEXC, your exchange account is usually enough. For decentralized launches, you will need a secure wallet.

Disclaimer: The information provided in this article is for educational and informational purposes only. It does not constitute financial, investment, or trading advice, and should not be interpreted as an endorsement of any specific project, product, or service. Always conduct your own research and consult with a qualified financial professional before making investment or trading decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up