On September 27, 2025, Bitlight Labs’ LIGHT token made its debut on MEXC’s Innovation Zone. The project pitches itself as a bold attempt to transform Bitcoin from a “digital gold” store of value into a programmable financial layer, leveraging the RGB protocol and the Lightning Network to enable smart contracts, tokenized fiat, and asset issuance directly on Bitcoin rails.

At first glance, the narrative is irresistible. For years, critics have argued that Bitcoin, while secure and decentralized, is too rigid to support the dynamic innovation that has flourished on Ethereum, Solana, and other programmable blockchains. Bitlight’s pitch challenges that assumption head-on: why not unlock programmable logic and tokenized assets on Bitcoin, while preserving its security and liquidity?

The market has responded with cautious enthusiasm. LIGHT launched with a total supply of 420 million tokens, quickly attracting trading volume of over $1.5 million in its first 24 hours across MEXC. On social media, advocates are calling LIGHT the “missing link” between Bitcoin’s dominance and Ethereum’s flexibility. MEXC even enabled its Convert feature at launch, suggesting the exchange anticipated both high demand and high volatility.

But beneath the buzz, critical questions linger. Integrating RGB and Lightning for mass-scale asset issuance and programmable logic is no trivial feat. Both technologies are promising but remain experimental, with limited adoption outside niche developer circles. Even LIGHT’s listing mechanics raise concerns. Without clear transparency on token distribution, vesting schedules, and insider holdings, investors risk becoming exit liquidity for early participants.

Then there’s the competitive landscape. Stacks, Rootstock, and Babylon are all building their own versions of Bitcoin-aligned programmability, several with active developer communities and years of iteration. For Bitlight, breaking through this noise will require more than bold claims, it will require proof of execution.

1.The Technical Architecture: Promise and Complexity

Understanding LIGHT’s value proposition requires examining the specific technical architecture the project claims will enable Bitcoin to compete with established smart contract platforms.

1.1 RGB Protocol Foundation

The RGB protocol represents Bitcoin’s answer to Ethereum‘s global state model. Unlike traditional smart contracts where all network participants process every transaction, RGB implements client-side validation where only parties directly involved in a contract observe and verify state transitions. Bitcoin’s blockchain serves merely as a commitment layer, anchoring proofs without exposing contract details to the broader network.

This architectural choice theoretically provides significant advantages: enhanced privacy since contract details remain confidential, improved scalability because the base layer doesn’t process contract logic, and reduced blockchain bloat. However, this same design introduces trade-offs that Bitlight must address. Client-side validation complicates contract composability—when Contract A cannot easily reference state from Contract B unless both parties participate in both contracts, building complex DeFi protocols becomes substantially more challenging than on platforms with global state visibility.

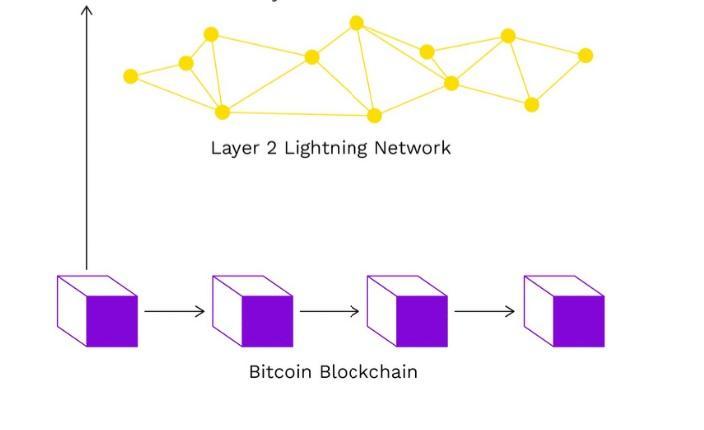

1.2 Lightning Network Integration

Bitlight’s innovation involves pushing Lightning channels to carry not just Bitcoin payments but also smart contract interactions, tokenized assets, and programmable logic. If successful, this would allow the same infrastructure that makes Bitcoin micropayments practical to also support complex financial applications.

One of the most compelling use cases involves bringing stablecoins directly onto Bitcoin. Currently, stablecoins like USDT and USDC dominate crypto transactions but operate primarily on Ethereum and alternative chains. Bitlight’s RGB implementation could enable Bitcoin users to send and receive stablecoins with the same speed and low fees as Lightning transactions, potentially revolutionizing Bitcoin’s utility for everyday payments and cross-border transfers.

The Foundation’s stated development focus includes building tooling for developers to issue assets, create stablecoins, and implement custom logic using this combined RGB + Lightning stack. If Bitlight successfully enables efficient stablecoin transfers on Bitcoin, it could address one of the network’s most significant competitive disadvantages against Ethereum and other smart contract platforms.

Figure 1: Bitlight Technical Architecture

2.Market Performance and Trading Realities

LIGHT currently reports a circulating supply of ~43.06 million tokens (≈ 10.3% of total supply) and a fully diluted valuation (FDV) of roughly $430–450 million, according to CoinMarketCap and other aggregators.

Even so, the fixed 420 million total supply raises legitimate questions about allocation and vesting. Many Innovation Zone launches have historically shown that projects with concentrated insider holdings and short or opaque vesting schedules experience sharp downward pressure when early stakeholders liquidate.

The absence of clear, publicly disclosed vesting schedules or allocation breakdown is a red flag that demands scrutiny, especially if one is contemplating a position beyond short-term speculation.

Figure 2: LIGHT Early Trading Metrics

MEXC’s Convert feature activation at launch demonstrates exchange confidence in maintaining liquid markets despite anticipated volatility, reducing slippage for moderate position sizes but not eliminating risk from wider spreads during extreme volatility.

3.The Optimistic Case: Why LIGHT Could Succeed

Despite execution risks, several factors support the bullish case for Bitlight’s viability. The broader crypto market in 2025 demonstrates renewed focus on Bitcoin beyond store-of-value narratives. Institutional adoption through ETFs, corporate treasury additions, and traditional finance integration have validated Bitcoin’s staying power while highlighting limitations in programmability.

Lightning Network has achieved meaningful traction for Bitcoin payments, with payment processing volume and channel capacity showing consistent growth. Bitlight’s approach of extending Lightning beyond payments could leverage these existing network effects. If successful, applications built on Bitlight would inherit Lightning’s existing liquidity and routing infrastructure rather than building from scratch.

While RGB remains less mature than Ethereum’s smart contract environment, the protocol has progressed substantially toward practical implementation. The Bitlight Foundation’s focus on developer tooling and ecosystem support could accelerate this maturation process.

4.The Contrarian Reality: Execution Challenges Ahead

Balanced assessment requires examining factors that could prevent Bitlight from achieving ambitious goals despite favorable narrative environments.

4.1 Unproven Technical Integration

Combining RGB protocol with Lightning Network creates technical complexity extending beyond what either technology has demonstrated independently. RGB smart contracts have seen limited production deployment, and pushing Lightning channels to carry complex asset transfers introduces untested edge cases. The gap between theoretical architecture and battle-tested production systems often proves larger than anticipated.

Smart contract platforms have a history of critical bugs discovered months or years after launch. Bitlight’s novel architecture means security researchers have less experience auditing RGB + Lightning interactions, potentially leaving vulnerabilities undiscovered until exploited.

4.2 Competitive Disadvantages

Bitlight enters a market where multiple Bitcoin programmability solutions already operate with varying degrees of success. Stacks has built a substantial developer community, deployed applications, and years of mainnet operation. Rootstock offers EVM compatibility allowing Ethereum developers to deploy familiar code. Even newer entrants like Babylon have raised significant venture funding and demonstrated technology in testnet environments.

The challenge isn’t just building working technology, it’s convincing developers to learn new tooling, build applications for unproven infrastructure, and accept client-side validation trade-offs rather than using more familiar alternatives with larger existing user bases.

4.3 Trading Implications and Risk Management

For participants considering LIGHT exposure, systematic approach to position sizing becomes essential given Innovation Zone volatility characteristics.

Historical patterns suggest distinct phases: Days 1-3 show extreme volatility suitable primarily for experienced traders. Days 4-14 present stabilization with better risk-reward for position entries. Days 15+ begin reflecting genuine developments rather than pure speculation, though many Innovation Zone tokens never reach this phase.

5.The Verdict: Infrastructure Play with Tangible Use Cases

Bitlight Labs represents genuine technical innovation attempting to expand Bitcoin’s capabilities beyond simple value storage. The combination of RGB protocol smart contracts with Lightning Network infrastructure addresses real limitations while maintaining Bitcoin’s security properties.

What distinguishes Bitlight from purely speculative projects is the practical utility its infrastructure could enable. If the project successfully brings stablecoins like USDT onto Bitcoin via RGB, it would fundamentally change how Bitcoin functions in everyday commerce. Bitcoin users could send and receive stablecoins with Lightning Network speed and minimal fees, transforming Bitcoin from primarily a store of value into a practical payment network for global commerce.

This stablecoin functionality alone represents significant market opportunity. Currently, stablecoins dominate crypto transaction volume but operate primarily on Ethereum and competing chains. Capturing even a fraction of that activity on Bitcoin through Bitlight’s infrastructure could validate the project’s approach and create sustainable network effects.

However, a substantial gap remains between architectural vision and proven production systems. RGB protocol requires further maturation, Lightning extension to complex transfers introduces untested challenges, and developer ecosystem development demands sustained effort. The competitive landscape includes alternatives with multi-year head starts in ecosystem building.

For traders, LIGHT presents high-risk speculation on Bitcoin’s programmability future. The modest valuation provides upside leverage if Bitlight executes on stablecoin infrastructure and developer tooling. But technical complexity and execution risks require treating positions as speculative allocation with disciplined risk management rather than core holdings.

MEXC’s rapid listing capability provides early access advantages for participants evaluating these opportunities ahead of broader market attention. The coming months will reveal whether Bitlight’s stablecoin vision and RGB + Lightning architecture can translate ambitious technical promises into production systems that developers and users actually adopt, or whether practical challenges prevent the project from achieving its Bitcoin programmability goals.

Disclaimer: This content is for educational and reference purposes only and does not constitute investment advice. Digital asset investments carry high risk, particularly Innovation Zone listings with extreme volatility characteristics. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up