Summary

Netflix Inc. (NASDAQ: NFLX), the pioneer and global leader in streaming entertainment, has fundamentally reshaped how audiences consume video content. With over 260 million global subscribers across 190+ countries, Netflix remains the undisputed leader in the streaming industry.

Each year, the company invests over $17 billion in original films, series, and documentaries — building a powerful moat of premium content and global brand loyalty.

TL;DR

- Netflix operates in 190+ countries with 260M+ paid subscribers.

- Annual investment in original content exceeds $17B.

- With NFLXUSDT perpetual contracts, traders can access 24/7 Netflix stock exposure using USDT, without a traditional brokerage account.

- Supports 1–50x leverage, allowing flexible positioning.

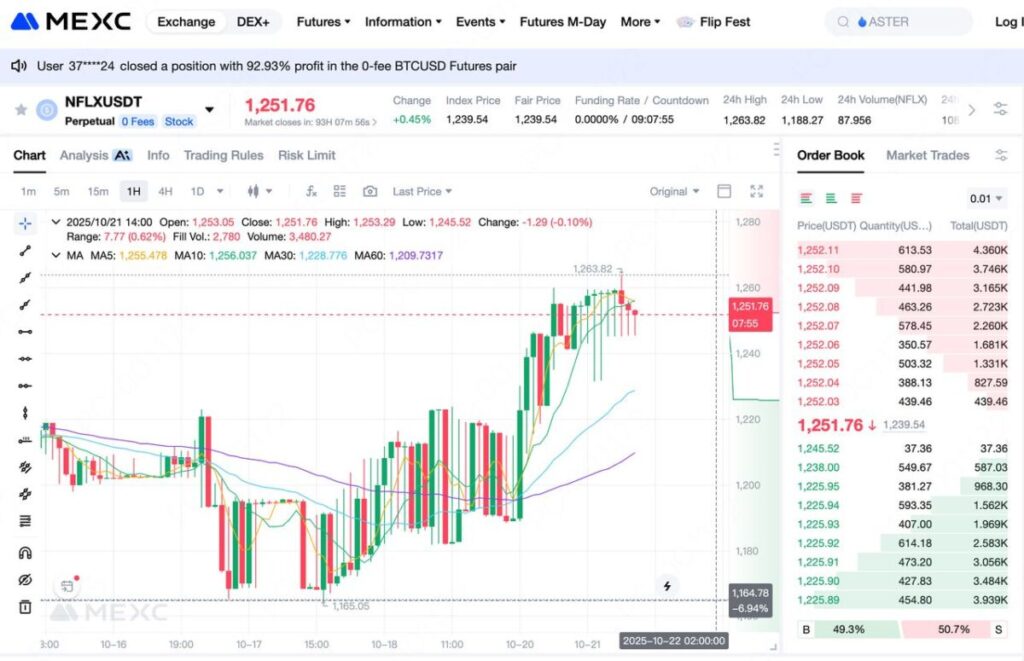

- Peak liquidity and lowest slippage occur during U.S. stock market hours (9:30 AM–4:00 PM ET).

- Always set stop-loss orders and limit position risk to 1–2% of total account equity. Beginners should start with 3–5x leverage using discretionary capital.

1.Netflix: The Engine of Global Streaming Growth

Founded in 1997, Netflix (NASDAQ: NFLX) evolved from a DVD-by-mail business into a global powerhouse in on-demand streaming. Its combination of exclusive original content, data-driven personalization, and aggressive international expansion has propelled its subscriber base to over 260 million worldwide — with annual revenues now exceeding tens of billions of dollars.

Netflix’s content-first strategy is at the core of its success. With annual production investments surpassing $17 billion, the platform continues to deliver award-winning originals and genre-defining entertainment. Beyond streaming, Netflix is diversifying into ad-supported tiers and gaming, expanding monetization opportunities and capturing new audience segments.

2.Why Trade Netflix (NFLX)?、

- Dominant Market Position:Netflix remains the cornerstone of global streaming and original content production, boasting massive global reach and a loyal subscriber base. Its multi-segment strategy — spanning content, advertising, and gaming — ensures sustained revenue growth and profitability momentum.

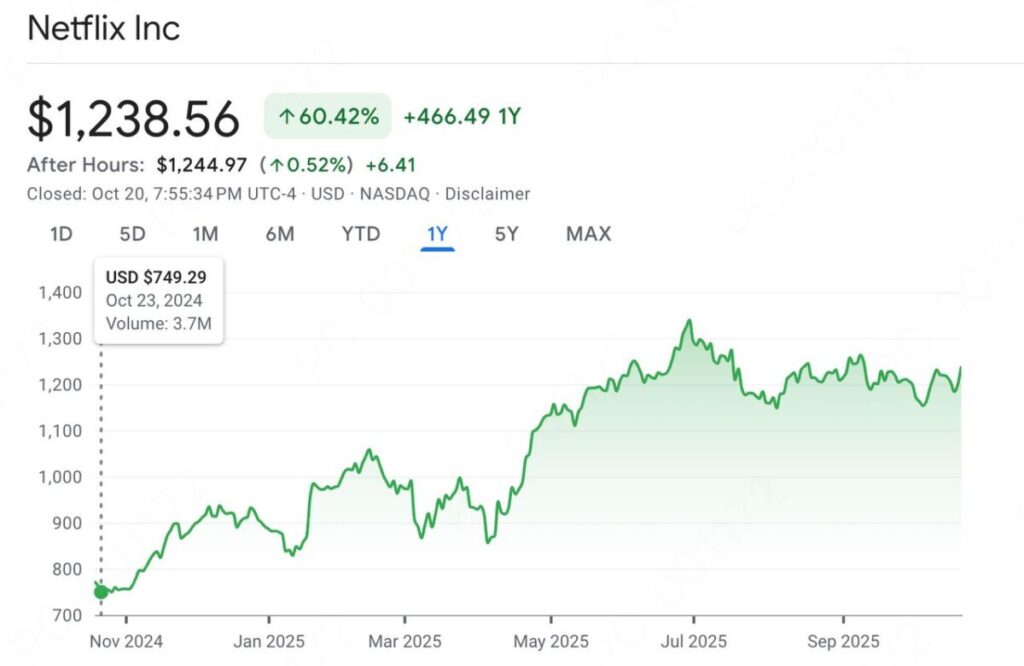

- High Volatility = High Opportunity:Over the past year, NFLX’s stock price has fluctuated between $744 and $1,341, an ~80% range that offers significant trading potential for derivative traders seeking short-term moves.

- Event-Driven Trading:From quarterly earnings to new content announcements and macro shifts in consumer spending, Netflix’s price action is consistently shaped by catalysts — making it ideal for active traders seeking both long and short opportunities.

- Tokenized Flexibility:With NFLXUSDT perpetual futures on MEXC, traders can easily track and trade Netflix price movements using USDT, without brokerage restrictions or market-hour limitations. This structure enables global, borderless access to U.S. stock exposure, 24 hours a day, 7 days a week.

3.How to Trade NFLXUSDT on MEXC ?

3.1 Step-by-Step Guide ?

As a leading global digital asset platform, MEXC provides a robust environment for trading tokenized stocks like Netflix, combining seamless execution with competitive fees.

To start trading NFLXUSDT:

1)Open and log in to the MEXC App or official website.

2)Search for “NFLX” in the futures market.

3)Choose your order type, input quantity and price, and confirm your trade.

3.2 Trading Strategies

- Bullish Setup (Long):Enter on retracements to key support levels or confirmed breakouts if you expect subscriber growth, ad-tier traction, or strong content performance.

- Bearish Setup (Short):Enter after downside breaks or weak earnings if you expect competition, margin pressure, or subscriber fatigue.

3.3 Risk & Position Management

- Stop-Loss:Always place stops just beyond key technical zones — e.g., long entry at $1,200, stop around $1,150.

- Take-Profit:Target resistance zones, such as $1,340–$1,350, based on technical structure.

- Leverage Discipline:Start small. Higher leverage magnifies both profits and losses — beginners should stick to low-to-moderate leverage.

- Hedging:For investors holding U.S. stocks or ETFs, inverse positions in NFLXSTOCK_USDT can help hedge downside exposure.

4.Key Trading Windows & Price Outlook

- Best Trading Hours:While MEXC allows 24/7 trading, the highest liquidity and most efficient price discovery occur during U.S. stock market hours (9:30 AM–4:00 PM ET).

- Current Snapshot (as of Oct 21, 2025):NFLX trades near $1,251.76, up +0.45% on the day.

- Technical Zones:Key support: ~$1,150,Key resistance: ~$1,340.Breakouts beyond these levels may trigger fresh directional trends.

5.Key Risks

- Leverage Exposure:Perpetual futures amplify both gains and losses — risk can escalate rapidly.

- Underlying Divergence:While NFLXUSDT mirrors Netflix’s price, factors like funding rates, liquidity, and platform mechanics can cause temporary price gaps.

- Market Risk: Macro shocks, industry competition, regulatory changes, or content underperformance may impact price action.

- Liquidity & Slippage:During volatile or low-volume periods, entry and exit prices may deviate from intended targets.

6.Frequently Asked Questions (FAQ)

Q1. Where can I check the current Netflix price?

You can monitor real-time pricing directly on the MEXC trading interface for NFLXUSDT, which tracks the live value of underlying Netflix shares.

Q2. What are funding rates and how do they affect my position?

Funding rates are periodic payments between long and short traders to keep the perpetual futures price aligned with the spot price. View current and historical rates on the MEXC contract page.

Q3. When is the best time to trade Netflix futures?

Liquidity and volatility peak during U.S. trading hours (9:30 AM–4:00 PM ET), when the underlying stock is most active.

Q4. How much capital do I need to start?

You can begin with as little as a few hundred USDT. However, for adequate margin and flexibility, a starting balance of $500–$1,000 USDT is recommended.

Q5. How long can I hold NFLXUSDT positions?

As a perpetual contract, there’s no expiration date. Positions can be held indefinitely as long as margin requirements are met and funding payments are maintained.

7.Conclusion

With NFLXUSDT perpetual contracts on MEXC, traders can seamlessly access Netflix’s global growth story — anytime, anywhere, and fully denominated in USDT.

Compared to traditional brokerage systems, tokenized stock trading delivers greater flexibility, accessibility, and 24/7 market exposure.However, futures trading carries inherent risk. Successful traders combine fundamental analysis, technical discipline, and strict risk management to navigate volatility effectively.

As AI-driven content creation reshapes the entertainment landscape, Netflix remains a core technology and media asset — and NFLXUSDT offers an innovative, borderless gateway for global investors to participate in its next chapter.

Join MEXC and Get up to $10,000 Bonus!