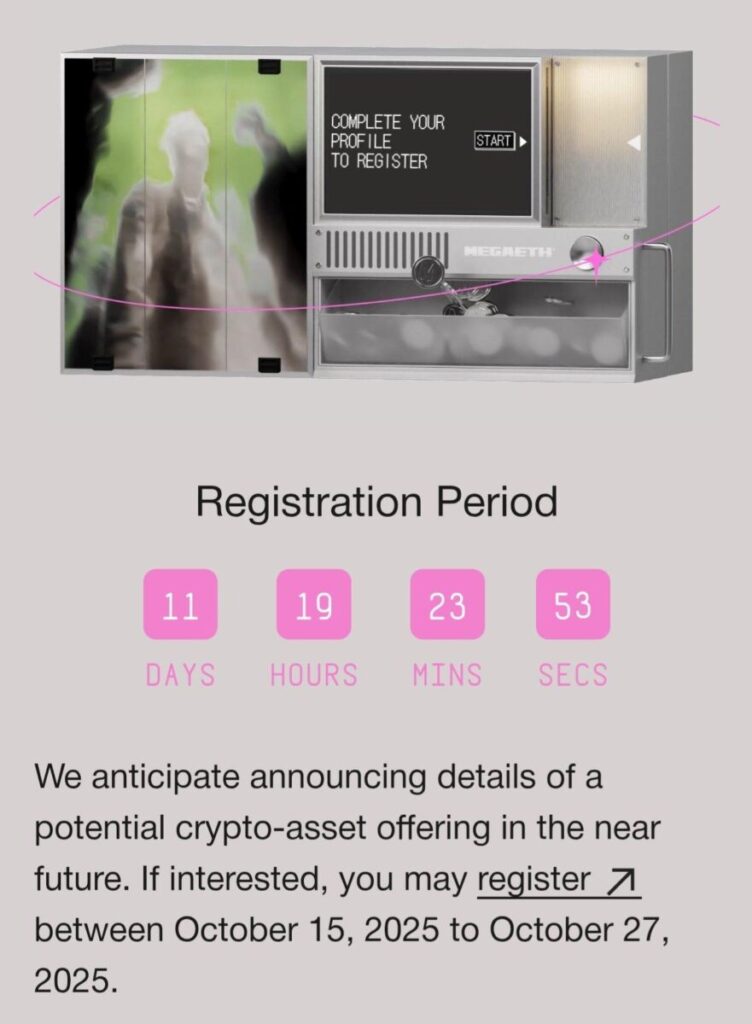

Just hours ago, MegaETH opened registration for its community ICO on Sonar, the token launch platform created by Lido co-founder Jordan “Cobie” Fish. Registration closes October 27, 2025, creating a two-week window to participate in what could be one of the year’s most significant Layer 2 token launches.

MegaETH’s potential public token sale takes place on Sonar, and represents a shift toward community-focused, transparent sales to drive user engagement and ecosystem growth. Unlike Binance’s extractive 9% model or traditional VC-heavy launches, this ICO represents ICOs making a comeback in 2025 with genuine community participation.

Here’s what you need to know before the October 27 deadline.

1.What Is MegaETH?

MegaETH is backed by notable investors including Dragonfly Capital and Vitalik Buterin. The project is building a real-time Ethereum Layer 2 with ambitious performance goals.

MegaETH’s specifications:

Current performance: 10-millisecond latency, 20,000+ transactions per second

Target performance: 1-millisecond latency (true “real-time blockchain”)

Architecture: EVM-compatible (existing Ethereum dApps can deploy immediately)

Design philosophy: Streaming transactions at Web2-like speeds

For context, Ethereum processes ~15 TPS with 12-second blocks. MegaETH’s 20,000 TPS with 10-millisecond blocks would make it among the fastest smart contract platforms available, if the technology delivers.

Ecosystem momentum:

Euphoria, a MegaETH-based crypto derivatives trading app, raised $7.5 million in seed funding from over 100 investors. Global Token Exchange (GTE), another MegaETH project, is backed by a $15M Series A led by Paradigm and is capable of processing up to 100,000 transactions per second.

The ecosystem is building rapidly. Multiple high-performance applications choosing MegaETH signals confidence in the underlying technology.

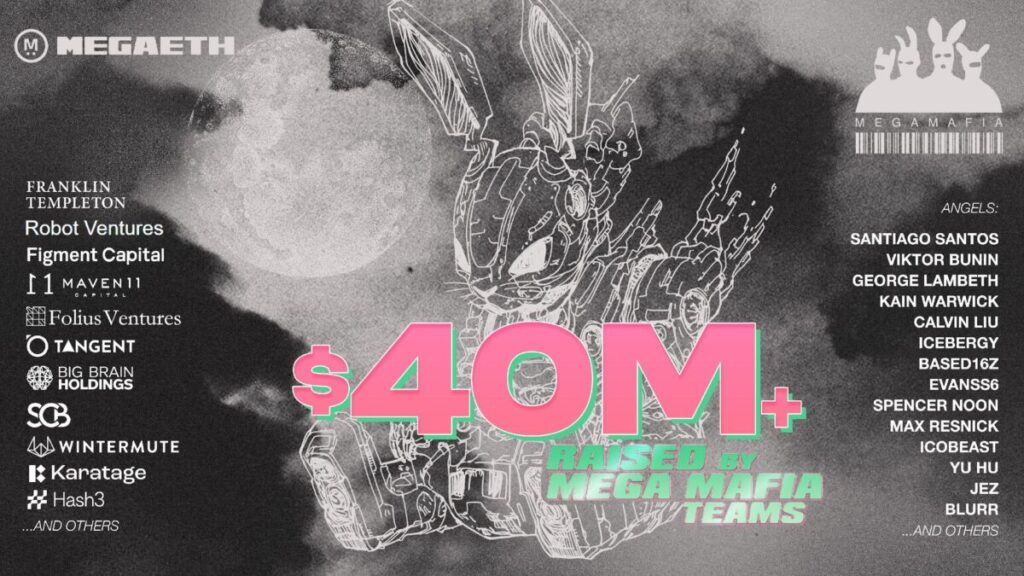

2.The Funding History: $57.73M Raised

According to Cryptorank, MegaETH raised $20 million on 27 June 2024, $10 million on 13 December and with plans of raising a further $27 million (via the NFT mint).

Total raised to date: $57.73M across multiple rounds

Funding breakdown:

– Seed round (June 2024): $20M

– Echo round (December 2024): $10M

– NFT mint (February 2025): $27.73M

– ICO (October 2025): TBD

Notable seed investors: Dragonfly Capital, Vitalik Buterin, Santiago R. Santos (angel investor)

The fact that Vitalik Buterin personally participated in the seed round is significant, it signals the Ethereum founder’s confidence in MegaETH’s technology as a genuine scaling solution.

3.The ICO Structure: Community-Focused, Fair Launch

Unlike traditional VC-heavy launches or Binance’s extraction model, MegaETH’s ICO prioritizes community participation.

Registration details (now open):

Registration deadline: October 27, 2025

Registration requirement: Identity verification on Sonar platform

Excluded: MegaETH employees, restricted jurisdictions

Payment method: USDT on Ethereum mainnet

Pricing format: English auction with fixed ceiling price

Lockup incentives:

U.S. residents: Mandatory 12-month lockup provides 10% discount on final token price

International: Optional 1-year lockup with 10% discount available

If oversubscribed: Additional profile information (social media, GitHub, wallets) will determine allocation

This structure rewards committed participants while allowing international traders flexibility.

4.Why This ICO Matters

Several factors make MegaETH’s ICO strategically important:

1. Vitalik-Backed Technology

Having Ethereum’s founder personally invest signals serious technical merit. This isn’t speculative,it’s validation from the ecosystem creator himself.

2. Community-First Model

ICOs are making a comeback in 2025, with MegaETH’s move showing a shift toward community-focused, transparent sales to drive user engagement and ecosystem growth. This contrasts sharply with Binance’s extraction or VC-dominated launches.

3. Real Performance Advantages

Unlike vaporware Layer 2s, MegaETH has demonstrated 10-millisecond latency and is targeting 1-millisecond blocks. Working derivatives platforms (Euphoria) and trading venues (GTE) are already building on it.

4. Narrative Alignment with Q4 2025 Altseason

Layer 2 tokens recently gained momentum (Mantle +19%). MegaETH entering the market during L2 narrative strength creates favorable timing.

5. Token Distribution Philosophy

Earlier this year, MegaETH announced plans to distribute its tokens through a new ICO model built around a soulbound NFT mint for its pioneer collection, The Fluffle. MegaETH said the NFT model was chosen to reward genuine community participation rather than speculative farming.

This philosophy, rewarding real usage over extracting value, aligns with trader sentiment tired of Binance-style deals.

5.Potential Risks

This isn’t a guaranteed win. Considerations:

Execution risk: Performance claims (10 ms, then 1 ms) must deliver in production. Many Layer 2s promise speed and underdeliver.

Competition: Arbitrum, Optimism, Solana already control significant TVL. Displacing them requires exceptional performance plus ecosystem network effects.

Regulatory uncertainty: Any Layer 2 faces potential regulatory changes affecting token utility or operations.

Market saturation: Layer 2 tokens are a crowded narrative. Price appreciation requires genuine differentiation, not just marketing.

Lockup periods: U.S. participants face mandatory 12-month lockup, restricting exit flexibility if needed during volatility.

6.Post-ICO: What to Expect

If historical ICOs are precedent, this is the timeline:

October 27: Registration closes

Late October/Early November: Terms announced (pricing, allocation details)

November/December: Token distribution and exchange listings

Post-launch: Initial volatility followed by price discovery

Earlier ICOs like Arbitrum (March 2023) and Optimism (May 2023) saw initial pumps followed by 40-60% corrections within 30 days. Patient traders who bought the dips participated in full recoveries 6-12 months later.

MegaETH, with stronger backing and clearer differentiators, could follow a similar pattern, or outperform if technology truly delivers.

7.MEXC Listing Expectations

When MegaETH eventually lists on centralized exchanges, MEXC will likely be among the first:

MEXC’s track record:

– Fast listings for high-profile tokens

– Deep USDT liquidity for smooth execution

– 0% maker fees reducing trading costs

– Advanced order types for volatile listings

For traders, MEXC’s platform will provide optimal infrastructure for accessing MegaETH tokens post-launch with minimal fees and maximum liquidity.

8.Your Timeline

Immediate: Register on Sonar before October 27 deadline for ICO eligibility

Late October: Monitor MegaETH channels for pricing/terms announcement

November: Prepare for token distribution and exchange listings

Post-launch: Monitor price action on MEXC and other exchanges

Don’t wait until October 27, register now to ensure you’re verified and eligible when terms are announced.

9.The Bottom Line

MegaETH represents the 2025 ICO renaissance: community-focused, founder-backed (Vitalik), technologically ambitious (10 ms), and fair-priced (no Binance extraction).

Whether the $57.73M raised to date (plus ICO proceeds) successfully builds a faster Layer 2 than competitors remains to be seen. But the combination of technical merit, strong backing, and genuine community focus makes this worth paying attention to through October 27.

For traders seeking Layer 2 exposure beyond Arbitrum/Optimism saturation, MegaETH’s ICO represents early-stage access to a differentiated project with real ecosystem momentum (Euphoria, GTE) already building on it.

Register before October 27. Then wait for MEXC listing.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up