Key Points:

- Singapore’s Matrixport anticipates a $25 billion investment into Hong Kong’s BTC ETFs via the Southbound Stock Connect program.

- The approval of spot Bitcoin ETFs in Hong Kong could channel underutilized Southbound quotas, amounting to $25 billion, into cryptocurrency.

- Chinese investors’ demand for diversification grows amidst the yuan’s decline, eyeing Bitcoin ETFs as a viable alternative asset.

Hong Kong stands on the verge of a financial shift with the expected approval of new Bitcoin spot ETFs. This move is likely to tap into a staggering $25 billion demand from Chinese investors, utilizing the Southbound Stock Connect framework. This channel, pivotal for mainland Chinese investors, grants access to eligible shares listed in Hong Kong, fostering a significant investment pathway.

Matrixport, a Singapore-based crypto services firm, shed light on this potential financial shift, highlighting the seamless facilitation the Southbound Connect program offers. This initiative could feasibly allocate up to 500 billion RMB ($70 billion) annually in transactions, suggesting a robust capacity for Bitcoin ETF investments in Hong Kong. Consequently, the anticipated approval of these ETFs might attract several billion dollars in capital, underscoring the vast investment appetite among mainland investors for Bitcoin as an asset class.

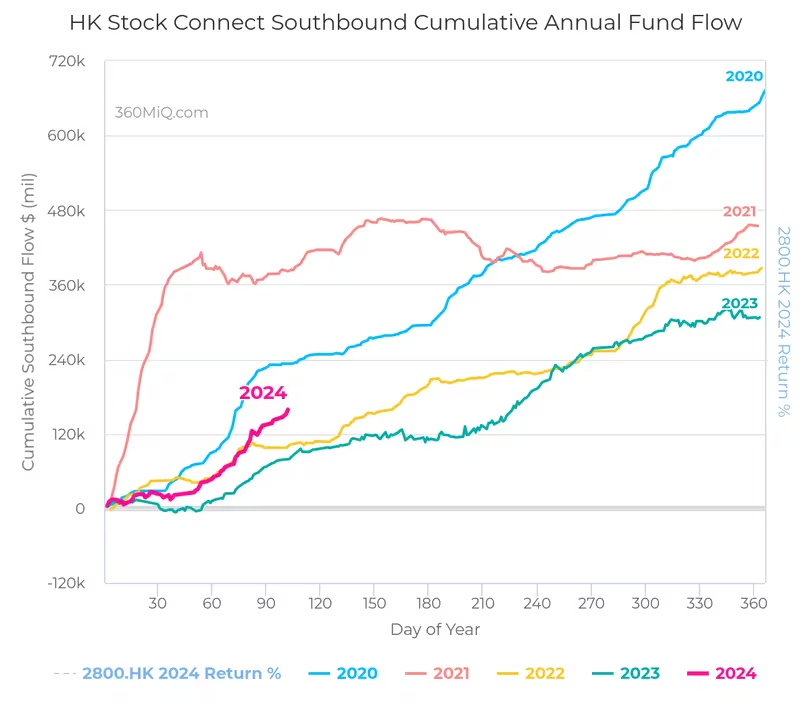

Data from 360MarketIQ indicates that the Stock Connect program’s historical flows have consistently fallen short of their full potential, leaving a substantial portion of the quota unutilized. This discrepancy presents a unique opportunity for Bitcoin ETFs to absorb the unclaimed quota, translating into a potential investment influx of $25 billion. Matrixport elaborates on this premise, indicating a bright outlook for cryptocurrency investment through this novel channel.

The prospects of such ETFs cater to the diversification strategy of mainland Chinese investors, especially in the wake of the yuan’s depreciation against the dollar. This financial dynamic has fueled the quest for alternative investments, with Bitcoin emerging as a compelling option amidst economic uncertainties. Matrixport’s analysis underscores the heightened demand for diversification, with the central bank’s gold purchasing spree mirroring this trend.

Observers in Hong Kong, including Nick Ruck of ContentFi Labs, noted the keen interest of mainland-based funds in launching spot Bitcoin ETFs through their Hong Kong subsidiaries. This strategic move would broaden access to Bitcoin for qualified mainland investors, marking a significant step in integrating digital assets into conventional financial portfolios.

Applications from leading Chinese financial entities, such as Bosera Asset Management, Harvest Global Investments, and GF Holdings-owned Value Partners, to issue ETFs in Hong Kong signify a growing institutional embrace of Bitcoin. This development coincides with the Stock Connect program’s expansion to encompass Hong Kong-listed ETFs, further augmenting the trading volume and investor interest in digital assets.

The global financial landscape observed a similar trend with the U.S. approval of several spot Bitcoin ETFs, resulting in a notable accumulation of investor funds and propelling Bitcoin to unprecedented heights. Hong Kong’s forthcoming approval of Bitcoin ETFs, therefore, not only symbolizes a significant milestone for cryptocurrency investment but also highlights the city’s strategic role in bridging traditional finance with the burgeoning world of digital assets.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!