When I first got into crypto, I didn’t fully understand why people were always talking about “scalability.” To me, Bitcoin was already huge, Ethereum was running smart contracts, and Solana was popping up everywhere with NFTs. But the deeper I looked, the clearer it became: blockchains can’t scale easily without trade-offs.

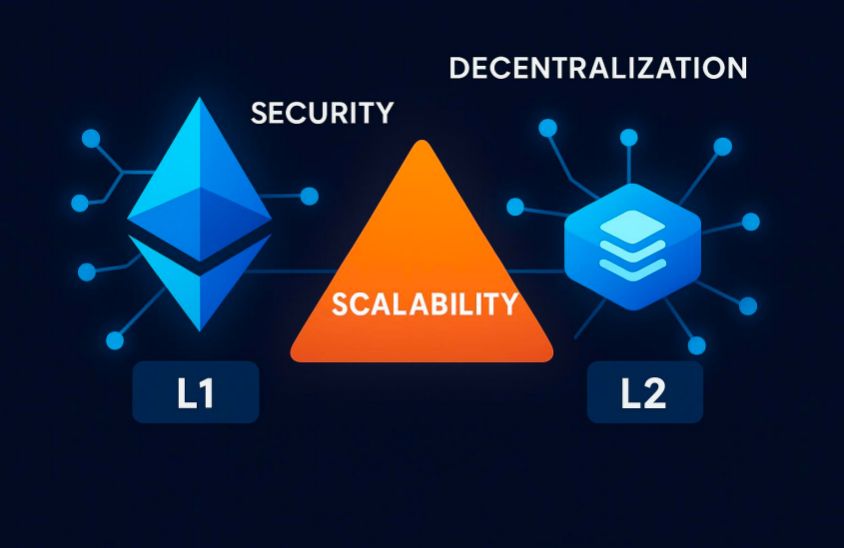

If you’ve been in crypto for even a short while, you’ve probably heard about the blockchain trilemma. It says that blockchains can only optimize for two things at once: security, decentralization, and scalability. You can’t have all three perfectly. And this trade-off is what shaped the rise of Layer-1 (L1) blockchains and Layer-2 (L2) solutions.

Fast forward to 2025, the battle is hotter than ever. Ethereum continues to dominate as a settlement layer, but its rollups (L2s like Arbitrum, Base, and zkSync) are stealing the spotlight. Meanwhile, Solana has staged a massive comeback, TON is onboarding millions through Telegram, and newer L1s like Sui and Aptos are fighting for developer attention.

The question is: will L1s remain the foundation of Web3, or will L2s win the scalability wars? The answer, as you’ll see, isn’t as simple as picking a winner.

1.What are Layer-1 and blockchains ?

Layer-1 blockchains are the base networks — the layer where everything is finalized. Bitcoin, Ethereum, Solana, TON, Aptos, Sui… all of these are L1s. They handle the actual transaction execution and maintain the integrity of the ledger.

Think of an L1 like the ground floor of a skyscraper. No matter how tall you build (dApps, DeFi, NFTs), the building only stands if the foundation is strong.

1.1 Strengths of L1s

- Security first: Transactions are validated directly on-chain, making them very difficult to tamper with.

- Native ecosystems: ETH, SOL, and TON aren’t just tokens — they’re the fuel of their networks.

- Sovereignty: Each L1 has its own governance, rules, and upgrade paths.

1.2Weaknesses of L1s

- Congestion: When demand spikes, fees rise and transactions slow (ask anyone who tried minting an NFT on Ethereum in 2021).

- Fragmentation: Users and liquidity get spread across multiple L1s, reducing overall network effects.

- Upgrade pressure: Every new L1 claims to “fix Ethereum,” but sustaining developer communities is much harder than it looks.

Right now, Solana and TON are proving that alternative L1s can still thrive, but Ethereum remains the gravitational center of Web3.

2.What are layer2 solutions?

Layer-2s are like turbochargers for blockchains. They take some of the transaction load off the L1, process it faster and cheaper, and then anchor the results back to the base chain. If L1 is the foundation, L2 is the high-speed highway built above it.

2.1 Examples of L2s in 2025:

- Arbitrum (ARB) – Still the leader in DeFi adoption.

- Optimism (OP) – Building its “Superchain” vision, letting multiple chains plug into one shared security model.

- Base – Backed by Coinbase, onboarding everyday retail users.

- zkSync & Starknet – Zero-knowledge rollups (zk-rollups) that many see as Ethereum’s future.

2.2 Strengths of L2s.

- Scalability: They dramatically reduce fees and increase throughput.

- Security inheritance: Since they anchor to Ethereum, they piggyback off its decentralization.

- Experimentation: They can iterate faster without waiting for global L1 consensus.

2.3Weaknesses of L2s.

- Dependence on L1: If Ethereum has issues, so do its L2s.

- Liquidity silos: Funds get stuck bridging across Arbitrum, Optimism, zkSync, etc.

- UX complexity: For many newcomers, bridging tokens feels risky and confusing.

- In short: L2s make Ethereum more usable, but they’re not “free-standing” the way Solana or TON are.

3.L1 vs L2 in 2025:The current state.

Here’s the reality check as we head deeper into 2025:

- Ethereum + Rollups: Ethereum has cemented its role as the settlement layer of Web3. Arbitrum, Base, and zkSync together process more daily transactions than Ethereum itself.

- Solana’s Resurgence: After setbacks in 2022–23, Solana has bounced back with strong NFT activity, DeFi, and memecoin hype. It’s fast, cheap, and user-friendly.

- TON’s Rise: Backed by Telegram, TON is onboarding millions of non-crypto natives — arguably the strongest “mass adoption” play right now.

- Aptos & Sui: Still growing but fighting hard for mindshare in the developer community.

So is it L1 vs L2? Not really. It’s more like L1 and L2, coexisting and addressing different needs. Ethereum provides neutrality and security. Solana provides speed. L2s provide scalability. TON provides distribution through social platforms.

4.The challenges ahead

Neither L1s nor L2s are perfect. Both face real obstacles:

4.1 For L1s

- Scalability limits: Even Solana struggles under extreme load.

- Regulation: Governments are watching tokens like ETH and SOL closely.

- Developer loyalty: Newer L1s must prove why devs should build there instead of Ethereum.

4.2 For L2s

- User education: Bridging, wallets, and seed phrases are still confusing for the average person.

- Liquidity spread: Too many competing rollups mean fragmented capital.

- Ethereum dependence: Their security is tied to Ethereum’s fate.

Ethereum dependence: Their security is tied to Ethereum’s fate.

Add in broader risks like hacks, bridge exploits, and policy uncertainty, and it’s clear the road ahead isn’t smooth for either side.

5.MEXC’s Role in the L1 & L2 story

Here’s where exchanges like MEXC come in. Let’s be honest — most users don’t start with MetaMask or Phantom. They start on exchanges.

MEXC Helps by:

- Listing both L1 and L2 tokens early — giving traders direct exposure.

- Educating users through MEXC Learn, closing the knowledge gap.

- Supporting projects via MEXC Launchpool and Kickstarter, helping new L1/L2 ecosystems grow.

Without exchanges bridging retail to these ecosystems, L1 vs L2 would stay a developer’s debate. MEXC turns it into something users can actually participate in.

6.Case studies

6.1 Etherium vs Solana

Ethereum is the global settlement layer. Solana is the retail-friendly speed demon. One prioritizes trust, the other prioritizes UX. Both survive because they serve different needs.

6.2Arbitrium vs Optimism vs Base

Arbitrum dominates DeFi. Optimism pushes governance and modularity. Base taps Coinbase’s user base. They’re not “one winner takes all.” They’re carving niches.

6.3Zksync & Starknet

Zk-rollups are the “long game.” They’re more complex but potentially the most powerful scaling solution. The race is still early, but by 2026, zk-based L2s could outpace optimistic rollups.

7.Conclusion

So, who wins the scalability wars in 2025?

The honest answer: no single chain or layer wins. This isn’t a boxing match; it’s a layered ecosystem.

L1s like Ethereum, Solana, and TON provide the secure and distributed foundations.

L2s like Arbitrum, Base, and zkSync make blockchains usable for the masses.

Exchanges like MEXC connect the dots, onboarding millions and educating the next generation.

As someone deeply engaged in the crypto space for years, I see the L1 vs L2 debate less as a rivalry and more as a roadmap for the industry’s evolution. Both layers solve different aspects of the trilemma, and together they are building a foundation for the next billion users.

The real question isn’t who wins, but how fast we can create an ecosystem where scalability, security, and decentralization coexist ,and how platforms like MEXC accelerates that journey.

Disclaimer:This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up