Crypto investing isn’t one-size-fits-all. Different people adopt different strategies depending on their background, risk appetite, and goals. For some, the “store of value” approach—buying and holding BTC or ETH for the long run—feels safest. But for many retail investors and degens, chasing trends and narratives is where the real action (and outsized gains) happens.

This style of investing thrives on FOMO-driven hype cycles. Done right, it can deliver returns that traditional markets simply cannot match. But it also comes with high risk if you don’t understand how narratives form and fade.

1.Looking Back at Key Trends & Narratives

To understand how to spot the next big story, it helps to look back at previous cycles. Stories repeat more or less structurally, even as the market evolves.

🗓 2021

Feb–Apr: NFT → SAND, MANA, etc.

- Catalyst: Beeple sold an NFT for $69M. Jack Dorsey sold his first-ever tweet as an NFT for $2.9M. OpenSea trading volume went vertical.

- Reason: NFTs exploded in early 2021 thanks to a perfect storm—mainstream media attention (Beeple, celebs), ultra-cheap liquidity, a compelling narrative around digital ownership + the metaverse, and infrastructure ready for mass adoption (OpenSea, NBA Top Shot). Retail investors piled in, fueling exponential growth.

Apr–May: Memecoin → DOGE, SHIB

- Catalyst: Elon Musk relentlessly tweeted about Dogecoin, even calling himself the “Dogefather.” He later mentioned DOGE on Saturday Night Live.

- Reason: Retail investors with small budgets were priced out of BTC and ETH. Memecoins like DOGE and SHIB offered cheap entry points and the dream of life-changing gains. The psychology: “If $100 in a meme can 100x or even 1000x, why not gamble?”

🗓 2022

Feb–Apr: Move-to-Earn → STEPN (GMT, GST)

- Catalyst: The launch of STEPN captured attention instantly—“run in real life, earn tokens.” The concept went viral on TikTok, Twitter, and beyond.

- Reason: Unlike DeFi or NFTs, which required crypto-native knowledge, Move-to-Earn was intuitive. It combined lifestyle, fitness, and crypto, onboarding an entirely new demographic. At its peak, it felt like everyone was running outside to farm GMT.

🗓 2023

Jan–Mar: AI Narrative (Wave 1) → FET, AGIX, RNDR, TAO

- Catalyst: OpenAI released ChatGPT in November 2022. By January 2023, it reached 100M users—the fastest adoption curve in history. Big Tech (Microsoft, Google) pivoted toward AI, sparking a global hype cycle.

- Reason: Crypto needed a new story after the brutal 2022 bear market (LUNA and FTX collapses). AI became the perfect bridge. The world was obsessed with AI, and crypto mirrored that energy by pumping AI-related tokens.

🗓 2024

May–Sep: Solana Meme Season → WIF, BONK, POPCAT

- Catalyst: pump.fun made it stupidly easy to launch tokens. Combined with Solana’s ultra-low fees, it created a fertile ground for memecoin mass adoption.

- Reason: Solana memes were cheap, liquid, and fast. Retail didn’t care about fundamentals—only community and storytelling. For many, this was the fastest way to turn a few hundred dollars into life-changing money.

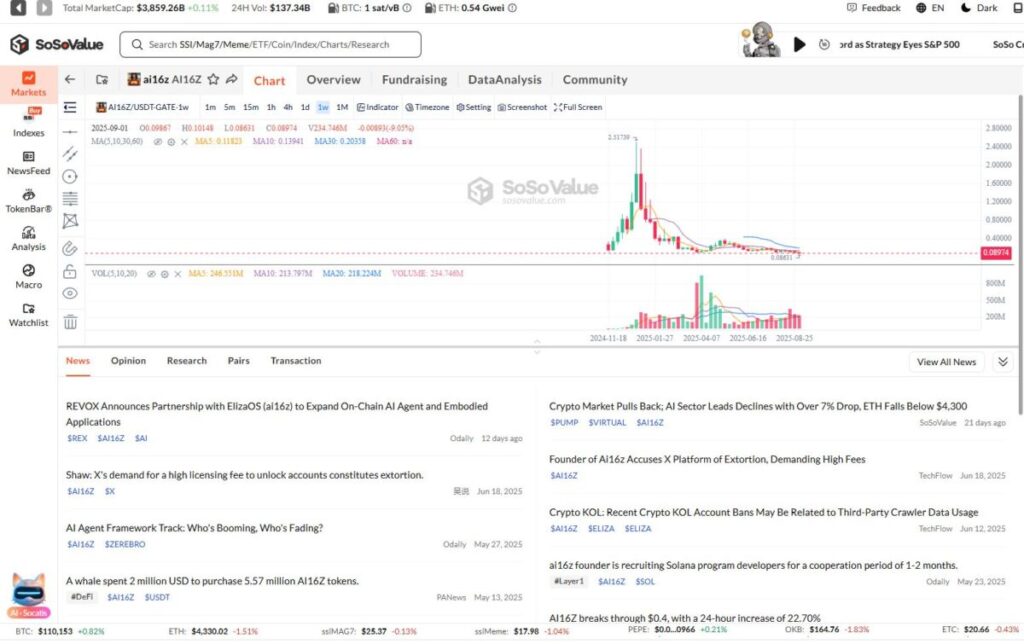

Sep 2024–Jan 2025: AI & AI Agents → GOAT, AI16z, VIRTUAL

- Catalyst: $GOAT appeared—a meme token tied to the AI Agent narrative. It blended the simplicity of memes with the futuristic vision of AI Agents.

- Reason: Most retail investors don’t understand decentralized AI infrastructure (DeAI). But “AI agents making money for you” is a meme anyone can grasp. It was easy to FOMO into, and the returns were insane.

2. How to Identify Emerging Narratives

Every successful trend has one thing in common: FOMO fuel. Narratives spread when amplified by KOLs, funds, exchanges, and social media. Here’s how to catch them early:

- Follow KOLs & Funds: Pay close attention to narratives being pushed by major influencers, VCs, and exchanges. Their backing often signals momentum.

- Track Top Gainers: Tokens leading price charts on major exchanges often belong to an active narrative. Explosive gains cluster together.

- Use Google Trends: Search interest in terms like “NFT,” “AI,” “memecoin,” or “AI agent” often spikes just before price action.

- Check On-chain Data: Look at metrics like TVL, revenue, or active wallets tied to a specific theme. A sudden surge usually means the trend is real.

When the memecoin trend explodes, related articles will appear more and more.

3. The 3 Phases of a Narrative

Every trend has a lifecycle. Knowing which phase you’re in can make the difference between life-changing gains and exit liquidity.

Phase 1: The Spark

- Only 1–2 “lead tokens” exist. The narrative is forming, but not yet mainstream.

- If you identify it here, returns can be astronomical. But almost no one has conviction or foresight.

- Example: $GOAT emerged from an AI experiment (Truth Terminal). It went on to multiply thousands of times, igniting the AI Agent trend.

Phase 2: Expansion

- Multiple projects start appearing and pumping together.

- KOLs begin mentioning the narrative more often. Alpha leaks come from degen circles on Crypto Twitter.

- Strategy: This is usually the sweet spot. The trend is confirmed, liquidity is flowing, and you still have time to capture strong upside.

Phase 3: Peak Hype

- Everyone knows the narrative. It’s trending on CT 24/7. KOLs nonstop mention it. Copycat projects flood the market but perform poorly.

- Risk: Entering here is dangerous. Retail is buying the top, while smart money is exiting.

Phase 4: Decay

- The narrative weakens as prices and volume declines, new capital stops, copycats collapse, and even lead tokens lose relevance.

- Don’t enter at this stage. If still holding, assess whether the project has real fundamentals. A few strong plays may survive, but most will fade into irrelevance.

=> If you’re investing based on trends or narratives, the best entry point is Phase 2 – Expansion. At this stage, the narrative is already confirmed, multiple projects are rallying together, KOLs are actively talking about it, and liquidity is flowing in.

For investors, this phase provides enough signals to be confident the trend is real, while still leaving plenty of upside before retail FOMO peaks at the top. In other words, Phase 2 strikes the right balance between safety and profit—whereas Phase 1 is too risky, and Phase 3 often turns you into exit liquidity for others.

$ai16z, a token of the AI-Agent trend, grew thousands of times and fell hundreds of times from the peak when the trend ended

4. Tips & Caution for Trend Investing

- Spot the Inflection Point: Recognize the difference between short-term hype vs. sustainable narratives. Some trends fade, others evolve into multi-year cycles.

- When a trend takes off, CEXs quickly start listing related projects. Some exchanges, like MEXC, are especially fast in listing trend-driven tokens early to capture user demand.

- Check Strength Factors: Duration, intensity of FOMO, accessibility to retail, and participation from VCs/exchanges all indicate how strong a trend may be.

- Stay Daily Updated: Narratives shift fast. Consistent research and monitoring are essential.

- Liquidity Matters: Narratives only fly when overall market liquidity is abundant. If liquidity dries up, even the hottest trend dies.

- Timing is Critical: Most trends last ~2 months on average. If you enter late, you risk bagholding.

- Take Profits Early: When mainstream chatter peaks, projects ramp up marketing, and major exchange listings begin, it’s often the right time to take profits.

5.Final Thoughts

Investing in trends/narratives can deliver massive gains in a short time, but the risks skyrocket once the hype fades. The key is getting in early and at the right moment. If you join too late, you’re just exit liquidity for others. The real edge comes from spotting the story early, riding the wave in the middle phase, and exiting before the crowd catches on.

Disclaimer: This content does not provide investment, tax, legal, financial, or accounting advice. MEXC shares information purely for educational purposes. Always DYOR, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up