Summary

In September 2025, a “stable” revolution is brewing in the crypto industry. Hyperliquid’s governance vote over the issuance rights of its native stablecoin USDH has become one of the most closely watched events in DeFi. This is not only a competition over stablecoin design, but also a fundamental reshaping of the value logic behind Hyperliquid’s governance token HYPE.

TL;DR

- In September 2025, Hyperliquid launched the governance battle for the issuance rights of its native stablecoin USDH, sparking widespread attention across the DeFi space and beyond.

- Meanwhile, HYPE price has surged, reaching a yearly high of $57.06. The momentum is further supported by the wave of projects launching on Hyperliquid—spanning DeFi, GameFi, and SocialFi—which reinforces the long-term value proposition of HYPE. The USDH battle marks a watershed moment for the ecosystem’s future direction.

- The USDH initiative is not just about bringing a new stablecoin to market; it represents a deep experiment in how value, governance, tokenomics, and compliance are restructured within the ecosystem. HYPE’s rally reflects the market’s attempt to price in these potential shifts ahead of time.

1.HYPE Token Market Performance

1.1 HYPE Token Price Data

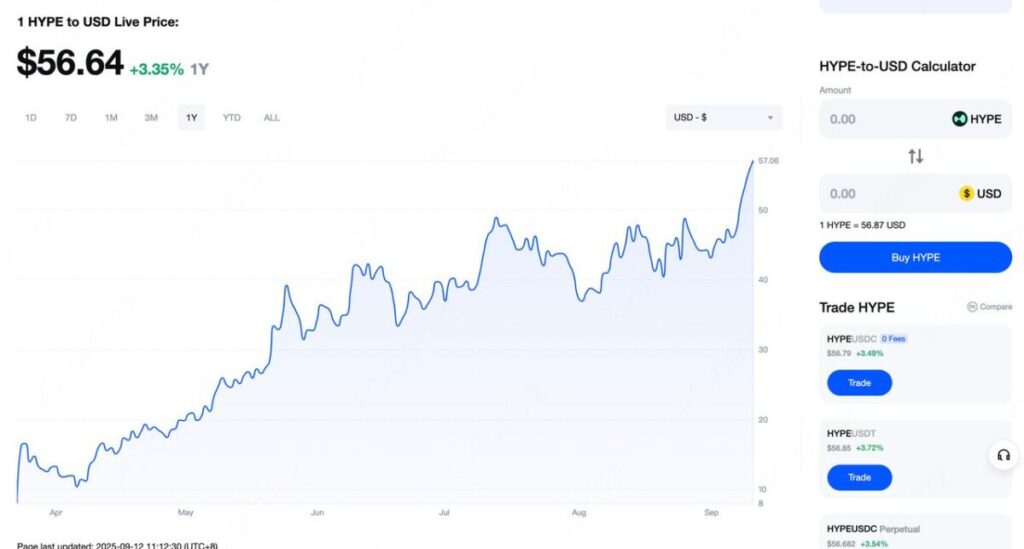

The latest data shows that HYPE has surged to $56.64. Over the past 24 hours, the token briefly dipped to around $53 before sharply rebounding to touch an intraday high of $57.43, closing at $56.88 — a +3.35% daily gain. This indicates strong buy-side support at lower levels and continuous capital inflows pushing the price higher.

Looking at the yearly trend, since its launch on 2024, HYPE has maintained an upward trajectory. Between May and July 2025, its price broke above $50, consolidating before climbing again in September to a new yearly high of $57.06.

HYPE’s market cap has surpassed $10 billion, with a fully diluted valuation (FDV) exceeding $30 billion. This milestone makes Hyperliquid the second decentralized exchange (DEX) project, after Uniswap, to cross the $10 billion valuation mark.

1.2 Ecosystem Expansion and Growth Outlook

Beyond its token price, Hyperliquid’s growth lies in the rapid expansion of its ecosystem. By early 2025, more than 100 projects have chosen to launch tokens on Hyperliquid, spanning DeFi, GameFi, and SocialFi sectors. This diversification injects strong momentum into the platform’s ecosystem and provides long-term value support for HYPE.

2.Why Is HYPE Rising?

HYPE’s rally during the USDH stablecoin vote is not a simple case of “good news speculation.” Instead, it reflects market consensus, governance power, and real profit expectations converging:

2.1 Yield Recapture and Inflation Hedge

If the winning USDH proposal allocates the majority of reserve interest income to HYPE buybacks and ecosystem funds, HYPE holders directly benefit. This strengthens the token’s intrinsic value and explains why markets are bullish on its governance model.

2.2 Scarcity and Control Premium

Control over USDH means control over a significant portion of Hyperliquid’s future economic flows. Validator voting, staking, and governance power amplify HYPE’s importance.

2.3 Liquidity Attraction and Ecosystem Growth

Once USDH is launched, liquidity pairs and trading activity will increasingly be denominated in USDH, generating higher trading fees and bringing more users into the ecosystem.

2.4 Pushback Against Stablecoin Centralization

The dominance of USDC and USDT has raised concerns over centralization and regulatory risks. By launching a native, transparent, and potentially compliant stablecoin, Hyperliquid positions USDH as a hedge against systemic risks while offering users more sovereignty in DeFi.

3.Why Hyperliquid Wants USDH

3.1 Stablecoin Market Landscape

Today, the stablecoin market is still dominated by USDT and USDC. Hyperliquid holds approximately $5.5–5.6 billion in stablecoin reserves, mostly in USDC. The interest generated from these reserves (around $220 million annually) is currently captured by external issuers, like Circle — leaving the Hyperliquid community excluded from this revenue stream.

At the same time, Hyperliquid’s monthly perpetuals trading volume nears $400 billion, generating over $100 million in trading fees. This makes control of its own stablecoin issuance a highly profitable and strategically critical move.

3.2 Strategic Goals of USDH

- Internalize reserve yields: Redirect the $220M+ in annual USDC yield into the ecosystem.

- Boost HYPE’s value: Allocate most reserve income to HYPE buybacks and ecosystem grants.

- Improve efficiency: Reduce trading friction, cut costs, and enhance cross-market liquidity.

- Enable compliance: Proposals highlight fiat on/off-ramps, regulatory approval, custodial partners, and even credit ratings for transparency.

3.3 Competing Proposals and Governance Vote

Issuing USDH is not decided unilaterally by Hyperliquid, but via on-chain governance and validator voting. Several contenders are competing for control:

| Competitor | Proposal Highlights |

| Sky (ex-MakerDAO) | $8B balance sheet backing, 4.85% yield, $2.2B liquidity for redemption, $25M ecosystem investment, HYPE buyback commitment. |

| Paxos | Partnership with PayPal, free fiat on/off-ramps, 95% of reserve yield to HYPE buybacks, global compliance guarantees, milestone-based revenue caps. |

| Frax Finance | Peg USDH to frxUSD 1:1, backed by U.S. Treasuries/RWA, 100% yield distributed via smart contracts to Hyperliquid users, transparent fees. |

| Agora | Banking custody, fiat rails, profit-sharing commitments, institutional-grade asset management. |

| Native Markets | Deep Hyperliquid-native integration, fiat bridges, yield directed to HYPE buyback funds, emphasis on ecosystem-native deployment. |

4.What’s Next for HYPE?

4.1 Likely Winner

As of September 11, 2025, validator voting data shows:

- 53.39% support for Native Markets

- 12.78% for Paxos

- 8.26% for Ethena

- Others at near zero

- 25.56% votes uncast

Given its ecosystem-native positioning and community alignment, Native Markets currently lead the race. Its transparent revenue-sharing model and technical integration make it a strong favorite. Still, Paxos and Sky remain competitive with their compliance strength and capital depth.

4.2 Potential Outcomes for HYPE

- If successful: USDH revenues will strengthen HYPE’s buyback program, expand its use cases, and enhance governance value — pushing the token higher.

- If unsuccessful or poorly implemented: Market confidence could erode, HYPE may retrace sharply, and governance disputes could arise if transparency is lacking.

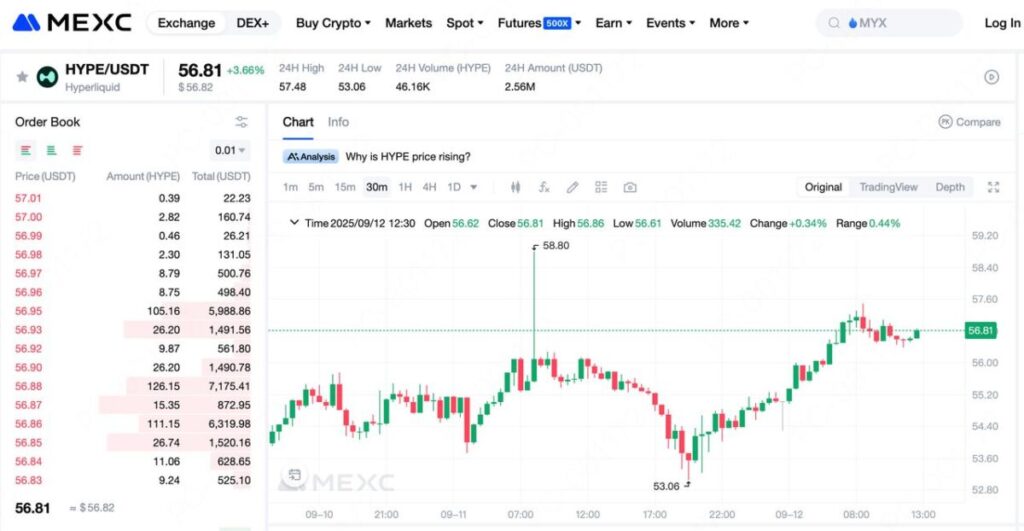

5.How to Buy HYPE on MEXC

MEXC, a leading global exchange, has listed $HYPE with deep liquidity and competitive trading fees. To purchase HYPE:

1)Log in to the MEXC App or website.

2)Search for HYPE in spot or futures markets.

3)Enter your trade details (price, amount) and place the order.

6.The USDH Battle: A Turning Point for DeFi

The USDH governance battle is more than a fight over stablecoin issuance—it represents a watershed moment for the restructuring of the Hyperliquid ecosystem. USDH is not just another stablecoin launch; it is a deep experiment in how value distribution, governance design, tokenomics, and regulatory alignment can be reshaped within a protocol. HYPE’s recent price rally reflects the market’s attempt to price in these transformative shifts ahead of time.

Regardless of which proposal ultimately prevails, several outcomes are already clear: Hyperliquid will move toward sovereign control of its stablecoin issuance; reserve interest revenue, which has historically gone to external institutions, could now accrue to the ecosystem; HYPE’s core value narrative will be amplified through the integration of USDH; and the dominance of a few centralized stablecoins is being directly challenged, with protocol-native (and compliance-friendly) stablecoins emerging as the next strategic frontier.

For investors and market watchers, the key checkpoints are: the September 14 governance vote, the transparency of proposal execution, whether validator and governance participants’ actions align with market expectations, and how USDH liquidity evolves post-launch.

Overall, Hyperliquid is rapidly becoming an undeniable force in DeFi. The strong performance of HYPE and the disruptive implications of USDH highlight the market’s recognition and expectations of the platform. While challenges and risks remain, Hyperliquid’s technical strength, ecosystem dynamism, and clear strategic vision put it in a strong position to sustain growth and deliver long-term value. For anyone tracking the DeFi sector, Hyperliquid is unquestionably a project worth close attention.

Join MEXC and Get up to $10,000 Bonus!

Sign Up