Digitization is the future, and we are gradually migrating in the right direction. From hard cash to credit cards, digital money, and a whole new way of storing and investing via the new digital asset of Blockchain Technology.

Investors are definitely inclined to experiment and are trying to digitize their assets. And this very inclination of investors to digitize their assets and experiment in new ways has enabled and empowered blockchain industries to innovate and the innovation is nothing but DEX, the Decentralized exchange platform.

Digitization followed by new and innovative ways to raise funds has given rise to a new fundraising model the “Initial DEX Offering” also known as the IDO. A fundraising community enabling and empowering the blockchain via the Decentralized Exchange.

What is Initial Dex Offering (IDO)?

ICO and IDO are launching mechanisms for community tokens. The ICO model, which was the earlier fundraising model, meant that we launch after making a price.

This essentially implies that first, the company raises funds from the public and then goes on to develop products and services.

However, products and services remain to be developed in the future, which is beyond the investors’ control.

Consequently, there are potential risks that the project can’t be delivered with good quality, and hence at times, it is terminated. In addition, it is easy for this model to be used for financial fraud.

For this very reason, it has been difficult to evaluate the projects launched in the ICO model. The ICO valuations have historically been faulty since the fundraising model lacked security and was not even regulated.

IDO is the new kid on the block, a unique fundraising model for projects that use cryptocurrencies as their medium of exchange. This form of crowdfunding eliminates the issues faced by its predecessors, enhances security, provides immediate liquidity, and goes beyond third-party influencers.

To know more about IDOs, their advantages, and disadvantages, read: A Complete Guide to Initial Dex Offerings (IDOs)

How Can You Participate in an IDO?

Have you ever bought a lottery ticket? Even if you haven’t, I am quite sure you know how it works.

It is a gamble, like any other investment. You need luck and with some amount of research, you know exactly which lottery ticket to buy.

Apart from this, you play the game of probability by buying a lottery ticket, whose pool size is relatively smaller, increasing your chance to win.

But IDOs are different. They work on similar lines with some technical differences. Let us understand these differences in more detail.

How they work

Any project or business needs capital to expand and grow, and what options do we have to raise capital?

Well, we have the traditional methods where we approach the banking sector or raise capital via a private equity investor. Or we could go on a different route with the new fundraising model, IDO. Any project which is going to be launched via an IDO will be on the brink of launching via the available platforms to raise capital.

To name a few, Binance launchpad, Paid Ignition, Polkastarter, TrustSwap, and trust me the list is endless, but I have mentioned the popular ones, where most of the IDOs have launched their projects via launchpads.

Once the investors have decided to invest, there are new ways to contribute, unlike traditional ways of using the currency used by that particular country.

Contribution by the users of an IDO platform for raising funds can be done via digital currency like ETH, BSD, AUD, USDT, or for that matter even via the native currency of that particular platform.

Any project being launched requires only a limited capital for growth, they do not intend to raise funds to such a huge extent that they then don’t know how to utilize it. So the offerings are limited, and hence a system of First come First served basis (FCFS) is followed

Overcoming the drawbacks of the previous fundraising models like ICO, IEO, in the case of an IDO, most of the platforms scrutinize the project and its team before launching it. Hence the investors are safeguarded and only the good projects are launched via an IDO. Though, of course, there will always be some platforms that do not vet the project, and as investors, it’s our job to select a good platform and a good project.

Most of the IDOs are oversubscribed. It is like buying a ticket to a Bryan Adams concert—most of the tickets are sold within minutes of the counter opening. Some of the platforms even allocate tokens based on a virtual lottery.

Phenomenal returns

Though IDO is a relatively new way of fundraising, many projects have used this route and have had success kissing their feet. As mentioned earlier, you need a launchpad to launch your IDO, and once the IDO is launched and listed, you are free to encash the profits. The lock-in period is hardly anything, and the craze for immediate liquidity makes this way of fundraising more popular.

Investing in an IDO

Every platform has different criteria for participation, but most of the steps are more or less the same, and if you follow them as mentioned, you are good to go. The steps are as follows.

The KYC Process

One of the most important steps is the KYC/AML screening (Know your customer/ Anti-money laundering).

The name says it all. The reason this is very very important is for the platforms to evade any legislative issues. In the banking sector, if the KYC process is doubtful, the bank outrightly will reject your application even to open an account, leaving aside transacting.

Holding Requisite Tokens

If you are inclined to invest, be it banking or the crypto world, you need the money and in our case the tokens.

Any IDO launch will definitely give preference to the investors holding their tokens (also known as the native tokens) since you are allowed to invest via two pools, one open for everyone and a special pool for special people. Though this is optional, if you do hold the native token, the chance of allocation becomes much higher.

The Whitelist

The biggest point of contention and what participants grumble about the most is the fact that only a handful few participants manage to get on the whitelist and receive tokens.

This happens because of the rationale that the demand for cryptocurrencies is beyond our imagination and the money raised via the new projects is also relatively little compared to previous fundraising methods (ICO).

The first step in the IDO process is the whitelist. Don’t get confused hearing the term Whitelist, just means to participate in any IDO, you need to register for that particular IDO.

Every platform has different criteria for participation. Some of the marketing tasks need to be done, to ensure you are on the whitelist.

Investors find out about any new IDO launches via social media platforms, apart from the subscription we have done on the particular launch platforms. So ensure you follow the Twitter handle and other social media platforms, and retweet to know more about the IDO.

Don’t worry, if you don’t know where to start, I’ll explain the entire process in the latter part of the article with the help of my experience in one of the IDOs I have invested in.

Choosing the Best Platforms

Many platforms have come up in recent times, and trust me with each passing day the number just seems to be going up.

Being a relatively new arena, the platforms are still developing in every aspect from their infrastructure to their offering and also their business models. Hence choose wisely. To name a few, DuckStarter, Ignition, and Polkastarter are some of the options you should consider.

Maintain a Wallet

For any sort of transaction in the crypto world, you need to have a hot wallet, a wallet from where you will invest and receive the tokens as well. Having a hot wallet optimizes the process. You can choose from the options available.

The more commonly used wallets are Coinbase, Exodus, and Metamask. To know more, check out our article: The Beginner’s Guide to MetaMask

Once the allocation happens, the tokens are stored in your wallet. Eventually, you can start trading the allocated tokens.

Steps to Participate in an IDO using Binance Smart Chain

Let us understand the step-by-step process to take part in an IDO. I am sure you have understood the technicalities, but a demonstration of the same will make the entire process clear to you.

I will be explaining how you can participate in an IDO via the BSCstarter launchpad operating on Binance smart chain.

Step 1: Acquire Tokens

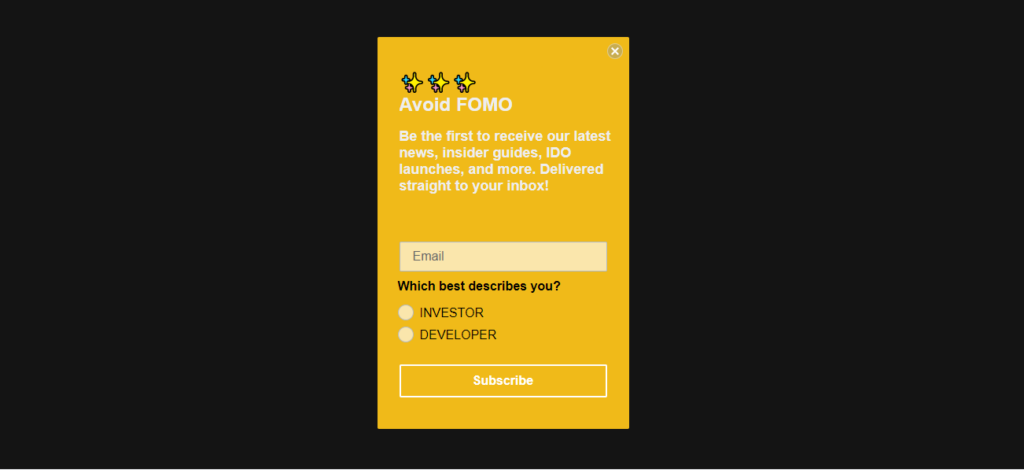

Head to the Bscstarter.finance to get the tokens.

Enter your email address, and you would get a confirmation for the same on your mail as well.

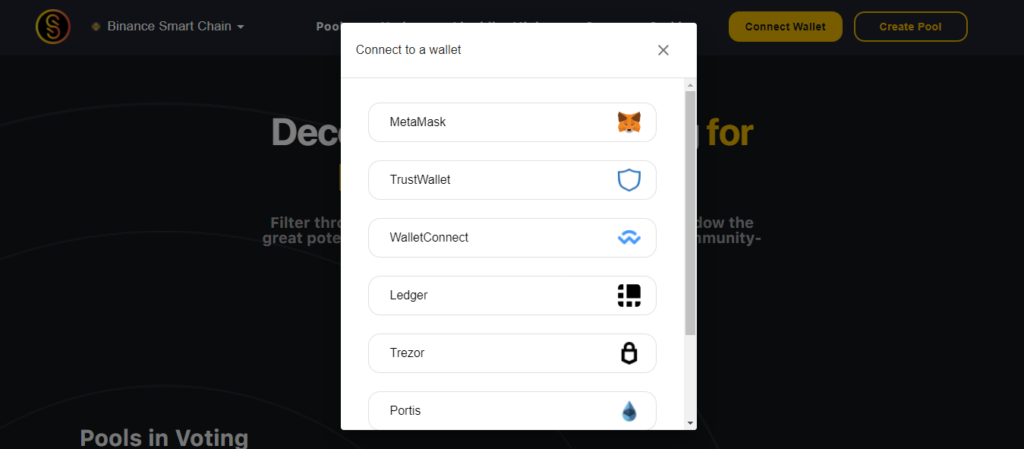

Step 2: Connect Your Wallet

You now need to connect your wallet. It will give you a dropdown menu to select, since I have a Metamask wallet, I will be connecting the same for my transactions.

Certain permissions need to be granted. It’s pretty basic actually, but if you are one of those investors who like to skim through, please feel free to do it.

Once your wallet is connected it will show on the upper right corner, with your wallet address.

Step 3: Acquire Native Tokens

To take part in any IDO on the Binance smart chain, you also need the START Token for staking. Once you visit the site and check the stats, you will notice the START Tokenomics, an interesting term isn’t it?. It simply states the token in circulation.

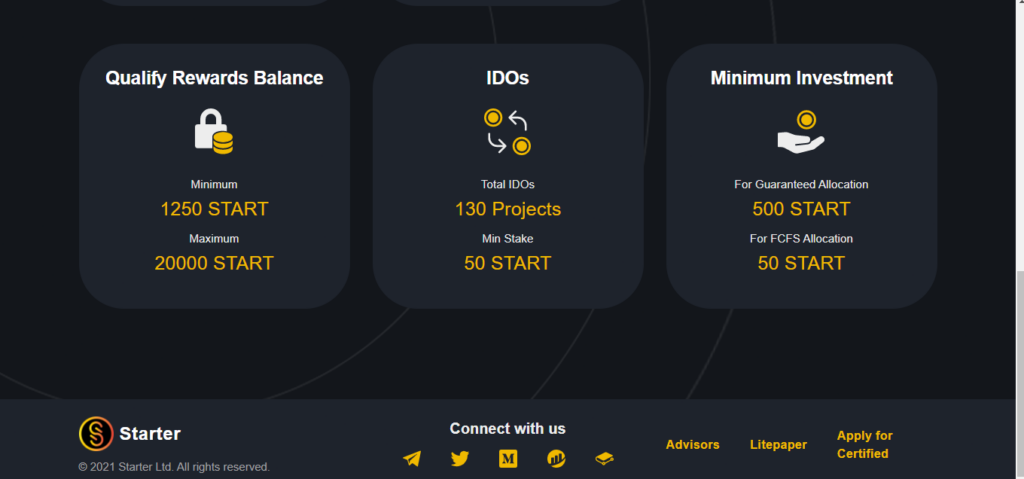

If you scroll further down, you will realize that to participate in an IDO, the minimum stake is 50 START tokens. Be very wary of the fact, with 50 START tokens, you can only participate. For a guaranteed allocation, the stake is 500 START Tokens, which sounds too much, trust me it’s expensive too.

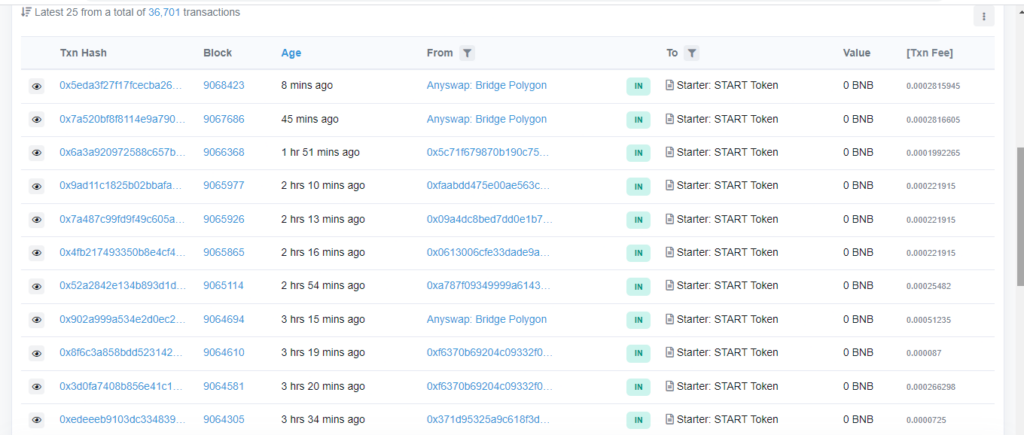

Now that you have understood the minimum requirements. You must have understood why it is important for you to acquire the same. If you click the link stated in START Tokenomics, it will direct you to the transactions happening in regard to the START token as well. This, of course, is just for your reference.

Rest assured, the crypto community never sleeps, it is quite evident from the number of transactions happening. Without wasting much time, you can head straight to purchasing the START Token.

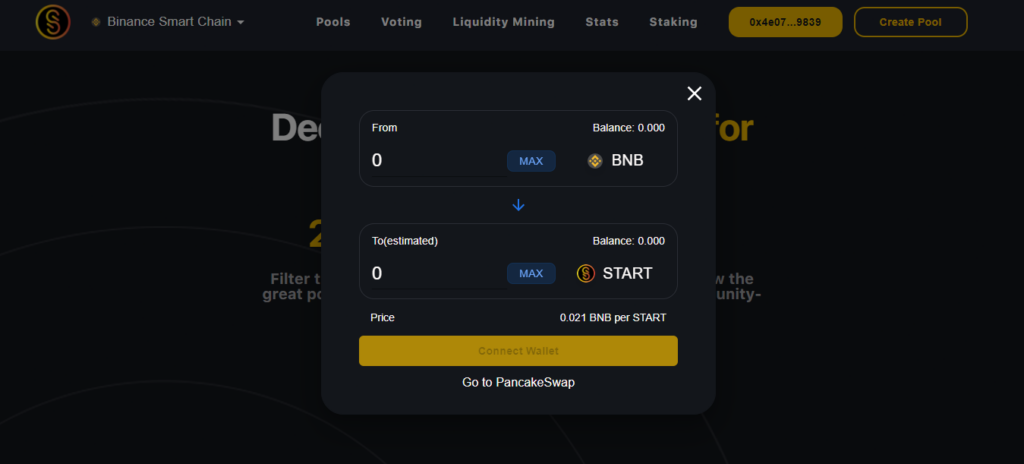

Let’s again come back to the main page. On the bottom right corner, you will come across the option of Buy START, clicking on which, directing to a pop-up.

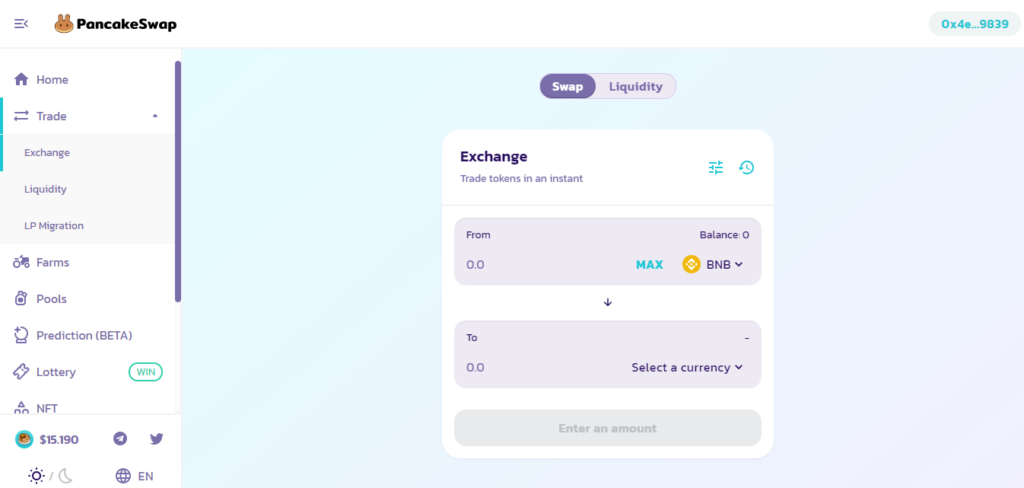

Basically, the START token can be taken in two ways, one is via PancakeSwap. You are directed there when you click on START Token. The other way is to use Bidesk.

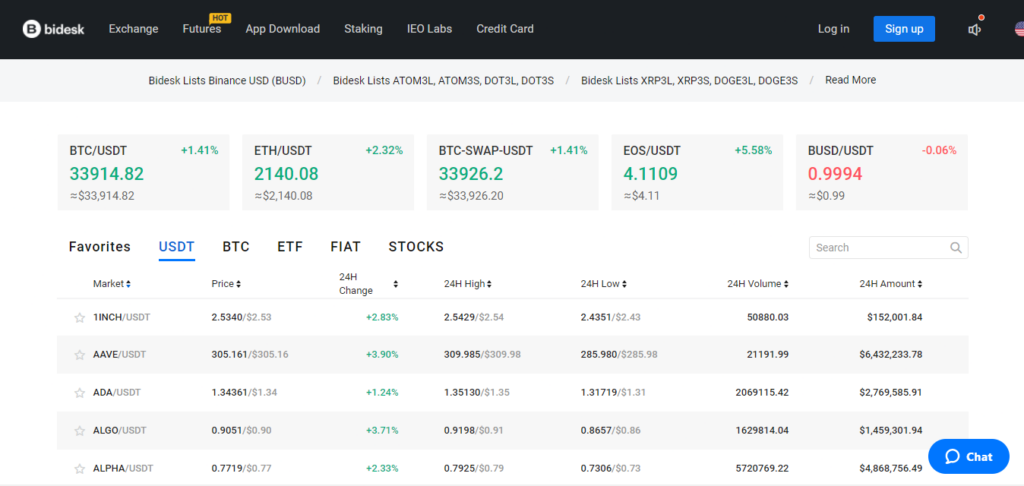

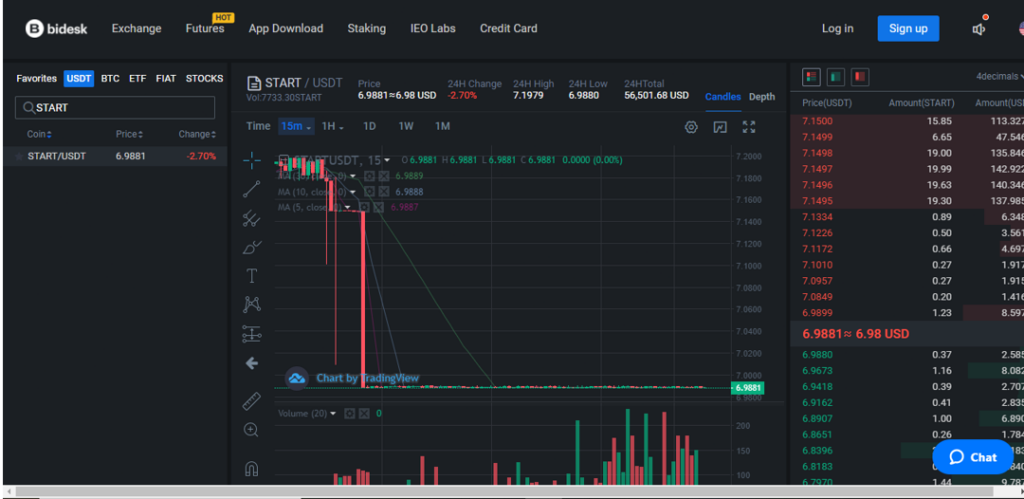

Head to https://www.bidesk.com. Don’t get all confused with all the numbers going up and down, simply click on Exchange, the options present on the top left corner, and search for START.

Now you will realize it shows START/USDT. One of the limitations of Bidesk is that you can sell and buy the START token only using USDT. On Bidesk also, you will need an account with your KYC done and a wallet connected for transactions to take place. As mentioned earlier, the other option to obtain the START token is via PancakeSwap.

DIrecting to this page from the Binance smart chain, you can connect your wallet. As seen in the top right corner, my Metamask wallet is connected. All there needs to be done now is to enter the amount and swap. It is as easy as it sounds.

Step 4: Preliminary Study

Once your basics are sorted, you have your wallet connected, you have the tokens to start with. Now, we have an important question—where would we invest?

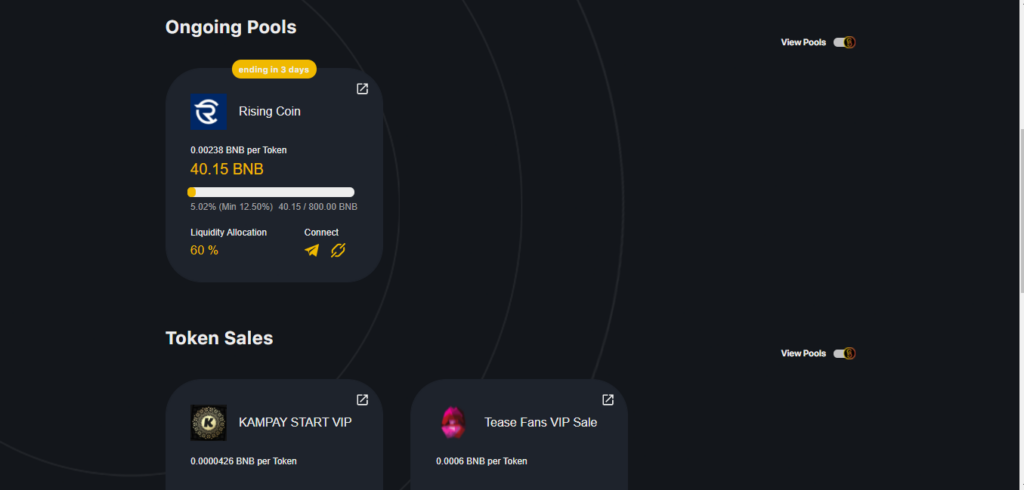

Coming back to the main page once again, scroll down and you can see the pools currently you can invest in. Let’s take the ongoing pool of Rising Coin. Now the main dilemma will start for you, which pool should you invest in.

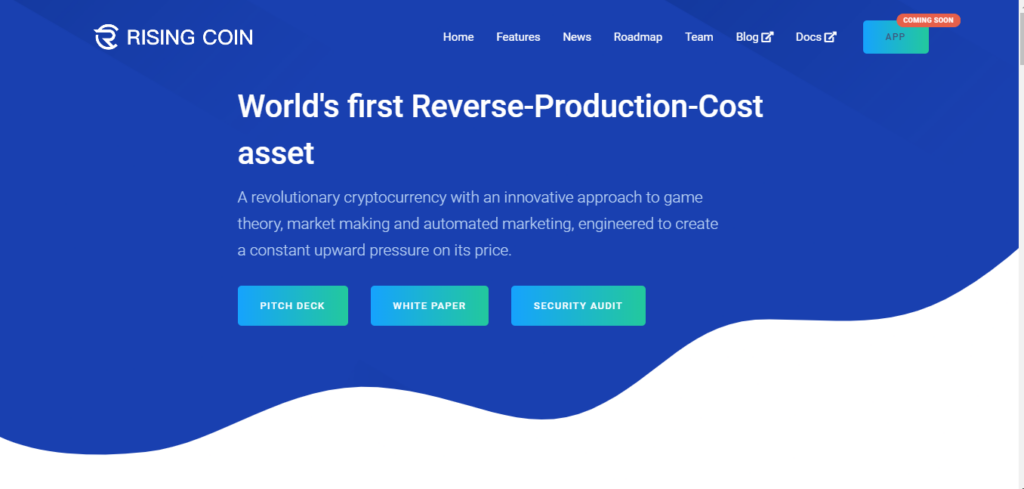

This is where you need to study the IDO you are investing in. Be it Rising Coin, KAMPAY START, or any other. The first step is to connect. You can see two options for connecting. Click on the first, which will make you join their telegram channel and the next one will direct you to their webpage.

This will tell you everything about the IDO, and this is where you need to gauge and make a conscious call on your investment. One of the most important sources of information would be their White Paper, which’s a detailed report talking about everything you need to know about the project. What is the project about? What’s the methodology? Their implementation, costing, and the returns expected from the project.

Apart from the whitepaper, you have auditors who have audited the project. And then there’s the pitch deck that you should read. It’s basically a presentation of what exactly the project is. It’s extremely important also to know who are promoters for the project are. If the promoter is someone like Vitalik Buterin, who is also the co-founder of Ethereum, you know you are at the right place than someone whom you have never heard of.

Skim through the entire website and also connect with them on their Twitter, telegram, and other social media handles to ensure that if you do make up your mind to invest, you should be whitelisted. As mentioned earlier as well, it’s imperative to do certain marketing tasks to be whitelisted.

Step 5: Invest

Once you are whitelisted, you are eligible to invest. Investment can only be done the day the IDO opens. The date and timings of each IDO are always mentioned. Ensure your calendar is marked for the same and a repeated reminder is also set (you can never be too careful).

Once your tokens are allocated, in due course, they will get listed and if you feel your return on investment criteria is met, feel free to liquidate and invest in the next IDO.

Before you go…

The business community is evolving each day and is coming up with unique and innovative ways to raise capital. IDO is definitely a game-changer but it is still sprouting and inceptive. As investors, we all know that we need to divide our risks.

So, if we are investing in a model giving us faster returns, we should also invest in an instrument that will give us a stable return. It is very important to strike that balance.

Don’t forget we are dealing with digital assets, so ensure at every step you double-check, one wrong address on your wallet or a simple typo can make you lose everything. Read and re-read about the project you are investing in to get the maximum returns on your investment.

Happy Investing!!!

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! You can learn more about cryptocurrency industry news. There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Start Trading Today!