A trigger order (stop order) is an order type that automatically converts orders into an order based on market conditions. Unlike a market order or a limit order, the trigger order will not be directly executed, but only be realized when the trigger condition takes effect.

The advantage of trigger orders is that once it has been set, it will automatically execute only when the predefined conditions are met by the market. You can use the trigger order to take profits and limit losses or simply to open a position only after the market price has reached your desired level.

How to use the trigger order to perform a take-profit or stop-loss:

1. The trigger order can be performed to open or close a position.

To set your trigger order, please enter your trigger price, price and quantity.

You can choose between “latest price”, “fair price” and “index price” for your trigger price type. If you select the index price as the trigger price type, your order will be triggered only when the index price reaches your desired level.

Valid Term: The validity of your trigger order – you can choose 24 hours, 7 days or long-term effective.

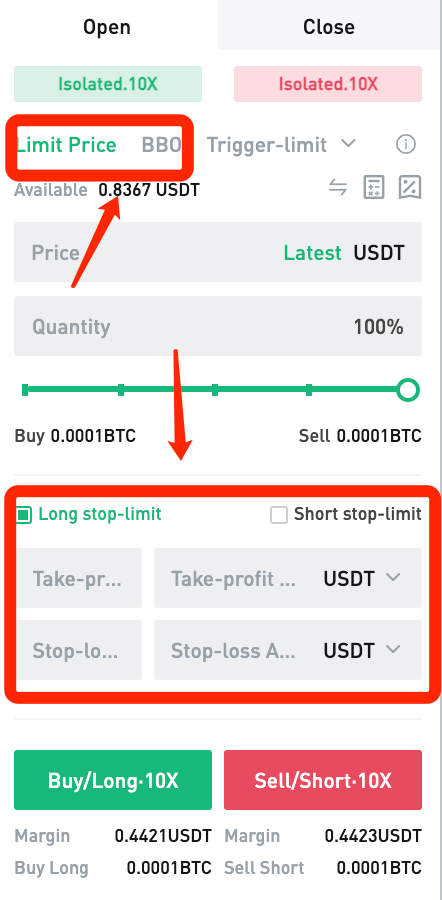

2. The trigger order can be placed along with limit or market orders

When you place a limit or market order, you may click on “long/short stop-limit” and set your trigger-limit prices. In this way, a trigger-limit order will be placed along with the limit or market order.

Please be noted that the trigger-limit order placed here will be filled at the best market price when the trigger price is reached the fair price.

3. The trigger order can be placed after holding a position

When holding a futures position, you can simply place the trigger order on the position sections.

Once you have confirmed your trigger order, you can view it in the [Stop-limit] tab. When setting stop-limit order, the assets will not be frozen before triggering. Thus, please make sure that you have sufficient assets to execute the order, or your trigger order may fail to be executed.

Example of Stop orders

Suppose you buy a 0.1 BTC position of BTCUSDT futures at 50,000 USDT.

You can set a trigger-limit order at 55,000 USDT to take profit and 49,000 USDT to stop loss:

- When the fair price of BTCUSDT futures reaches 55,000 USDT, the trigger order is automatically executed at the best market price and realize around 500 USDT profit.

- When the fair price of BTCUSDT futures reaches 49,000 USDT, the trigger order is automatically executed at the best market price and stop your loss at around 100 USDT.

Summary

You set stop orders to take profits and limit losses,which can help you to control the risk and realize more profits.

Join MEXC and Start Trading Today!