Leveraged ETFs, like futures products, are important trading tools in the field of crypto assets, but their characteristics have incomparable advantages over futures and spot products, so they are favored by many people. This article mainly introduces the leveraged ETF product in detail.

What is MEXC Leveraged ETF?

Leveraged ETF is a perpetual leveraged product that magnifies the price changes of the benchmarked asset and aims to provide leveraged gains of the benchmarked perpetual futures.

The name of the product is represented by “cryptocurrency + leverage + long/short direction.” For example, buying BTC3L means a 3x long for BTC, and buying BTC3S means a 3x short for BTC. If the BTC price goes up by 1% on the day, BTC3L will go up by 3% and vice versa.

The characteristics of MEXC Leveraged ETF

No margin, no liquidation price, high capital utilization

Take buying 3x long for BTC or 3 x short for BTC as an example. If you go for 3x long, you only need to buy BTC3L. If you go for 3x short, you only need to buy BTC3S. This is similar to buying/selling BTC, in which there is no complicated operation like dealing with futures. There is no need to occupy part of the position as a margin to raise or lower the liquidation price, the capital utilization is high, and there is no liquidation rule.

Compound interest effect

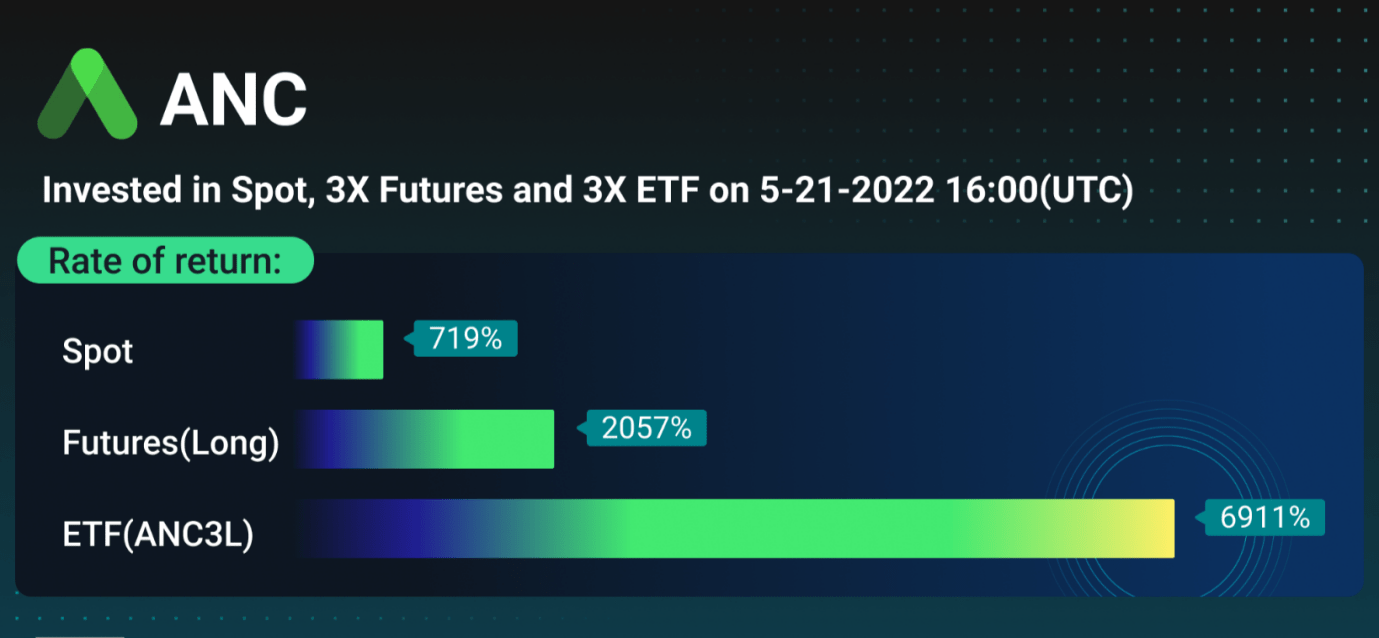

Due to the rebalancing mechanism of leveraged ETFs, in the continuous rising/falling market, the daily profit will be automatically transferred to the position and reinvested to achieve compound interest. Hence, the profit will be higher than that of margins or futures products of the same multiple.

The picture above shows the comparison of the gains among ANC’s margins, leveraged ETFs, and futures after bottoming out on May 21, 2022. Due to the compound interest effect, the cumulative gains of ANC3L are greater than those of the margins and futures of the same multiples.

Fast launch speed and many tradable assets

MEXC currently supports leveraged ETF trading of more than 400 crypto assets. Popular projects are launched quickly, and it has a wide range of trading categories, covering mainstream public chains such as Ethereum, Polkadot, Solana, and Avalanche Protocol, as well as NFT, Metaverse, GameFi, DeFi, Layer2, DAO, etc. For example, MEXC supports the leveraged ETF trading of recently popular LUNA, NEAR, KNC, JAMSY, etc.

The differences between leveraged ETFs and leveraged tokens

The leveraged ETF of crypto assets originates from the leveraged ETF of the traditional financial market. It is an exchange-traded fund (ETF) issued off-chain, while leveraged tokens are issued on-chain. Every time a user buys a leveraged token, the corresponding token will be issued on the Ethereum chain, and if it is burned, it will also be destroyed on the blockchain. This is the essential difference between leveraged tokens and leveraged ETFs.

Leveraged ETFs do not issue corresponding tokens on-chain. Therefore, when the transaction on the Ethereum chain is active, the transaction fee of leveraged tokens will be higher, and the transaction will be congested. However, this situation does not exist in leveraged ETFs.

In addition, the issue price of leveraged ETFs is $1, while the issue price of leveraged tokens is different. Data on the Ethereum chain shows that the price of the leveraged token (3x long for BTC) has risen to $3,627.81.

Risk control

Leveraged ETFs are suitable for unilateral or trending markets yet not suitable for repeated oscillating markets. Therefore, they are not suitable for long-term holding. Long-term holders will have to bear daily capital fees, position rebalancing, and other wear and tear costs.

Interested in MEXC ETF Products?

MEXC Exchange provides you with nearly ten forms of ETF index trading combinations to meet your flexible index trading needs. Read more hot news about them in MEXC ETF.

Join MEXC and Get up to $10,000 Bonus!

Sign Up