In today’s crypto markets, stablecoins have quietly become the foundation of trading. Whether it’s USDT, USDC, or DAI, these digital dollars act as the main unit of account, store of value, and trading pair for millions of users worldwide.

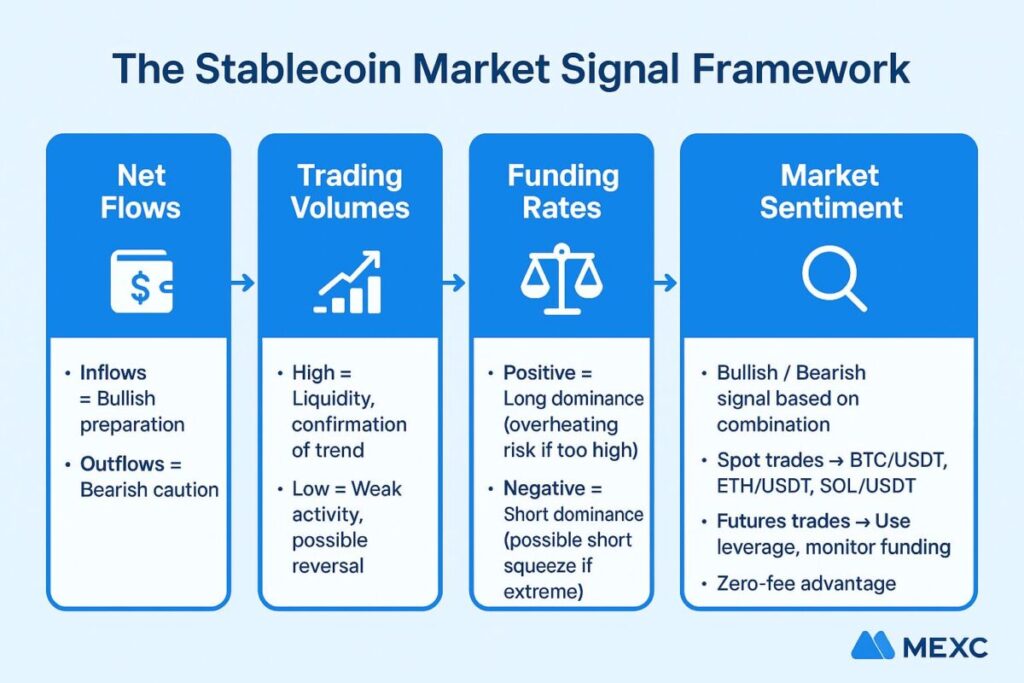

But beyond being a simple medium of exchange, stablecoins provide powerful market signals. By monitoring net flows, trading volumes, and funding rates, traders can better understand sentiment, anticipate market moves, and refine their strategies.

At MEXC, we’ve built tools and insights that help traders put these signals into practice. In this article, we’ll break down what each metric means, why it matters, and how you can use them for smarter trading decisions.

1.What Are Stablecoin Net Flows?

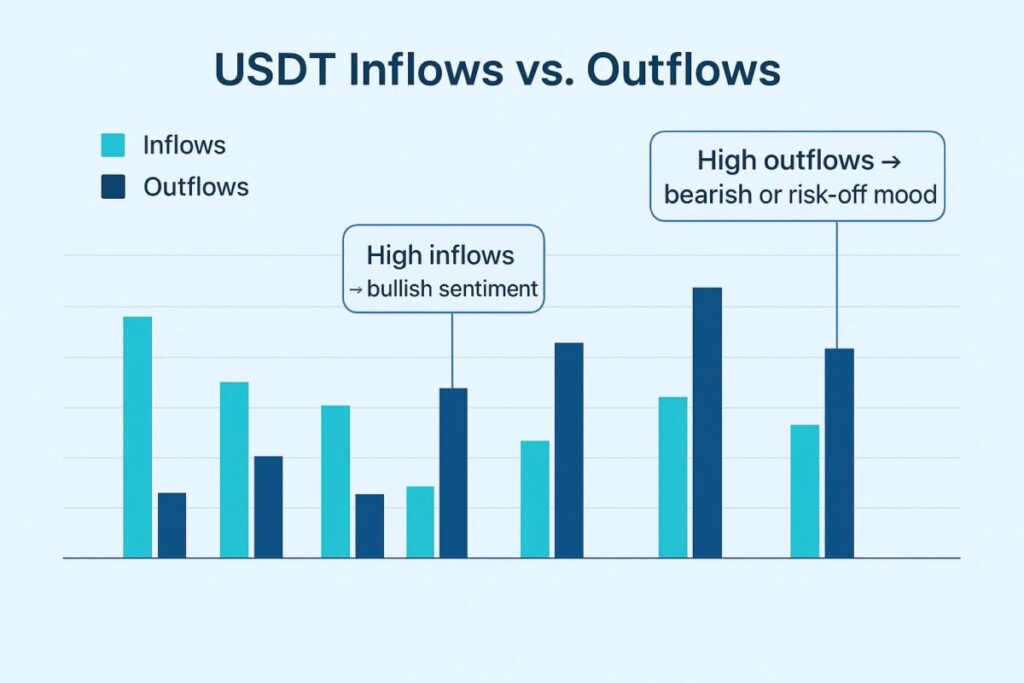

Stablecoin net flows measure how much money is entering or leaving exchanges.

- Inflow → Traders deposit stablecoins into exchanges, often preparing to buy crypto assets.

- Outflow → Stablecoins are withdrawn, often signaling traders taking profits or moving to safety.

On MEXC, we monitor on-chain flows to track how USDT and USDC are moving. If inflows spike, it often means traders are getting ready to go risk-on. If outflows dominate, it can mean they’re cashing out or parking funds in cold wallets.

- Pro tip for MEXC users: Keep an eye on MEXC’s research and market insights where we regularly highlight net flow patterns. These signals can give you an early edge before big moves happen.

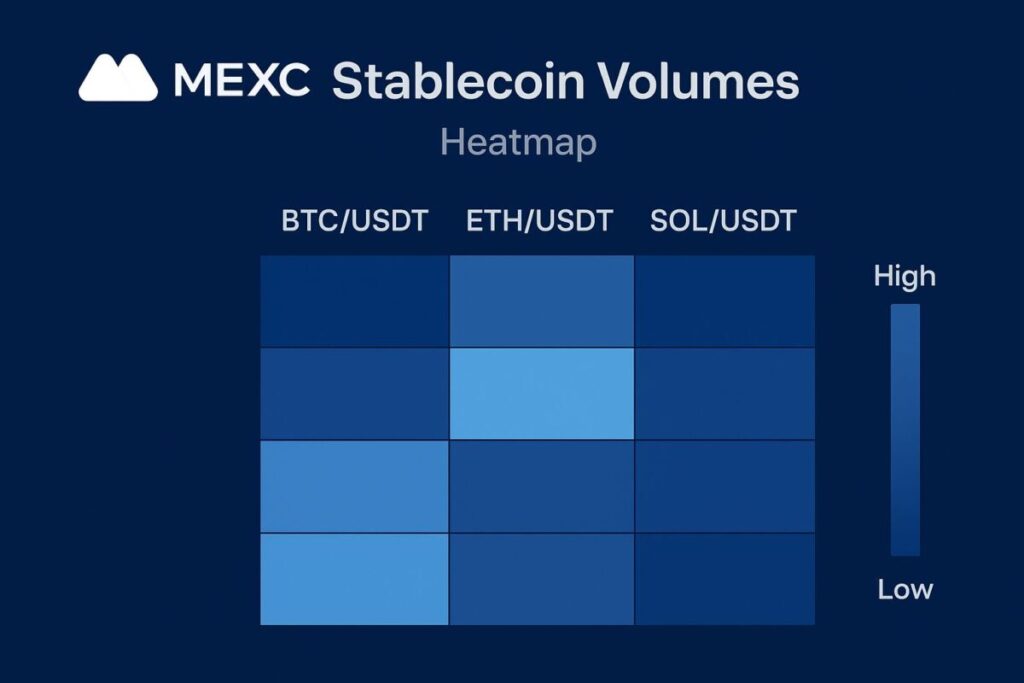

2.Stablecoin Volumes: Liquidity in Action

Volumes tell us how much stablecoin trading is happening within a given period. High stablecoin volumes typically mean:

- Increased market activity

- More liquidity in spot and futures markets

- Tighter spreads and lower slippage

At MEXC, stablecoin pairs dominate spot markets, with deep liquidity across 3,000+ assets. This benefits traders by ensuring smooth order execution, even in volatile times.

- If you’re a beginner, high volume = safer entry/exit points. If you’re advanced, volume spikes can act as confirmation of trend strength.

Check out our spot trading page to explore stablecoin pairs in action.

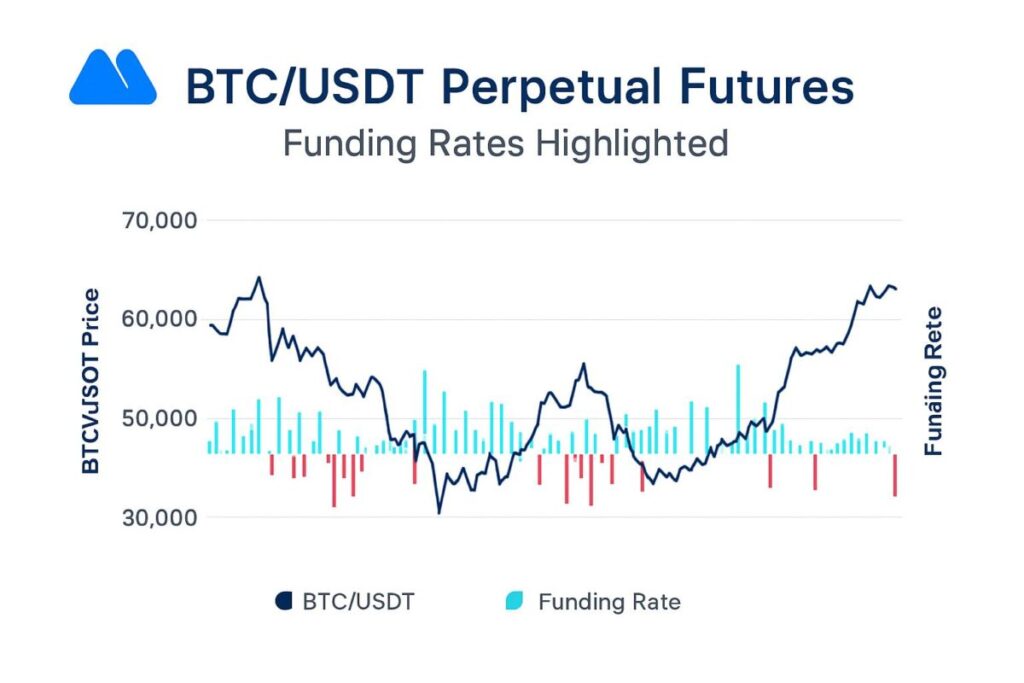

3.Funding Rates: Reading Futures Sentiment

Funding rates are the heartbeat of perpetual futures.

- A positive funding rate means long positions are paying shorts → bullish sentiment dominates.

- A negative funding rate means shorts are paying longs → bearish sentiment dominates.

At MEXC, with up to 500x leverage and zero-maker fees, futures traders pay close attention to funding. If funding rates get too high, it can mean longs are overcrowded and a correction is likely. If deeply negative, the opposite may happen.

- Use MEXC’s futures platform to monitor funding rates in real-time and adjust your positions accordingly.

4.Putting It All Together: A Stablecoin Trading Framework

The real power comes from combining net flows, volumes, and funding rates into a single strategy.

Imagine this scenario:

- Stablecoin inflows surge → Traders are loading up exchanges with USDT.

- Volume increases → Spot markets heat up with BTC/USDT and ETH/USDT trades.

- Funding rate turns positive → Futures markets show strong bullish positioning.

Together, this signals a potential uptrend.

Now flip it:

- Outflows rise → Traders withdraw stablecoins, reducing exchange balances.

- Volume declines → Liquidity dries up.

- Funding flips negative → Bearish sentiment takes over.

This is often a risk-off period, signaling caution.

5.How MEXC Traders Can Act

MEXC provides zero-fee trading, deep liquidity, and advanced tools to help you act on these signals quickly.

- Watch stablecoin inflows/outflows in research dashboards.

- Trade confidently on high-volume pairs like BTC/USDT, ETH/USDT, SOL/USDT.

- Use funding rates in futures to gauge sentiment and plan entries/exits.

And don’t forget, with Proof of Reserves updates and a $526M insurance fund, MEXC ensures a secure trading environment while you focus on strategy.

6.Conclusion

Stablecoins aren’t just “digital dollars”, they’re market barometers. By paying attention to net flows, volumes, and funding rates, MEXC traders can gain a deeper understanding of sentiment and move ahead of the curve.

At MEXC, we make this easy with transparent data, a robust exchange ecosystem, and zero-fee trading. Whether you’re a beginner exploring stablecoin pairs or a professional futures trader fine-tuning your strategy, these metrics can be your compass.

Ready to put this into action? Start trading today on MEXC’s spot and futures markets and see how stablecoin signals can guide your next move.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!