While most of the community is concerned about the unstake queue being many times larger than the stake queue, the reality is that there are four massive sources of demand quietly lining up — ready to completely flip the Ethereum staking landscape in the coming months.

1.Ethereum’s Stake/Unstake Landscape

Recently, despite ETH surging to nearly $5,000 and breaking its all-time high, the Ethereum network has been facing an issue that the entire community is watching closely.

By mid-September 2025, the unstake queue reached a record ~2.5M ETH — worth over $12B — as many rushed to take profits. The withdrawal wait time stretched to 46 days, the longest in Ethereum staking history.

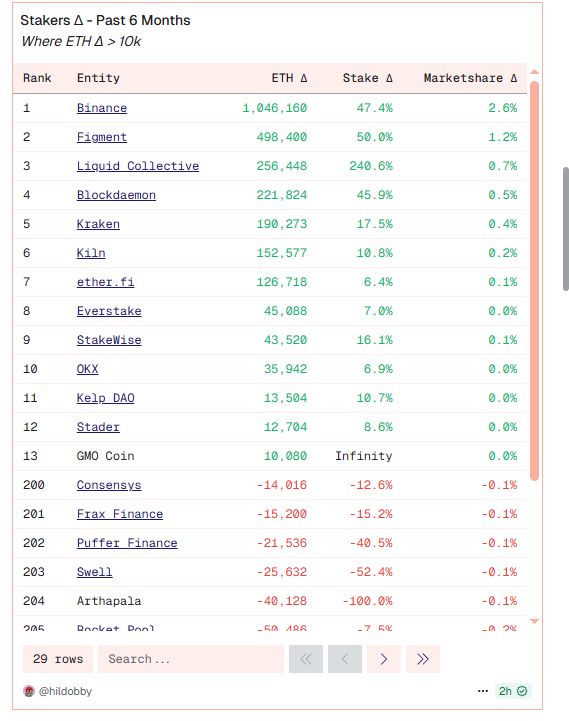

On top of that, on September 9, 2025, Kiln — the world’s 5th-largest staking provider with $15B in assets under management — was forced to unstake all 1.6M ETH it held after a security incident. This triggered fears of a sharp ETH price drop due to a sudden supply shock.

As of late September 2025, the situation has calmed somewhat, but the unstake queue still sits at ~2.3M ETH — far higher than the 300k–500k ETH waiting to be staked. The stake queue wait time has also dropped from 16 days to just 8, showing staking demand has slowed down. At first glance, this picture doesn’t look too optimistic — but is that really the case?

2.Positive Catalysts for Ethereum Staking Ahead

2.1 Kiln’s Comeback

On September 9, 2025, Kiln — the 5th-largest ETH staking manager with $15B AUM — suffered a security breach and was forced to unstake all of its ETH. This single action sent the unstake queue skyrocketing from ~500k ETH to over 2.5M.

Now, after securing its systems, Kiln is preparing to restake its entire 1.6M ETH position. Interestingly, the timing of this restake could align with three other major sources of staking demand waiting in the wings.

2.2 The Digital Asset Treasury (DAT) Wave

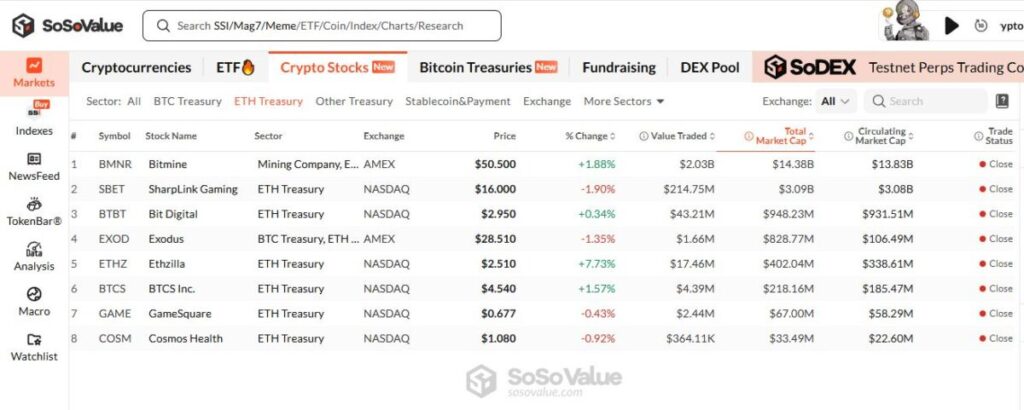

2025 is shaping up to be the breakout year for Digital Asset Treasuries — companies holding crypto as a long-term investment strategy. So far, 15 players have publicly disclosed ETH holdings worth a combined $18B. Even more bullish: these firms aren’t just holding ETH, they’re optimizing it through staking.

- Sharplink has staked nearly 100% of its $3.5B ETH holdings.

- Ether Machine has staked over 90% of its $2B ETH.

- Bitmine, with $10B in ETH preparing to be staked, could be a game-changer for the ecosystem.

Analysts believe billions more in ETH from smaller firms are still “sitting idle,” waiting to be staked. This trend highlights Ethereum’s growing acceptance among financial institutions as a yield-generating financial asset — a critical step in ETH becoming a mainstream financial instrument.

2.3 ETH Staking – Opening the Institutional Floodgates

According to Bloomberg, the SEC could approve ETH staking ETFs by mid-to-late October. This would be a historic milestone, signaling full institutional acceptance of Ethereum, with ~6.75M ETH (~$27B) from ETF funds potentially flowing into staking.

Currently, ETH ETFs only benefit from price appreciation. With staking enabled, they could add 2.85–2.9% annual passive yield — making ETH ETFs more attractive compared to Bitcoin ETFs, which lack such yield mechanisms.

Recently, Rex Shares introduced the REX-Osprey Ethereum + Staking ETF ($ESK) — the first pilot product combining direct spot ETH exposure with on-chain staking rewards. This is seen as a precursor to official SEC approval of ETH staking ETFs.

2.4 Fusaka Upgrade – A Technical Breakthrough for Staking

Ethereum’s Fusaka hard fork, scheduled for December 3, 2025, will bring several key upgrades:

- EIP-7251: Raises the maximum Effective Balance per validator, allowing institutions to run validators with more than 32 ETH → improving staking efficiency.

- PeerDAS (Peer Data Availability Sampling): Reduces data load on validators → lighter, more stable staking operations.

- Increased blob capacity: Boosts throughput for L2 rollups → indirectly raising staking demand for network security.

- $2M bug bounty from the Ethereum Foundation to ensure safety ahead of mainnet deployment.

Fusaka is considered a foundational upgrade — optimizing validators and scaling data capacity — creating a more favorable environment for both institutions and individuals to stake ETH with lower costs and higher efficiency.

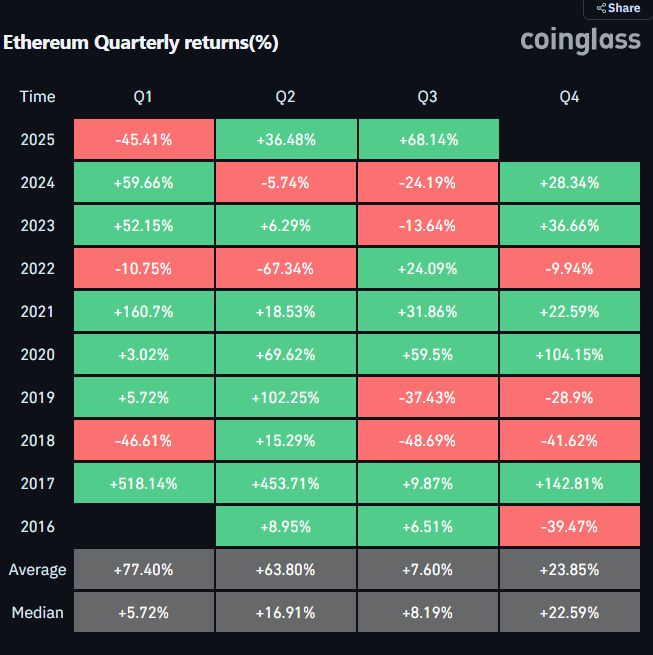

2.5 End-of-Year FOMO

Finally, we can’t ignore psychology. Q4 has historically been the “golden season” for crypto — especially Ethereum. Historically, ETH pumped +142% in Q4 2017 and +104% in Q4 2020.

While ETH is already up +36% YTD and +140% since April, many still expect another end-of-year rally. If this happens, demand for ETH ownership and staking could surge once again, echoing the recent wave of DAT participation.

Looking at these catalysts, it’s clear Ethereum’s ecosystem is undergoing a major shift. As more ETH gets locked into staking, Ethereum’s foundation becomes stronger — setting the stage for the next wave of innovation.

3. Projects That Will Benefit

3.1 Liquid Staking

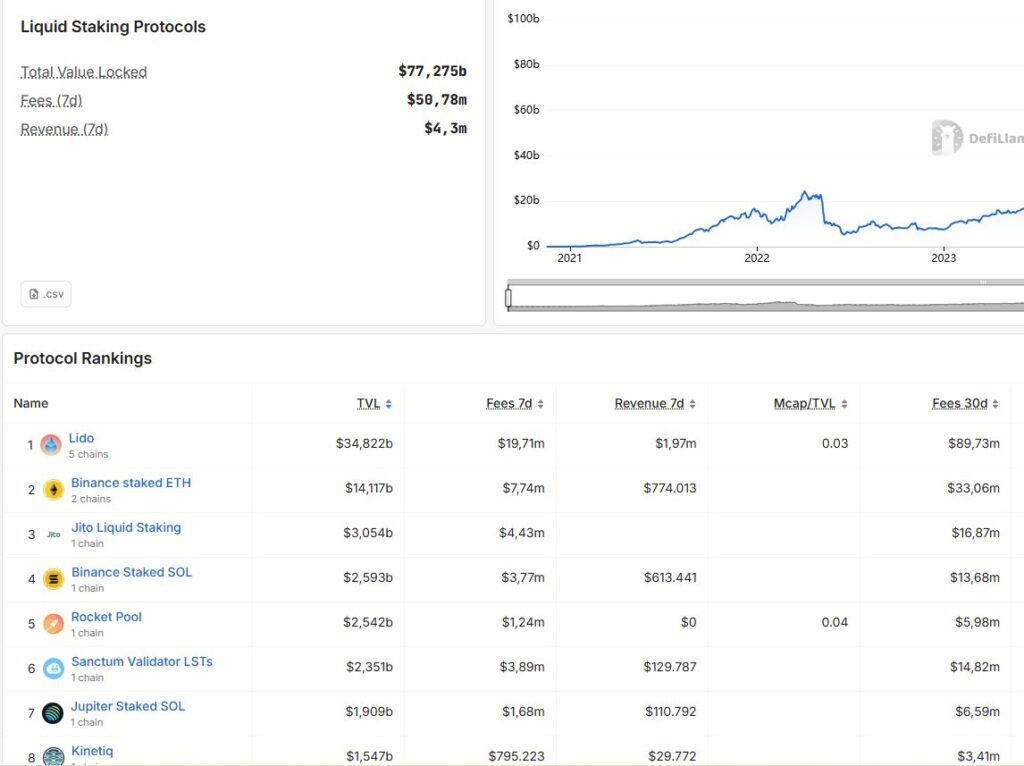

Surging staking demand will accelerate growth of liquid staking solutions — which let users stake ETH while keeping liquidity. In short: when you stake via these protocols, you receive Liquid Staking Tokens (LSTs) that represent your staked ETH. You can use these LSTs in DeFi protocols to earn yield, while still collecting staking rewards — unlike traditional locked staking.

Currently, Lido dominates liquid staking with 23.6% market share (over $35B ETH staked). Stakers receive stETH, a token widely integrated across DeFi, making Lido a cornerstone of the Ethereum staking ecosystem. Lido also recently announced a token buyback to strengthen holder value and optimize treasury capital use.

But Lido isn’t alone. Other strong contenders include:

- Rocket Pool (RPL) – decentralized model, allowing anyone to run a node with 8 ETH + RPL.

- StakeWise (SWISE) – transparency-focused, offering flexible staking products.

- Stader (SD) – expanding beyond Ethereum, supporting multi-chain staking.

- Frax (FXS) – innovating with frxETH and sfrxETH, combining yield with stablecoin mechanics.

- Swell (SWELL) – a rising LSD protocol attracting users with incentives and user-friendly UX.

Liquid staking has become one of DeFi’s most critical pillars — unlocking passive yield while ensuring flexible ETH liquidity.

3.2 Restaking

If liquid staking was the first leap, restaking is the second evolution. Protocols like EigenLayer and Ether.fi let users restake their LSTs to earn additional yield on top of liquid staking rewards — meaning two income streams from the same staked ETH.

- EigenLayer currently leads with ~$17B TVL.

- Ether.fi follows with ~$6B TVL.

Other rising restaking protocols include:

- Renzo (REZ) – liquid restaking built on EigenLayer, allowing ETH, stETH, wETH deposits → ezETH. Multi-chain support, optimizing restaking rewards.

- Puffer Finance (PUFFER) – native liquid restaking protocol (nLRT) on EigenLayer, with anti-slashing design. Token: pufETH.

- Kelp DAO (KELP) – supports ETH & multiple LSTs (stETH, ETHx, sfrxETH), issues rsETH, integrates directly with EigenLayer.

4.Conclusion

The record-high Ethereum unstake queue may look concerning on the surface, but it’s more of a temporary reset than a real threat. Over the next few months, powerful catalysts — Kiln restaking 1.6M ETH, billions in Digital Asset Treasury inflows, the potential approval of ETH staking ETFs, and the Fusaka upgrade — are lining up to drive fresh demand. Add in Q4’s historical FOMO, and Ethereum staking is positioned not for decline, but for its next major growth cycle.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always DYOR, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up