Ethereum, the second-largest cryptocurrency, is gaining momentum among investors and developers due to its smart contract capabilities and decentralized applications.

However, the big question looming is whether Ethereum will witness the introduction of spot exchange-traded funds (ETFs) in the United States, following the recent success of Bitcoin ETFs.

Spot Crypto ETFs in the US

Spot ETFs, which mirror the price of an underlying asset like a cryptocurrency, provide a regulated avenue for investors to enter the crypto market without grappling with the technical intricacies and security hurdles associated with purchasing and storing digital assets.

Bitcoin recently celebrated a breakthrough with the approval of 10 spot ETFs by the US Securities and Exchange Commission (SEC), after years of rejections and delays.

Mixed Feelings on an Ethereum ETF Approval

Brett Tejpaul, head of Coinbase Institutional, has expressed strong client demand and enthusiasm for a spot at Ethereum ETF. Several industry leaders share the sentiment that such a product would add significant value to the market.

Despite this optimism, the path for Ethereum spot ETFs is less straightforward than it was for Bitcoin. The SEC has yet to determine whether Ethereum falls under the category of a security or a commodity, a crucial classification that dictates eligibility for an ETF.

Bitcoin’s SEC approval wasn’t unanimous, with two commissioners dissenting and Chair Gary Gensler cautioning against interpreting it as a green light for crypto asset securities.

This ambiguity has sparked debates among analysts about the likelihood and timing of Ethereum spot ETFs. Some optimists draw parallels between Bitcoin and Ethereum, highlighting the latter’s growing adoption and innovation.

Bloomberg Intelligence’s Eric Balchunas gives a 70% chance for Ethereum ETF approval this year, while his colleague James Seyffart estimates a slightly lower 60–65%.

However, skeptics point to regulatory and technical challenges Ethereum faces, including the impending shift to a proof-of-stake consensus mechanism and scalability issues.

JPMorgan analyst Nikolaos Panigirtzoglou emphasizes the SEC’s need to classify Ethereum as a commodity, not a security, for ETF approval. He deems this outcome uncertain, assigning no more than a 50% chance before May.

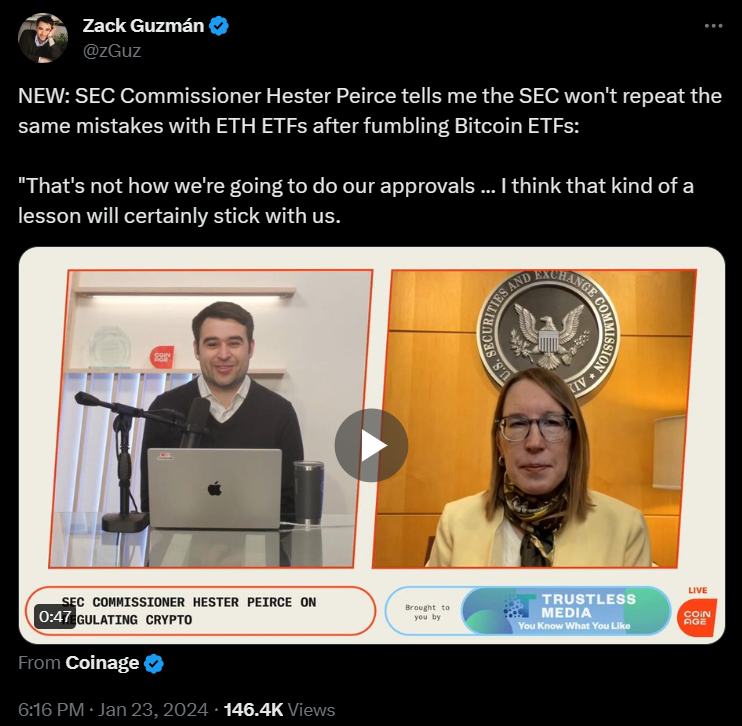

Crypto Mum Hester Pierce Sheds Some Insights

In a potential glimmer of hope, SEC Commissioner Hester Pierce, known for her pro-crypto stance, hinted at a different approach to spot Ethereum ETFs. In a January 24, 2024, interview with Coinage, she suggested the SEC might treat spot crypto ETFs like traditional funds, potentially sidestepping the need for a court decision.

While the crypto market eagerly anticipates the SEC’s decision on Ethereum spot ETFs, investors still have alternative avenues to access Ethereum, including futures ETFs, trusts, and direct purchases.

However, the widespread hope is for the approval of a spot ETF, offering a more straightforward and efficient investment route into the second-largest cryptocurrency and enabling investors to capitalize on its potential growth and innovation.

Down ETH, Down

While there’s some optimism around spot Ethereum ETFs, ETH has suffered a bearish fate over the past few days. Since January 20, the cryptocurrency has notched five straight bearish days as it fell from a few points under $2,500 to $2,200, where it currently struggles to stay afloat.

This decline began as chatter intensified about the spot Bitcoin ETF approvals in the US having no lasting impact on the price of Bitcoin and the rest of the market as previously expected. That said, this decline in sentiment and price is expected to persist for a while, as the $2.135 support mark looks likely to be tested in the coming days or weeks.

ETH Statistics Data

ETH Current Price: $2,215

Market Cap: $265.4B

ETH Circulating Supply: 120.1M

ETH Total Supply: 120.1M

Market Ranking: #2

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!