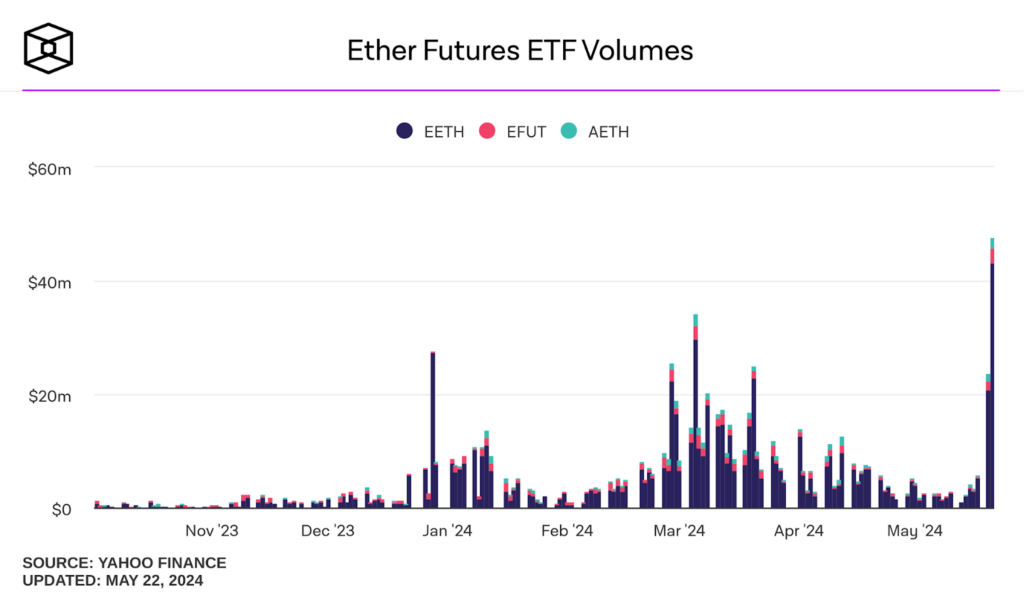

Anticipation is reaching a fever pitch for the potential approval of spot Ethereum exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). This excitement has manifested in surging trading volumes for existing Ethereum futures ETFs.

On Tuesday, May 21, Ethereum futures ETFs saw their highest-ever daily trading volume of $47.75 million, blowing past the previous record of $34.18 million set in early March.

ProShares’ Ether Strategy ETF (EETH) dominated the field, capturing 90% of the volume. VanEck’s Ethereum Strategy ETF (EFUT) and Bitwise’s Ethereum Strategy ETF (AETH) took silver and bronze.

ETH ETF Volume Lags Behind Bitcoin Counterparts

While the new milestone is impressive, Ethereum futures ETF volumes still lag far behind their spot Bitcoin ETF counterparts. The latter group, led by BlackRock’s IBIT, generated a whopping $2.16 billion in trades on Tuesday alone. However, even this massive figure represents a steep decline from the all-time high of nearly $10 billion achieved on March 5th, the same day Bitcoin surpassed its 2021 peak of $69,000.

Established Ethereum investment vehicles are also catching the rising tide. The Grayscale Ethereum Trust (ETHE) saw its best trading day in two years on Tuesday, with a volume of $684 million.

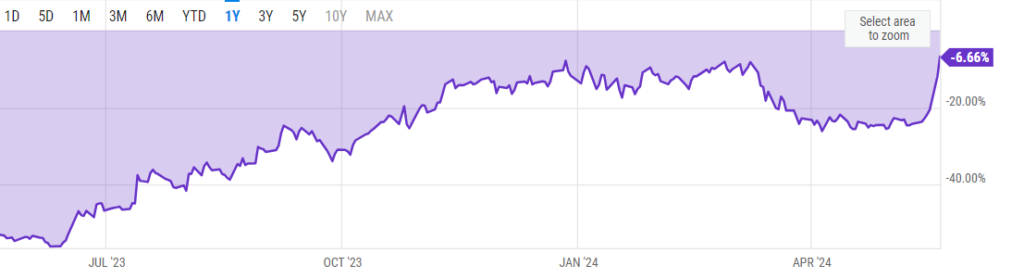

Meanwhile, The Block reports that ETHE’s notorious discount to net asset value shrank to just 6.66%, its lowest level since early 2021. Speculators appear to be scooping up cut-rate shares in hopes of an ETF conversion windfall, similar to what occurred with the Grayscale Bitcoin Trust in January.

75% Chance of Ether ETF Approval: Bloomberg Analysts

Fueling the sudden shift in sentiment were predictions from Bloomberg’s ETF experts on Monday that the odds of imminent spot Ethereum ETF approval have jumped from 25% to 75%. The analysts cited the SEC’s light-touch revision requests for ETF providers’ key regulatory filings as a telling sign of the agency’s change of heart. Some believe the critical paperwork could get the green light as soon as Wednesday.

Since the bold calls from the Bloomberg team, ether’s price has surged 22% to $3,765 at press time. A successful launch of the long-awaited spot ETFs could open the crypto floodgates to a massive new pool of institutional and retail investors.

Although nothing is guaranteed, it’s clear that major players are positioning for a seismic shift in the Ethereum investment landscape. By this time next week, buying ETH could be as simple as purchasing a share of Apple or Amazon.

ETH Records Massive Bullish Surge, Drags Entire Crypto Market Along

As mentioned, the recent move by ETH has renewed trading volumes around the cryptocurrency and the entire crypto market at large.

Before the reinvigoration of hopes about possible ETF approvals in the U.S., Ethereum had suffered a sustained decline from its March 12 peak near $4,100. The ETF excitement pushed the cryptocurrency to a two-month high of $3,840.

While there’s fundamental backing, this surge followed our previous price action prediction for the cryptocurrency, where we explained that Ethereum was set to finally breach the $3,300 ceiling.

At the moment, ETH appears to be losing momentum but we expect volatility to remain for this cryptocurrency leading up to the decision on ETFs by the SEC. And if things go as the market hopes, we could see ETH approach the $4,500 mark in no time.

ETH Statistics Data

ETH Current Price: $3,765

Market Cap: $450.4B

ETH Circulating Supply: 120.1M

Total Supply: 120.1M

ETH Market Ranking: #2

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up