The leading blockchain network known for its high transaction volume, Ethereum, has experienced a significant surge in revenue from transaction fees in the first quarter of 2024.

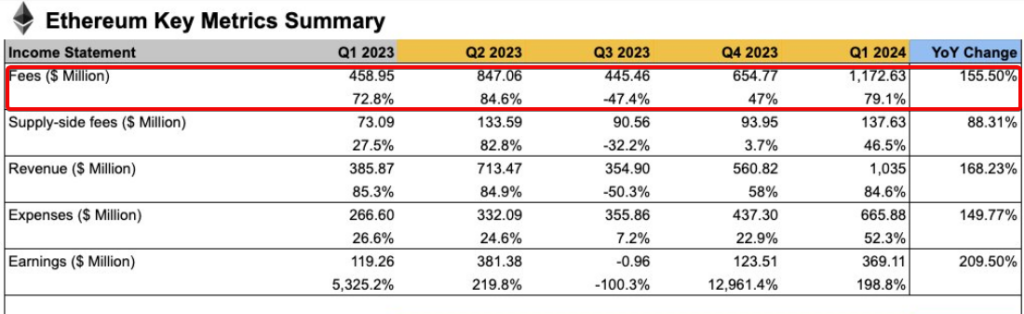

According to data from Coin98 Analytics, Ethereum’s revenue from transaction fees alone reached a remarkable $1.2 billion, marking a substantial 155% increase from the same period last year.

This surge in revenue is part of a broader trend of growth for Ethereum. The network’s total earnings tripled on a quarter-over-quarter basis, reaching $369 million, which represents a staggering 210% jump from Q1 2023’s $119 million.

The increase in Ethereum’s transaction fees and revenues by 79% and 85%, respectively, quarter-over-quarter, reflects the network’s expanding usage and the rising cost of transactions.

As Ethereum’s price approached all-time highs in March, transaction fees surged, with some users reporting fees exceeding $100 at peak times. On March 1, the average gas fee for a swap transaction was around $79, and some instances saw fees climbing as high as $400 in late February.

Despite the high fees, Ethereum’s network usage showed significant growth, with total transactions in Q1 2024 rising by 8.4% quarter-over-quarter, surpassing 107 million. Additionally, the total value locked in Ethereum’s decentralized finance (DeFi) ecosystem surged by 86% quarter-over-quarter to reach $55.9 billion.

Ethereum ETF Approval Hangs in the Balance as Interest Wanes

In related news, the Securities and Exchange Commission (SEC) is currently soliciting public input on several proposed spot ether exchange-traded funds (ETFs), including the Fidelity Ethereum Fund, Grayscale Ethereum Trust, and Bitwise Ethereum Trust. Public comments are requested within 21 days.

However, optimism for the approval of a spot-ether ETF by the SEC has diminished. Bloomberg ETF analyst Eric Balchunas reduced the likelihood of approval by May from 70% to 30%. His colleague, James Seyffart, noted that recent filings for Ethereum ETFs do not suggest any change in the SEC’s stance, indicating that the agency’s silence may not bode well for approval.

Ethereum’s robust performance in early 2024 underscores the network’s resilience and the growing interest in DeFi. As the SEC deliberates on the fate of ether ETFs, the cryptocurrency community eagerly awaits the potential impact on Ethereum’s valuation and the broader market.

ETH Records Some Stability Amid Volatile Market Sessions

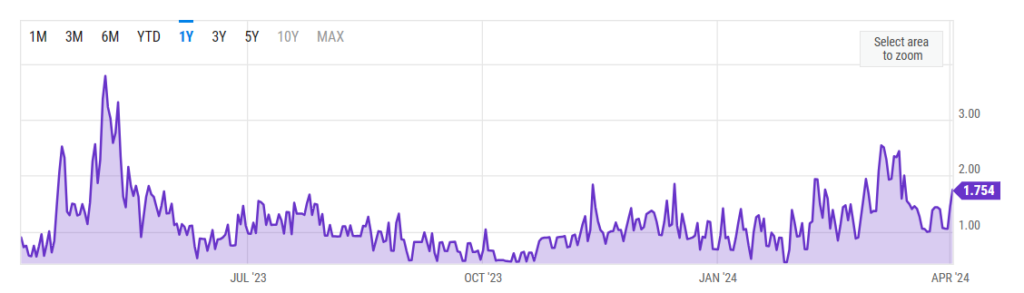

Ethereum has found some price stability in the near term above the $3,200 floor, as the support level saves the cryptocurrency from protracted declines. This comes after a two-day 12% plunge from the $3,600 top, which itself comes on the heels of prolonged consolidation around the top.

As relative stability returns to the broader market, we can expect Ethereum to pick up the pieces over the coming day and possibly retest the $3,600 top once again. Of course, the hope of ETH bulls is for the price to breach that top, which should open the door for an easy return to the upper-$4,000 range.

With trading conditions at neutral levels, a mild resurgence in ETH appears very likely in the near term. However, there’s always the possibility that the market does the exact opposite of our expectations and breaches the $3,200 floor.

ETH Statistics Data

ETH Current Price: $3,300

Market Cap: $396.3B

ETH Circulating Supply: 120M

ETH Total Supply: 120M

Market Ranking: #2

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up