Cryptocurrencies have taken the financial world by storm, offering exciting opportunities for investment, innovation, and financial inclusion. However, the ever-evolving regulatory landscape has a profound impact on the cryptocurrency industry, investors, and technological advancement. In this article, we will analyze the current state of cryptocurrency regulations and how they influence the industry, investors, and innovation.

The Regulatory Landscape

Cryptocurrency regulations vary significantly from one country to another, and they continue to evolve. Regulatory approaches can be broadly categorized into three main types:

- Permissive (Pro-Innovation): Some countries have embraced cryptocurrencies and blockchain technology, providing a favorable environment for innovation. They may have clear legal frameworks that encourage the growth of the crypto industry.

- Restrictive (Anti-Innovation): On the other end of the spectrum, certain nations have adopted strict regulations or outright bans on cryptocurrencies. These measures are often driven by concerns about financial stability, consumer protection, and money laundering.

- Wait-and-See (Adaptive): Many countries fall somewhere between these two extremes, taking a “wait-and-see” approach. They may lack comprehensive regulations but occasionally issue guidelines or statements on cryptocurrencies.

Impact on the Industry

The regulatory environment significantly influences the cryptocurrency industry:

- Market Confidence: Clear and supportive regulations can boost market confidence, attracting more institutional investors and traditional financial institutions to enter the crypto space.

- Innovation: Regulations can either stifle or foster innovation. In jurisdictions with supportive regulations, startups are more likely to experiment and develop new use cases for blockchain and cryptocurrency technology.

- Compliance Costs: Compliance with regulations can be costly, particularly for cryptocurrency exchanges and service providers. Stringent requirements may lead to consolidation in the industry.

- Market Access: Cryptocurrency companies may face restricted access to traditional financial services, like banking, if they operate in regions with ambiguous or restrictive regulations.

Impact on Investors

Investors in the cryptocurrency space are directly affected by regulatory developments:

- Investor Protection: Regulations aimed at safeguarding investor interests can reduce the risk of scams and fraud in the crypto market, creating a safer environment for investors.

- Taxation and Reporting: Regulatory requirements often include tax obligations, which can be complex and burdensome for cryptocurrency investors and traders.

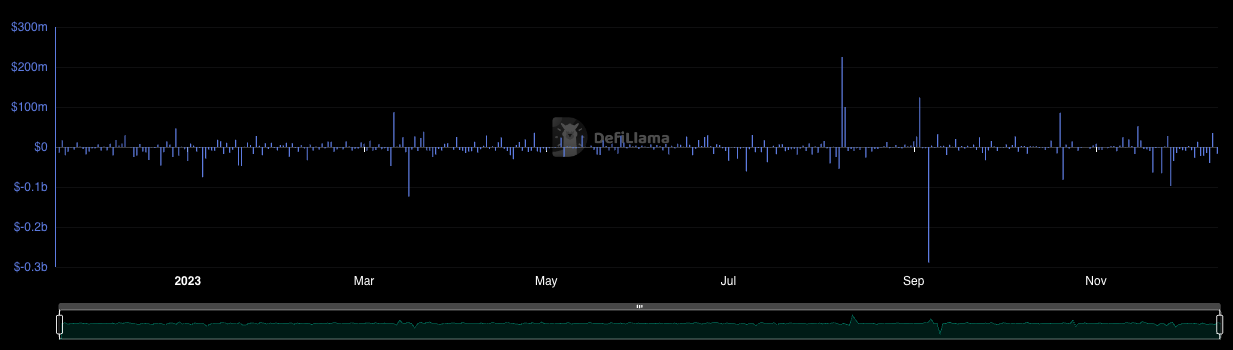

- Market Volatility: Regulatory announcements can lead to significant market fluctuations, impacting investor portfolios and influencing trading decisions.

- Asset Availability: Some regulations limit the availability of certain cryptocurrencies to local investors, affecting investment options.

Impact on Innovation

The regulatory landscape has a profound impact on the pace and direction of cryptocurrency and blockchain innovation:

- Legal Clarity: Clear regulations provide legal certainty, allowing innovators to develop applications with confidence, while ambiguous or strict regulations can hinder experimentation.

- Compliance Hurdles: Compliance with regulations can be a significant hurdle for startups. The need to navigate complex legal requirements can slow down innovation and increase costs.

- Geographic Focus: Regulatory preferences can lead to a geographic concentration of cryptocurrency and blockchain innovation. Startups may choose to operate in regions with more favorable regulations.

- Privacy and Security: Regulations aimed at enhancing security and privacy in the crypto space can foster innovative solutions and protect user data.

Conclusion

The regulatory landscape for cryptocurrencies is continually evolving, influencing the cryptocurrency industry, investors, and innovation. Striking the right balance between investor protection, market stability, and technological advancement remains a challenge for regulators worldwide. As the cryptocurrency space matures, it is imperative for governments and regulatory bodies to work collaboratively with industry stakeholders to create a regulatory framework that fosters innovation, ensures investor protection, and facilitates the responsible growth of this transformative technology.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!