The crypto market just faced its biggest crash in months on October 11, 2025, as Bitcoin plunged nearly 20% to around $101,000, while most altcoins dropped 20–50%, with some even losing 90–95% of their value.

According to Coinglass, over $19.2 billion worth of futures positions were liquidated within 24 hours — the largest single-day liquidation in crypto history.

But as always, when the market bleeds, opportunities appear.

This post breaks down the key strategies, checklists, and on-chain + TA signals you can use to buy the dip smartly — not emotionally.

1.What Triggered the Crash?

The sell-off was mainly sparked by a surprise announcement from President Donald Trump, declaring a 100% tariff on all Chinese goods, alongside new restrictions on U.S. strategic software exports.

This decision sent shockwaves across global financial markets — from equities to crypto.

According to the White House, this new 100% tariff is in addition to existing ones, meaning total import duties on some Chinese products could now reach 150–200%.

Tensions rose further when Trump accused Beijing of sending a “hostile letter” to several nations and vowed to limit exports of almost all goods starting November 1, 2025.

Analysts say this marks the most severe trade conflict since 2018, raising fears of a global economic war — with risk assets like crypto taking the hardest hit.

The USD Index (DXY) spiked immediately, while U.S. bond yields hit a 9-month high.

Institutional investors fled risk markets, rotating capital into USD and gold.

As liquidity drained, BTC and ETH lost critical support levels, triggering a domino effect of mass liquidations.

By 9 PM UTC, major coins like ETH, BNB, and XRP had already fallen over 20%, while smaller tokens such as IP and HEI plunged more than 90% within hours.

Though this shock might be short-term, many analysts believe the Trump–Xi tariff tension is only just beginning.

If China retaliates by tightening exports of rare earth materials or semiconductors, global markets could face another major shock.

Still, funds like Pantera Capital and ARK Invest expect Bitcoin to recover in the mid-term, as investors turn to non-sovereign assets amid geopolitical risk.

2.How to Buy the Dip Properly

2.1 Understand the Macro Trend First

“Buy the dip” only works in a long-term bull trend.

If the market is still in a deep bear cycle (like in 2022), prices can drop another 70–80% before the real bottom.

Focus on major timeframes (weekly, monthly) for key support levels.

Understand why the crash happened — is it macro-driven (e.g., Fed rate hikes), FUD, or temporary sentiment panic?

If it’s macro-driven, wait for signs of economic stabilization before buying in.

2.2 DCA Instead of Going All-In

Never go all-in on a single dip.

Split your capital into 4–6 tranches, buying 20–25% each time price drops another 10–20% from your previous entry or hits major support zones.

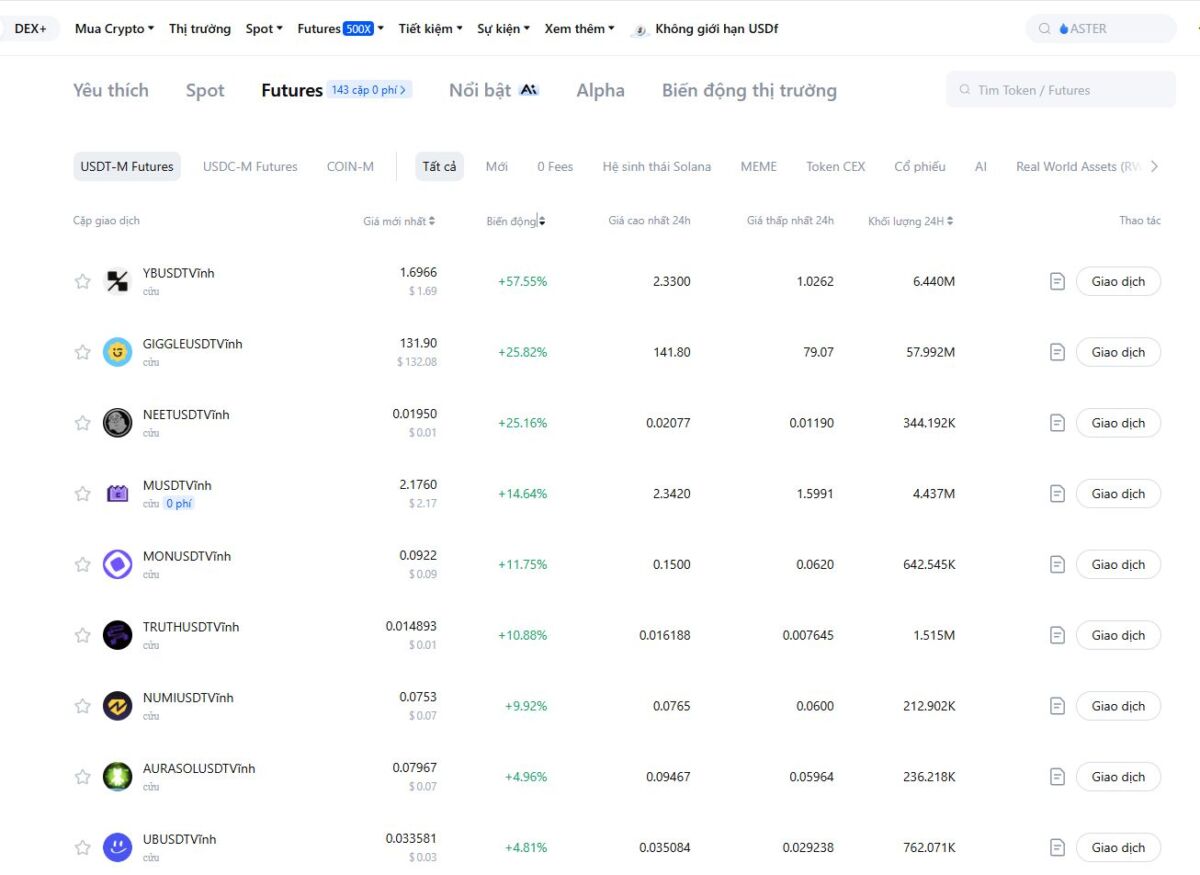

Prioritize strong coins like BTC/ETH, or tokens with clear narratives and liquidity flow (e.g., PerpDEX, memecoins in trend).

Use limit orders on exchanges (like MEXC) to automate your DCA plan — it removes emotion from the equation.

2.3 Watch for Technical Bottom Signals

Guessing bottoms rarely works — you’ll usually catch a fake bottom.

Instead, rely on objective technical indicators to confirm a reversal.

Key ones to monitor:

- RSI (Relative Strength Index): When RSI drops below 30 on daily or weekly timeframes (like BTC’s RSI hitting 20 in 2022), and then bounces, that’s a strong reversal signal.

- Fear & Greed Index: When sentiment enters Extreme Fear (<20) — historically the best time to buy (e.g., index hit 5 in 2022).

- MACD Divergence: If price continues to fall but MACD turns upward (bullish divergence), a bottom is likely forming.

Combine 2–3 indicators for confirmation.

When everyone’s panicking and prices stop dropping, it’s usually smart money accumulating — not luck.

2.4 Use On-Chain Metrics to Confirm Real Bottoms

Before you buy, check on-chain data and derivative metrics to avoid bull traps.

- Funding Rate: Deep negative rates (shorts paying longs) show oversold conditions. When funding normalizes back to zero or slightly positive, balance is restored, and a bounce is more likely.

- Open Interest (OI): Sharp OI drops alongside a crash mean forced deleveraging. Once OI flushes out, sell pressure fades.

- Stablecoin Supply/Liquidity: Rising stablecoin balances on exchanges indicate buying power waiting to deploy.

- Whale/Smart Money Accumulation: Track wallets with proven buy-and-hold behavior. If they’re accumulating during panic, that’s a strong long-term confidence signal.

- Liquidation Map: After clusters of liquidation levels get cleared, the market often experiences a technical bounce.

2.5 Manage Risk — Don’t Let Emotions Control You

In panic crashes, most retail investors sell at the bottom, while disciplined ones position for the next leg up.

Tips for capital protection:

- Allocate wisely: Only use 1–5% of your total portfolio for high-risk trades. Diversify with stablecoins (USDT) or non-crypto assets (gold, stocks) for balance.

- Avoid FOMO or FUD: Don’t rush to buy the dip if macro signals still point to weakness or new lows.

3.Final Thoughts

Crashes are brutal, but they reset the market — wiping out leverage and greed.

If you stay patient, data-driven, and disciplined, buying the right dips in a bull cycle can be life-changing.

Markets reward conviction and strategy, not fear or impulse.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always DYOR, understand the risks, and invest responsibly

Join MEXC and Get up to $10,000 Bonus!

Sign Up