In a remarkable display of defiance against regulatory challenges, the cryptocurrency industry is experiencing a surge in Bitcoin adoption. The number of Bitcoin addresses holding a non-zero amount of BTC has reached an all-time high, showcasing the unwavering commitment and resilience of Bitcoin enthusiasts.

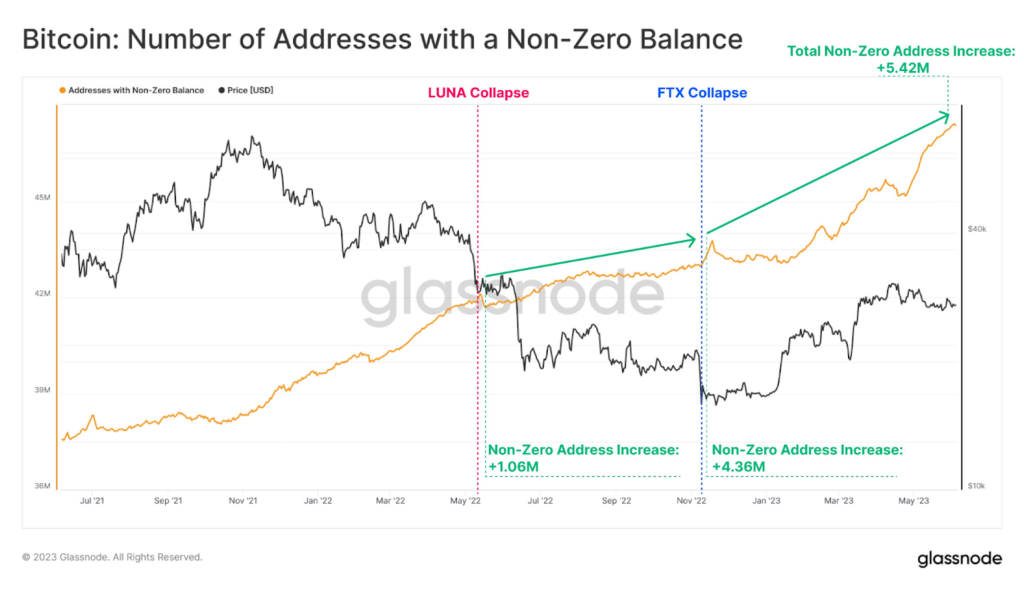

Glassnode, a prominent on-chain analytics platform, reports impressive growth in non-zero BTC addresses. The Bitcoin network is on fire, with an astonishing influx of 5.42 million new non-zero BTC addresses over the last year. This surge in adoption is even more awe-inspiring when considering the two significant market collapses that shook 2022.

Astonishingly, over a million addresses were added between the collapse of the Terra/Luna ecosystem and the downfall of FTX. And since the FTX debacle in November 2022, an additional 4.36 million non-zero Bitcoin addresses have come into existence, painting a picture of an expanding user base and a cryptocurrency with enduring appeal.

Resilience in the Face of Regulatory Challenges

Regulators may be breathing down the necks of the crypto industry, but it seems Bitcoiners have taken the challenge head-on. Glassnode’s analysis confirms that network adoption remains steadfast, with Bitcoin enthusiasts refusing to be deterred by regulatory efforts.

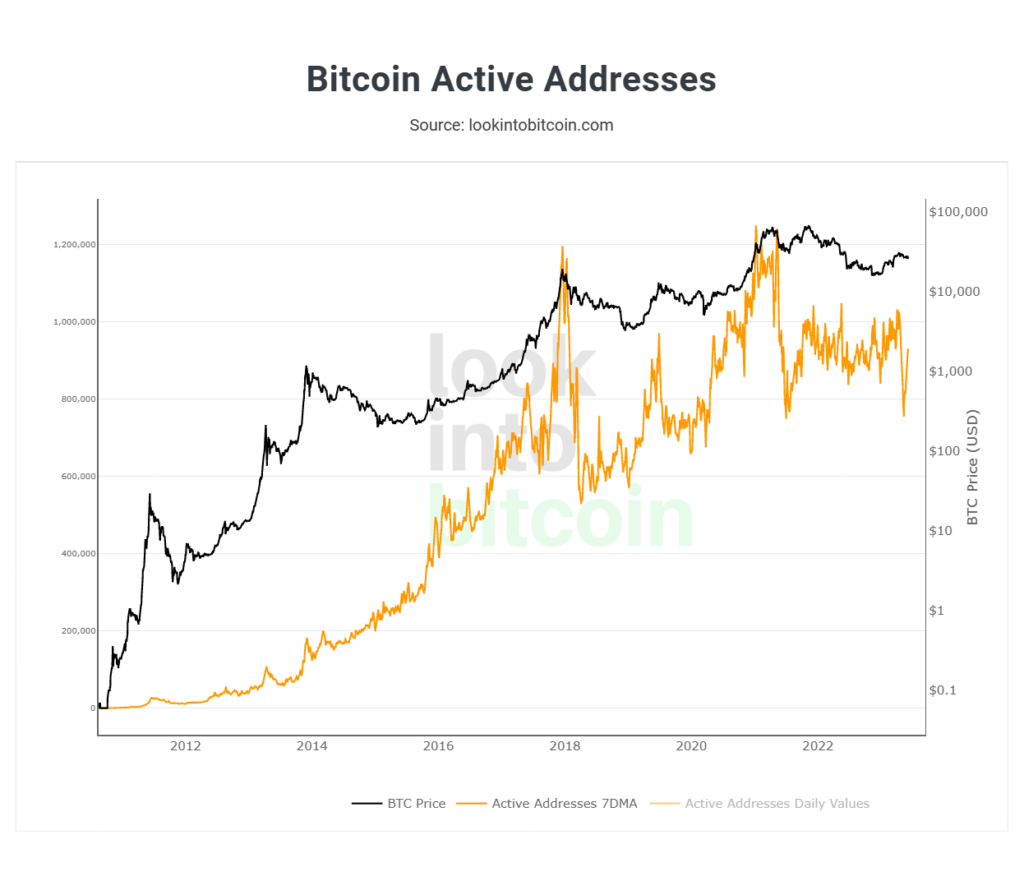

While the number of active addresses has tapered off since the peak of the crypto market in November 2021, the overall trend remains positive. As of June 4, there were a whopping 923,025 active BTC addresses, according to LookintoBitcoin. And despite a slight dip observed on May 13, subsequent data indicates a swift recovery, proving that Bitcoiners are made of resilient stuff.

The surge in Bitcoin addresses is not just about one cryptocurrency; it signifies a broader trend across the crypto sector. With a growing user base, the potential for widespread adoption amplifies, igniting excitement among enthusiasts. This influx of new participants into the Bitcoin ecosystem further solidifies the decentralization of the network, enhancing its security and diluting wealth concentration.

It’s a testament to the unwavering commitment and unwavering belief in the transformative potential of cryptocurrencies, even in the face of regulatory hurdles.

Low Realized Losses Amidst Volatility

In addition to the surge in non-zero Bitcoin addresses, on-chain data reveals a surprising trend—Bitcoin’s realized losses have remained relatively low, even amidst the wild swings in its value. Another Glassnode analysis indicates that investors only realized a mere $112 million in losses during the recent downward spiral. This “entity-adjusted realized loss” metric measures the total amount of loss (in USD) that Bitcoin investors have actually realized on the blockchain.

During the dip, the realized loss metric measured around $112 million. Following the dip in the realized loss metric, the very next day brought a significant reduction in losses, slashing the metric to approximately $64 million. This indicates that many investors are displaying remarkable conviction by holding onto their coins, even when their investment is momentarily at a loss.

In times of market volatility, there’s often a flurry of panic selling by inexperienced short-term holders. However, the relatively low realized losses observed during recent price fluctuations suggest that experienced long-term holders are staying true to their beliefs. Their unwavering conviction in Bitcoin’s long-term potential allows them to ride out short-term market turbulence, ultimately contributing to the strength and stability of the crypto industry.

Bitcoin Is Fighting to Stay Up

Following actions by the SEC on two crypto exchanges this week, the crypto market reacted aggressively, with the total market capitalization shedding about 6% in a day. The bearish wave sent Bitcoin to the $25,367 bottom, the cryptocurrency’s lowest point since March 17.

Coincidentally, the recent price dip sent BTC to a critical technical point, causing the cryptocurrency to retest our long-standing bearish channel. Following this drop, we can expect to see the price return to the $28,000 level, where it could struggle and possibly resume a bearish charge. Of course, this could take weeks to play out.

At the time of writing, BTC trades at $26,290 amid a spike in volatility, as highlighted by the ATR indicator. It would be interesting to see how Bitcoin fares when it reaches the $28,000 mark again in the coming days.

BTC Statistics Data

BTC Current Price: $26,290

Market Cap: $510.5B

Circulating Supply: 19.3M

BTC Total Supply: 21M

BTC Market Ranking: #1

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Start Trading Today!