Short Summary

1. The ideal business model for blockchain is the efficient use and commercialization of the block space, which can be considered a blockchain product. How can we design efficient ways to utilize the block space and make it easily accessible to users? What blockchain technologies can lead to trends by providing user cases for mass adoption?

2. Can Ethereum’s ecosystem, which provides trust-based protocols and service utilities as seen in the State of Ethereum 2022 Q3 Q4 metrics, represent the most important value of future blockchain trends? What significance will the announcement of Ethereum’s scalability improvement solutions centered around sharding/roll-ups have in the market or upcoming blockchain trends?

3. The launch of Coinbase’s Ethereum-centric Layer 2 BASE scalability improvement solution on the blockchain, with its numerous user base and vast capital, holds significant implications. What direction and trends will the crypto industry take based on this development? The vision of Layer 2 BASE is to create 1) interoperability and 2) use cases for both Web 2.0 and Web 3.0. How will this play a guiding role in understanding the future trends of the industry?

1.0 Blockchain business models for mass adoption

Today, the US dollar ($) as a reserve currency, which serves as the foundation for all industries, has value due to its hegemony from a business, economic, cultural, and political perspective. In reality, Visa, which provides financial networks to make the dollar useful for the general public, can be considered as creating value by connecting hundreds of millions of people in each country.

“ Hegemony” refers to the power, leadership, or dominance that can lead or direct the whole from a leading position. It is a concept that can obtain voluntary agreement and consensus from different social classes in the political, cultural, and national contexts of modern society and can rule over them.

What hegemonic value can be attributed to the numerous crypto industries/projects, including cryptocurrencies, currently based on blockchain technology? How can they address the problems they face and generate profits through new business models in our society’s future?

The ideal business model for blockchain is efficient utilization and commercialization of block space. This would be a blockchain product. From an industry perspective, the challenge is how to quickly, transparently, and securely create value for users using the block space generated in the blockchain network. The business model that blockchain companies need to design in the future is to create efficient utilization plans for block space and make them easily accessible to users.

However, the increasing demand for attractive block usage should not focus on specific users who work in the crypto/blockchain industry. It should also not dabble in investments but should be more comprehensive. The ultimate goal is to achieve blockchain mass adoption by attracting public interest in the technology. This includes demonstrating real-world business use cases incorporating blockchain technology.

Gartner Hype Cycle for Blockchain and Web 3

I personally believe that the current state of blockchain technology is still in its early stage. Furthermore, there are many areas that need to be improved. According to the Gartner Hype Cycle for Blockchain and Web 3 2022 report released by Gartner, a leading IT consulting firm in the US that many consulting firms around the world seek advice from, smart contracts technology that helps to utilize the block space of blockchain and new business creation opportunities centered on tokenomics still have endless possibilities for the future as an independent existence despite the adversity of last year’s crypto market.

As can be seen in the table, user cases such as the use of cryptocurrency, Dapps, and Blockchain wallets, which are representative services based on blockchain technology, are creating various revenue cases and models, and now the public has entered the slope of enlightenment, where they are starting to understand the technology behind blockchain, unlike the past. However, the fundamental reason that Gartner suggests that blockchain technology is still in the early stage is that it has not yet provided killer use cases that incorporate blockchain technology to the public, paradoxically stating that it is in the plateau of productivity, where the technology has not yet achieved mass adoption in the market.

“Smart contracts and tokens are just computer code and are independent of the greed and corruption of the ‘centralized’ bad actors that took advantage of them. No Killer Use Cases In the meantime, other than cryptocurrency trading, we still have not seen killer use cases yet. They need to leapfrog over current applications in terms of making our lives better. For example, wouldn’t it be helpful if you had a car accident, that you received your insurance payment for the damage within ten minutes? That could conceivably happen with the combination of Web3 and other technologies, like AI and IoT. It’s just a matter of time before it does.” -Gartner Hype Cycle for Blockchain and Web3, 2022 by Avivah Litan-

( I recommend referring to Gartner’s Hype Cycle for blockchain and Web 3 2022 report for more information.)

Therefore, in order to achieve mass adoption or to develop attractive blockchain business models with profitability, it can be observed that current existing blockchains still have several technical limitations that need to be addressed. We commonly recognize these issues as the current blockchain trilemma for blockchain mass adoption.

Understanding the Blockchain Trilemma

Resolving the blockchain trilemma would be a process in which the general public can easily use blockchain-based services in their daily lives, and the need for blockchain technology is recognized naturally through blockchain applications. This is considered the future trend and direction of the blockchain industry. Therefore, the focus is on the following three main points, including various projects in the blockchain industry and practitioners.

- How can we design revenue from transactions while maintaining the fundamental decentralization of blockchain and sustaining its security?

- What technical security measures need to be in place to achieve the above?

- Based on these technical improvements, can we provide user cases/business opportunities to the general public mentioned above and achieve mass adoption?

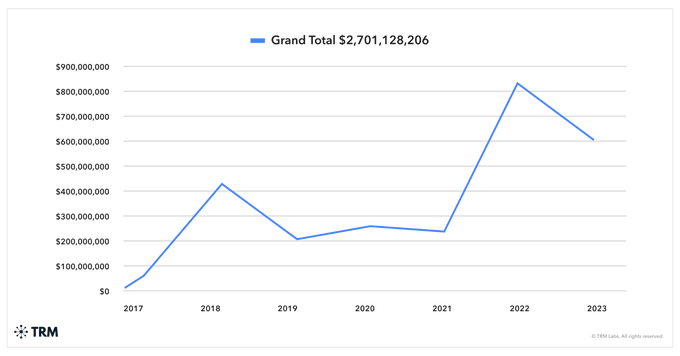

In 2022, the crypto market entered a winter phase due to market downturns such as the crisis from TERRA and FTX. These market adversities created even more negative images for the general public. However, the impact is especially obvious for the ignorant about existing blockchain technology or have a negative perception of crypto. Against this market backdrop, the upcoming year of 2023 poses a significant challenge for all crypto companies. Building successful user cases and addressing the technical improvements necessary for blockchain will be a challenge.

2.0 State of Ethereum 2022 Quarter 3 and Quarter 4

The blockchain trilemma refers to the problem of simultaneously meeting scalability, decentralization, and security requirements. Therefore, what is the blockchain network that can most closely achieve mass adoption while addressing this trilemma?

Currently, it is impossible to say which blockchain will fully achieve mass adoption. However, the blockchain network that will have the most significant impact in 2023 is still Ethereum. As of March 8, 2023, Ethereum holds the second-largest market capitalization of $190.84B, following only Bitcoin with a total cryptocurrency market cap of $1.01T. Furthermore, Ethereum’s TVL (Total Value Locked) is overwhelmingly high at 59.18%, indicating that most DeFi services and protocols are built on the Ethereum network. In fact, as seen from the perspective of sustainable profitability of blockchain, the Bitcoin network, which holds the largest market capitalization, has no significant utility other than transferring the digital gold-like symbol BTC within the network.

On the other hand, Ethereum’s network offers many valuable Dapps that users can directly benefit from, besides ETH transfer. This ecosystem of Ethereum, which is based on overwhelming trust, is providing protocol and service utility and represents the most important value of blockchain trends that will continue to evolve in the future.

TVL Total Value Locked: TVL stands for “Total Value Locked” and refers to the total amount of funds locked in a decentralized finance (DeFi) platform. It represents the value of assets locked in the platform, including loans, liquidity pools, and other investments. TVL is used as a measure of the size and popularity of DeFi platforms, as well as a metric for analyzing trends and performance in the DeFi ecosystem.

Use Cases

In February 2023, Bitcoin developed a new and attractive blockchain product that enables NFT creation based on the Ordinals Protocol, in search of a new innovative community utility. The impact of this new utility protocol development on the market remains to be seen as a game-changer. However, the significance of the development of the Ordinals Protocol has been influenced by the direction of the Ethereum network ecosystem, which seeks to activate numerous economic activities on a reliable basis above the utility dApps and the network. In other words, it is believed that the trend of Ethereum toward blockchain mass adoption, through a perfectly decentralized and secure mass network, is an important aspect that can be directly or indirectly observed within and outside the market.

In 2022, the importance of Ethereum’s trust network can be seen through the market performance. The FTX Bankrun/Alameda Research incident in 2022 contributed to a significant setback for the crypto ecosystem. Due to market turbulence, Ethereum recorded approximately 1.1 million transactions in Q4, which is about an 8% decrease compared to Q3. NFT and ETH transactions in the Ethereum ecosystem also showed a decrease of about 38% and 23%, respectively, contributing significantly to the decline in Ethereum transactions. Moreover, ETH volatility continued to lose stability and trended downward in Q4 following the trend from the third quarter.

Four Indicators for Discerning Sustainable Ecosystems

| 1. Market capitalization – a metric that measures the total value of network tokens issued on the network. |

| 2. TVL (Total Value Locked) – the total value of assets deposited in DeFi smart contracts on the network, which allows us to measure the financial activity of DeFi. |

| 3. DApps – a metric that measures the total number of projects developed on the network, allowing us to measure network activity. |

| 4. Protocols – a metric that allows us to measure the actual economic activity of a blockchain network. |

Despite experiencing a bear market, Ethereum has maintained a relatively stable and robust performance in terms of liquidity and utility on its network, which sets it apart from other chains. The reason why Ethereum was able to maintain stable and sustainable performance in the midst of market adversity is due to its overwhelming decentralization and security mentioned briefly above. Referring to the data above, the staking ratio on the Ethereum network is significantly lower, about 13%, compared to other Layer 1 mainnets such as Solana (70%), Avalanche (63%), and Polkadot (45%). Essentially, the higher the ratio of staking to the network, the stronger the network’s security and stability. However, an excessively high staking ratio could also be problematic in terms of the fundamental aspect of decentralization.

(*Another reason for the low staking ratio on the Ethereum network is the inability to withdraw once staked. However, this is expected to be improved in the future roadmap development.)

Blockchain Networks Should Consider Three Types of Decentralization for a Decentralized Ecosystem

| 1. Inclusivity of diversity: a multi-chain ecosystem that is not limited to a specific chain. |

| 2. Free competition and non-infringement of principles: an open-source-based free market competition structure. |

| 3. Freedom of choice: not bound to a specific chain. |

To lead the future trend, the blockchain network ecosystem should establish a multi-chain ecosystem. It should accommodate various services while enabling open-source-based free competition both inside and outside the network. It should also ensure users’ freedom of chain selection. The blockchain trilemma consists of three elements that cannot be simultaneously fulfilled. However, the author believes that one chain does not have to handle all three aspects.

On the other hand, the mainnet ecosystem that leads the upcoming trend is a problem that requires agile collaboration to address the trilemma. We need to consider coexistence with other chain ecosystems and resolving the trilemma. From this perspective, the technical decentralization value of the multi-chain ecosystem based on DApps that can create business opportunities using attractive block space utilization and numerous decentralized utility protocol services on top of Ethereum’s overwhelming user base, market size, and TVL is significantly different from other platforms in terms of block utilization within the network.

Confidence from Ethereum Network

In other words, the reason why the Ethereum network gave users confidence even during the crypto winter of 2022 despite its low staking ratio compared to other mainnets is that Ethereum shows the most successful indicators in the four indicators listed above and has the necessary functions as a decentralized mainnet that must provide reliability to users. Moreover, it is currently leading the collaboration with other chains from the perspective of activating the blockchain network economy sustainably to solve the fundamental problem of the absence of user cases in the future blockchain industry. Through this, the implication is that the decentralization, security, and large trust that Ethereum’s network has for its ecosystem can pioneer innovative hegemonic values for blockchain mass adoption in the future, which is very significant.

The Merge

- With the achievement of Ethereum’s PoS finality, the existing PoW block creation method has been changed.

- This has led to a 99% reduction in the internal network energy consumption of the chain. There is also a decrease in the gas fees generated by transactions.

- The newly issued Ethereum has seen a 90% reduction in the existing issuance amount.

The Merge update of the Ethereum network, which holds significant value in this market, has truly added even greater ripple effects to the blockchain trend. With the successful update of Ethereum Merge on September 15th, the Ethereum network has achieved the integrity of transitioning from the previous Proof-of-Work (PoW) consensus mechanism to the Proof-of-Stake (PoS) chain. Through The Merge update, Ethereum has evolved into a sustainable blockchain network capable of generating profitability, unlike existing deficit blockchains.

Following this development, the real staking income and MEV of users who deposited into the Ethereum network have increased from 1% in Q3 to 6% in Q4. The number of users staking on the network has also increased compared to before. Among the users are numerous staking service companies (Coinbase, Lido Finance) that currently occupy a large share of the Ethereum ecosystem.

Although the Merge update, which adopts a stake-based block creation method, is being contrasted with Vitalik Buterin’s philosophy due to some centralization issues, the Ethereum ecosystem still appears to be the most attractive and overwhelming network with the most active use of block space.

3.0 Blockchain Mass Adoption: Ethereum Roadmap and Layer 2 Solution

In this section, we will briefly introduce the concepts of Layer 1 and Layer 2 before delving into further details.

Layer 1: As the word “Layer” suggests, it refers to a layer or level. Layer 1 simply refers to the initial blockchain or existing network. Some prominent Layer 1 blockchain include Ethereum, Bitcoin, Solana, and Avalanche. Layer 1 blockchains adopt different consensus algorithm methods and utilize various approaches to create and utilize their own unique language. These Layer 1 blockchains maximize decentralization and security through their own consensus processes. However, they have drawbacks such as slower speed and performance in terms of scalability (block creation) and TPS (transactions per second).

Layer 2: It is a concept that involves adding another layer on top of the existing Ethereum network. Layer 2 does not aim to exist independently. Instead, it improves the scalability of Ethereum, increases transaction speed, and reduces network fees.

Ethereum’s Trilemma: As we can see from the conceptual difference between Layer 1 and Layer 2, Ethereum is superior to other blockchains in terms of decentralization, security, and market value. However, it has yet to solve the Trilemma problem in terms of scalability.

The Ethereum Trilemma

The Ethereum Trilemma refers to the challenge of achieving high levels of security, decentralization, and scalability simultaneously in a blockchain network. Prior to the crypto market’s winter, many Layer 1 mainnets emerged to compete with Ethereum’s ecosystem. They strive for better scalability and functionality. Unfortunately, they have shown relatively poor performance in comparison to Ethereum. It was especially obvious in terms of its multi-chain ecosystem, security, and overwhelming decentralization. In contrast, the hot trend driving the crypto market in 2023 is the Layer 2 market. Numerous projects, including Arbitrum and Optimism, are increasing the market’s size and their own size by expanding Ethereum’s ecosystem in various ways to improve scalability. If the Ethereum network improves scalability, it could lead to the trend for mass adoption in the future. Let’s take a look at the network development roadmap that will determine Ethereum’s future.

EIP: stands for Ethereum Improvement Proposal, which is a proposal for new standards submitted by programmers to add features and improvements to the Ethereum network, with the aim of enhancing the ecosystem of the network.

Ethereum Roadmap Order: The Merge-The Surge-The Scourge-The Verge-The Purge-The Splurge

The Merge: a great event for Ethereum and many problems to solve PoS—PoW

The Surge: direct improvements to scalability and privacy

The Scourge: improvements for decentralization

The Verge: simplifying Ethereum verifications

The Purge: simplifying Ethereum

The Splurge: fixing everything else

Therefore, summarizing the Ethereum roadmap at present:

- Switch to a proof-of-stake (PoS) consensus mechanism and address scalability through rollups going forward.

- Separate block creation and verification processes.

- Simplify and lighten the block verification process.

Vitalik Buterin’s Take on Decentralization

Vitalik Buterin, the creator of Ethereum, shared his thoughts on the upcoming protocol updates in his Medium post. He noted that rapid protocol changes within Ethereum are currently occurring and that complete decentralization is difficult to achieve during this period of drastic change. However, he emphasized that slower and simpler protocol changes lead to more favorable decentralization. Therefore, to maintain the essential decentralization and security of the Ethereum network, he urged the community to slow down and decrease the speed.

In his vision of the future, Ethereum Layer 1 will provide a system optimized for safety rather than a rapidly changing protocol technology that impresses the public. Instead, the future trend is to develop solutions centered on successful scalability improvements for mass adoption, such as The Surge – a Layer 2 scalability technology based on sharding and rollups that can process more than 500-1000 transactions per second beyond the current maximum of 15-20 TPS, ultimately aiming for scalability improvement to 100,000 TPS.

The success of Buterin’s philosophy for Ethereum’s safety and complete decentralization, as well as the successful development of scalability improvement-centered solutions for mass adoption, raises significant interest and intriguing implications for whether Ethereum will become a trendsetter for blockchain-based services in the future. Therefore, we are at a turning point where we must consider the impact of Ethereum’s moves on the current market.

4.0 Coinbase Layer 2 Solution: BASE

On February 23rd, Coinbase, the world’s second-largest cryptocurrency exchange, announced the development of a blockchain-based Layer 2 scalability solution called BASE, focused on Ethereum. Coinbase, a large cryptocurrency exchange based in the United States, currently has approximately 100 million users and holds around 80 billion dollars in assets. The announcement of BASE is significant given Coinbase’s influence and position within the cryptocurrency market.

BASE Blockchain

The news of the launch of Coinbase’s blockchain BASE, a scalability solution centered around Layer 2 Ethereum, which holds the second-highest market cap on exchanges, has significant implications in the crypto market after the announcement of Ethereum’s rollup-centered scalability improvement. While users who have utilized Coinbase’s exchange may already understand this to some extent, the biggest advantage of the exchange is its ability to provide optimal UX/UI to allow users to access the Web 3 environment and trade cryptocurrencies as easily as possible. Rather than creating its own Layer 1 mainnet ecosystem to compete with Ethereum, Coinbase, which has the most exposure to Web 3.0/blockchain technology among the general public as a large exchange, collaborates with Ethereum-centered solutions, making it particularly interesting from both a business perspective and a trend for mass adoption in the crypto industry.

The ultimate goal of Ethereum 2.0 is to increase network economic activity. It is speeding up block propagation among nodes, rather than increasing the block space size of a utility-based giant network. To achieve this, there has been an update to Merge PoW-PoS. Currently, Surge is being developed as a rollup-centered scalability improvement solution for the Ethereum network. EIP-4844, which embodies Vitalik Buterin’s philosophy that the network must maintain its decentralization while adopting rollup solutions, is the ultimate goal of this. EIP-4844, commonly known as Danksharding, aims to improve Ethereum’s scalability without sacrificing decentralization on a PoS-based network.

What is Sharding

Let’s easily explain the concept of sharding. Previously, every existing node on the Ethereum network had to have all the vast amounts of transactions that occurred on the network (Full Node). However, duplicating large amounts of data onto a few nodes is inefficient. It causes scalability issues within the network, which becomes a major obstacle during the block’s propagation and verification process. A blockchain with sharding technology is called a shard chain. By applying this technology, instead of having all nodes on the network hold information, we give the authority to a few nodes to process and verify transactions and help collect these shards to form the entire Ethereum network.

Coinbase, which has entered the scalability solution market of Ethereum, has a significant meaning in terms of crypto market trends. They announced the launch of an Optimism and Layer 2 blockchain, based on Layer 2 Solutions EIP-4844 collaboration. Let’s take a look at Coinbase’s vision for improving the scalability solutions centered around the Ethereum ecosystem.

Interoperability

They envision an ecosystem that connects various Layer 2 blockchains that collaborate on top of Ethereum. It is a network where Ethereum assets can move freely between all Layer 2 chains without the need for existing bridge technologies. They also envision making it easy to move other Layer 1 blockchain assets. Coinbase is currently the most trusted centralized decentralized company. Although it is unclear whether asset movement without a chain bridge is technically possible, as there is currently no decentralized bridge solution, Coinbase is planning to create an attractive blockchain service project vision for mass adoption based on its high level of reliability compared to other exchanges.

Creating User Cases for Web2 and Web3

As a decentralized exchange that allows on and off-ramp options, Coinbase appears to offer user cases for upcoming blockchain trends through the onboarding process of 100 million users. Coinbase includes a natural extension of its product line based on the Ethereum network, including digital asset staking solutions, liquidity staking derivatives, institutional custody solutions, non-custodial wallet products, and in-app integrated DeFi accessibility. The expansion of Coinbase’s product line is naturally based on the numerous users it possesses.

The performance of Layer 2 on Coinbase’s platform should be closely monitored in the future. Will Coinbase be able to win in competition with other rollups in the future? Furthermore, the problem of centralized sequencing must be addressed in some way. However, the launch of Coinbase’s Layer 2 Ethereum-centric scalability improvement service can be a good guidepost example for determining the current market trend. These issues need to be considered with regard to the directionality of the current market trend in the context of blockchain and crypto technology.

On-ramp refers to the process by which users of a cryptocurrency exchange convert fiat currency to tokens within their own wallet. This process allows users to enter the cryptocurrency ecosystem by acquiring tokens that can be used on the exchange.

Off-ramp, on the other hand, refers to the process by which users convert their tokens back into fiat currency, typically through a custodial bank account. The off-ramp process is important for users who wish to convert their cryptocurrency holdings back into traditional currency for use in the real world.

5.0 Conclusion

In this article, we examined the problem of the blockchain trilemma that needs overcoming for blockchain to achieve mass adoption. We also look at efficient ways to utilize attractive blockchain space that users can easily access. Don’t forget the Ethereum network ecosystem, which is the best at utilizing such blockchain space. There is also the launch case of the Ethereum-centric Layer 2 expansion solution Base.

Currently, due to the absence of direct user cases for technology and last year’s numerous market adversities, the public’s perception of crypto is in an urgent need for blockchain technology developments and service cases that can lead the trend from the perspective of industry development. This refers to blockchain technology that can achieve technical decentralization, high complementarity, and scalability improvement. Furthermore, it should be fast without the inconvenience and can enable numerous business economic activations.

The launch of Coinbase Exchange’s Layer 2 Base has significant value and importance. It provides a collaboration point between Web 2 and Web 3 on top of the Ethereum network that boasts the highest utility, pursuing economic activation, which is very interesting in terms of whether the Ethereum network can provide hegemonic value to the public in the future. We also need to watch how other blockchains, such as Avalanche, Solana, and Bitcoin, will react to this trend. We believe that we are at a very important moment in the journey toward blockchain mass adoption. Will we be able to experience blockchain technology as a direct and essential service in our lives?

Reference

1. Crypto Research, Data, and Tools | Messari

2. Scaling Blockchains: Layer 1 vs Layer 2 – An Overview of Scaling Solutions (crypto.com)

3. 수익이 나는 최초의 블록체인 by Bankless. 본 포스팅은 Bankless의 뉴스레터인 “The first… | by 100y | Medium

5.Introducing Base: Coinbase’s L2 Network | Coinbase Help

6. Ethereum’s Roadmap: A Guide to The Merge and Beyond (gsr.io)

7.https://blogs.gartner.com/avivah-litan/2022/07/22/gartner-hype-cycle-for-blockchain-and-web3-2022/

10.Ethereum’s Roadmap: A Guide to The Merge and Beyond (gsr.io)

11.https://blog.cryptostars.is/with-the-merge-on-the-verge-buterin-previews-the-surge-b50e74e099b1

12. Introducing Base – Blog (coinbase.com)

13.이더리움 확장성 솔루션, EIP 4844의 모든 것 – BeinCrypto Korea

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! You can learn more about crypto industry news. There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Start Trading Today!