Summary:

Founded in 2013, Circle has evolved from a Bitcoin payment startup into a leading issuer of regulated stablecoins and blockchain infrastructure services. Its flagship product, USDC, is now the world’s second-largest dollar-pegged stablecoin, widely adopted by global enterprises and financial institutions. With the company’s NYSE debut and regulatory expansion, Circle stands at the intersection of traditional finance and Web3 innovation.

TL;DR

- Circle, the issuer of USDC, the world’s second-largest stablecoin, currently boasts a market capitalization exceeding $34 billion.

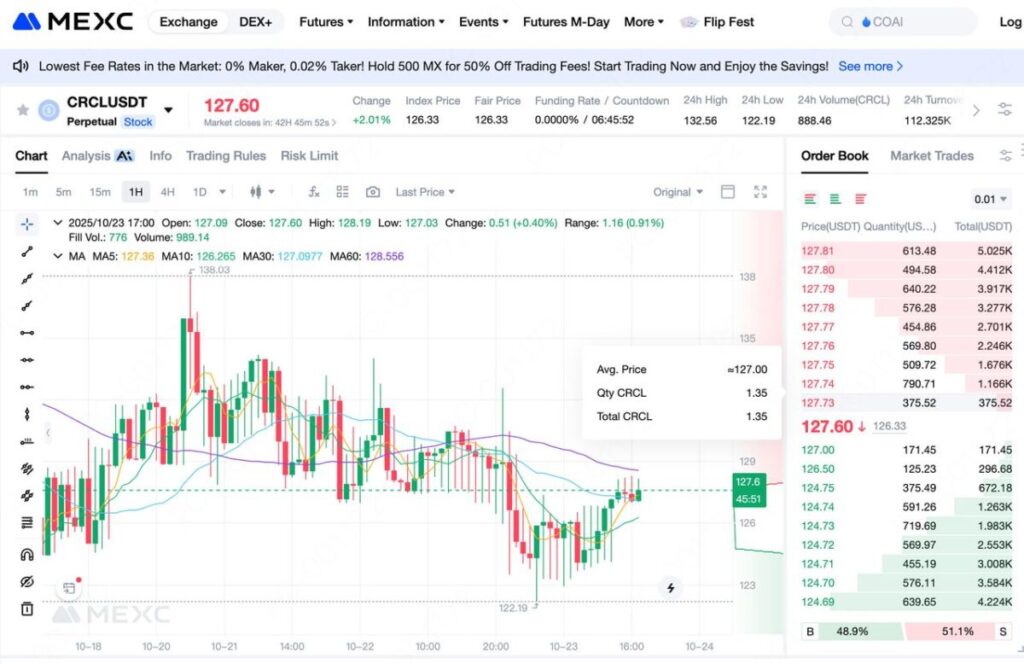

- MEXC has launched the CRCLUSDT perpetual futures, offering up to 25x leverage for traders.

- In a high-interest-rate environment, Circle’s 2024 revenue is projected to surpass $2 billion, with a gross margin of around 85%.

- Through CRCLUSDT, investors can gain early exposure to Circle’s growth potential and enjoy the flexibility of 24/7 trading access.

1.Company Overview and Business Model

1.1 About Circle Internet Financial

Headquartered in New York, Circle Internet Group, Inc. was established in 2013 and has since grown into a cornerstone of the digital financial ecosystem. Launched in 2018, USDC rapidly became a trusted digital dollar for institutional payments, cross-border settlements, and DeFi protocols worldwide.

1.2 Business Model and Revenue Streams

- Stablecoin Issuance & Reserve Management:Circle earns interest income from USDC reserves and service fees associated with issuance and redemptions.

- Digital Asset Infrastructure Services:Circle offers institutional-grade APIs for payments, custody, and cross-border transfers, serving enterprises and fintechs alike.

- Expansion Potential:As stablecoins become integrated into corporate payments, DeFi, and on-chain settlements, Circle’s infrastructure is positioned for exponential growth.

1.3 IPO and Milestone Timeline

- IPO Listing (June 2025): Circle debuted on the NYSE under the ticker CRCL, priced at $31 per share and raising over $1 billion.

- Strong Market Reception: The stock surged on listing day, underscoring strong investor confidence in Circle’s compliance-first model.

- Regulatory Expansion: Circle is pursuing a U.S. National Trust Bank charter to directly custody USDC reserves and offer digital asset services to institutions.

2.Why Now Is the Right Time to Invest in Circle

2.1 Explosive Growth of the Stablecoin Market

The stablecoin sector is entering a hypergrowth phase. Global market capitalization has soared from $20 billion in 2020 to over $160 billion in 2024, with projections surpassing $1 trillion by 2030.This boom is fueled by demand for cross-border payments, DeFi liquidity, and digital asset adoption by enterprises.

As the most compliant and transparent stablecoin, USDC enjoys strong institutional adoption. Financial giants like Visa and PayPal have already integrated USDC into their networks—solidifying Circle’s strategic position.

2.2 Regulatory Compliance as a Competitive Moat

Circle’s deep regulatory compliance infrastructure represents its core competitive moat. The company holds money transmitter licenses across multiple U.S. states and was among the first crypto firms to secure an Electronic Money Institution (EMI) license under Europe’s MiCA framework. This comprehensive compliance strategy does more than just mitigate regulatory risk—it’s Circle’s golden ticket to Wall Street and traditional finance. While competitors like Tether operate in regulatory gray zones, Circle’s transparency and by-the-book approach have made it the go-to choice for institutional players who won’t touch anything that doesn’t pass their compliance sniff test.

2.3 Key 2025 Catalysts

In 2025, several catalysts are driving a major revaluation of Circle’s market value. The passage of the U.S. Stablecoin Act (GENIUS Act) has finally established a clear legal framework for the stablecoin industry, paving the way for broader institutional adoption. At the same time, the Federal Reserve’s sustained high interest rate environment continues to generate substantial interest income for Circle’s USDC reserve holdings.

3.Investment Value: Opportunities and Risks

3.1 Bull Case

- Regulatory clarity will open massive new markets for compliant stablecoins.

- Expanding USDC use cases (settlements, remittances, treasury management) drive revenue growth.

- Strategic shift from issuance to full-stack financial infrastructure deepens client dependency.

- As one of the first “stablecoin + infrastructure” public companies, Circle benefits from first-mover advantage.

3.2 Bear Case

- Regulatory delays or policy shifts could stall adoption.

- Heavy reliance on USDC makes Circle vulnerable to market competition and reserve scrutiny.

- Current valuations are high; earnings execution remains a question.

- Operational risks include security breaches, reserve mismanagement, and market liquidity pressure.

4.How to Trade CRCLUSDT on MEXC?

4.1 Account Setup

Visit MEXC.com or download the MEXC App and register using your email or phone number.For higher limits and security, you should Enable 2FA and complete KYC verification.

4.2 Executing a Trade

Search for CRCL in the trading pair section,and Select the CRCLUSDT perpetual contract.Enter order size, choose leverage, and confirm to execute.

4.3 Advanced Trading Tools

MEXC offers Copy Trading, allowing users to mirror professional traders’ strategies — ideal for beginners or those seeking passive strategies.

5.FAQs

Q1:What’s the difference between CRCLUSDT and Circle stock?

CRCLUSDT is a 24/7 perpetual futures contract that supports leverage and shorting.Circle stock, on the other hand, trades only during U.S. market hours and offers no leverage.

Q2: What’s the minimum capital required?

Trading can start with as little as 10 USDT, but beginners are advised to start with 100–500 USDT for better risk control.

Q3: Is leveraged trading safe?

Leverage amplifies both gains and losses. Beginners should limit to 1–3x, with experienced traders going up to 10x. Leverage above 20x is only suitable for professionals.

Q4: How can I avoid liquidation?

Here are some tips: limit each position to less than 10% of total funds,use stop-losses (max 5–8% per trade),avoid over-leverage and ensure adequate margin and scale into positions gradually.

6.Conclusion

Circle stands at the frontier of the digital financial revolution. As the issuer of USDC and a pioneer in blockchain-based financial infrastructure, it embodies the convergence of traditional finance and Web3.Through MEXC’s CRCLUSDT perpetual futures, investors can capture exposure to one of the most transformative companies in the global digital economy.

Remember: successful trading requires patience, discipline, and risk control.Stay informed, trade wisely — and let Circle’s innovation power your next investment opportunity.

Join MEXC and Get up to $10,000 Bonus!

Sign Up