Key Insights:

- Record-breaking accumulation by whale and shark wallets drove Bitcoin to $70k, signaling renewed confidence in the cryptocurrency.

- Wallets holding 10 to 10,000 BTC now possess the highest number of coins since July 10, 2022, indicating a strong bullish sentiment.

- While Bitcoin’s surge is impressive, concerns arise as USDT and USDC holdings dwindle, highlighting potential liquidity challenges in the market.

Bitcoin has surged to a staggering $70,000, catching traders off guard with its unexpected rebound. Key stakeholders in the cryptocurrency market orchestrated one of the largest accumulation events in recent years.

Santiment, a market intelligence platform with on-chain & social metrics for cryptocurrencies, shared this insight on X, highlighting Bitcoin’s surge to $70k fueled by significant accumulation from whale wallets.

Bitcoin Holders Growing Wide

Over 51,959 bitcoins were amassed on Sunday alone by wallets holding between 10 and 10,000 BTC. This represents a remarkable 0.263% of the entire available supply, signaling a substantial movement in the market.

Interestingly, wallets holding between 10 and 10,000 BTC now possess the highest overall amount of coins since July 10, 2022. Additionally, they hold the highest Ratio of Bitcoin’s supply since July 6, 2023.

However, this accumulation trend is not limited to Bitcoin alone. Wallets containing 100,000 to 10 million USDT have seen a decline in tether holdings, reaching levels not seen since January 7, 2023. Similarly, wallets holding USDC have hit their lowest amount of USD coins since March 15, 2023.

Excitement For Bitcoin Halving

As the cryptocurrency community approaches the final three weeks before the halving event on April 19th, analysts anticipate continued growth in these wallets. Such accumulation could have a positive impact on the overall market caps of cryptocurrencies.

Yet, there’s a cautious note regarding the diminishing reserves of whale and shark wallets in USDT and USDC. Often referred to as “dry powder,” these reserves are vital for liquidity and the ability to swap for more cryptocurrencies swiftly.

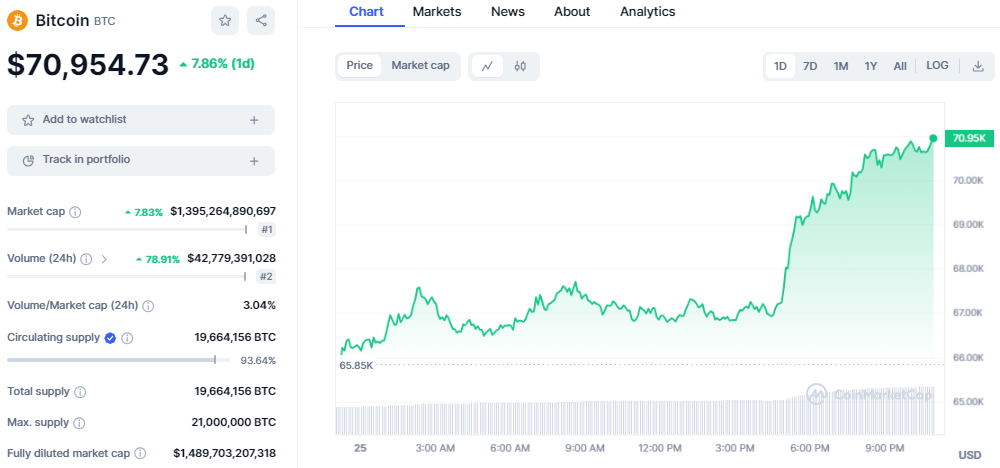

As of this writing, Bitcoin is trading at $70,954, up by 8% in the past 24 hours. The recent uptick in Bitcoin’s value coincides with the broad market rally, which has surged the overall market capitalization to $2.67 Trillion, an increase of 6%. Bitcoin’s dominance inched the 52% value again as the market capitalization climbs to $1.4 Trillion while the trading volume is currently at $42 Billion.

In conclusion, the recent surge in Bitcoin’s price to $70k is attributed to significant accumulation by key stakeholders. As the market braces for the upcoming halving, continued accumulation in these wallets could shape the trajectory of cryptocurrencies in the weeks ahead.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up