Bitcoin, the world’s leading cryptocurrency, saw a significant price jump last week following a surprise move by the U.S. Federal Reserve. The central bank cut interest rates by 50 basis points, sparking a rally in both traditional and crypto markets.

What Happened?

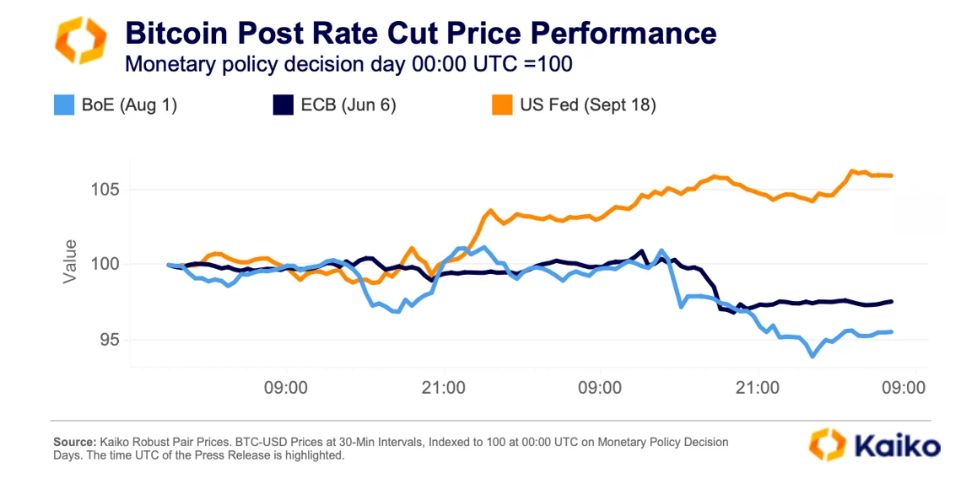

On September 18, the Federal Reserve announced a larger-than-expected rate cut of 0.5%. This decision marks the start of an easing cycle, with the Fed hinting at two more cuts by the end of the year. The news sent shockwaves through financial markets, with Bitcoin being a major beneficiary.

Within 24 hours of the announcement, Bitcoin’s price shot up by over 5%. This quick rise shows how sensitive Bitcoin can be to big economic news. The jump wasn’t just a flash in the pan, either. Over the course of the week, Bitcoin climbed more than 8%, reaching levels not seen since August.

Why Did Bitcoin Go Up?

There are a few reasons why Bitcoin reacted so positively to the rate cut:

1. Weaker U.S. Dollar: When interest rates go down, the U.S. dollar usually gets weaker. Since Bitcoin is often bought and sold using dollars, a weaker dollar can make Bitcoin more expensive.

2. More Money in the System: Lower interest rates mean banks can lend more money. This extra cash often finds its way into investments, including Bitcoin.

3. Risk Appetite: Rate cuts can make people feel more confident about taking risks. This can lead to more buying of assets like Bitcoin, which are seen as riskier than traditional investments.

Market Depth and Trading Volume

The price jump wasn’t the only interesting thing that happened. The amount of Bitcoin available to buy or sell quickly (called “market depth”) also went up. This suggests that more traders were ready to buy and sell Bitcoin at various prices.

Trading volume, or how much Bitcoin changed hands, also increased. This is a sign that more people were actively trading Bitcoin after the news.

While Bitcoin grabbed the headlines, other cryptocurrencies also saw some action. However, the gains weren’t spread evenly. Bigger, more well-known altcoins did better than smaller, less popular ones. This shows that investors might be playing it safer within the crypto world, sticking to more established coins.

Looking Ahead: The U.S. Election Factor

As we move closer to the U.S. presidential election in November, Bitcoin might see more ups and downs. Both major candidates have talked about cryptocurrency, which is new compared to past elections.

Former President Trump has said he supports Bitcoin, while Vice President Harris recently mentioned she would encourage new tech like digital assets.

This political attention could lead to more people buying or selling Bitcoin based on what the candidates say or how they perform in debates. In fact, during a recent debate, Bitcoin’s price actually fell a bit when some traders thought Trump didn’t do as well as expected.

As we head into fall, there are a few key things Bitcoin investors should keep an eye on:

1. More Fed Decisions: The central bank has hinted at more rate cuts this year. Each announcement could affect Bitcoin’s price.

2. Election Updates: As candidates talk more about crypto, it could cause price swings.

3. Options Expiry: A large number of Bitcoin options contracts are set to expire on September 29. This could lead to some short-term price changes.

Bitcoin Price Outlook

Bitcoin remains in solid shape as we head into October and is set to end the month in the green. The benchmark cryptocurrency, which recently peaked near the cryptical $64,850 resistance level, is fighting to hold above the $63,000 price point, at least until the week runs out. This could fast-track a bullish resurgence by the start of October.

BTC/USD Daily Chart

This sentiment is supported by an outlook from Deribit, which recently told The Block that there’s $5.8 billion in options expiry set for September 27. Deribit reports that this is the second-largest in open interest history on the platform.

The platform mentioned that this option expiry could lead to massive market volatility, which is just what bulls need to drive prices higher.

It would be interesting to see how this all plays out in the coming days.

BTC Statistics Data

BTC Current Price: $63,350

Market Cap: $1.25T

BTC Circulating Supply: 19.7M

BTC Total Supply: 21M

Market Ranking: #1

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up