Key Insights:

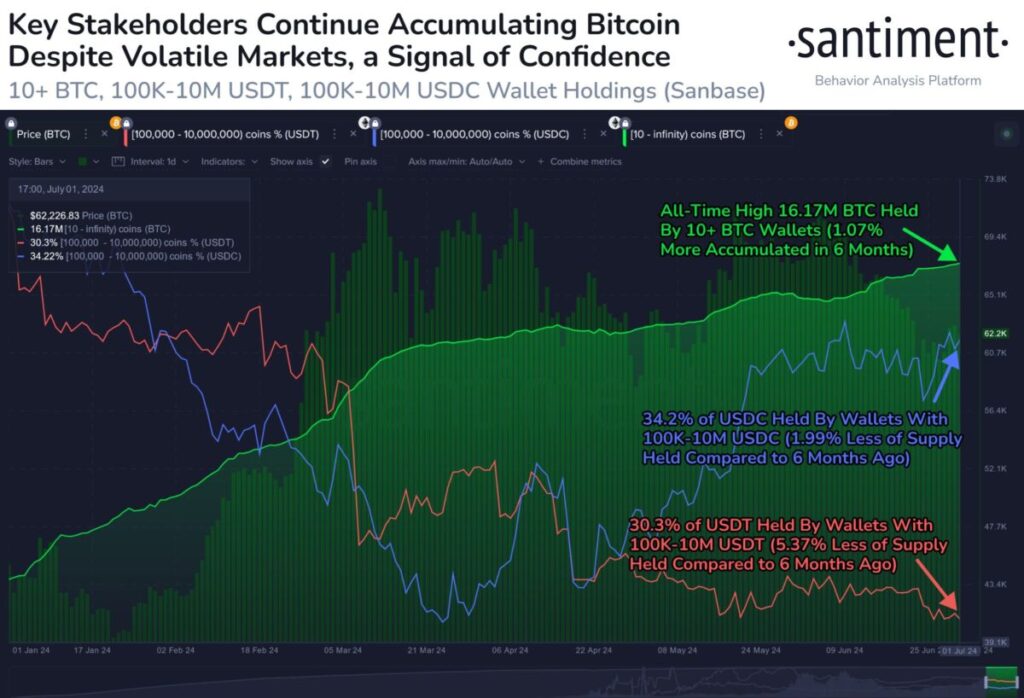

- Bitcoin stakeholders demonstrate confidence; over 16.17M BTC is now held in 10+ coin wallets, a new record.

- USDC and USDT analysis reveals a significant decrease in holdings, signaling shifting market strategies.

- Increased buying power is anticipated from stablecoin holders, potentially triggering a surge in a crypto bull market.

Despite enduring market volatility, Bitcoin’s key stakeholders demonstrate their long-term confidence in the digital currency by significantly increasing their holdings. Recent data reveals that wallets holding more than ten Bitcoins now contain a record 16.17 million BTC, underscoring a bullish outlook from major investors.

The accumulation trend is not just a minor uptick but represents a notable growth, with these wallets adding approximately 1.07% more Bitcoin over the last six months. This strategic accumulation suggests that key players are bracing for future market expansions and anticipating significant price movements.

Stablecoin Holdings and Market Dynamics

While Bitcoin sees an increase in stakeholder confidence, the dynamics for major stablecoins like USDC and USDT tell a different part of the story. Approximately 34.2% of all USDC is held by wallets containing between 100,000 and 10 million USDC, a slight decrease of 1.99% from six months ago. Similarly, USDT holdings in this wallet category have decreased 5.37%, now making up 30.3% of the total supply.

This shift in stablecoin holdings might indicate a strategic reallocation of resources, as investors potentially wait for opportune moments to convert their stable assets into more volatile ones like Bitcoin. The substantial reserves held in these stablecoins suggest that a significant amount of ‘dry powder’ could fuel the next bull run in the crypto market.

Implications for the Crypto Market

The continuous accumulation of Bitcoin by influential market stakeholders, combined with the maintained reserves of major stablecoins, paints a complex but cautiously optimistic picture of the cryptocurrency market’s trajectory. These trends suggest that while the market faces immediate fluctuations, the foundational confidence in Bitcoin’s long-term value remains strong.

Moreover, the behavior of these stakeholders could potentially lead to a cascade effect, where increased buying power from stablecoin reserves may indeed “open the floodgates” for a new era of bullish trends in the cryptocurrency space.

This analysis of current trends and stakeholder behavior points to a robust strategic positioning within the crypto market, signaling that despite short-term volatility, the long-term outlook by influential investors remains decidedly positive.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up