In a surprising turn of events, the cryptocurrency market experienced significant volatility this week, with Bitcoin at the center of attention. The world’s leading digital currency saw its price briefly dip near the $49,000 mark before rebounding to around $57,700 on August 7, leaving investors and analysts scrambling to make sense of the situation.

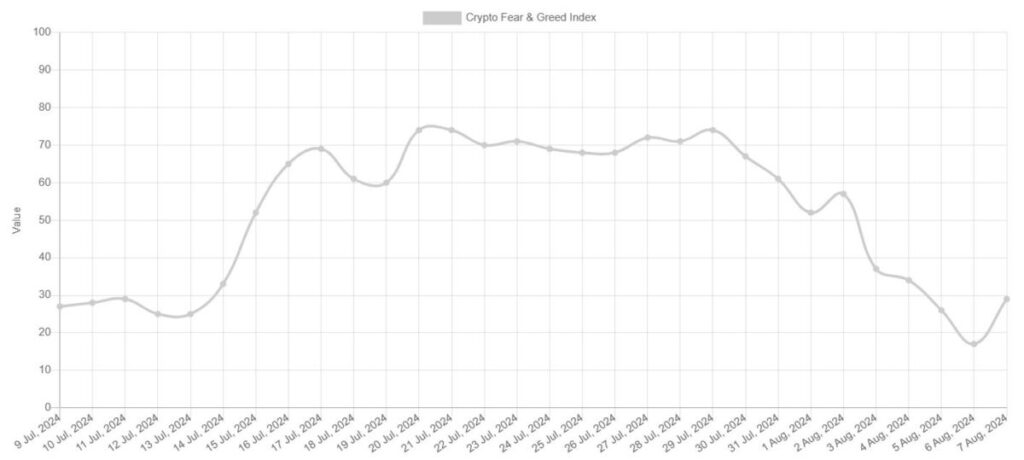

The market upheaval began on Monday (August 5) when over $1 billion worth of crypto positions were liquidated. This massive sell-off pushed the crypto fear and greed index into the “extreme fear” zone, reflecting widespread uncertainty among investors.

Despite the initial panic, Bitcoin has shown resilience, bouncing back from its low point. However, market sentiment remains cautious, with many experts advising traders to reassess their risk management strategies.

Markus Thielen, head of research at 10X Research, pointed out a key issue in the current market: a lack of fresh capital inflows. He explained, “The market has turned into a zero-sum game among traders, made worse by too much leverage.”

This situation led to more liquidations than seen in previous market corrections earlier this year.

Bitcoin MVRV Ratio Falls to Below Yearly Average

Adding to the complexity, a report from CryptoQuant highlighted concerns about Bitcoin’s market value to realized value (MVRV) ratio. This technical indicator has fallen below its yearly average, a sign that has historically pointed to extended price declines or the start of bear markets.

However, not all analysts share a gloomy outlook. Raoul Pal, a well-known market observer, remains optimistic. He believes the current correction could lead to what he calls the “banana zone”—a period of strong recovery based on patterns from previous market cycles.

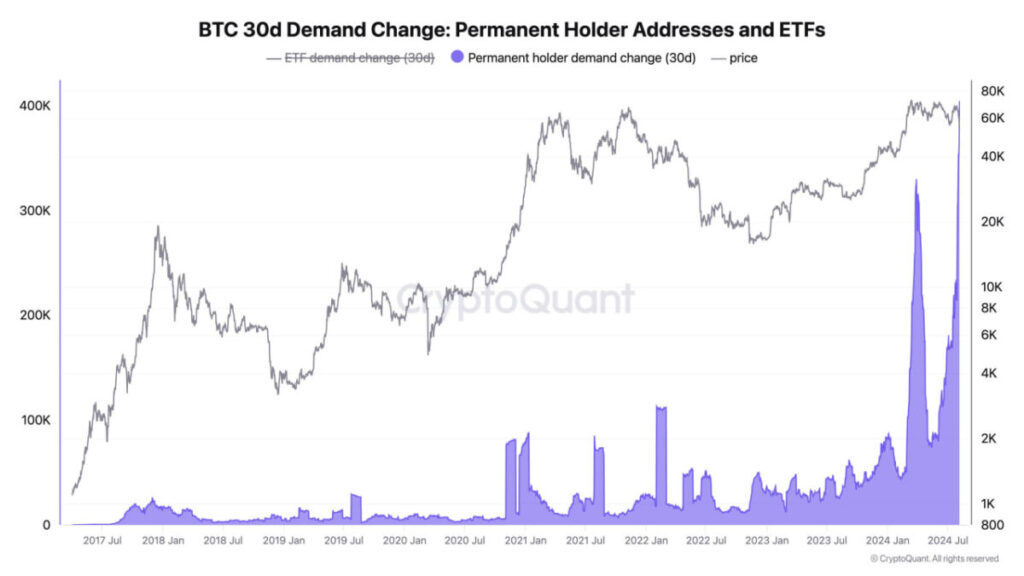

Interestingly, amid the market turmoil, long-term Bitcoin holders appear to be quietly accumulating more of the digital asset. Ki Young Ju, CEO of CryptoQuant, reported that over 404,000 bitcoins, worth about $22.6 billion, moved to addresses associated with long-term holders in the past month. This suggests that some investors see the current price dip as a buying opportunity.

Mt. Gox Creditors Holding Firm in the Face of Bearish Trend

The recent market events have also brought attention to the ongoing distribution of Bitcoin to creditors of Mt. Gox, a defunct cryptocurrency exchange. Surprisingly, many of these creditors, who have waited over a decade to reclaim their funds, are choosing to hold onto their Bitcoin rather than sell immediately.

This “HODL” mentality among Mt. Gox creditors could be seen as a vote of confidence in Bitcoin’s long-term potential. As one Binance Research spokesperson noted, “Many Mt. Gox creditors may have become even stronger believers in Bitcoin and its future potential, choosing to hold further.”

The cryptocurrency market’s ability to absorb the reintroduction of Mt. Gox Bitcoin without major disruption is seen by some as a sign of growing maturity in the ecosystem.

As the dust settles from this week’s market turbulence, the crypto community remains divided on what comes next for Bitcoin.

Bitcoin Price Action Remains Restrained

Since touching the $70,000 mark on July 29, BTC has plunged from low to low as macroeconomic factors come together to send the price to a 6-month low.

That said, since Bitcoin’s rebound from the $49,270 area, the $55,000 support line is acting as a defense against renewed price drops. However, BTC could likely breach this support in a short while without a breakaway from the downward channel highlighted in the 4-hour chart.

In such a case, we can expect to see a retest of the lower-$49,000 axis and a possible continuation. However, with the cost of mining a single Bitcoin pegged at $43,000 in the US, sustained price declines could spell serious problems for Bitcoin and the broader crypto market.

BTC Statistics Data

BTC Current Price: $55,200

Market Cap: $1.08T

BTC Circulating Supply: 19.7M

BTC Total Supply: 21M

Market Ranking: #1

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!