Cryptocurrency enthusiasts and investors are eagerly anticipating the Bitcoin Halving event scheduled for 2024. This event, which occurs approximately every four years, has a significant impact on the world of Bitcoin and the broader cryptocurrency market. In this article, we will delve into the details of Bitcoin Halving 2024, exploring its significance, implications, and expert opinions. So, let’s dive in!

What is Bitcoin Halving?

Every 210,000 blocks, roughly equivalent to four years, the Bitcoin network experiences a noteworthy event known as “halving.” This event is aptly named because it precisely halves the reward granted to Bitcoin miners for their role in processing transactions. The consequence of this halving is a reduction in the rate at which new bitcoins enter the market.

This particular reward mechanism will persist until approximately the year 2140. At that point, it will reach the proposed limit of 21 million coins. Beyond this juncture, miners will earn rewards in the form of transaction fees, which will be paid by users of the network. These fees aim to continue providing miners with a strong incentive to participate actively and sustain the network’s operations.

The History of Bitcoin Halving

The first Bitcoin halving event unfolded in November 2012, marking a significant milestone in cryptocurrency’s history. Subsequently, the next halving took place in July 2016, and the most recent occurred in May 2020.

Here are the accurate dates of the previous Bitcoin Halving:

- November 28, 2012, when the reward decreased to 25 bitcoins.

- July 9, 2016, which brought the reward down to 12.5 bitcoins.

- May 11, 2020, resulting in a reward of 6.25 bitcoins.

When Bitcoin initially launched in 2009, the reward or subsidy for mining was set at a generous 50 BTC per block. However, with each successive halving event, this amount undergoes a precise 50% reduction. To illustrate, following the inaugural halving, the reward for Bitcoin mining decreased to 25 BTC per block.

The ultimate destination on this halving journey is 2140, at which juncture there will be a total of 21 million BTC in circulation, and no further coins will be generated. Beyond this point, miners will exclusively receive compensation in the form of transaction fees.

Why Do We Need Bitcoin Halving?

Bitcoin Halving serves several crucial purposes. Firstly, it controls the inflation rate of Bitcoin. Reducing the rewards ensures that new Bitcoins are issued at a decreasing rate, ultimately capping the total supply at 21 million coins. This scarcity is one of the factors contributing to Bitcoin’s value.

Secondly, it ensures the security and decentralization of the Bitcoin network. The reduced rewards make it economically challenging for miners to continue operating less efficient hardware, leading to a more competitive and secure network.

What Happens After All Bitcoin Are Mined?

As of now, there are approximately 18.8 million Bitcoins in circulation, leaving around 2.2 million yet to be mined. After all Bitcoins are mined, miners will rely solely on transaction fees for their income. This is expected to make transaction fees more critical to sustain the network. However, there will be economic concern for the missing Bitcoin.

Bitcoin’s unique monetary policy gradually transforms it into one of the scarcest currencies worldwide. With its inflation rate halving every four years, Bitcoin is on a trajectory to become exceptionally rare. In the most recent halving, when the block subsidy was reduced from 12.5 BTC to 6.25 BTC, Bitcoin’s inflation rate dropped from approximately 3.7% to about 1.8%. This reduction rendered Bitcoin less inflationary than the U.S. Dollar, which targets a 2% inflation rate. Remarkably, the 2024 halving could make Bitcoin even less inflationary than gold, an asset traditionally prized for its low stock-to-flow ratio.

However, some economists are concerned about the influence of deflationary currencies on the economy. They suggest that Bitcoin’s deflationary policy may cause a money shortage in the financial system. It could also raise interest rates to excessively high levels and impede economic progress.

Concerning deflation, most Bitcoin supporters claim that concerns about Bitcoin causing a deflationary spiral and reducing demand for products are overblown. Unlike inflationary fiat currencies, which favor short-term consumption, Bitcoin encourages long-term investment over short-term consumption. However, expecting them to completely stop consuming is unreasonable.

As a result, Bitcoin would not undermine economic demand. Rather, it would shift the emphasis from current products to future goods. While certain industries dealing in frivolous, short-term items may encounter difficulties as a result of Bitcoin’s deflationary characteristics, others, such as technology, are likely to thrive.

What Are The Exact 2024 Bitcoin Halving Dates?

The exact date of Bitcoin Halving in 2024 cannot be predicted with absolute certainty due to the variable nature of block mining times. However, based on current estimates, it is expected to occur at block 840,000 which is slated on Apr 26, 2024, 04:31:22 AM UTC. Bitcoin enthusiasts around the world will be closely monitoring blockchain for the precise moment when the reward reduction takes place.

Will Bitcoin Halving in 2024 Bring in a Bull Run?

Historically, Bitcoin Halving events have been associated with bull markets.

On November 28, 2012, the first Bitcoin halving event occurred, resulting in a drop in the block reward from 50 BTC to 25 BTC. During this time, the price of Bitcoin was around $12.35. Following the halving, Bitcoin began an astonishing journey. It continuously increased in value and eventually reached an astounding peak of $1,242 in November 2013. This spike marked a startling increase of more than 100 times the price before the halving.

On July 9, 2016, the second Bitcoin halving occurred, lowering the block reward from 25 BTC to 12.5 BTC. Bitcoin was trading at $650 at the time. Following the halving, Bitcoin’s price began to rise gradually, reaching an all-time high of $19,106 in December 2017.

The most recent Bitcoin halving occurred on May 11, 2020. When the block reward was reduced from 12.5 BTC to 6.25 BTC, Bitcoin was valued at around $8,500 at the time. Following the halving, Bitcoin saw a slight price drop before continuing on an upward trajectory. Eventually, it reached an all-time high of almost $64,000 in April 2021.

The reduction in new supply, coupled with increased public awareness, often leads to increased demand and higher prices. While past performance is not indicative of future results, many investors are optimistic about a potential bull run following the 2024 Bitcoin Halving.

Why is there no Ethereum Halving?

Unlike Bitcoin, Ethereum does not have a fixed supply cap of 21 million coins. Ethereum’s supply is not capped, and its issuance rate is determined differently. Ethereum 2.0, the network’s upgrade, also implements a Proof of Stake (PoS) consensus mechanism. Meaning, ETH does not require mining and, thus, eliminates the need for halving events.

Bitcoin Price After Halving

Indeed, with only three Bitcoin halvings to study, it’s difficult to draw firm conclusions about the constant trends surrounding BTC’s performance before and after these watershed moments.

However, one significant tendency that has arisen from these previous halvings is that the Bitcoin price was lower one month prior to each of the three Bitcoin halvings than it was at the time of the halving. This discovery implies that there is a sense of optimism and anticipation in the Bitcoin markets in the run-up to major events. As a result, accumulating more BTC as a halving plan may be a speculative strategy worth exploring.

Predicting the exact price of Bitcoin after the 2024 Halving is challenging. However, historical data suggests that previous Halving events have been followed by substantial price increases. If demand remains strong and the supply continues to decrease, we may witness a significant surge in Bitcoin’s value.

Should I Buy Bitcoin Now?

As with any investment, timing is crucial. Bitcoin might possibly be at its all-time low in 2023. Therefore, buying Bitcoin could potentially bring you amazing rewards. However. it’s essential to conduct thorough research, consider your financial goals, and assess your risk tolerance before investing in Bitcoin. While some investors choose to buy Bitcoin in anticipation of the Halving event, it’s essential to make informed decisions based on your individual circumstances.

How To Trade BTC Halving?

You can buy BTC Tokens on MEXC by following the steps:

- Log in to your MEXC account and click [Trade]. Click on [Spot].

- Search “BTC” using the search bar to see the available trading pairs. Take BTC/USDT as an example.

- Scroll down and go to the [Spot] box. Enter the amount of BTC you want to buy. You can choose from opening a Limit order, a Market order, or a Stop-limit order. Take Market order as an example. Click [Buy BTC] to confirm your order. You will find the purchased BTC in your Spot Wallet.

You can find a detailed guide on how to buy BTC Tokens here.

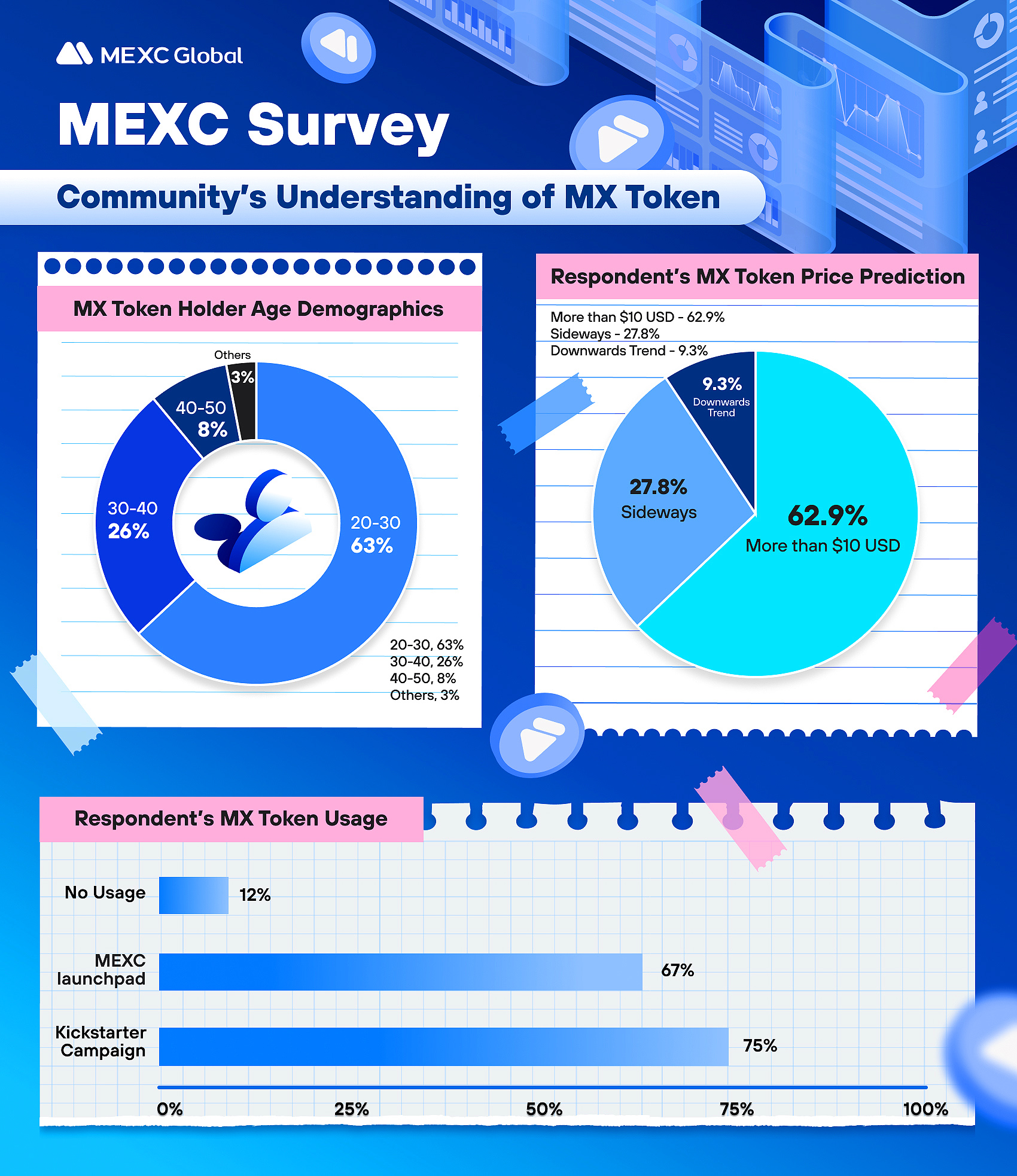

Get Free Airdrops with MEXC Launchpad!

Did you know MEXC gives out 20+ free airdrops weekly? Launchpad and Kickstarter events ensure that all our loyal MX token HODLers receive a ton of new tokens! Learn all about it at our MX Zone now!

Meanwhile, check out all of the listings in the Innovation and Assessment zones as well as the major tokens in the Main Zone – we have more amazing projects to come! Visit the Hot Projects section as well to uncover more featured popular tokens. Lastly, feel free to visit MEXC Academy to learn more about cryptocurrency!

Join MEXC and Get up to $10,000 Bonus!

Sign Up