Summary

Recently, Aster (ASTER) has become one of the hottest topics in the crypto market. Its remarkable price rally has not only drawn strong investor attention but also showcased the project’s underlying technical value and the market’s confidence in its long-term potential.

TL;DR

- ASTER opened at $0.03015 and peaked at $0.528 on day one — a 1650% surge, with trading volume topping $342M.

- Within 24 hours of launch, 330K+ new wallets were created, while TVL jumped to $1.005B and annualized revenue surpassed $60M.

- Key growth drivers: the booming perpetual DEX sector, Aster’s tech upgrades & ecosystem expansion, institutional backing, and early listing scarcity.

- ASTER is now listed on MEXC, where users can buy via spot or futures trading.

1.Price Rally and First-Day Performance

Aster’s Token Generation Event (TGE) was a turning point that catapulted the project into the spotlight.

- Opening price: $0.03015

- Day-one high: $0.528 (+1650%)

- Total first-day trading volume: $342M+

- Combined spot and derivatives volume: nearly $1.5B

These figures highlight Aster’s explosive early growth and validate its ability to secure both liquidity and users in record time.

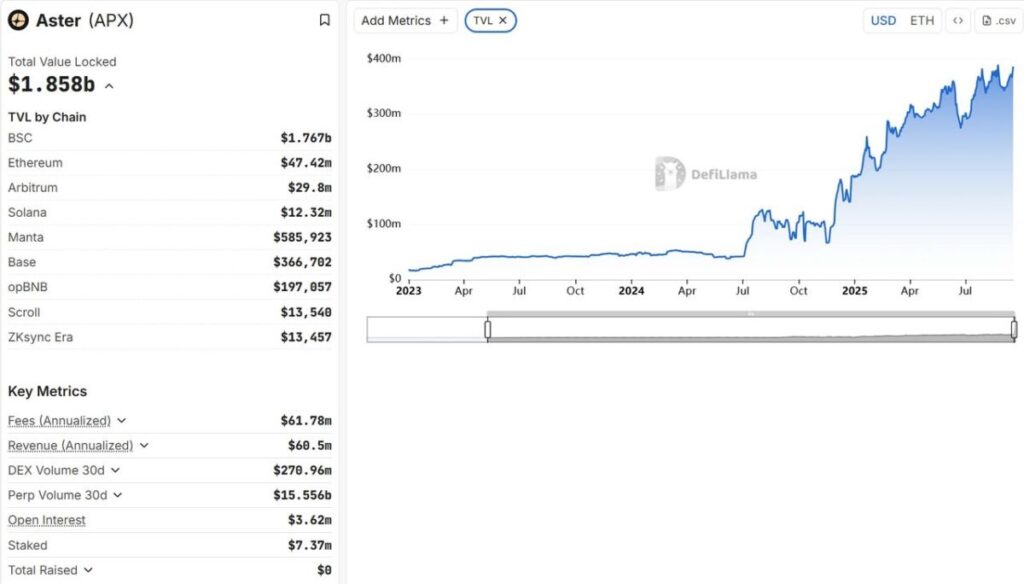

2.On-Chain Metrics: User Growth and Capital Inflows

Beyond price action, Aster’s on-chain performance has been equally striking.

Within the first 24 hours of launch, the network added over 330,000 unique wallet addresses, underscoring strong user engagement and long-term confidence. At the same time, TVL surged by $660M, reaching a total of $1.005B — a clear signal of massive capital inflows and trust in the protocol’s sustainability.

Aster’s dual trading modes are a key factor behind this adoption:

- Simple Mode: Fully on-chain perpetual contracts, streamlined for beginners.

- Pro Mode: An on-chain order book system with deep liquidity, real-time data, and advanced tools tailored for professional traders.

According to DefiLlama, Aster has already become the #1 protocol on BNB Chain by contract trading volume, with annualized revenue exceeding $60M. This demonstrates not only capital inflows but also solid profitability.

3.Why Did ASTER Pump? Key Growth Drivers

ASTER’s rally wasn’t just fueled by hype — it was the result of multiple reinforcing factors.

3.1 Market Environment & Sector Momentum

The perpetual DEX sector is one of the fastest-growing areas in crypto. With users demanding greater transparency, self-custody, and risk diversification, decentralized derivatives platforms are gaining serious traction. The success of Hyperliquid validated this trend, and Aster, as a rising player on BNB Chain, has naturally benefited.

3.2 Technology Upgrades & Ecosystem Expansion

Aster continues to improve network performance, enhance cross-chain functionality, and incentivize developers. This has boosted ecosystem activity and strengthened user stickiness, driving further adoption.

3.3 Institutional Support

Backed by YZi Labs, Aster enjoys strong strategic, liquidity, and capital advantages. Institutional participation not only fuels price growth but also adds a layer of long-term stability.

3.4 Scarcity & Launch Effect

At launch, ASTER was available exclusively on Aster DEX, concentrating liquidity and attention in one venue. This scarcity effect amplified price momentum during the early stage.

4.Risks and Challenges

No rally comes without risks. Key considerations for Aster investors include:

- High volatility: Early parabolic gains make the token vulnerable to sharp corrections.

- Concentration risk: With ASTER initially tradeable only on Aster DEX, any issues in liquidity, execution, or fees could be amplified.

- Competition: Established players like Hyperliquid and rising challengers such as Lighter and EdgeX pose threats in the perp DEX space.

- Regulatory uncertainty: Products like stock perpetuals, stablecoins, and cross-chain assets are potential targets for stricter regulation, especially where TradFi overlaps exist.

5.ASTER Price Outlook

Aster’s price trajectory will largely depend on its ecosystem growth, user adoption, and overall market conditions.

- Short to mid-term: Given ecosystem expansion and active trading, ASTER may hold strong at current levels, with potential for continued upward momentum — though short-term pullbacks are possible after such rapid gains.

- Long-term: If Aster sustains product innovation, revenue growth, and user adoption — while navigating regulatory and competitive pressures — it could establish itself as a key player in the decentralized perpetual space. Conversely, stagnation in development or loss of competitive edge could trigger a correction phase.

6.How to Buy ASTER on MEXC

As a leading global crypto exchange, MEXC has listed ASTER, offering both spot and futures trading with low fees and smooth execution.

Steps to buy ASTER on MEXC:

- Log into the MEXC app or official website.

- Search for ASTER in the trading bar.

- Choose spot or futures, set order type and size, then execute the trade.

7.Conclusion

Aster’s explosive debut was no accident. From a 1650% day-one surge to record-breaking on-chain growth, its momentum reflects both strong fundamentals and favorable market dynamics.

That said, sustainability will hinge on execution. In an increasingly competitive DeFi landscape, Aster must continue to deliver on technology, user experience, and compliance. For investors, monitoring key signals — such as token unlock schedules, trading volumes, open interest, and revenue consistency — will be crucial.

In the end, Aster has proven itself as a project worth watching. With continued ecosystem growth and institutional support, it has the potential to become a major force in the perpetual DEX ecosystem.

Join MEXC and Get up to $10,000 Bonus!