Summary:

Apple Inc. (Stock Symbol: AAPL), as the world’s most valuable technology company and a leader in consumer electronics, has consistently been a cornerstone investment for portfolios worldwide. This comprehensive guide provides insights into Apple’s current stock price dynamics, fundamental company analysis, and a detailed walkthrough on trading Apple US stock futures through the MEXC platform.

TL;DR

- MEXC’s AAPLUSDT perpetual futures enable trading Apple stock exposure using USDT, eliminating the need for traditional brokerage accounts or currency conversion, with 24/7 market access unlike regular stock market hours.

- While MEXC offers up to 50x leverage on Apple futures, beginners should start with 3-5x maximum. Higher leverage dramatically increases liquidation risk—most leveraged traders lose money, especially when starting out.

- Apple futures on MEXC use a funding rate mechanism (paid every 8 hours) to track the underlying stock price. Choose between isolated margin (limits losses to position) or cross margin (uses entire account as collateral) based on your risk tolerance.

- Despite 24/7 availability, liquidity and price discovery are best during U.S. market hours when the underlying AAPL stock actively trades, reducing slippage and improving execution quality.

1. Apple Stock Current Price & Market Performance

Stock prices fluctuate continuously throughout trading sessions, so accessing current pricing requires checking live sources:

Real-Time Price Resources:

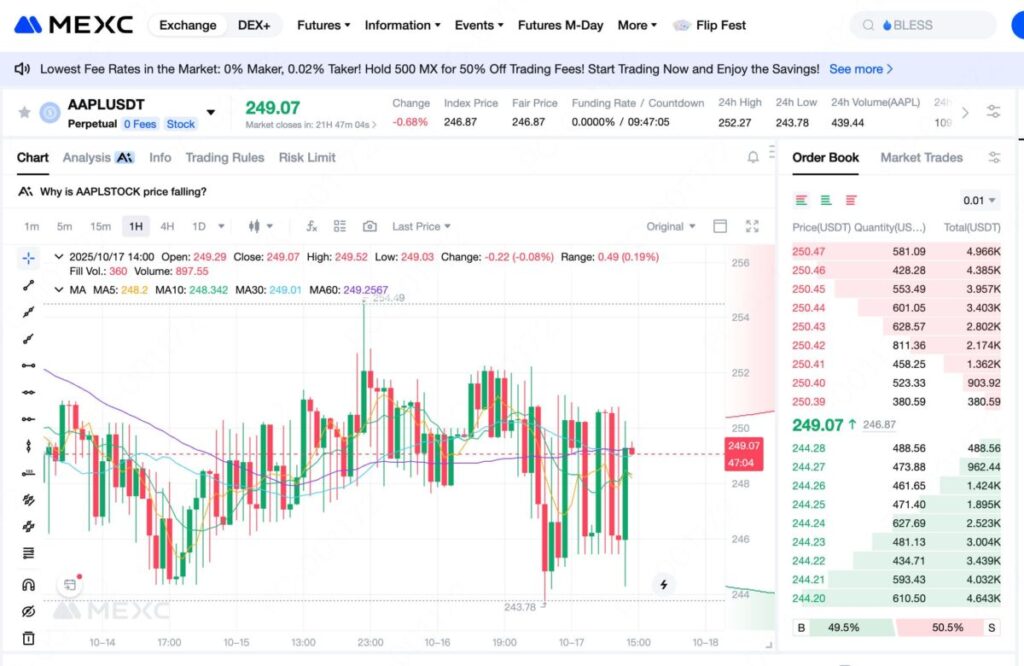

- MEXC trading platform’s AAPLUSDT futures contract page

- Google Finance search for “AAPL stock price”

- Official sources like Nasdaq.com or NYSE.com

- Financial data providers including Bloomberg, Yahoo Finance, Reuters

- Stock trading applications such as Robinhood, Webull, or Interactive Brokers

Apple’s stock has delivered extraordinary returns for long-term shareholders. The company has executed multiple stock splits throughout its history, most recently a 4-for-1 split in August 2020, making shares more accessible to retail investors. Over the past decade, Apple transformed from primarily a hardware company to a diversified technology giant with robust services revenue.

Apple frequently trades positions with other mega-cap tech companies for the title of world’s most valuable publicly traded company. Its market capitalization typically exceeds $2.5 trillion, representing substantial weight in major indices like the S&P 500 and Nasdaq 100. This dominant market position means Apple’s performance significantly influences broader market movements, particularly within the technology sector.

2. Apple Inc. Fundamental Analysis

2.1 Company Overview & Business Model

Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple Inc. is headquartered in Cupertino, California. The company designs, manufactures, and markets consumer electronics, computer software, and online services. Apple’s vertical integration strategy—controlling hardware, software, and increasingly, semiconductor design—creates competitive advantages through ecosystem lock-in and superior user experience.

2.2 Competitive Advantages

Apple’s enduring success stems from multiple interconnected competitive moats:

Brand Power represents perhaps Apple’s strongest asset. The company commands premium pricing across product categories, with customers willingly paying more for the Apple experience. This brand equity translates directly to profit margins significantly exceeding industry averages. The aspirational nature of Apple products creates self-reinforcing demand, particularly in emerging markets where ownership signals status.

Ecosystem Lock-In creates formidable switching costs. Once consumers invest in multiple Apple devices and services, migrating to competitors becomes increasingly difficult. Features like AirDrop, Handoff, iMessage, and iCloud seamlessly integrate across devices, creating user experience competitors struggle to replicate. This ecosystem generates network effects where each additional Apple product a customer owns increases the value of their existing devices.

Financial Strength provides strategic flexibility. With substantial cash reserves and strong free cash flow generation, Apple can invest in long-term R&D, make strategic acquisitions, weather economic downturns, and return massive capital to shareholders through dividends and buybacks.

2.3 Financial Performance Highlights

Apple consistently demonstrates financial excellence across key metrics:

Revenue Growth has remained positive through most periods, driven by service expansion, wearables growth, and iPhone’s resilience. While hardware categories experience cyclicality, services provide increasingly stable revenue foundations.

Profit Margins significantly exceed consumer electronics industry norms. Gross margins typically range 38-43%, while operating margins exceed 25%. These margins reflect pricing power, operational efficiency, and favorable services mix shift.

3. Apple Stock Investment Value Assessment

3.1 Bullish Investment Thesis

Optimism around Apple’s stock is supported by several core factors. The company’s services segment remains a key growth engine, with expanding user base and rising average revenue per user driving high-margin performance. Emerging markets still show low service adoption, offering meaningful upside as they mature. Apple’s innovation pipeline continues to deliver, with ongoing investments in areas like augmented reality, health technology, and potentially autonomous systems paving the way for new product categories and revenue streams.

Meanwhile, emerging market expansion—particularly in India, Southeast Asia, and Latin America—offers substantial growth opportunities as rising incomes fuel demand for premium devices. The Apple ecosystem further strengthens customer loyalty, as each new service or product increases switching costs and lifetime value, while initiatives like Apple Pay and Apple Card deepen engagement.Financially, Apple’s share buyback and dividend strategy supports earnings per share and enhances shareholder returns. Despite regulatory scrutiny, Apple’s integrated hardware-and-services model provides a relative moat, likely making it more resilient to antitrust actions compared with advertising-driven peers.

3.2 Risk Factors and Concerns

Apple investors should remain mindful of several key risks. The company’s heavy reliance on iPhone revenue continues to pose a vulnerability; any meaningful slowdown in smartphone demand or extended replacement cycles could pressure overall performance and weaken its ecosystem. Regulatory challenges are escalating worldwide, with antitrust scrutiny of App Store policies and potential privacy mandates threatening to impact services revenue and profitability.

Apple also faces innovation and execution risk, as sustaining premium pricing depends on consistently launching successful new products. Missteps or delays could damage brand strength and cede ground to rivals. China exposure compounds geopolitical and operational uncertainty, as rising tensions and domestic competition could disrupt supply chains or demand.Meanwhile, services growth may decelerate amid increasing competition in streaming, payments, and digital content, potentially leading to valuation compression. Finally, Apple’s elevated valuation leaves little room for error, and technological disruption—whether through AI, AR, or new computing paradigms—remains a long-term existential challenge despite Apple’s strong track record of adaptation.

4. Understanding Stock Futures vs. Traditional Stocks

What Are Stock Futures?

Stock futures (or stock index futures/single stock futures) are derivative contracts obligating buyers to purchase, or sellers to deliver, a specified quantity of stock at predetermined future dates and prices. In cryptocurrency trading contexts like MEXC, these are often perpetual futures without expiration dates, tracking underlying stock prices through funding rate mechanisms.

Derivative Nature means you don’t own actual Apple shares. You’re trading contracts deriving value from Apple stock price movements. Consequently, you don’t receive dividends, voting rights, or other shareholder privileges.

Leverage Availability distinguishes futures from cash stock trading. Futures require only margin deposits (often 5-20% of notional value), enabling larger position sizes with less capital. This amplifies both potential gains and losses.

Bidirectional Trading allows profiting from both rising and falling prices. Short selling futures is straightforward, unlike borrowing shares required for traditional short sales.

Mark-to-Market Settlement means daily P&L realization. Gains and losses reflect in account balances continuously rather than only upon position closure.

Lower Capital Requirements enable participation with smaller account sizes. Where buying 100 Apple shares might require $15,000-20,000, controlling equivalent exposure through futures might require only $1,000-3,000 margin.

Perpetual Futures Mechanics

MEXC likely offers perpetual futures contracts, differing from traditional quarterly futures:

No expiration means positions can be held indefinitely without rolling to new contract months. This simplifies trading and reduces rollover costs.

Funding Rate Mechanism anchors perpetual futures prices to spot prices. When contract prices exceed spot (contango), long pay short funding fees; when below spot (backwardation), shorts pay longs. These periodic payments (typically every 8 hours) incentivize arbitrage keeping futures prices aligned with underlying assets.

Continuous Trading operates 24/7, unlike traditional futures with specific trading hours. This provides flexibility but also means risk exposure during sleep hours.

Advantages of Traditional Stock Ownership

Capital Efficiency through leverage allows controlling larger positions with less cash. This enhances return on capital for successful trades but increases risk proportionally.

Short Selling Ease removes borrowing requirements and costs associated with traditional short sales. Market makers provide liquidity for both long and short positions equally.

Tax considerations may differ from stock ownership in some jurisdictions, potentially offering advantages. However, tax treatment varies significantly by location—consult tax professionals familiar with cryptocurrency and derivatives.

Accessibility for international investors bypasses restrictions often limiting foreign participation in US stock markets. Cryptocurrency platforms generally impose fewer geographical restrictions than traditional brokers.

24/7 Trading accommodates different time zones and schedules. News breaking during US market closure can be acted upon immediately rather than waiting for the next session.

Disadvantages Compared to Stock Ownership

No Ownership Rights means missing dividends and shareholder votes. For Apple specifically, dividend yields are modest but still represent income sacrificed by futures traders.

Funding Rate Costs accumulate for positions held through funding periods. These costs can be substantial for long-term holdings, particularly during persistent contango or backwardation.

Liquidation Risk from leverage means positions can be force-closed during adverse price movements, potentially at unfavorable prices. Even correct long-term views may suffer liquidation from short-term volatility.

Counterparty Risk exists with exchange platforms. Unlike stock ownership with SIPC insurance and regulatory protections, cryptocurrency platform failures could result in total loss.

Complexity increases relative to simple stock purchases. Understanding funding rates, margin requirements, liquidation prices, and contract specifications requires education and monitoring.

5. MEXC Platform Overview

5.1 About MEXC Exchange

MEXC is a cryptocurrency exchange founded in 2018. The platform has grown rapidly to serve millions of users across 170+ countries, offering spot trading, futures/derivatives, staking, and various other digital asset services.

Product Diversity includes 1,500+ cryptocurrencies and tokens, plus stock futures for major US equities. This breadth allows portfolio diversification within a single platform.

High Liquidity ensures tight bid-ask spreads and efficient order execution, particularly important for leveraged products where slippage impacts profitability significantly.

Competitive Fee Structure features maker/taker fees typically 0.00%-0.06%, lower than many competitors. High-volume traders and MX token holders receive additional discounts.

User-Friendly Interface balances functionality with accessibility, suitable for both beginners and experienced traders. Mobile apps provide full feature parity with desktop platforms.

Security Measures include cold wallet storage for majority of funds, multi-signature wallets, SSL encryption, and optional security features like withdrawal whitelisting and anti-phishing codes.

Customer Support operates 24/7 through live chat, email, and ticketing systems, with multilingual assistance including English, Chinese, Korean, Japanese, and others.

5.2 MEXC Stock Futures Offerings

MEXC provides perpetual futures contracts tracking major US stocks including META, Tesla, NVIDIA, Microsoft and others. These contracts enable cryptocurrency holders to access equity market exposure without converting to fiat currencies or establishing traditional brokerage relationships.

USDT Settlement means all margins, profits, and losses denominate in Tether (USDT), the leading dollar-pegged stablecoin. This eliminates currency conversion friction and enables seamless capital movement between cryptocurrency and stock futures positions.

Flexible Leverage typically ranges 1x-50x for stock futures, though specific limits vary by asset. Conservative traders can use minimal leverage while aggressive traders access higher multiples, though higher leverage dramatically increases liquidation risk.

Isolated and Cross Margin Modes provide risk management flexibility. Isolated margin limits losses to position-specific allocated funds; cross margin utilizes entire account balance as collateral, offering liquidation protection but risking total account in extreme scenarios.

Advanced Order Types include limit orders, market orders, stop-loss orders, take-profit orders, and conditional orders, enabling sophisticated entry and exit strategies.

Real-Time Data Integration provides charts, order books, and trade history mirroring traditional stock market data, facilitating technical analysis and informed decision-making.

5.3 Regulatory and Safety Considerations

Licensing Status: MEXC operates under various regulatory frameworks depending on jurisdiction. Users should verify platform legality in their specific locations before trading.

Fund Security: While MEXC implements robust security protocols, cryptocurrency exchanges face different regulatory oversight than traditional brokerages. SIPC insurance and similar protections don’t apply. Never store more funds than necessary for active trading on any exchange.

Know Your Customer (KYC) Requirements: MEXC requires identity verification for full account functionality, complying with anti-money laundering regulations. Verification processes involve submitting government-issued IDs and sometimes address proof.

Risk Disclosure: MEXC provides risk warnings about leveraged trading. Futures can result in losses exceeding initial deposits in extreme scenarios with insufficient margin. Understanding and accepting these risks is essential before trading.

6. Step-by-Step Guide: Trading Apple Futures on MEXC

Step 1: Account Registration

Visit Official Website: Navigate to mexc.com or download the official MEXC mobile app from App Store or Google Play. Verify website authenticity to avoid phishing sites.

Create Account: Click “Register” and choose email or phone number registration. Enter required information including email/phone, password (use strong, unique passwords), and referral code if applicable.

Email/Phone Verification: MEXC sends verification codes to confirm ownership. Enter the code to activate your account.

Security Setup: Immediately enable two-factor authentication (2FA) using Google Authenticator or similar apps. This critical security measure prevents unauthorized access even if passwords are compromised. Configure anti-phishing codes and withdrawal whitelists for additional protection.

Step 2: Identity Verification (KYC)

Basic Verification: Navigate to account settings and select identity verification. Upload government-issued photo ID (passport, driver’s license, or national ID card). Enter personal information exactly matching ID documents.

Advanced Verification: For higher withdrawal limits and full platform access, complete advanced verification involving selfie verification and sometimes address proof (utility bills, bank statements).

Processing Time: Basic verification typically completes within minutes to hours. Advanced verification may take 24-48 hours depending on queue volumes and manual review requirements.

Verification Benefits: Verified accounts enjoy higher deposit/withdrawal limits, access to all trading pairs, and priority customer support.

Step 3: Depositing USDT

Cryptocurrency Deposit: If holding USDT on external wallets or exchanges, transfer to MEXC:

- Navigate to “Assets” and select “Deposit”

- Choose USDT and select network (TRC20 recommended for low fees and speed; ERC20 offers wider compatibility but higher fees)

- Copy your unique MEXC deposit address

- Initiate transfer from external source to this address

- Wait for blockchain confirmations (typically 1-5 minutes for TRC20)

Fiat Purchase: For users without existing USDT:

- Select “Buy Crypto” and choose payment method (credit/debit card, bank transfer, P2P trading)

- Availability and fees vary by region

- Follow prompts to purchase USDT directly to your MEXC account

- P2P trading often offers better rates but requires more time and carries counterparty risk

Deposit Confirmation: Once deposits confirm, USDT appears in your Spot Wallet. Check “Assets” to verify arrival.

Step 4: Transfer to Futures Account

MEXC segregates spot and futures wallets. Before trading, transfer USDT:

Navigate to Transfer: In “Assets,” select “Transfer” or “Internal Transfer”

Configure Transfer: Choose “From: Spot Account” and “To: Futures Account,” select USDT, enter amount to transfer

Execute: Confirm transfer—funds move instantly without fees

Verification: Check Futures Account balance to confirm successful transfer

Tip: Don’t transfer entire balance; maintain reserves in spot account for flexibility and emergency liquidity

Step 5: Locate Apple Stock Futures

Access Futures Trading: From main navigation, select “Futures” then “USDT-M Futures”

Find AAPLUSDT: In trading pair search, type “AAPL” or “Apple” to locate AAPLUSDT perpetual contract

Contract Information: Review contract specifications including:

- Current price and 24h change

- Funding rate and next funding time

- Open interest and volume

- Maximum leverage available

- Minimum order size

Chart Setup: Configure charting timeframes, technical indicators, and layout preferences for analysis

Step 6: Configure Trading Parameters

Before placing orders, set critical parameters:

Leverage Selection:

- Click leverage settings (typically displays “10x” or similar by default)

- Adjust slider from 1x (no leverage) to maximum allowed (often 20x-50x for stocks)

- Recommendation: Beginners should use 3x-5x maximum; even experienced traders rarely need >10x for stocks

- Higher leverage = higher liquidation risk and smaller margin for error

Margin Mode:

- Isolated Margin: Only allocated margin at risk; other account funds safe from this position’s liquidation. More conservative, recommended for beginners and multiple positions

- Cross Margin: Entire account balance backs position; offers more liquidation protection but risks full account. Better for experienced traders with single focused positions

Position Sizing: Determine how much capital to risk. Conservative approach risks 1-2% account value per trade; aggressive traders might risk 5-10%, though higher risk percentages dramatically increase account volatility and ruin probability.

Step 7: Place Your Order

Order Type Selection:

Market Order: Executes immediately at best available price. Use when prioritizing speed over price, such as reacting to breaking news or urgent position entries/exits. Accept some slippage in exchange for certainty of fill.

Limit Order: Specifies maximum buy price or minimum sell price. Order waits in queue until market reaches your price. Provides price control but risks non-execution if market moves away. Ideal for patient entries at specific technical levels.

Stop-Loss Order: Triggers market order when price reaches specified level, protecting against adverse moves. Essential risk management tool.

Take-Profit Order: Automatically closes profitable positions at predetermined targets, removing emotion from profit-taking decisions.

Opening Long Position (Betting on Apple price increase):

- Select “Buy/Long”

- Choose order type and enter price (if limit order)

- Input quantity (in contracts or USDT value)

- Review margin required, leverage used, and estimated liquidation price

- Confirm and submit order

Opening Short Position (Betting on Apple price decrease):

- Select “Sell/Short”

- Follow same process but in reverse direction

- Pay special attention to funding rates—persistent positive funding means shorts pay longs, adding to holding costs

Order Confirmation: Successfully placed orders appear in “Current Orders” (if unfilled limit orders) or “Positions” (if filled).

Step 8: Set Stop-Loss and Take-Profit

Immediate Implementation: Set protective orders immediately after position opening, before emotion or distraction compromises discipline.

Stop-Loss Placement:

- Click position in positions tab, select “Stop Loss”

- Determine stop level based on:

- Technical support/resistance levels

- Percentage risk tolerance (e.g., 5% from entry)

- Account risk limits (e.g., maximum 2% total account loss)

- Enter stop price and trigger price

- Confirm—order now protects against catastrophic losses

Take-Profit Strategies:

- Single Target: Set one profit target at key resistance (for longs) or support (for shorts)

- Scaled Exits: Set multiple partial profit targets, taking chips off table as profits accumulate while letting portion run

- Trailing Stops: Some platforms support trailing stops that automatically adjust as position moves favorably, locking in profits while allowing continued upside

Monitoring: Regularly review stop/profit levels, adjusting as market structure changes or new information emerges.

Step 9: Monitor and Manage Position

Active Monitoring Requirements:

- Check positions multiple times daily during active markets

- Set price alerts for critical levels

- Monitor funding rate changes affecting holding costs

- Watch for relevant news or events impacting Apple

Position Metrics to Track:

- Unrealized P&L: Current profit/loss if position closed now

- Liquidation Price: Price triggering forced closure; never let market approach this level

- Margin Ratio: Used margin vs. available margin; maintain buffer for volatility

- Funding Payments: Accumulating costs or income from funding mechanism

Position Adjustments:

- Adding to Winners: Can increase position size as trade moves favorably, though this increases risk

- Hedging: Opening opposing positions to lock in profits or reduce risk temporarily

- Partial Closure: Taking some profits while maintaining exposure captures gains while preserving upside potential

Step 10: Close Position

Market Close: Click “Close” on position and select market order for immediate exit at current prices. Use when urgency outweighs price optimization.

Limit Close: Set limit order at desired exit price. Waits for market to reach level, providing price control. Risk is non-execution if the market reverses before hitting the target.

Stop/Profit Trigger: Previously set stops or profit targets automatically close positions when activated.

Partial vs. Full Close: You can close the entire position or specified percentage, allowing flexible exits.

7. Apple Stock Futures Trading Strategies

Technical Analysis Approaches:Apple’s price action often respects key support and resistance levels, with breakouts on strong volume signaling trend continuation. Moving averages (50-day, 200-day) help define bias—trading above favors longs, below favors shorts. Momentum indicators like RSI and MACD confirm overbought or oversold conditions and trend shifts. Recognizable chart patterns such as triangles or double tops guide entries and risk management, especially on higher timeframes.

Fundamental Event Trading:Apple’s stock often reacts sharply to fundamental events such as earnings reports, product launches, and macroeconomic developments. Quarterly earnings (January, April, July, October) drive significant volatility, offering opportunities for pre- or post-earnings trades once direction is clear. Major product announcements, especially iPhone launches, tend to follow a “buy the rumor, sell the news” pattern. Apple is also sensitive to economic indicators tied to consumer spending and to Federal Reserve policy, as rate hikes weigh on valuations while rate cuts generally support growth stocks.

Market Structure Strategies:Apple’s price action often mirrors broader market structure dynamics. As a major S&P 500 component, it closely tracks index movements, with divergences signaling relative strength or weakness. Sector rotations also influence performance—Apple tends to benefit when tech and growth stocks lead. Short-term traders watch opening range breakouts during the first hour of trading for directional cues, while pre-market activity provides early insight into sentiment that can carry into the regular session.

8.Frequently Asked Questions (FAQ)

Q1:What is Apple’s current stock price, and how can I view it in real-time? As market prices fluctuate continuously, you can view real-time AAPLUSDT futures prices directly on the MEXC trading interface.

Q2:What are funding rates, and how do they affect my Apple futures positions? Funding rates are periodic payments exchanged between long and short position holders in perpetual futures contracts, designed to anchor the contract price to the underlying spot price. You can view current and historical funding rates on MEXC’s contract information page, helping inform position timing and duration decisions.

Q3:Can I lose more money than I deposit when trading with leverage? Under MEXC’s standard isolated margin mode, no—losses are limited to the margin allocated to each specific position. Remember that while leverage amplifies gains, it equally amplifies losses. Trade only with funds you can afford to lose, always prioritizing capital preservation over profit maximization.

Q4: What is the best time to trade Apple futures for maximum liquidity? Trading liquidity significantly impacts execution quality, especially when using leverage where slippage and spread costs become more critical. For Apple futures on MEXC, optimal trading windows align with U.S. market hours when the underlying AAPL stock is actively traded.

9.Conclusion

Apple Inc. represents one of the most accessible yet sophisticated trading opportunities in global markets, combining massive liquidity, comprehensive research coverage, and a well-understood business model. MEXC’s Apple stock futures democratize access to this premium asset through cryptocurrency holdings, flexible leverage, and 24/7 market access. However, these same appealing features—leverage, bidirectional capability, and continuous markets—dramatically amplify risks. Success demands mastering not just Apple’s fundamentals, but also technical analysis, risk management, trading psychology, platform mechanics, and perpetual futures characteristics. The sobering reality is that most leveraged traders lose money, particularly early in their trading careers.

Approach Apple futures trading with humility, patience, and discipline—start with minimal leverage and position sizes, treating initial trades as education rather than profit opportunities. Develop and rigorously test strategies before risking significant capital, maintain detailed records for honest performance assessment, and never trade with funds essential for living expenses. The convergence of traditional equities and cryptocurrency markets creates unprecedented opportunities for informed, disciplined participants who understand Apple’s business, master MEXC’s platform, and implement robust risk management. Trade wisely, manage risk religiously, and never stop learning—markets reward preparation and discipline while harshly punishing overconfidence and ignorance.

Join MEXC and Get up to $10,000 Bonus!