Aave is among the largest protocols deployed in the decentralized finance (DeFi) market.

It has managed to take a dominant position in the DeFi lending market. This direction is becoming one of the most promising, as it simplifies access to funds.

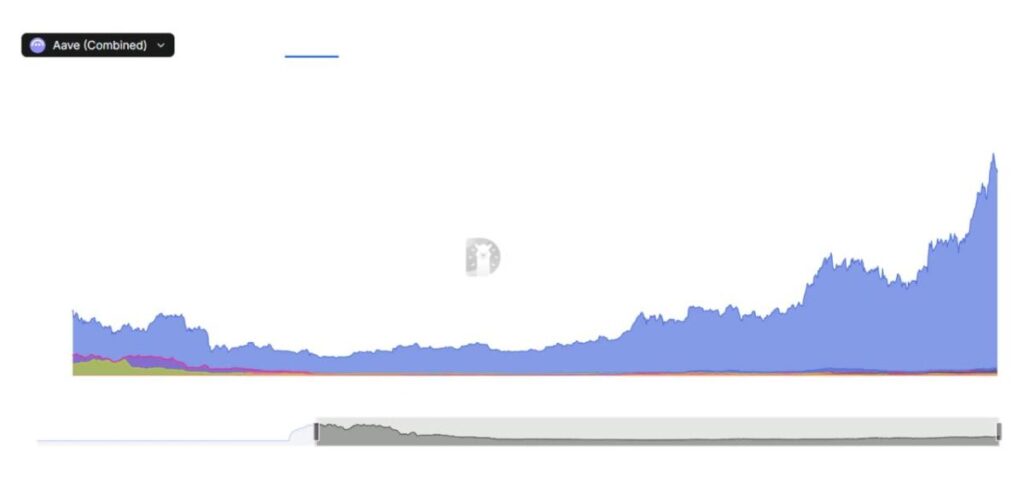

By the end of summer 2025, the Aave project had accumulated digital assets of approximately $47 billion. In early 2024, the total value locked (TVL) was estimated at $8 billion.

According to DeFiLlama, a lion’s share of Aave’s funds is stored on Ethereum – $33.711 billion. The top 5 networks also included Arbitrum, Base, Avalanche, and Polygon.

A sharp increase in TVL on Aave has been observed since June of this year. According to many analysts, this trend is the result of institutional capital participation in the ecosystem’s expansion.

Explosive growth across all metrics

The Aave protocol has shown strong growth in nearly all areas, including TVL, lending, and transaction processing revenue.

According to Token Terminal, the aforementioned metrics have increased approximately 3 to 4 times.

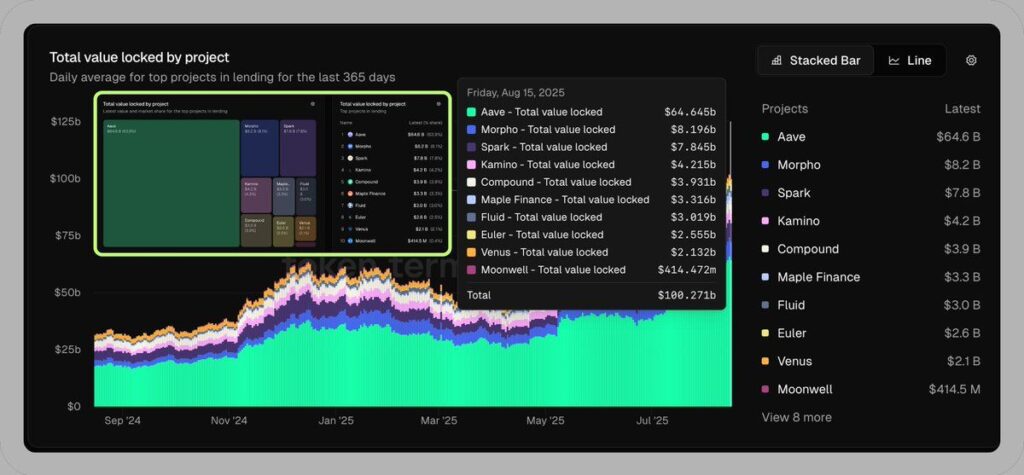

One of the striking examples has been the explosive growth of Aave in the lending market. Its total turnover has increased 3.13 times from $32 billion to $100.2 billion since last year.

64% of the DeFi lending market ($64.6 billion) is based on Aave, and experts believe we are only witnessing the first phase of investors transitioning to the new capital raising system.

Over the next 10 years, we will see a significant increase in deposit volumes. DeFi lending protocols, primarily Aave, will become some of the largest banks in the world.

Several growth factors can be identified in this sector.

1. Free access to capital (You can raise funds and give loans from anywhere in the world where there is internet access).

Attractive terms for lenders (Conditions for placing funds in protocols are more advantageous compared to commercial banks, where interest rates range from 1 to 3% per annum).

Funds can be raised 24/7 and without the paperwork required in the banking sector.

The possibility of using cryptocurrency, tokenized assets, including NFTs, as collateral.

Creating a global infrastructure (Hedge funds, banks, corporations, sovereign and pension funds, as well as insurance companies, non-profit organizations, universities, and even some governments have started to enter the DeFi lending market).

Although Aave dominates the market, any potential borrower has the right to consider the lending conditions offered by other protocols.

Against the backdrop of competition, ecosystems will soften policies to attract as many users as possible.

Growth of TVL – an indicator of institutional interest.

As of August 20, the value of digital assets locked in the Aave protocol was approximately $47 billion. At the beginning of last year, this amount was only about $8 billion.

The growth of TVL reflects the increasing institutional interest in decentralized lending projects.

Investors are attracted not only by favorable financial conditions and a more flexible mechanism for providing funds but also by the transparent execution of smart contracts. The lender and borrower can track the terms and movement of capital in real time.

Aave accounts for about 80% of all outstanding debts on the Ethereum network. The number of unique borrowers on the platform has already exceeded 1000 users. They actively use various forms of borrowing funds. The protocol is growing, including through the expansion of large capital presence.

In recent years, institutions have not only started to closely observe DeFi projects but have also begun testing their capabilities. We are witnessing a qualitative transition to a new global financial infrastructure. Cryptocurrency exchanges are an integral part of it.

If initially the DeFi industry represented a predominantly speculative ecosystem, now it is a new form of relationships among investors interested in establishing common rules to protect their interests.

How much can DeFi lending on Aave grow?

A borrower who has attracted funds from the DeFi market can even use them to buy shares of giants like Apple. However, for this, one must go through the KYC procedure with address verification.

Then you need to choose a broker who will convert your tokens into US dollars. The conversion fee will be approximately 0.5%-2% + a brokerage fee of 0.1%-0.5%.

Aave lends funds on both short and long terms at rates of 4-6% per annum. The main advantage is the fact that interest rates will be the same for everyone. That is, it doesn’t matter in which country you reside for the lender.

Currently, the total market capitalization of the ten largest corporations in the United States exceeds $23 trillion.

If at least 10% of that capital moves to blockchain within the next five years, the DeFi lending market will reach $2.3 trillion. Provided that at least 10% of those funds go to the Aave protocol, its turnover will grow to $230 billion.

However, many observers believe that lending on Aave will be significantly higher by 2030, reaching $500-700 billion.

The protocol’s liquidity is supported by the project’s own funds. The reserves have added over $270 million, which places Aave on the list of the largest and most reliable ecosystems.

The base token of the protocol – AAVE is trading at $270, the market capitalization of the digital currency is $4.266 billion (according to CoinGecko). In May 2021, the coin reached an all-time high of $667.69, whereas in November 2020 it was trading at $26.02.

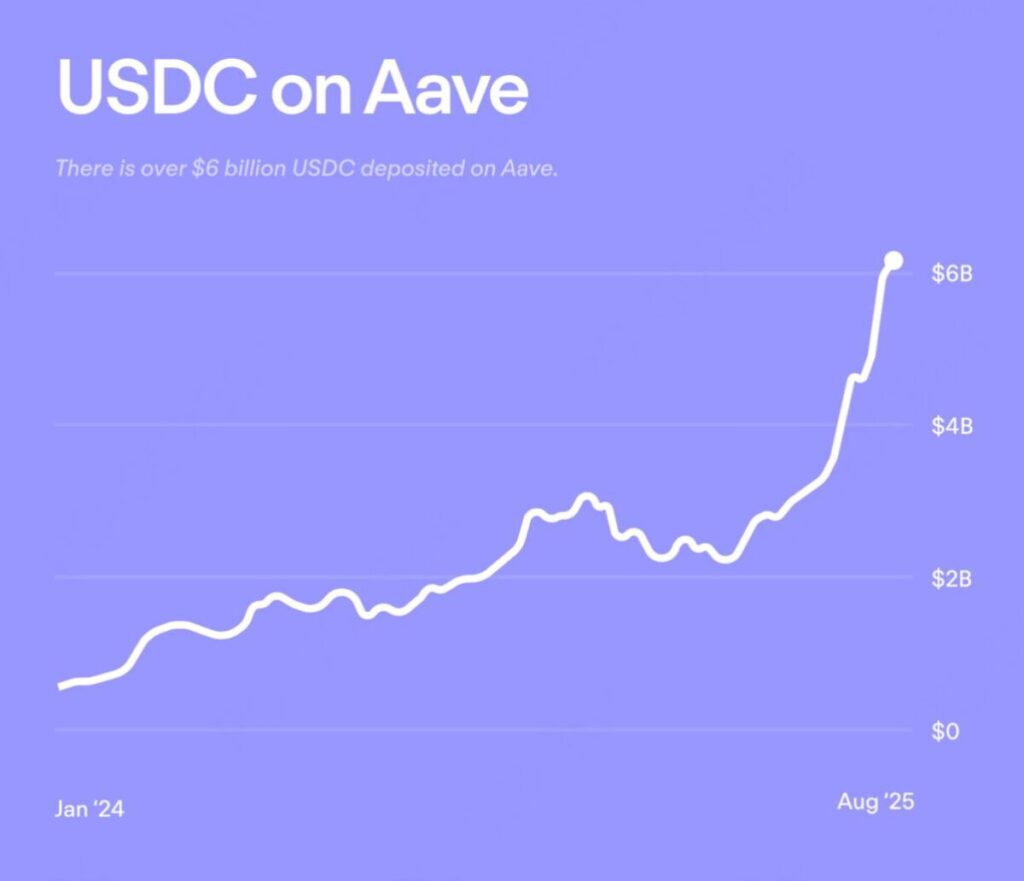

The protocol’s liquidity is also supported by a large volume of USDC stablecoins worth over $6 billion, analysts note.

Large capital is only testing the possibilities of the decentralized finance market. But if this sector is legalized in the USA, Wall Street will gain another channel for managing financial markets.

sources – Aave, CoinGecko, The Block, DeFiLlama, Token Terminal, X

Join MEXC and Get up to $10,000 Bonus!