Key Messages about the AMA recap to share

TL;DR:

- USD1 is a USD-pegged stablecoin developed by World Liberty Financial, fully backed by short-term U.S. Treasuries and cash. Custody is handled by BitGo, ensuring asset security at an institutional standard.

- Unlike earlier stablecoins, USD1 is designed with a compliance-first architecture, offering transparent reserves, no fees for minting or redemption, and plans for regular third-party audits.

- MEXC supported the launch with zero trading fees for the USD1/USDT pair and waived withdrawal fees, boosting accessibility for users across 170+ countries.

- USD1 has already reached a $2 billion market cap and played a central role in a landmark $2 billion transaction between MGX and Binance, reinforcing its credibility.

- The stablecoin is currently deployed on Ethereum and BNB Chain, with TRON (TRC-20) next in line. Multi-chain expansion is part of the broader strategy to maximize liquidity and user reach.

- The project is backed by investors, including Justin Sun. Airdrops to WLFI holders are under consideration to test on-chain distribution and reward early supporters.

- Prior to listing, MEXC conducted full legal, custodial, and compliance reviews to ensure USD1 meets the platform’s listing standards and regulatory expectations.

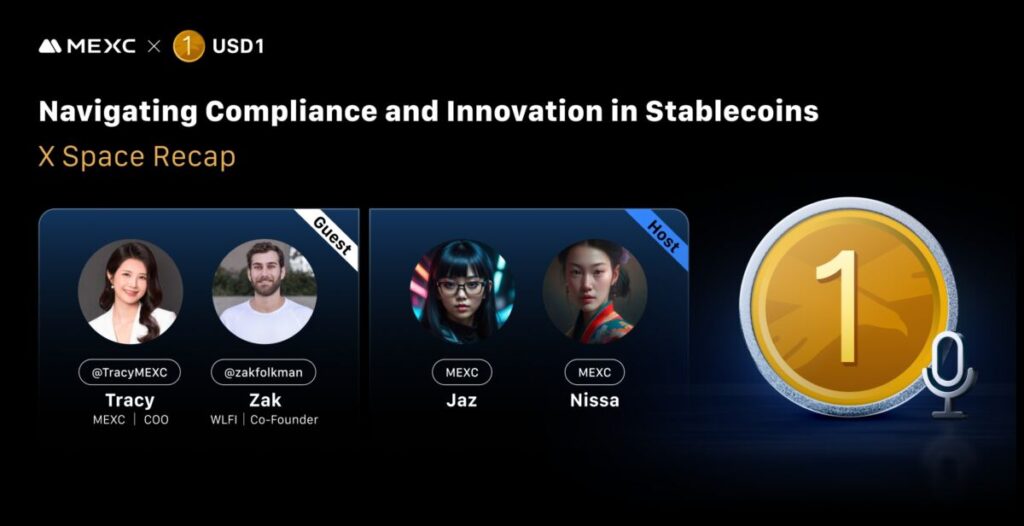

On May 14, MEXC held an AMA with COO Tracy Jin and Zak, Co-founder of World Liberty Financial (WLFI), in MEXC X Space.

Key Takeaways

USD1‘s Launch Motivation and Structural Design

Nissa: Could you give us a brief introduction to USD1? What motivated you and your team to launch a new USD-pegged stablecoin in such a competitive market?

Zak: USD1 is World Liberty Financial’s digital dollar stablecoin offering. We launched it because we saw a clear gap in the market for a truly institutional-grade stablecoin—one that is 100% backed by short-term U.S. Treasuries and cash. While the stablecoin space is crowded, we believe USD1 is different. We charge no fees for minting or redemption, which is a significant benefit for users. For custody and security, we’ve partnered with BitGo, the largest independent qualified custodian in the digital asset space. USD1 is currently live on Ethereum and Binance Smart Chain, with additional chains to follow. But this is just the starting point—we’re building an entire suite of DeFi products to bridge traditional finance and digital assets.

Nissa: What core problem does USD1 aim to solve in the current stablecoin landscape dominated by USDT, USDC, and others?

Zak: The core issue we’re addressing is the lack of stablecoins built for true institutional adoption. Most existing stablecoins were originally developed for crypto-native users, with institutional requirements considered only later. USD1 flips that model. We prioritize what institutional and sovereign entities expect from the beginning: robust reserve management, complete transparency through regular third-party audits, and a governance structure that balances innovation with long-term stability.

Partnership with MEXC

Jaz: What does this partnership with MEXC mean for USD1?

Zak: Listing on an exchange like MEXC, which serves over 40 million users across 170+ countries, dramatically improves USD1’s accessibility and trading activity. It allows us to enter a major trading ecosystem that supports secure, on-chain transactions.

I’m especially impressed by MEXC’s listing support—offering zero trading fees for the USD1/USDT pair and zero withdrawal fees for USD1. That kind of infrastructure-level support is extremely valuable for a growing stablecoin like ours. With USD1 recently crossing the $2 billion market cap milestone, this collaboration helps establish the trading foundation for our continued expansion.

Jaz: From MEXC’s side, what made you decide to partner with USD1 at this stage of its development?

Tracy: At MEXC, we consistently look for projects that combine strong fundamentals with long-term vision. USD1 stood out because of its transparency, 1:1 backing with high-quality reserves, and its strategic focus on stability rather than yield.

What impressed us most was the team’s commitment to compliance, institutional-grade infrastructure, and a rapidly growing ecosystem. These factors align closely with MEXC’s objective to provide users with secure and diversified stablecoin options.

Jaz: MEXC has recently launched several stablecoin-focused campaigns. Does this cooperation indicate deeper investment into stablecoin infrastructure?

Tracy: Yes, absolutely. Stablecoins are critical to the crypto economy—not just for trading, but for cross-border payments, DeFi protocols, and settlement use cases. MEXC has always supported innovation in this space. Our collaboration with USD1 marks the beginning of deeper involvement in stablecoin infrastructure, both on-chain and off-chain. We believe that the next wave of growth will come from stablecoins offering better transparency and security — and MEXC is committed to helping lead that transition.

Reserve and Transparency

Nissa: USD1 maintains a strict 1-to-1 dollar peg backed by U.S. Treasuries, cash, and equivalents, with BitGo as custodian. Could you elaborate on the asset backing model and how transparency is ensured?

Zak: USD1 was designed with a conservative reserve model: 100% backed by short-term U.S. Treasuries and cash equivalents. This structure is intended to meet the expectations of sovereign entities, global financial institutions, and regulated platforms. BitGo acts as our independent qualified custodian, offering institutional-grade security. Transparency is ensured by leveraging world-class custody and compliance infrastructure, along with regular third-party audits. We are committed to releasing detailed audit reports on a consistent basis.

Nissa: Why did you choose to prioritize capital preservation over higher returns?

Zak: It was a deliberate decision. Capital preservation meets the risk tolerance of large institutions and aligns with the long-term vision for USD1 as a scalable, trustworthy stablecoin. We are building for global payments and financial infrastructure—not short-term yield farming. This approach is key to supporting both institutional and retail users who demand safety and compliance.

Multi-Chain Deployment and Adoption

Nissa: USD1 is currently deployed on Ethereum and BNB Chain, with expansion to TRON planned. What’s the strategy behind this multi-chain deployment?

Zak: We chose Ethereum and BNB Chain as our starting points due to their maturity and large user bases. The decision to expand to TRON allows us to tap into its efficient, low-cost infrastructure, which is particularly strong in Asia. The goal is to maximize accessibility and cross-chain liquidity, and we’ll continue adding new chains based on user demand and ecosystem growth.

Jaz: USD1 already sees over $120 million in daily volume and recently supported a $2 billion transaction. What’s driving this adoption?

Zak: A key driver was the historic $2 billion transaction between MGX and Binance, the largest stablecoin and crypto equity deal to date. Our stablecoin’s transparent backing and institutional-grade structure made it possible. Broad deployment across major chains also helps maximize liquidity and usage.

Community Engagement and WLFI Incentives

Jaz: There’s talk of airdrops to WLFI holders and future rewards for early supporters. What incentives can users expect?

Zak: We’re considering a small on-chain airdrop to eligible WLFI holders. This would serve both as a system test and a way to thank early adopters. Community participation is essential to our long-term roadmap, particularly in governance. WLFI will serve as the governance token as we roll out our full DeFi platform, and its utility will grow over time.

Regional Demand and Strategic Alignment

Jaz: How does MEXC see the current market demand and user behavior around stablecoins like USD1, especially in the Asia-Pacific region?

Tracy: In Asia-Pacific, especially among retail users and institutional clients in Southeast Asia, we’ve seen strong demand for stablecoins that combine security and liquidity. However, users are becoming more selective — they care deeply about transparency, auditability, and regulatory alignment. USD1’s approach checks all those boxes. The timing is right, and we believe the partnership will benefit our users in the region.

Addressing Public Concerns and Regulatory Compliance

Nissa: Your team includes major investors like Justin Sun. How has he influenced the project’s direction?

Zak: Justin Sun invested $75 million in WLFI, making him our largest known investor and advisor. His involvement has accelerated our fundraising and provided strategic insights, particularly in navigating both Western and Asian markets.

Nissa: USD1 has drawn attention over political affiliations. How do you respond to these concerns?

Zak: World Liberty Financial is not a political organization. Any suggestion otherwise is incorrect. We’ve enforced rigorous KYC and AML checks on all token sale participants to ensure transparency and legal compliance. Our focus is building reliable financial infrastructure—not politics.

Nissa: With growing global regulatory scrutiny, how does USD1 ensure compliance?

Zak: We are proactively building a world-class compliance team, staying updated on evolving regulations, and working with third-party auditors to maintain transparency.

Tracy: At MEXC, compliance is core to our listing decisions. We conducted full due diligence before listing USD1—including legal reviews, KYC checks, and regulatory risk assessments. USD1’s transparency-first approach aligns with our internal standards. Our responsibility is to offer users access to innovative products while ensuring strong compliance oversight.

Conclusion:

MEXC remains committed to supporting stablecoin innovation rooted in transparency, security, and long-term utility. USD1 was listed following a full scope of due diligence covering its legal structure, reserve composition, custodial arrangements, and audit readiness. Its institutional-first design and growing adoption reflect strong alignment with MEXC’s listing standards and user expectations. We look forward to supporting its continued growth through future campaigns, listings, and ecosystem development.

Join MEXC and Get up to $10,000 Bonus!