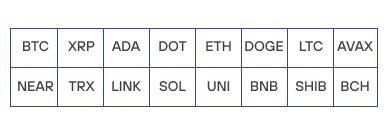

Good liquidity ensures smoother buying and selling with minimal slippage. This article provides an in-depth analysis of the spot and futures market depth from across five major centralized exchanges: Binance, OKX, Bitget, Bybit, and MEXC. Using data from CoinMarketCap, we analyzed the top 30 tokens by market cap, excluding stablecoins, and selected 16 token pairs available on all five exchanges, as shown in Figure 1 (note: here, “futures” refers to USDT-margined perpetual futures, while “spot” refers to USDT trading pairs). By utilizing the exchanges’ API interfaces, 0.05% depth data was collected every 20 minutes over a week (October 1 to October 7, 2024), which formed the basis of our comparative analysis.

Futures Market: Who Leads in Market Depth?

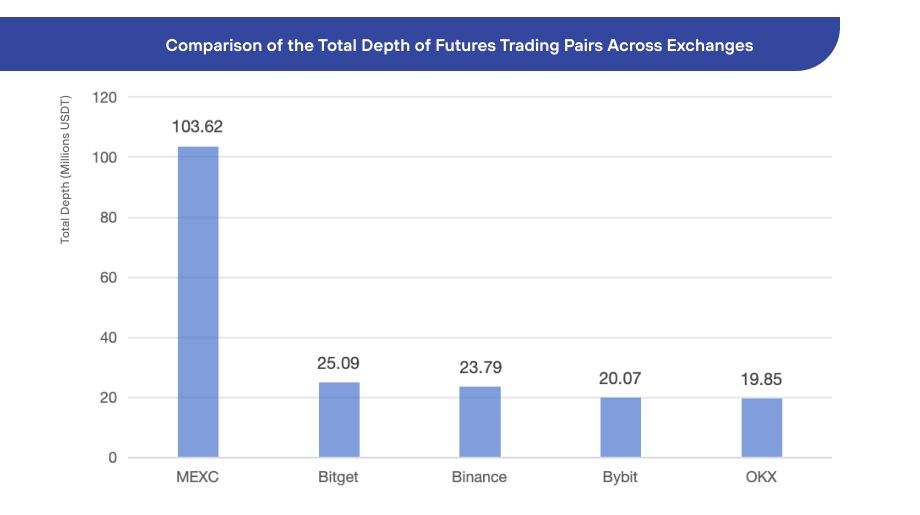

Figure 2 shows the total 0.05% depth of 16 futures trading pairs across multiple exchanges. MEXC leads with a total depth of 103.62 million USDT, 4 times that of the second place exchange. Meanwhile, Bitget ranks second with 25.09 million USDT, followed by Binance and Bybit.

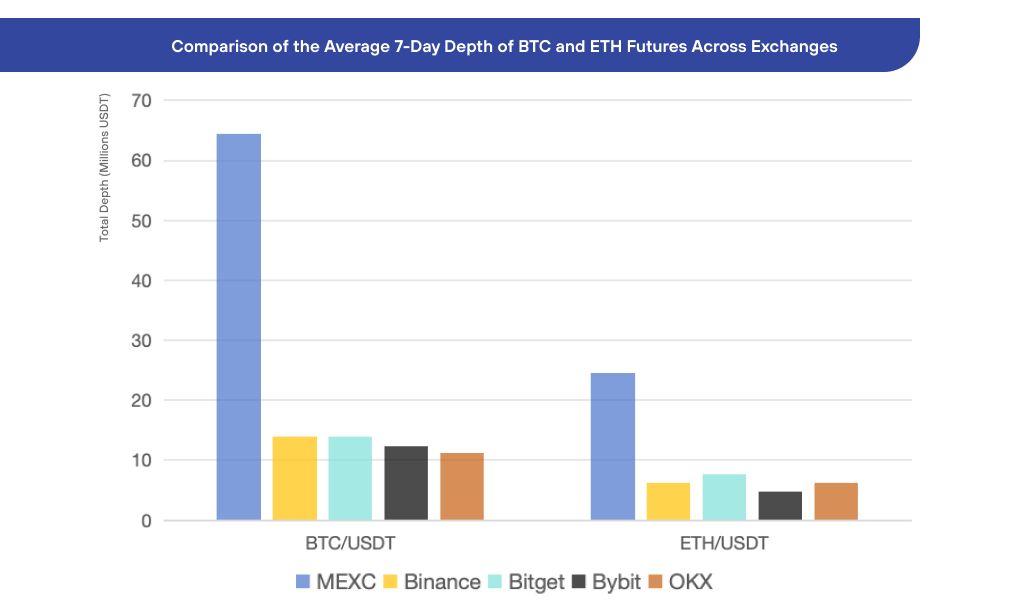

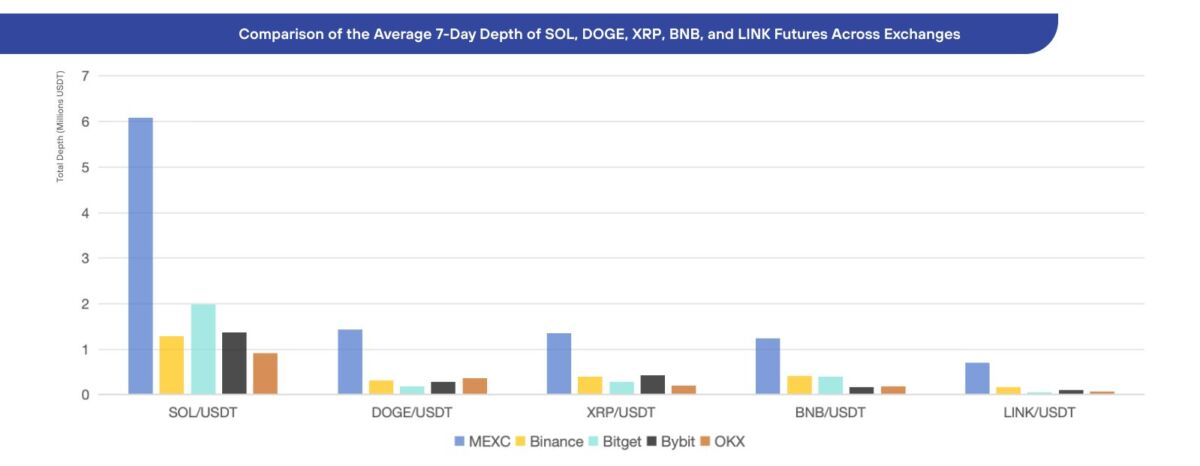

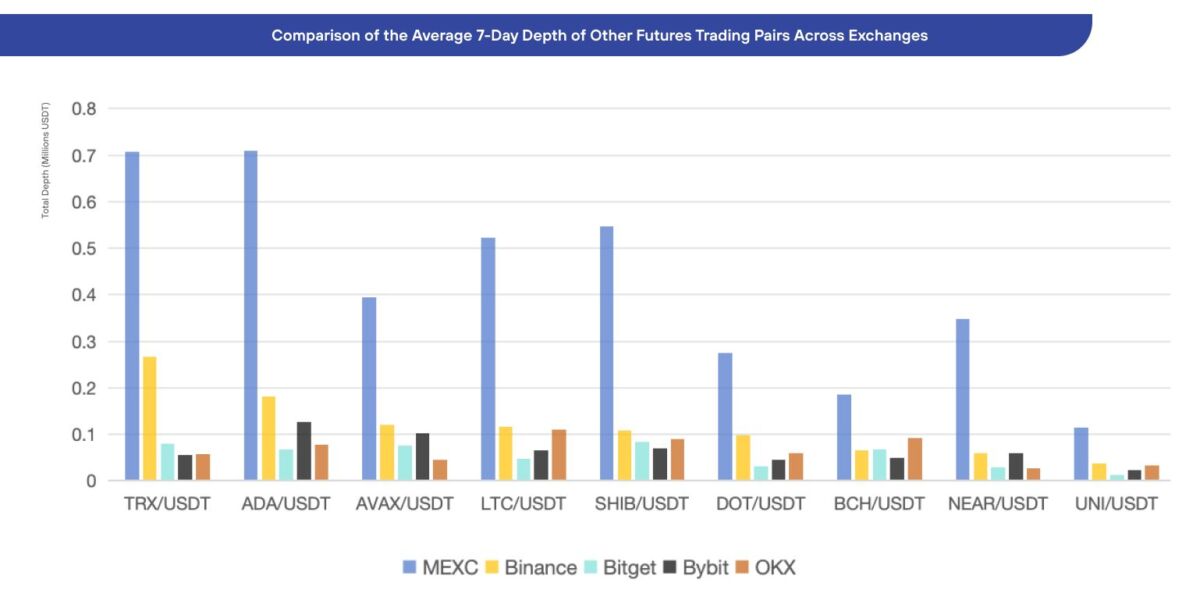

Figure 3-1 illustrates the 7-day average depth of BTC and ETH futures on each exchange. MEXC’s futures trading liquidity significantly exceeds that of Binance, the second-place competitor. While Binance performs marginally better than Bitget, Bybit, and OKX in BTC futures, it falls short in ETH futures. As demonstrated in Figures 3-2 and 3-3, MEXC consistently leads in trading pair depth across all pairs, with Binance and Bitget following behind.

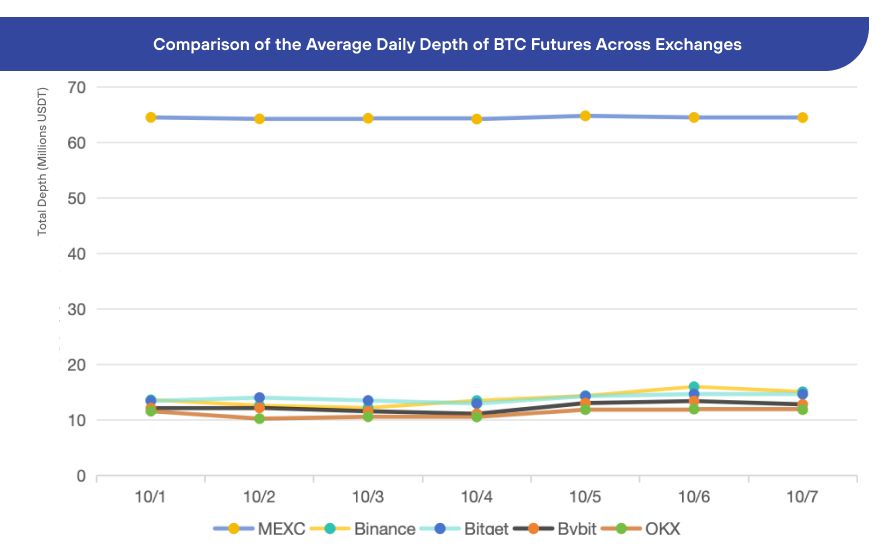

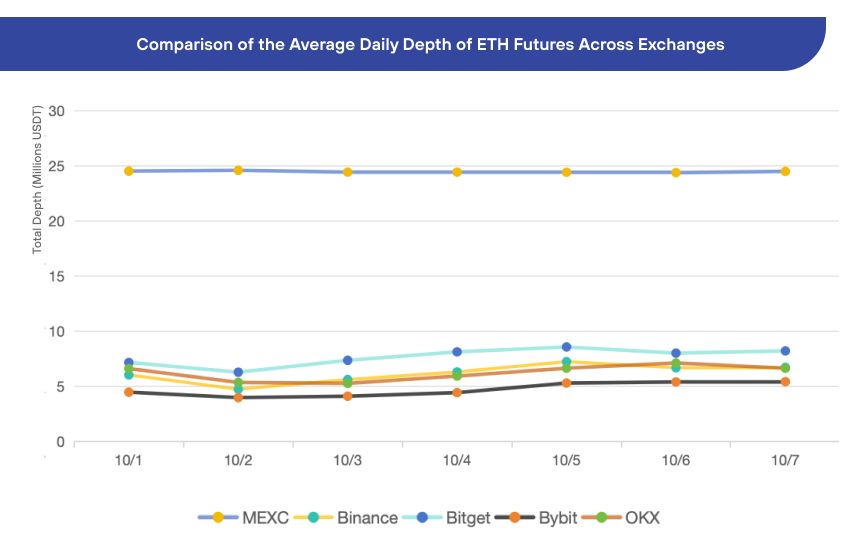

Figure 4 charts the daily liquidity trends of BTC and ETH futures to assess the robustness and consistency of liquidity across exchanges. The data reveals that MEXC leads in market depth and shows strong stability, outperforming competitors in both BTC and ETH futures. While other exchanges show more competition in BTC futures, Bitget ranks second to MEXC in terms of ETH futures stability.

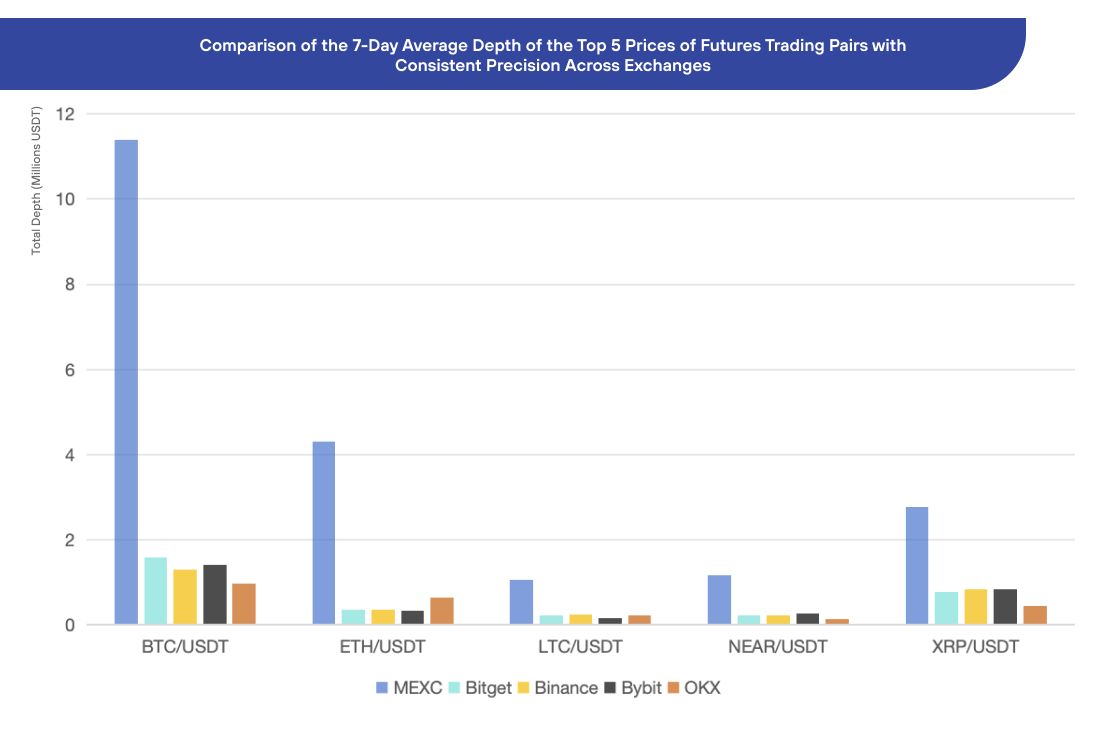

Additionally, we compiled the total depth of the top five bid and ask prices for trading pairs with consistent futures price precision across the five major exchanges. This data provides investors with a different perspective on the market depth of each platform. Figure 5 shows that the top five prices for BTC futures on MEXC, Bitget, Binance, and Bybit all exceed 1 million USDT, significantly ahead of other trading pairs. MEXC’s top five prices across these trading pairs far surpasses that of other platforms in terms of depth.

Spot Market: Who Takes the Lead?

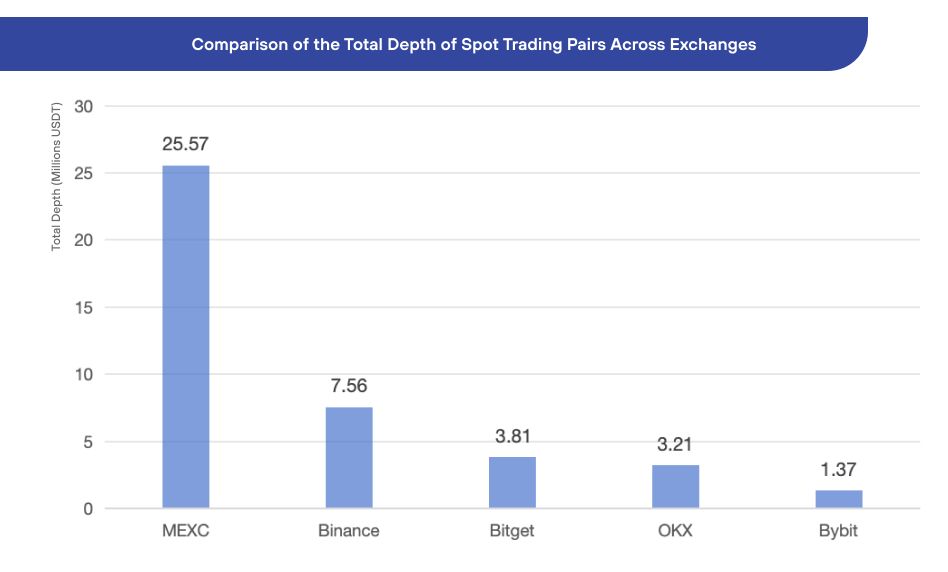

Using the same approach, we analyzed spot market depth for 16 trading pairs across the five exchanges. Figure 6 shows the 0.05% total depth for the 16 trading pairs. MEXC leads with a total depth exceeding 25 million USDT, 3.38 times that of the second place. Binance holds a solid second place, and Bitget surpasses OKX, securing third place.

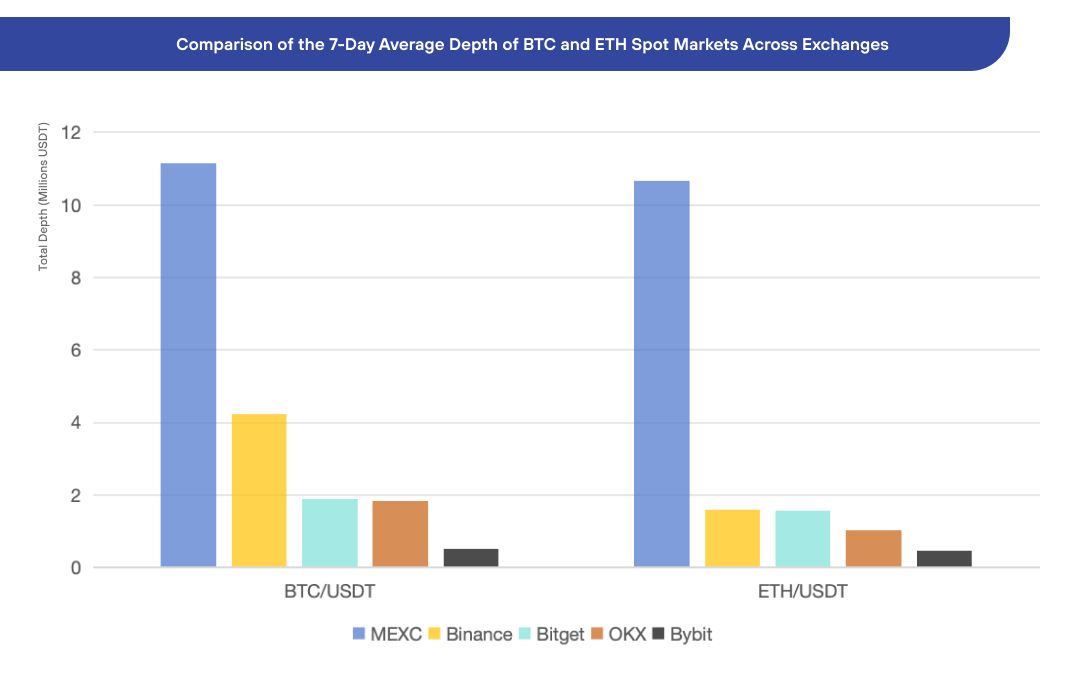

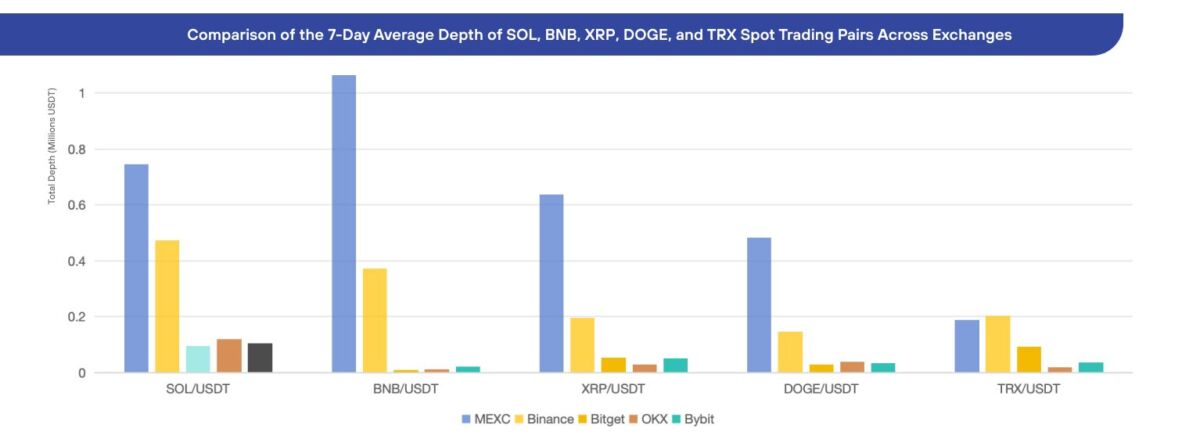

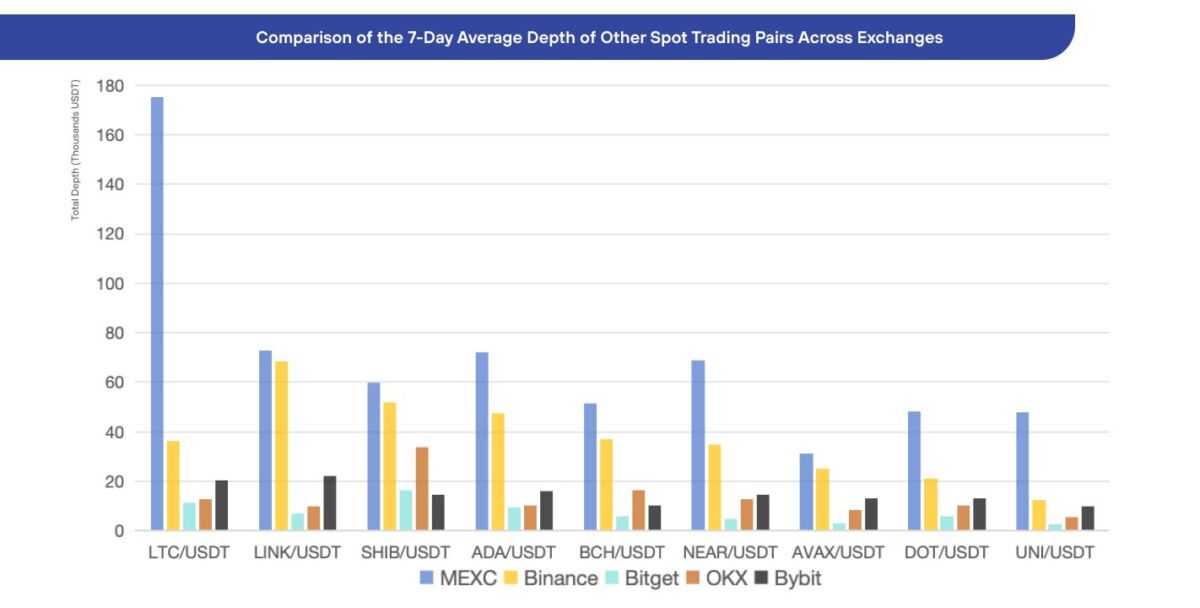

Figures 7-1, 7-2, and 7-3 display the 7-day average depth for different pairs. MEXC and Binance dominate, taking the top two spots across all pairs. Binance slightly edges out MEXC for first place in the TRX spot market.

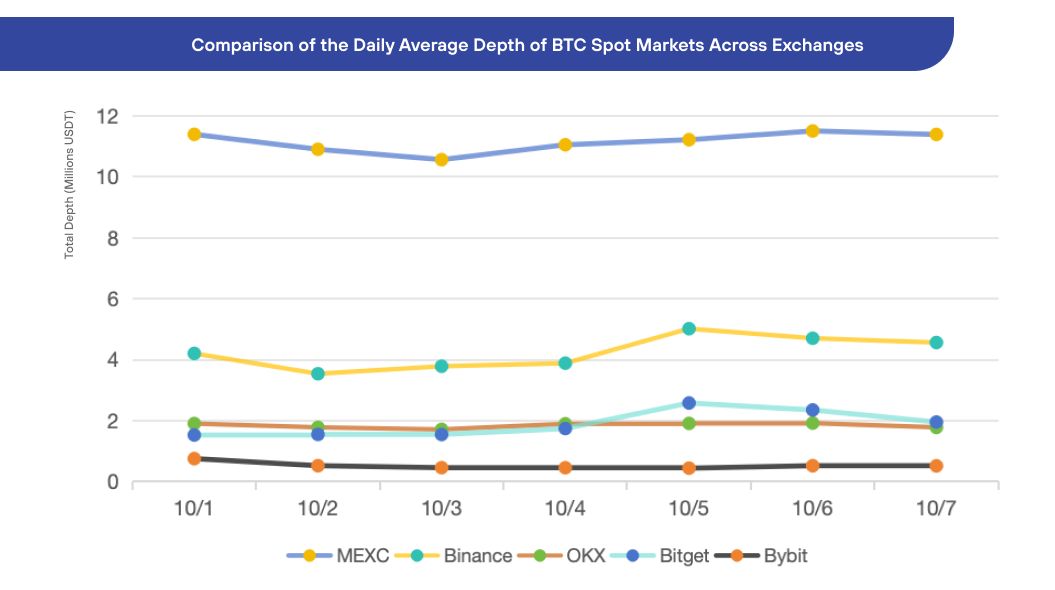

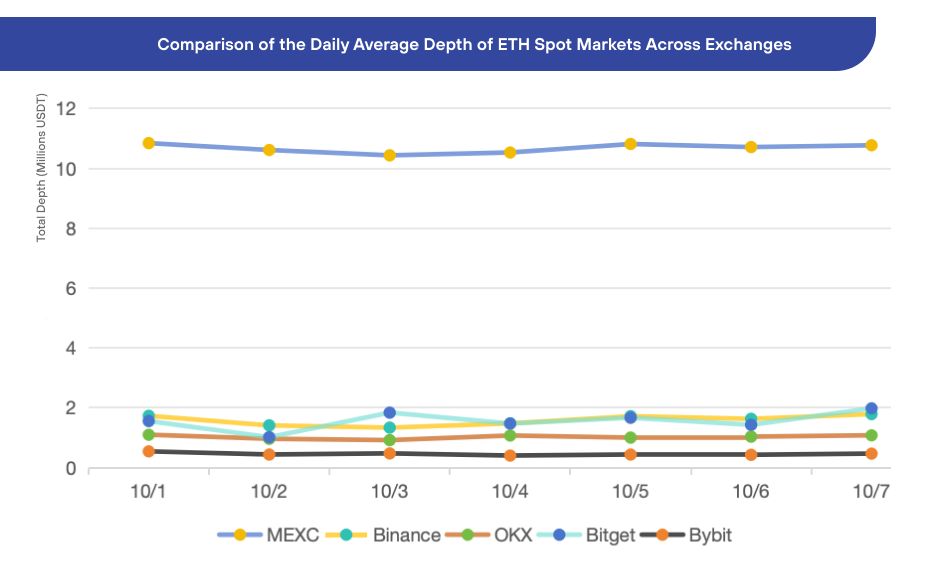

Figure 8 charts the daily liquidity trends of BTC and ETH spot pairs across different platforms. The trends show that MEXC’s daily depth remains highly stable and leads consistently, with Binance in second place, occasionally intersecting with Bitget for ETH.

Undisputed Liquidity Leader

Through the above comparison, it was found that MEXC consistently ranks first in terms of total market depth and individual trading pair depth, both in spot and futures markets, with its depth being several times that of the second place. In fact, MEXC’s total futures depth is greater than the combined total of the other five exchanges, making MEXC the undisputed liquidity leader in the cryptocurrency market. Binance, as an established exchange, holds a steady second place in both spot and futures depth.

Join MEXC and Get up to $10,000 Bonus!

Sign Up