Key Insights

- Range trading allows investors to profit by buying low and selling high within a defined trading range.

- Grid trading bots automate trading, ensuring continuous profit opportunities in Bitcoin’s stagnant market.

- Decentralized finance platforms offer passive income through interest on Bitcoin holdings, even during market stagnation.

Bitcoin (BTC) holds significant challenges, especially getting frustrated when the prices cease to move in the market as it results in low volatility. Still, speaking of adverse effects, these periods of stagnation can be beneficial for technical traders, while creating problems for buy-and-hold investors on the stock market.

Understanding Bitcoin Price Stagnation

In the context of the current discussion, it is important to note stagnant prices mean that the value of bitcoin does not change for a significant period of time. This is often attributed to either side’s dominance by buyers or sellers or lack of information asymmetry in the market. Unlike the previous phase, no move is made, this phase may warrant a large market adjustment, including consolidation.

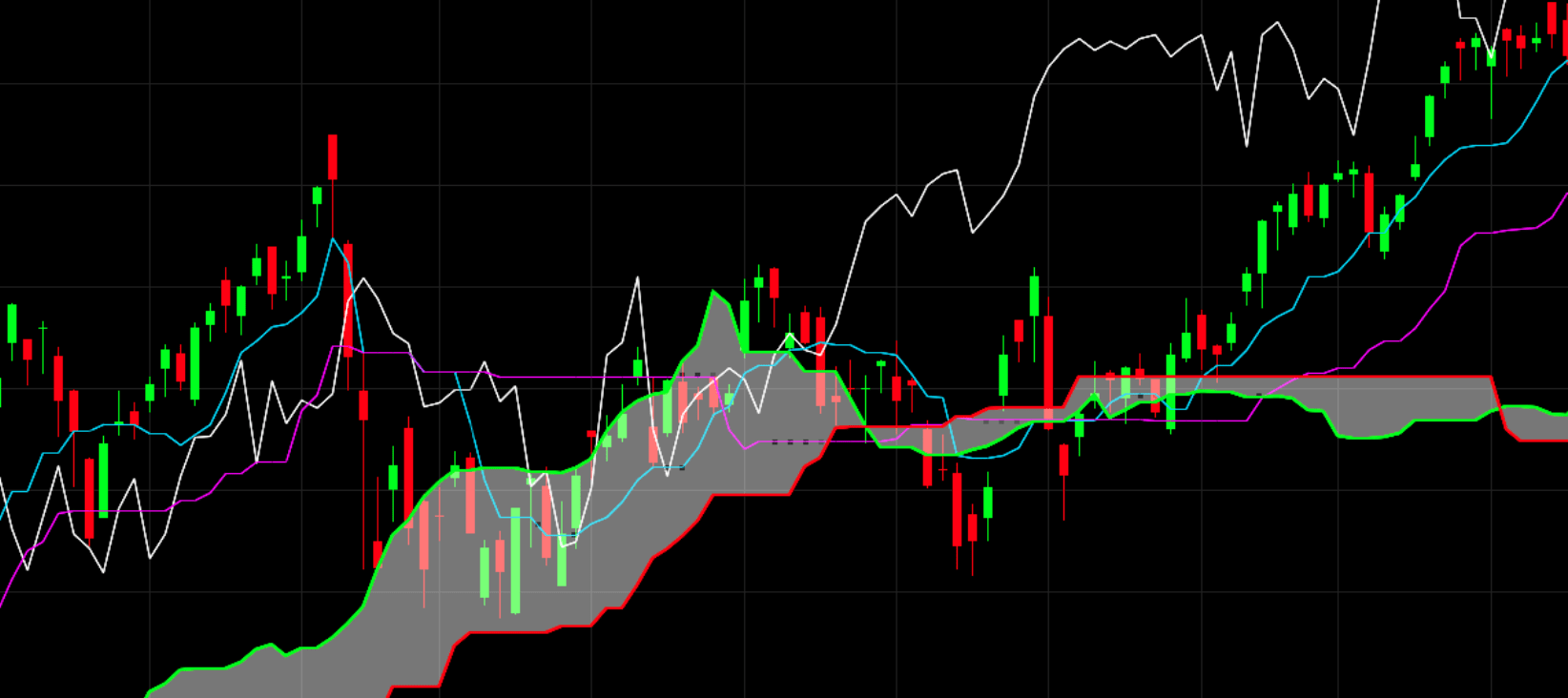

Thus, range trading is quite practical for making profits during Bitcoin’s trading in the sideways pattern. Traders always use the bid and ask price wherein they purchase at a low price and sell at a higher price within a given range of prices. The use of trend lines can be used to identify the range to help in making key trades and at the same time minimize losses using stop-loss orders.

Leveraging Grid Trading Bots

Grid trading bots offer an automatic way of making profits within stagnant markets. These bots act in the market unemotional and put in buy and sell orders at a specified range. It enables the trader to trade as often as possible within the range exploiting every opportunity within it.

DeFi platforms provide a way whereby those who own BITCOIN can earn interest through yield farming, and staking, among other techniques. By earning interests of between 3% and 8% annually, investors earn the money they need to feed themselves and their families for free through a passive income especially when the market is subdued.

Exploring Bitcoin Lending

Crypto lending is quickly becoming one of the most popular methods of earning passive income. Firms such as Compound and Aave offer their owners an opportunity to lend out their Bitcoin to earn interest and meet liquidity across different blockchains. This strategy helps to spread earnings and to keep dependence on Bitcoin at the same time.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!