The Bitcoin network has achieved a new milestone, with its seven-day moving average hash rate hitting an unprecedented 693.84 exahashes per second (EH/s) on Sunday, according to data from The Block.

This surge in computational power comes as the cryptocurrency’s price holds steady around the $57,000 mark.

Mining Difficulty Adjustment

Concurrent with the hash rate increase, Bitcoin’s mining difficulty saw a 3.6% upward adjustment, reaching an all-time high of 92.67 trillion at block height 860,832. This marks a significant leap from the previous peak of 90.67 trillion set in late July.

The difficulty adjustment, which occurs approximately every two weeks, ensures that new blocks are mined at a consistent average rate of one every 10 minutes, regardless of fluctuations in the network’s total hash power.

Despite the robustness of the network’s fundamentals, market sentiment remains cautious.

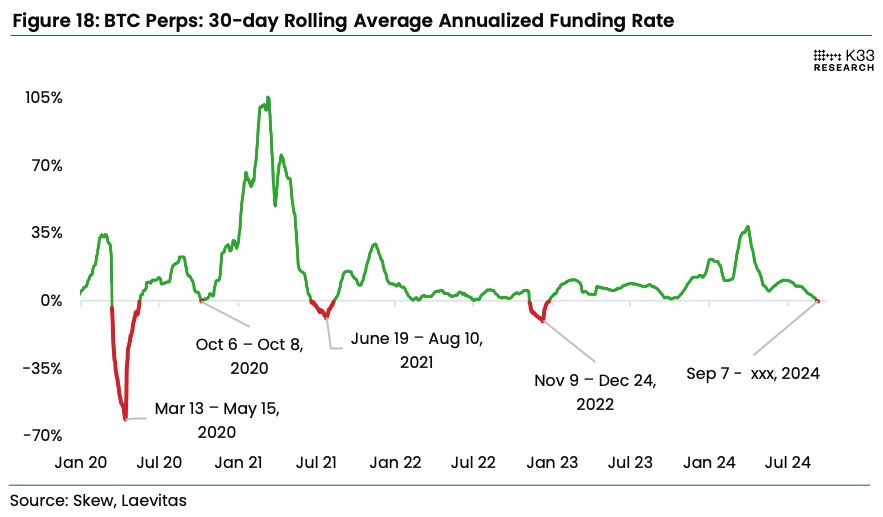

K33 Research analysts Vetle Lunde and David Zimmerman report that perpetual swap funding rates have turned negative, indicating a prevailing bearish outlook among traders.

The 30-day average funding rate has reached levels not seen since March 2023, marking only the seventh occurrence of negative rates since 2018.

Historically, such periods of negative funding have often preceded market bottoms. K33’s data shows that following these events, Bitcoin has experienced an average 90-day return of 79%, with median returns of 55%.

Short-Term vs. Long-Term Holder Dynamics

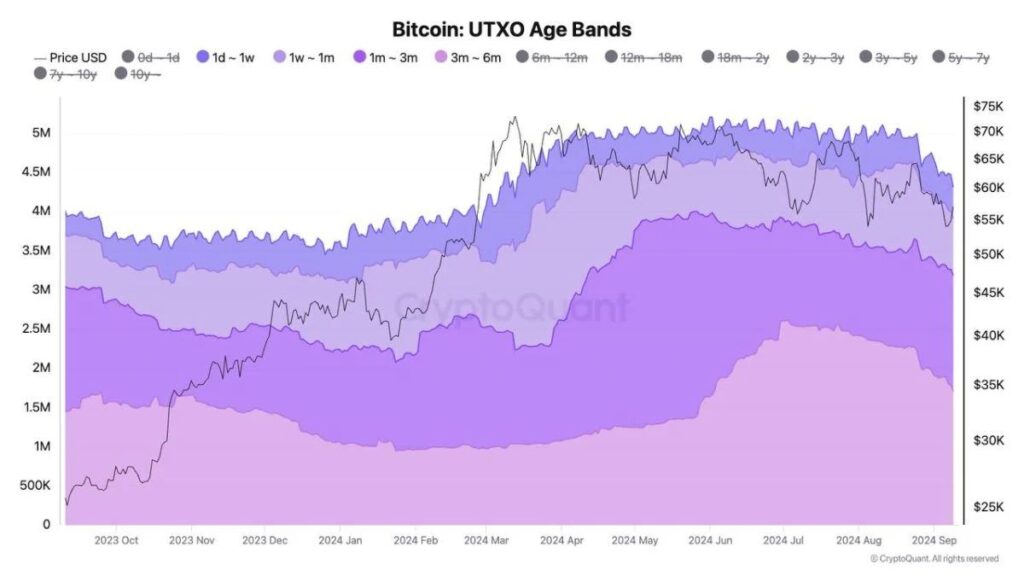

In related news, CryptoQuant’s analysis reveals a notable shift in Bitcoin ownership patterns. Short-term holders, defined as those possessing coins for less than 155 days, have been reducing their positions since late May.

This trend accelerated throughout July and August, potentially signaling weakening demand among newer market participants.

Conversely, long-term holders appear to be accumulating Bitcoin, as evidenced by an increase in their net positions. This transfer of assets from “weak hands” to “strong hands” could contribute to price stabilization and set the stage for potential future appreciation.

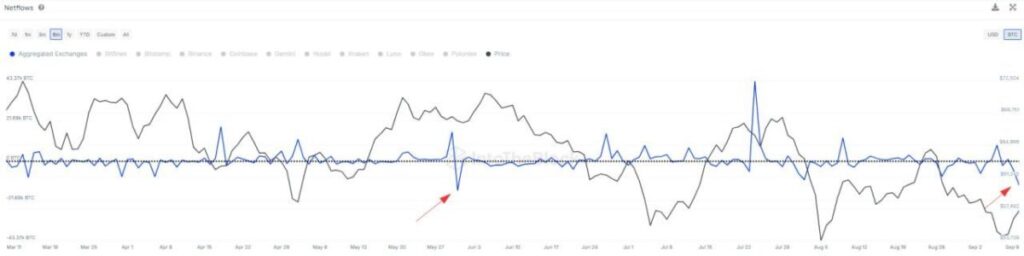

On-chain metrics offer additional context to the current market state. The largest net Bitcoin outflow from exchanges since May occurred on Tuesday, totaling $750 million.

This substantial movement of assets off exchanges to private wallets often indicates significant accumulation by holders, potentially reducing selling pressure in the short term.

Mining Sector Health

Despite the challenges posed by April’s halving event, which saw block rewards decrease from 6.25 BTC to 3.125 BTC, the mining sector shows signs of resilience.

After an initial decline, the network’s hash rate has rebounded strongly, suggesting that miners are adapting to the new reward structure and potentially deploying more efficient hardware.

However, the hash price—a measure of miner revenue per unit of computational power—has reached all-time lows of $0.04 this month. This metric underscores the ongoing pressure on mining profitability, even as the overall network security continues to strengthen.

Looking Ahead

As the market navigates this complex landscape of technical strength and sentiment-driven caution, several factors could influence Bitcoin’s trajectory in the coming months.

These include potential shifts in Federal Reserve policy, the upcoming U.S. election, anticipated FTX bankruptcy repayments, and the delayed effects of the recent halving event.

While short-term price action remains uncertain, the underlying robustness of the Bitcoin network and continued accumulation by long-term holders suggest a foundation for potential future growth.

BTC Technical Outlook

Following a 4-day rebound from the $52,550 low, Bitcoin faced notable resistance along the $57,950 mark, which led to a sharp dip to $55,550 on September 11. However, this dip was short-lived as the benchmark cryptocurrency returned to the $57,000 axis.

Moving forward, BTC could stave off further declines below the $55,000 round figure has traders target the upper-$60,000 area.

BTC Statistics Data

BTC Current Price: $57,350

Market Cap: $1.1T

BTC Circulating Supply: 19.7M

BTC Total Supply: 21M

Market Ranking: #1

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up-1-211x150.jpg)