Liquidation is the event that happens when the margin reaches the maintenance margin requirement, all your futures position will be liquidated and lose the maintenance margin. Liquidation will be triggered when the fair price reaches the maintenance margin.

Feature of Liquidation

Liquidation is based on the fair price. MEXC uses fair price marking to avoid liquidation due to market manipulation or illiquidity.

Larger position sizes will need higher margin levels under the requirement of risk limits. This gives the liquidation system a more usable margin to effectively close large positions that would otherwise be difficult to safely close. Larger positions are incrementally liquidated if possible.

If liquidation is triggered, MEXC will cancel any open orders on the current futures in an attempt to free up margin and maintain the position. Orders on other futures will still remain open. MEXC employs a partial liquidation process involving automatic reduction of maintenance margin in an attempt to avoid a full liquidation of a trader’s position.

The Calculation of liquidation price

We will try to use the example to calculate the liquidation price (Commission excluded)

Liquidation condition: Position Margin + unrealized P&L < Maintenance Margin

- Long: Liquidation Price = (Maintenance Margin – Position Margin + Averaging opening price * position size) / (position size)

- Short: Liquidation Price = (Averaging opening price * position size -Maintenance Margin + Position Margin) / (position size)

Suppose you buy a 0.1 BTC position of BTCUSDT futures at 50,000 USDT, the initial leverage is 25x.

Maintenance Margin = 50000*0.1×0.4%= 20USDT

Position Margin = 50000*0.1/25=200USDT;

Liquidation Price for the Long position =(200-29+50000×0.01)/(0.1)= 51,800 USDT

Liquidation price under different position mode

Under isolated margin mode, the liquidation price will be calculated as the above formula. The margin is just the isolated margin. You may manually add on margin to reduce risk.

Under cross margin mode, the margin will be all available balance. But it should be noted, the loss of wallet balance cannot be the margin of other positions in the cross margin.

Since the gap between the liquidation price and the opening price will be larger after manually adding on more, you may use this way to reduce the risk when the liquidation risk is high.

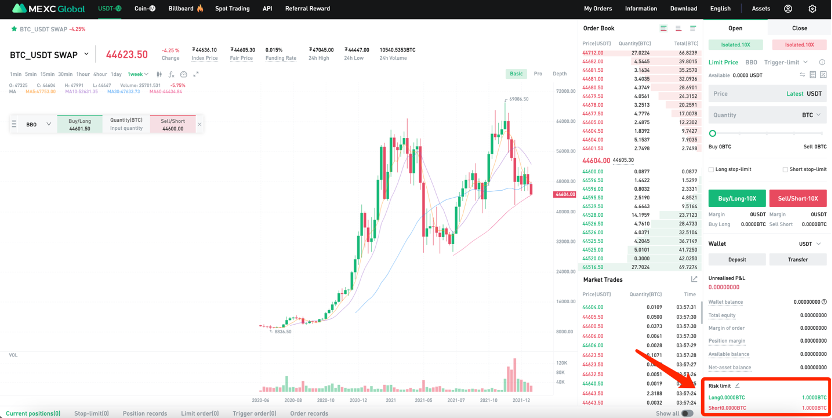

Risk Limit

MEXC Futures will give a risk limit on each account. In this way, the liquidation of larger positions will happen less. With the increase of position, the required initial margin and maintenance margin will be higher. The margin rate will be increased or decreased with the change of risk limit.

Here, you can check and change your risk limit.

Summary

Please pay close attention to the liquidation price change when trading futures. You can add margins on time to avoid the unnecessary loss from liquidation.

Join MEXC and Get up to $10,000 Bonus!

Sign Up