The stablecoin infrastructure race just got interesting. Two purpose-built Layer 1 blockchains, Plasma and Stable ,are in development. Plasma was launched in September while the other Stable is still in development. Both have the same ambitious goal: becoming the dominant settlement layer for USDT transactions.

Both projects serve almost the sand function, but they’re taking notably different approaches. Plasma tends to compete for the existing USDT market, while Stable is exclusively focused on USDT, creating an interesting competitive dynamic in the emerging stablecoin blockchain space.

With stablecoins facilitating over $5 trillion in adjusted transaction volume last year, over 1/3 the volume of Visa and Mastercard, the infrastructure supporting these assets matters more than ever. Let’s break down how these two networks compare.

1.What Are Plasma and Stable?

1.1 Plasma: The Multi-Stablecoin Platform

Plasma is a Layer 1 blockchain designed specifically for global stablecoin payments, featuring zero-fee USDT transfers, support for custom gas tokens, and a native Bitcoin bridge.

Designed for stablecoins from the ground up, Plasma powers near-instant, fee-free payments with institutional-grade security. The network launched its mainnet on September 25, 2025, after raising $24 million from investors including Bitfinex.

1.2 Stable: The USDT-Only Chain

Stable is a purpose-built Layer 1 for USDT, designed to move stablecoins at scale. Stable quietly announced itself after a year in stealth development, positioning itself as USDT’s dedicated infrastructure layer.

The key philosophical difference: Plasma supports multiple stablecoins, while Stable focuses exclusively on USDT.

Plasma:

– Launch: September 2025 (Mainnet Live)

– Focus: Multi-stablecoin support

– Fees: Zero-fee USDT transfers

– Backing: Bitfinex + $24M raise

– Token: XPL (native token)

Stable:

– Launch: TBD( But started PR June 2025)

– Focus: USDT-exclusive

– Fees: Low-cost USDT optimized

– Backing: Tether-aligned

– Token: TBD

2.Key Technical Differences

2.1 Fee Structure

Plasma’s approach: Zero-fee USDT transfers with support for custom gas tokens. This means users can pay transaction fees with tokens other than the native XPL, including potentially USDT itself, a user-friendly feature for those who don’t want to hold multiple assets.

Stable’s approach: Designed to move stablecoins at scale with optimized, low-cost transactions specifically for USDT. While not explicitly marketed as “zero-fee,” the entire infrastructure is purpose-built for maximum cost efficiency.

Winner: Plasma has a clearer marketing message with “zero-fee” transfers, but actual cost differences will emerge with real-world usage patterns and network congestion.

2.2 Multi-Chain vs Single-Asset Focus

Plasma: Supports multiple stablecoins including USDT, USDC, and potentially others, making it a broader stablecoin payment infrastructure rather than a single-asset chain.

Stable: Exclusively focused on USDT, betting that the world’s largest stablecoin (currently 62% market share) deserves dedicated, optimized infrastructure.

This represents a fundamental strategic divergence:

– Plasma bets that users want optionality and flexibility across multiple stablecoins

– Stable bets that USDT’s dominance justifies single-asset specialization and optimization

Read also: USDT vs USDC: Market Share Comparison

2.3 Privacy Features

Plasma proposes Shielded Transactions, while Stable plans to support Confidential Transfers—both enhancing privacy protection capabilities while maintaining compliance.

Both networks recognize that institutional users require privacy features for competitive and operational reasons, while still maintaining regulatory compliance. This is a delicate balance that traditional transparent blockchains struggle to achieve.

3.Strategic Positioning

3.1 Plasma’s Market Approach

Plasma tends to compete for the existing USDT market, positioning itself as infrastructure for the broader stablecoin ecosystem. The strategy appears to be:

First: Attract existing stablecoin users with zero-fee transfers and superior user experience.

Second: Support multiple assets to capture diverse use cases—payments, remittances, DeFi, institutional settlement.

Third: Build network effects through broader adoption across different stablecoin communities.

The Bitfinex backing is strategically significant,it connects Plasma indirectly to the Tether ecosystem while maintaining independence to support competing stablecoins like USDC.

3.2 Stable’s Market Approach

Stable takes a more focused bet: USDT is the world’s most used digital asset and deserves its own dedicated chain. Their strategy seems to be:

First: Become the definitive, optimized infrastructure specifically for USDT transactions.

Second: Optimize every aspect of the chain exclusively for USDT use cases without compromise.

Third: Leverage deep Tether relationships for direct integration and institutional adoption.

Stable has launched “Enterprise Blockspace”, suggesting a primary focus on institutional and enterprise use cases rather than retail adoption—at least initially.

4.Who’s Winning So Far?

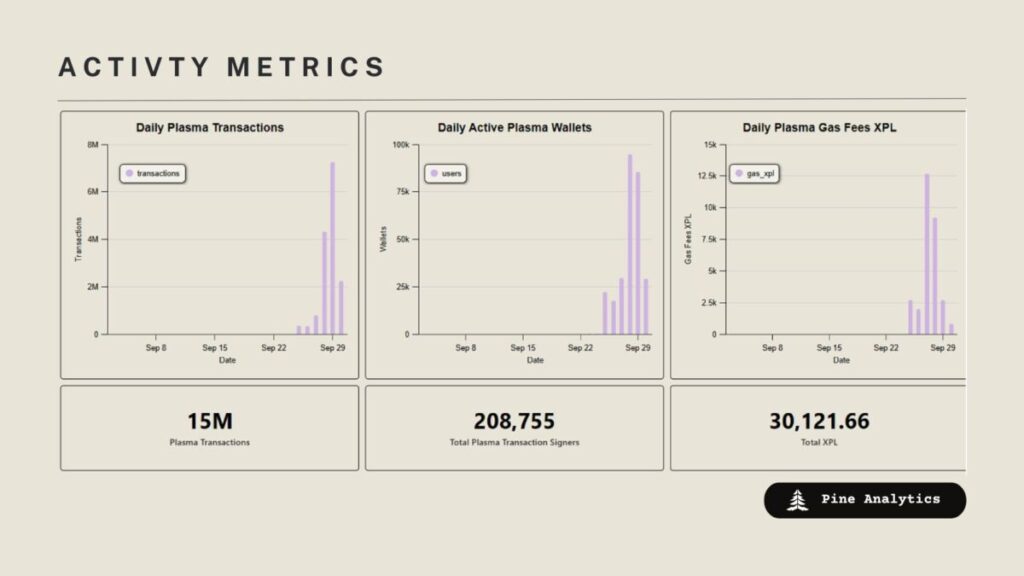

Plasma completed a record number of test deposits in mid-2025 and launched its mainnet on September 25, 2025—just four days ago. The network is now live and processing real transactions with growing adoption.

Stable’s mainnet status is less publicly clear. Stable quietly announced itself after a year in stealth development in June 2025, but specific launch timelines and current operational status haven’t been as publicly visible.

Early momentum appears to favor Plasma based on several factors:

– Clearer public launch with defined milestones and communication

– Active mainnet with verifiable transaction processing

– Native token (XPL) listed on major exchanges including MEXC

– More visible ecosystem partnerships and developer activity

However, Stable’s stealth approach may be intentional—focusing on deep institutional integration and enterprise partnerships before seeking public retail adoption and visibility.

5.Real-World Use Cases

5.1 Payments and Remittances

Both networks target the same core use case: seamless integration with real-world payment systems for everyday transactions, cross-border payments, and remittances.

For the broader population in emerging markets, stablecoins represent a hedge against hyperinflation, a stable store of value, and efficient payment rails. Purpose-built infrastructure like Plasma and Stable makes these use cases more accessible and cost-effective.

5.2 Institutional Settlement

Stable’s “Enterprise Blockspace” specifically targets institutional users requiring dedicated infrastructure for high-volume, predictable settlement operations.

Plasma’s approach is more generalized but still targets institutional adoption through its security features, compliance capabilities, and zero-fee structure that reduces operational costs.

5.4 DeFi and Smart Contracts

Plasma’s native Bitcoin bridge allows BTC to be used within smart contracts on the network, enabling DeFi applications beyond simple stablecoin transfers—lending, derivatives, and complex financial instruments.

Stable’s approach to smart contracts and DeFi applications is less publicized, suggesting their primary focus remains on optimized payment rails rather than complex financial applications.

5.5 The Tether Connection

Both networks have indirect connections to the Tether/Bitfinex ecosystem:

– Plasma raised $24 million from investors including Bitfinex

– Stable is likely indirectly connected to the Tether ecosystem and is exclusively focused on USDT

This isn’t coincidental. With USDT holding 62% of the stablecoin market and processing trillions in annual volume, Tether has strategic interest in purpose-built infrastructure that can:

– Reduce settlement costs for users and partners

– Increase transaction speed and throughput

– Maintain USDT’s dominance against competing stablecoins

– Enable new use cases through specialized features

The question is whether Tether benefits more from Plasma’s multi-stablecoin approach that improves USDT infrastructure while remaining open, or Stable’s USDT-exclusive focus that dedicates all resources to a single asset.

6.Potential Challenges

6.1 For Plasma

Multi-stablecoin complexity – Supporting multiple assets may dilute focus and create technical challenges in optimization, security, and governance.

Network effects – Needs to attract multiple stablecoin issuers and their respective user bases simultaneously, which is more difficult than focusing on one dominant asset.

Regulatory uncertainty – Supporting multiple stablecoins may face more regulatory scrutiny as different stablecoins have varying compliance frameworks and legal statuses across jurisdictions.

6.2 For Stable

Single-asset risk – If USDT’s market share declines significantly or faces regulatory challenges, the entire network’s value proposition weakens dramatically.

Limited use cases – USDT-only focus may restrict adoption in multi-asset DeFi scenarios where users need to interact with various stablecoins.

Competition from Tron – Tron already dominates USDT settlement with proven infrastructure, deep liquidity, and established network effects. Convincing users to migrate is challenging.

Both networks also face the fundamental challenge of convincing users to move from established chains like Ethereum, Tron, and Solana—which already have proven infrastructure, developer ecosystems, and user bases—to new, unproven networks.

7.Which Should You Watch?

From a strategic perspective, Plasma and Stable tend to compete for the existing USDT market, making them more direct competitors than complementary solutions.

Watch Plasma if:

– You believe stablecoin infrastructure should support multiple assets for flexibility

– You value immediate mainnet activity and verifiable ecosystem growth

– You’re interested in stablecoin + Bitcoin bridge use cases and DeFi applications

– You want to trade the native token (XPL) on MEXC and other major exchanges

Watch Stable if:

– You believe USDT’s dominance justifies dedicated, optimized infrastructure

– You prioritize institutional and enterprise use cases over retail adoption

– You expect deeper Tether integration and official support to drive adoption

– You prefer focused, single-asset optimization over broad multi-chain support

8.The Bottom Line

Both Plasma and Stable represent the next evolution in stablecoin infrastructure—purpose-built blockchains optimized specifically for stablecoin transactions rather than general-purpose chains retrofitted for payment use cases.

Plasma’s thesis is that stablecoins have grown large enough to justify infrastructure designed for them alone, and Stable shares this fundamental belief while taking a more focused, USDT-exclusive approach.

The real competition isn’t necessarily between these two networks—it’s between purpose-built stablecoin infrastructure as a category and existing chains like Tron, Ethereum, and Solana that currently dominate stablecoin settlement.

Whether Plasma’s multi-asset approach or Stable’s USDT-exclusive focus proves more successful will depend on several factors:

– Actual transaction costs and speed in production environments under real network load

– Ecosystem adoption and liquidity from users, developers, and institutional partners

– Regulatory clarity and compliance features that enable mainstream adoption

– Integration with existing payment systems and traditional financial infrastructure

With both networks launching in 2025, the next 12-18 months will reveal which strategic approach wins in the battle for stablecoin infrastructure dominance.

MEXC currently supports XPL trading, allowing users to gain exposure to Plasma’s growth trajectory as the stablecoin infrastructure race unfolds.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up