A new week has started with an increase in bearish activity on the cryptocurrency market. The largest altcoin Ethereum (ETH) reached $4783 in mid-September, but by the second half of the month, it found itself in a correction phase.

On the exchange MEXC the day before, the ETH rate dropped to $4080 – this mark became a local bottom, as the crypto quickly received support and bounced back to $4199.

The Relative Strength Index (RSI) is in the neutral zone, which weakens the risks of a new downturn.

At the same time, the chances of resuming the expansion also remain small considering that the address activity on Ethereum is decreasing, leading to a narrowing of the price fluctuation range of the altcoin.

1. The reserves of ETH whales have increased by 14% since April.

Since spring 2025, whales have been accumulating Ethereum. The activation of addresses with a balance of 1000 to 100,000 coins created conditions for the rise of ETH to an all-time high. On August 24, the altcoin first rose to $4953.

According to Santiment, whale accumulation of Ethereum has become aggressive since early April. In the last five months, wallets holding between 1000 and 100,000 ETH acquired 5.54 million coins.

Thus, whale reserves have increased by about 14% since mid-spring, and the volume of crypto under their control has reached 45.2 million ETH.

- Whale accumulation of digital currency was replaced by sell-offs in the second half of September. The jump above $4500 became the main trigger for another profit-taking.

A similar situation was observed in winter-spring when Ethereum could not hold above $1500. On the MEXC exchange, the coin dropped to $1472 but quickly managed to regain its positions, thanks to the return large and medium investors interested in purchasing at comfortable prices.

In the sales organized in September, retail traders predominantly participated.

Large investors continue to accumulate. In 2025, addresses with a balance of more than 1000 coins did not abandon the strategy of long-term accumulation of the asset, as indicated by the data CryptoQuant.

Another important signal was the decision of Grayscale to transfer more than 40,000 ETH to the ETH 2.0 deposit contract.

Grayscale’s crypto ETF has accumulated approximately 1.5 million ether.

If confirmed, the investment company transfers ETH to staking for increased yield, this will be the first case among Ethereum ETFs in the USA where funds are directed to a deposit contract.

Transferring funds to staking leads to a reduction in the supply of crypto on the market, which also contributes to the increase in its value in the long term.

2. Weak network activity – as an obstacle to volatility

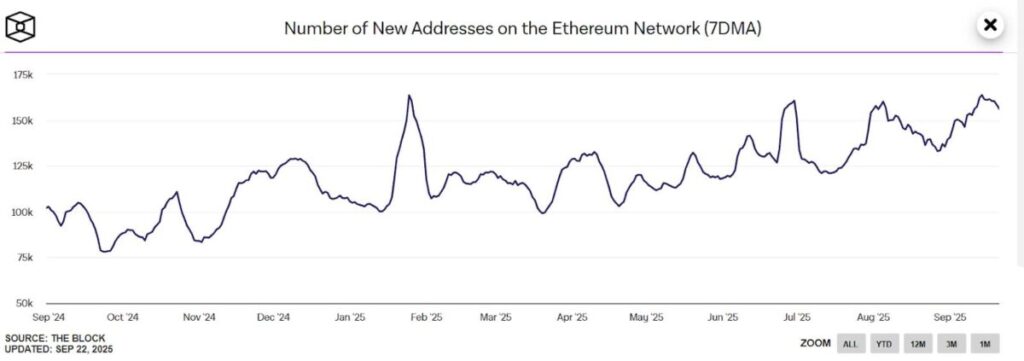

Last weekend, address activity on the Ethereum network began to decline. Usually, a decrease in the number of addresses regularly participating in transactions leads to a decrease in the value of the digital currency.

The weakening of the ETH exchange rate at the beginning of the current week was indeed observed against the backdrop of low network activity.

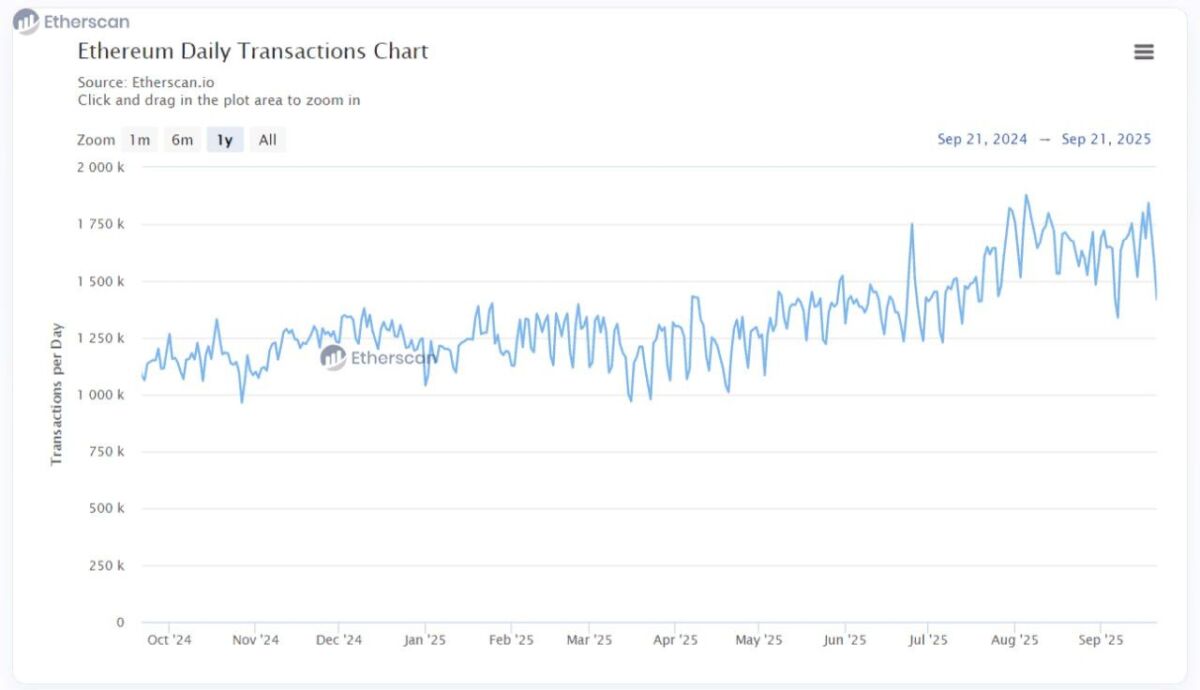

The average daily number of transactions in the blockchain the day before was 1.418 million. Last week it fluctuated from 1.518 million to 1.843 million (according to Etherscan).

Despite the pressure that ether faced in recent days, it managed to hold above $4000 and maintains chances of approaching $5000 again.

But such aggressive growth is unlikely due to weak demand for capital movement on Ethereum.

According to The Block, on average, about 643,000 addresses are active in the network daily.

In August, funds were sent and received daily by up to 680,000 users.

The rate of new address registrations on the blockchain has also decreased. On September 21, only 156,140 wallets were registered on Ethereum, while at the beginning of the month, up to 154,000 addresses were accepted daily by the network.

Transaction fees this month are stable and amount to $0.66 due to weak demand for sending funds.

- A new phase of turbulence is expected only if whales and sharks become active.

Analysts estimate that a key event will be the influx of mega-whales holding more than 10,000 ETH.

If they resume purchases after the correction, Ether could rise to $4,500 soon or even exceed this psychological mark. Currently, there are 1,200 addresses in the network with a balance of more than 10 000 Ether.

Mega-whales continue to buy, but in September they have been less frequent in purchasing coins. As soon as accumulation takes on an aggressive nature, the famous race from the spring of 2021 could repeat.

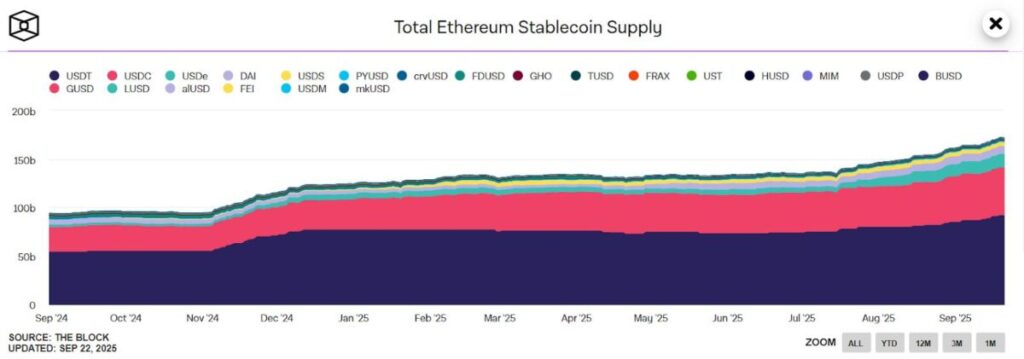

The movement of stablecoins across the ETH blockchain is also becoming a growth factor for altcoins. The inflow of capital into fiat-backed digital currencies improves the liquidity of the Ethereum ecosystem and increases the value of its underlying asset.

3. The supply of stablecoins on ETH has reached a new high

Ethereum remains the main blockchain for stablecoins. Such fiat-backed digital currencies are extremely popular among retail and institutional investors who buy bitcoin and ether, as well as test the potentials of projects in the DeFi and NFT markets.

Over the month, the capitalization of Ethereum-based stablecoins soared from $149.5 billion to $166 billion. (according to The Block).

The dominant position is held by the USDT token, its supply on ETH has increased to $87.8 billion. Following it is stablecoin USDC – $48 billion.

- According to analysts, the shift of investors to stablecoins creates conditions for large-scale and accelerated dollarization of projects in the decentralized finance market, which are gradually evolving from speculative to ecosystems providing users with various tools for enhancing yield.

Ultimately, the influx of capital into tokens USDT and USDC, based on Ethereum, fuels the demand for the underlying digital asset of the network – ether. It becomes an important tool for financing projects deployed on the blockchain.

Institutional adoption of ETH is becoming one of the key factors supporting the long-term growth of the largest altcoin.

Disclaimer: This information is not investment, tax, legal, financial, accounting, consulting, or any other advice related to these services, nor is it advice for buying, selling, or holding any assets. MEXC Training provides information solely for reference purposes and is not investment advice. Please ensure that you fully understand all risks and exercise caution when investing. The platform is not responsible for users’ investment decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up