Ethereum has emerged as the beating heart of crypto but Layer 2s are making it scalable for the next billion users. By 2025, when Ethereum is surging past a $500B market cap and 2 million transactions a day, Layer 2 (L2) networks are not side experiments. They are ecosystems, curating DeFi, NFTs, gaming, and identity projects that are the future of Web3.

We saw the story live at MEXC, as traders chased the growth story around L2 tokens. Whether it was Arbitrum (ARB), Optimism (OP), or zkSync’s ZK token, demand suggests L2s are changing portfolios just as fast they’re changing Ethereum.

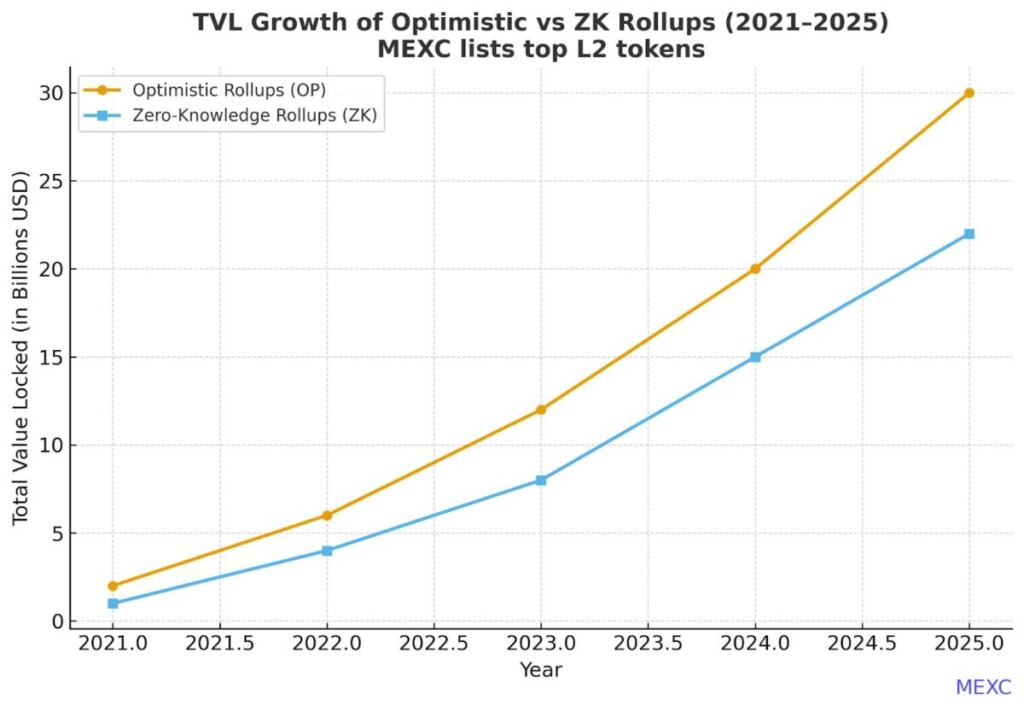

But from the two dominant models; Optimistic Rollups (OP) and Zero-Knowledge Rollups (ZK), the question is not technicalist. Where are the ecosystems thriving with OP? Where are the ecosystems exploding with ZK? Where else are smart traders looking for the next phase of opportunity?

1.The Significance of Layer 2 Rollups

Layer 2s alleviate the burden on Ethereum’s mainnet by aggregating transactions, executing them off-chain, and then securely settling back on-chain. In doing so, they lower transaction costs from the dollar range to the cent range and increase throughput from around 15 TPS on L1 to thousands on L2s.

At present, more than 80% of Ethereum activity runs on L2s due to the increased usage of AI-related dApps, tokenization of on-chain real-world assets, and increasing participation of institutional players. For traders, this isn’t just new infrastructure, it is alpha. Total Value Locked (TVL) across Layer 2 solutions has now surpassed $50B and the action is here.

At MEXC we provide traders easy access to position themselves for these opportunities whether that is spot trading L2 tokens without transaction fees or positioning themselves with up to 200x leverage on L2 derivatives.

2.Optimistic Rollups: The Accessible Builders

As implied by their namesake, Optimistic Rollups are optimistic, they presume to the validity of transactions unless proven otherwise. If there is a dispute, fraud proofs will settle the dispute within a pre-defined challenge period.

Why it matters for traders: OP for L2s is inexpensive, fast, and exceedingly developer-friendly. With almost complete EVM compatibility, development teams can quickly migrate projects on L1 to L2. The only downsides are longer withdrawal periods back to Ethereum – but even increasingly flexible proof systems and bridging techniques are solving this problem.

2.1 Ecosystem Highlights:

- Optimism (OP): Central to the “Superchain,” amalgamating various OP chains through shared liquidity.

- Arbitrum (ARB): The TVL leader (~$15B), flourishing with existing DeFi luminaries such as GMX and Uniswap forks.

- Base (Coinbase’s L2): Boomed in 2025 with NFT marketplaces and on-chain social applications.

- Mantle, Metis, and Boba: Also finding niches in restaking DAOs, and hybrid compute.

OP ecosystems have a reinforced dynamic through community support; Optimism’s RetroPGF grant program has directed more than $500mil into builders rewards. You will also see tokens like ARB, and OP trending toward top-traded assets on MEXC.

2.Zero-Knowledge Rollups: The Privacy Pioneers

ZK Rollups are more strict, every batch of tx, contains a validity proof (mathematically verified on-chain). The outcome is finality, security, and privacy features that cannot be surpassed.

Why does this matter to traders: ZK’s cryptography is a future-proof system, not simply looking to answer the question of speed. Recursive proofs and hardware acceleration has quickly driven down ZK fees, making it as cost-effective as OP, while capturing privacy and compliance benefits.

2.1 Ecosystem Highlights:

- zkSync Era (ZK): With over $5 billion in total value locked (TVL), zkSync is leading the charge in account abstraction and user experience.

- Polygon zkEVM (MATIC): The first major implementation of zk proofs in Polygon’s massive ecosystem, spanning everything from DeFi to enterprise chains.

- StarkNet (STRK): Relying on STARK proofs that offer quantum resistance, while supporting wallets like Argent and dApps like JediSwap.

- Scroll and Linea: Focused on the compatibility of zkEVMs with privacy-first applications.

- Immutable X: Dominating NFT gaming with titles like Gods Unchained.

ZK ecosystems have garnered over $300 million in grants to builders in 2025 and inspired experimentation for use cases ranging from private voting to Web3 social applications.

3.OP vs ZK: A Direct Comparison in 2025

- Scalability: Both can scale far beyond L1, but ZK has a definitive advantage with proofs that could, theoretically, reach 100,000 TPS.

- Security: ZK is more secure with validity proofs baked into the layer at the code level. OP is secure due to the challengers verifying assertions or due to economic incentives.

- Costs: OP remains less expensive for simple transactions; however, ZK has made incredible, rapid technological progress, closing the gap quickly.

- Compatibility: OP still provides the friendliest development environment for devs, but zkEVMs are closing quickly on cost and ease of use.

- Privacy: ZK is far superior and provides a framework for shielded transactions which is better for regulators who must follow compliance applications.

For ecosystems, OP draws in social apps and DeFi and ZK excel in gaming, enterprise, and privacy finance.

4.Future Perspective: The Hybrid Horizon

The future is neither OP nor ZK, but both. Hybrid models are already emerging that combine OP’s speed with ZK Proofs for faster finality. Optimism’s “Cannon” upgrade, StarkNet’s recursive proof improvements, and zkSync enterprise pilots show us the way to 2026.

With Ethereum’s Dencun upgrade now live and sequencer decentralization on the roadmap, expect the L2s to take 90% of Ethereum activity by 2026.

5.Concluding Thoughts: Your L2 Edge at MEXC

The rollup wars are not wars but are two complementary forces pushing Ethereum to a global settlement layer. Optimism and Arbitrum offer accessibility and zkSync and StarkNet offer security and privacy. Together they create the foundation for Web3’s next phase.

At MEXC, we will not only help you witness this story but help you trade it! Flip through L2 tokens like OP, ARB, ZK, and MATIC with deep liquidity and low fees all the way up to 200x futures.

Prepared to grow your portfolio with the future of Ethereum? Today is the day to sign up on MEXC and get involved in the conversation now!

When it comes to Layer 2 ecosystems, the real opportunity isn’t even tomorrow, it’s today!

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up