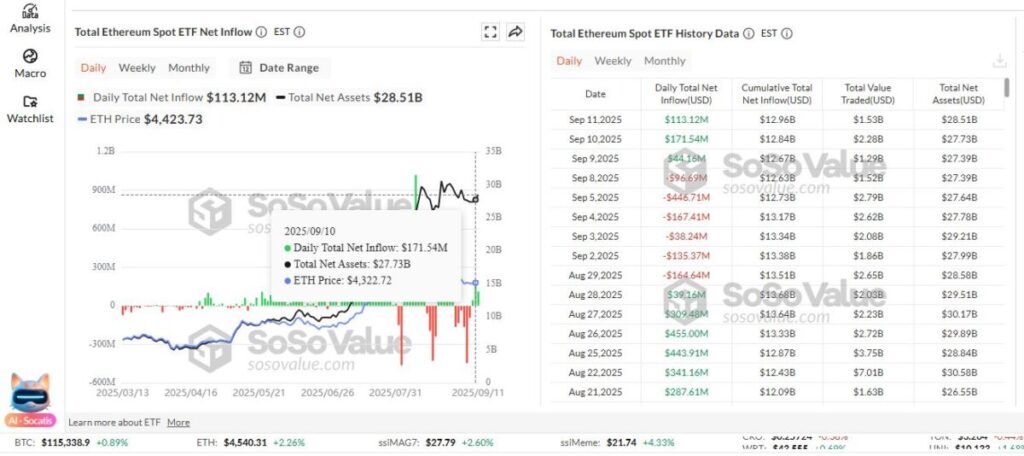

Over the past year, traditional inflows from ETH ETFs and Digital Asset Treasury companies helped $ETH rally from $1,500 to $4,500. Yet, in a recent report, Messari went so far as to use the word “dead” to describe Ethereum’s current state. The paradox they highlight is troubling: while $ETH reached new ATHs in August, Ethereum’s actual revenue collapsed.

This has sparked a heated debate within the crypto community, splitting opinions into two sharply opposing camps.

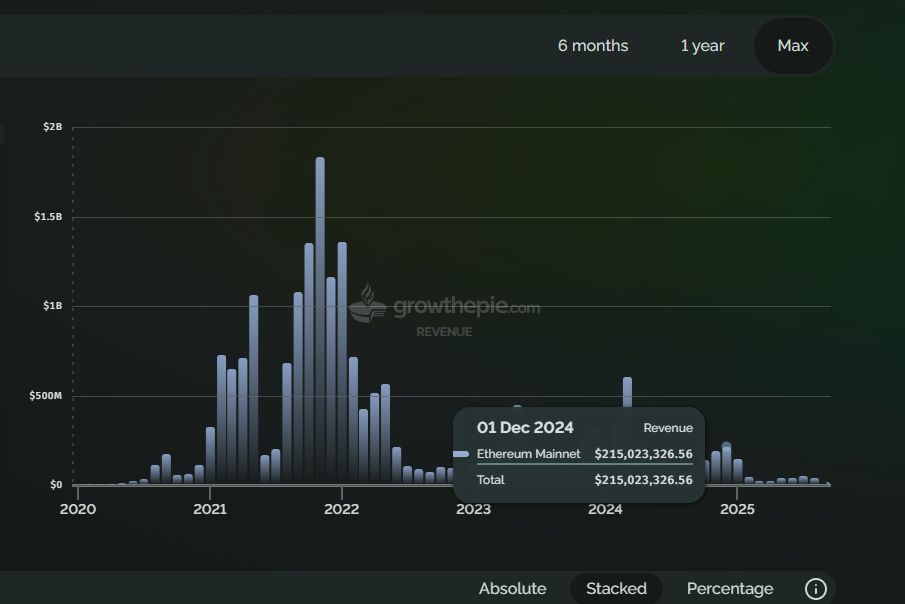

1.ETH Price Up, Ethereum Revenue Down 75%

The controversy began when AJC, Head of Research at Messari, pointed out a harsh reality: Ethereum’s revenue is in freefall.

- In August 2025, Ethereum’s total network revenue was just $39.2M.

- Compared to August 2023: down 75% (from $157.4M → $39.2M).

- Compared to August 2024: down 40% (from $64.8M → $39.2M).

- This marks the 4th lowest revenue month since January 2021.

The paradox: while revenue keeps dropping, ETH price has been soaring. This disconnect fuels fears of an Ethereum bubble — is the market being manipulated? Are we living in an illusion?

Why revenue is collapsing:

- Layer 2 “stealing” mainnet fees: Since the Dencun upgrade in 2024, Layer 2s like Base and Arbitrum have processed most transactions. Mainnet gas fees collapsed. While L2s help scale Ethereum, AJC argues they’ve weakened mainnet economics because user growth hasn’t been strong enough to sustain both L2 and Ethereum simultaneously.

- ETH as Wall Street’s financial instrument: $ETH is increasingly treated as a speculative asset by Wall Street giants via ETH ETFs. In 2025, firms like BitMine and SharpLink Gaming aggressively accumulated ETH — not to use in DeFi, but as collateral to leverage their stock positions. This explains why ETH price pumps while on-chain activity remains stagnant.

- Competition From Other Blockchains

Solana, BNB Chain, and others attract users with low fees and high speed, especially in memecoins, gaming, and DeFi.

Many activities that once happened on Ethereum have moved entirely to these chains, leaving Ethereum to act more as a settlement layer for high-value transactions.

2. Two Conflicting Perspectives

The report split the community into two camps

2.1 The Pessimists: “Ethereum is entering decline”

Messari and its supporters are sounding alarms with one core principle: revenue is the heartbeat of a blockchain.

- Revenue = network health: High gas fees once meant users truly needed Ethereum. A 75% drop in revenue suggests users are leaving, perhaps migrating to Solana, BNB Chain, or abandoning Ethereum altogether.

- ETH burn mechanism under threat: Since 2021, each transaction burns part of the gas fee, reducing ETH supply. When revenues were high (2021–2022), millions in ETH were burned daily, making ETH deflationary. But with just $39M/month revenue today, burn is too low to offset staking rewards. ETH has reverted back to being inflationary.

- Competition is fierce: Solana’s memecoin boom last year drew massive activity away from Ethereum. With memecoins likely to keep booming, Ethereum risks further decline.

- Narrative inconsistency: In 2021, when gas hit $200–300 per tx, people proudly claimed “high fees prove Ethereum is valuable.” Now with low fees, they say “cheap fees are good for adoption.” This 180-degree narrative shift fuels skepticism about Ethereum’s direction.

2.2 The Optimists: “This is progress, not decline”

Ethereum leaders quickly pushed back. Voices like David Hoffman (Bankless) and Vivek Raman (Etherealize) argue Messari fundamentally misunderstands Ethereum.

- Ethereum ≠ Tech Company: Hoffman says comparing Ethereum to Amazon or Apple is flawed. Ethereum is more like a “digital city” than a company. Lower fees attract more users and developers, creating a vibrant ecosystem. ETH gains value from network effects and its role as settlement infrastructure — not just from revenue.

- History is repeating:Vivek Raman points to the 1990s internet: people once paid $100/month for slow dial-up. Later, broadband dropped to $20–30/month, telcos lost revenue, but cheap internet birthed Google, Amazon, Facebook — trillions in value. Ethereum’s low-fee model may follow the same path: sacrifice short-term revenue to unleash innovation.

- Ethereum’s new role = settlement layer: Ethereum is evolving from “global computer” to base settlement layer. L2s handle millions of fast, cheap transactions, then batch them back to Ethereum for final security. Like a central bank, Ethereum doesn’t need to process every retail transaction — it just guarantees system integrity.

Data backing optimism:

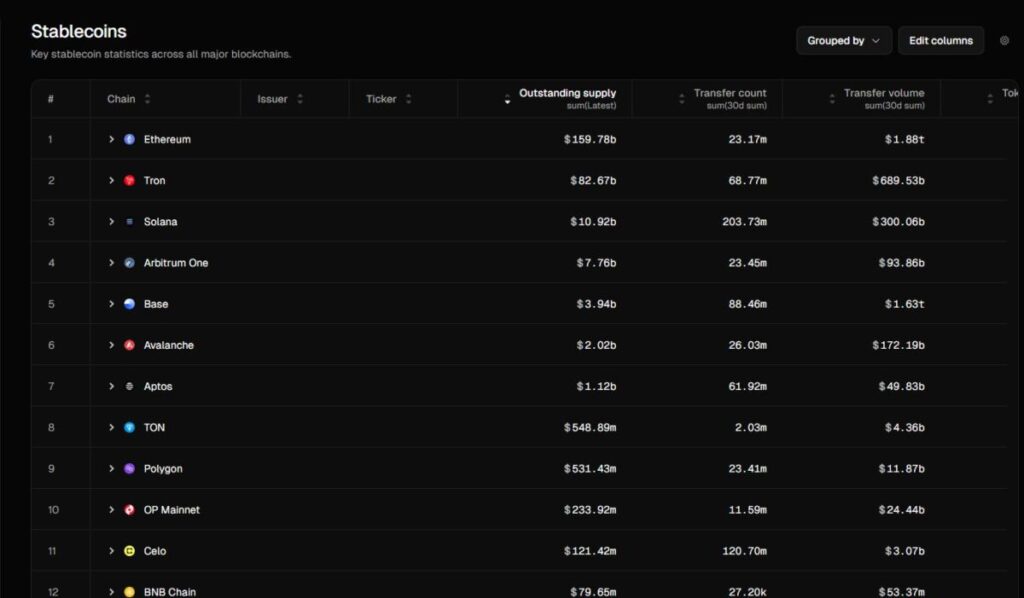

- 60% of global stablecoins (~$100B) still sit on Ethereum + L2s. USDT & USDC remain Ethereum-first.

- Real World Assets (RWA): out of $250B tokenized assets, Ethereum captures ~55% market share.

- Big money trusts Ethereum: if it’s “dying,” why are institutions parking hundreds of billions on it?

- U.S. Treasury Secretary Scott Bessent publicly supports stablecoins — most of which live on Ethereum.

- TVL, active dev count, and daily addresses remain strong. Focusing only on revenue ignores Ethereum’s bigger picture.

Unused ETH is waiting: Much of the $ETH acquired by ETFs and Digital Asset Treasuries hasn’t yet been deployed in DeFi (staking, lending, liquidity). This capital could re-enter the ecosystem in the future.

3.Ethereum’s Transformation

Since transitioning from Proof of Work → Proof of Stake, Ethereum has shifted from a crypto tech platform to a global economic layer. This transformation comes with challenges: declining mainnet revenue, competition from L2s, etc.

But history suggests this may be the natural path forward.

- Like the internet’s shift from expensive dial-up → cheap broadband: ARPU (average revenue per user) went down, but the digital economy exploded.

- Ethereum is at a similar inflection point: shrinking mainnet revenue may simply be the cost of enabling exponential growth via its broader ecosystem.

- L2s aren’t stealing value from Ethereum — they’re amplifying Ethereum’s strategic role.

No matter the camp, one fact is undeniable: Ethereum remains the most important blockchain after Bitcoin.

The debate over Ethereum’s direction may rage for months or even years, but that’s a healthy sign — proof that the community remains passionate, engaged, and deeply invested in Ethereum’s future.

4.Conclusion

Ethereum is at a crossroads. On one side, shrinking mainnet revenue raises real concerns about sustainability, competition, and whether ETH’s price has become detached from on-chain fundamentals. On the other, lower fees, L2 scaling, and institutional adoption may signal a more mature phase — where Ethereum evolves into the global settlement layer underpinning the crypto economy.

Whether you stand with the pessimists or optimists, one truth remains: Ethereum is too important to ignore. Its future will be shaped not just by revenue charts, but by the ecosystems, institutions, and communities that continue to build on it. The debate isn’t a weakness — it’s proof of Ethereum’s resilience and its central role in crypto’s next chapter.

Disclaimer: This content does not provide investment, tax, legal, financial, or accounting advice. MEXC shares information purely for educational purposes. Always DYOR, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up