Key Insights:

- Ethereum’s transition to Ethereum 2.0 has significantly reduced transaction fees, fostering wider adoption and diverse use cases.

- Analysts caution against potential downward pressure on altcoins if Bitcoin and Ethereum fail to attract buying interest amidst prevailing market trends.

- Despite the decline in Ethereum’s market capitalization, increased trading volume suggests ongoing market activity and potential opportunities for investors.

Ethereum’s transition to Ethereum 2.0 has led to a significant drop in transaction fees, now averaging $9.35, marking a substantial reduction from previous levels. This remarkable shift not only promotes scalability and network stability but also fosters wider adoption and varied use cases within the Ethereum ecosystem.

Cost-Effective Changes For Ethereum

The recent data shared by Santiment, a prominent market intelligence platform specializing in cryptocurrency analysis, indicates a notable decline in Ethereum’s transaction costs. With fees plummeting from $63 to $9.35 per transaction, the network has become more cost-effective and accessible thanks to the successful implementation of Ethereum 2.0. This transition has effectively alleviated congestion, paving the way for enhanced efficiency.

Lower transaction fees and reduced network congestion have historically catalyzed broader adoption of Ethereum, accommodating diverse applications and attracting both developers and users. Consequently, the newfound affordability of Ethereum could drive further adoption and innovation, solidifying its position in the competitive cryptocurrency landscape.

Price Prediction on Ethereum (ETH) Token Price

However, despite these positive developments, caution is advised. Analyst 52kSkew highlights concerns regarding Ethereum’s 4-hour chart trends, warning of potential repercussions for altcoins. Should Ethereum and Bitcoin fail to attract buying interest soon, downward pressure on altcoins could intensify.

Observing Ethereum’s 4-hour chart, analysts note a continued weakness in price, particularly concerning the prevailing trend. This situation could lead to unfavorable outcomes for altcoins. Nevertheless, amidst such caution, analysts express readiness to capitalize on significant market downturns, particularly at key high-timeframe levels, such as the $3400 range.

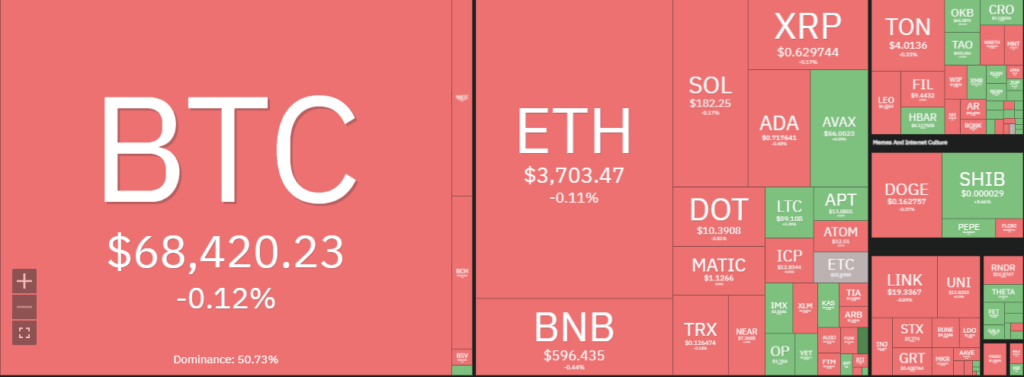

In the broader market landscape, Bitcoin has faced a sharp correction, witnessing a decline from the $73k to $66k range, marking a 6% decrease in the daily timeframe. Consequently, the total crypto market cap has dropped by 6%.

As of the latest data, Ethereum’s price stands at $3,703, marking a 0.11% decrease in the past 24 hours. With a decline from the $4k level, Ethereum seeks support at $3,600 amidst prevailing bearish sentiment. Although ETH’s market capitalization has fallen by 4% to $442 billion, an increase in trading volume by 58% to $34 billion signifies ongoing market activity.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up