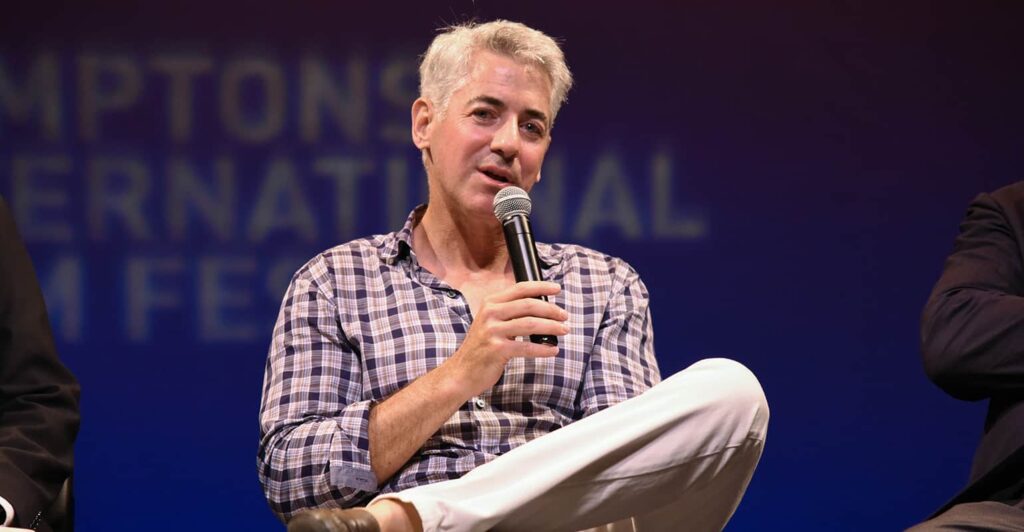

Renowned investor Bill Ackman, CEO of Pershing Square Capital Management, has expressed a desire to buy Bitcoin (BTC), the world’s leading cryptocurrency. However, his stated reasons for this potential move have drawn criticism from various industry experts and analysts.

Divergent Views on Ackman’s Rationale

According to Ackman, his interest in Bitcoin stems from his belief that the digital asset could serve as an inflation hedge and a potential replacement for cash. He has cited concerns over the Federal Reserve’s monetary policies and the potential devaluation of traditional fiat currencies as driving factors behind his consideration of Bitcoin.

However, many critics argue that Ackman’s rationale is flawed and that he may be overlooking the inherent volatility and risks associated with cryptocurrencies like Bitcoin.

Inflation Hedge or Speculative Asset?

While some proponents of Bitcoin view it as a potential store of value and a hedge against inflation, others contend that the cryptocurrency’s price fluctuations and lack of widespread adoption as a medium of exchange undermine its usefulness as an inflation hedge.

“Bitcoin’s volatility and speculative nature make it a poor choice as an inflation hedge,” said financial analyst Sarah Thompson. “Investors seeking protection against inflation would be better served by more traditional assets like gold or real estate.”

Regulatory Uncertainty and Adoption Challenges

Another point of contention lies in the regulatory uncertainty surrounding cryptocurrencies and the challenges faced in their mainstream adoption. Despite the growing interest from institutional investors, cryptocurrencies remain largely unregulated, and their legal status varies across jurisdictions.

“Ackman’s interest in Bitcoin is commendable, but he should be mindful of the regulatory risks and the potential for governments to impose stricter controls on cryptocurrencies,” cautioned legal expert Michael Hawkins.

Diversification and Risk Management

Amidst the debate, some experts emphasize the importance of prudent risk management and diversification when considering investments in emerging asset classes like cryptocurrencies.

“While Bitcoin may have its merits, investors should approach it with caution and ensure it comprises only a small portion of a well-diversified portfolio,” advised financial advisor Jessica Wilson.

A Nuanced Perspective

As the discourse around Ackman’s potential Bitcoin investment continues, it highlights the need for a nuanced understanding of the risks and opportunities associated with cryptocurrencies. While some view Bitcoin as a revolutionary asset class, others remain skeptical of its long-term viability and practical applications.

Ultimately, investors like Ackman will need to carefully weigh the potential benefits against the inherent risks and make informed decisions based on their investment objectives and risk tolerance.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!