In mid-September, Bitcoin briefly reached a monthly maximum, on the eve of the cryptocurrency on the exchange MEXC testing values above $114,000.

The last time BTC traded at this level was on August 23, and by September 1, the coin had fallen below $109,000. Here it found a bottom, then entered a consolidation phase and tried to shoot up again.

Whales holding more than 1,000 coins changed their tactics last month and began accumulating BTC. During this time, 13 new wallets with a balance of over 1,000 coins appeared on the network. The total number of Bitcoin whales reached 2,087.

A similar situation was observed in August in the Ethereum blockchain. According to Santiment, the number of ETH whales controlling more than 10,000 coins increased by 48 over the month to 1,275.

Whale support became the main trigger of the August rally. At the end of last month, large investors took profits, and by September, BTC faced pressure.

1. The consolidation phase is stretching

This week, Bitcoin briefly broke above $114,000, but was forced to retreat due to pressure. The cryptocurrency is trading at $113,300 on MEXC, and long-term consolidation of the asset cannot be ruled out.

The Relative Strength Index (RSI) indicates overbought BTC. Therefore, a jump in the coming days is unlikely. On the contrary, the risks of a dip have increased considering that the whales, after the pumping and dumping in August, decided to change their tactics and settled at the bottom.

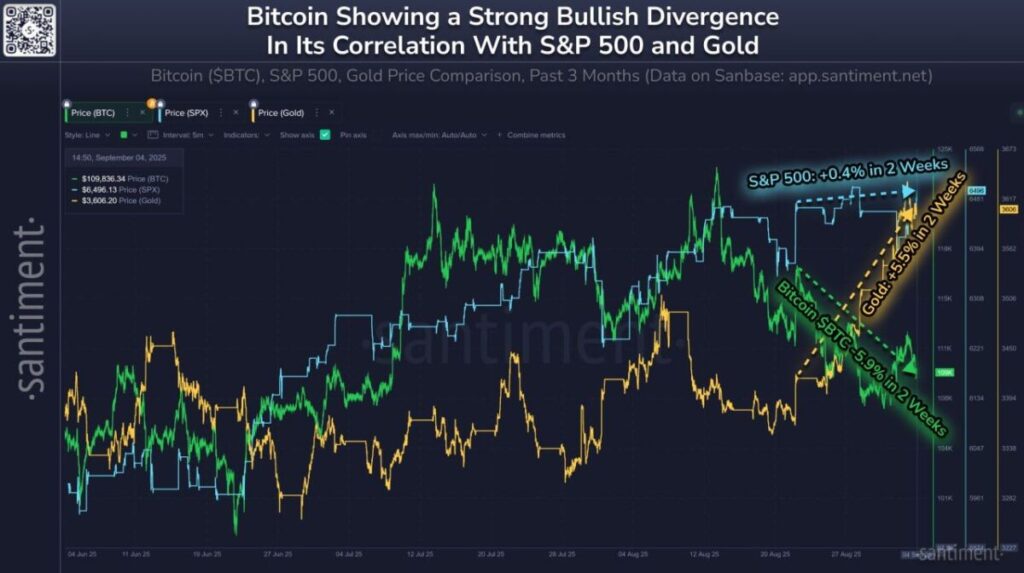

While the leading digital currency is predominantly trading in a narrow range, gold has shown growth.

The US stock market is also rising in the first half of the month, but at a more modest pace.

Given the strong correlation between BTC and the S&P 500 index, analysts predict a return of crypto to a bullish phase, but a little later. Investors will need time to reallocate capital between stocks and BTC in favor of the latter.

According to CryptoRank, in August, due to a powerful sell-off orchestrated by whales, the BTC rate weakened by 6.43%.

In September, the coin grew by 4.63%, but is not yet able to regain the positions lost since August 22. In 2023-2024, September ended with a slight strengthening of Bitcoin, but overall, during this period, the amplitude of fluctuations remained low.

Another important indicator for assessing the near-term prospects of the digital currency is the sentiment in the futures market.

Open interest in BTC futures has dropped to $41.1 billion on the eve (according to Coinalyze).

The rate on perpetual swaps at MEXC remains in positive territory for now. However, the ratio of long-term to short-term positions (Long/Short) is decreasing, which creates additional risks for the asset.

2. Negative sentiment on social media has stabilized the BTC rate

In addition to technical indicators, sentiment on social media can also be used to assess the near-term prospects of the digital currency.

In September, on Telegram, X, Reddit, and 4Chat negative forecasts for Bitcoin and Ethereum dominate. A surge in pessimistic sentiment was the result of the recent drop in BTC and ETH.

Prolonged consolidation raises concerns among users. Many of them predict Bitcoin will fall below $100,000, and ETH – below $3,500. For now, the largest cryptocurrencies are trading significantly above these levels.

- The return of negativity usually accelerates reaching a local bottom. Therefore, in the expert community, many believe that for Bitcoin, the mark of $110,000 could become fundamental. This means that upon the emergence of failure risks, support should strengthen here, as most traders are currently not interested in a negative scenario.

- On the other hand, if positive sentiments begin to dominate on social media, especially during an asset’s growth, then one should prepare for profit-taking and retreat.

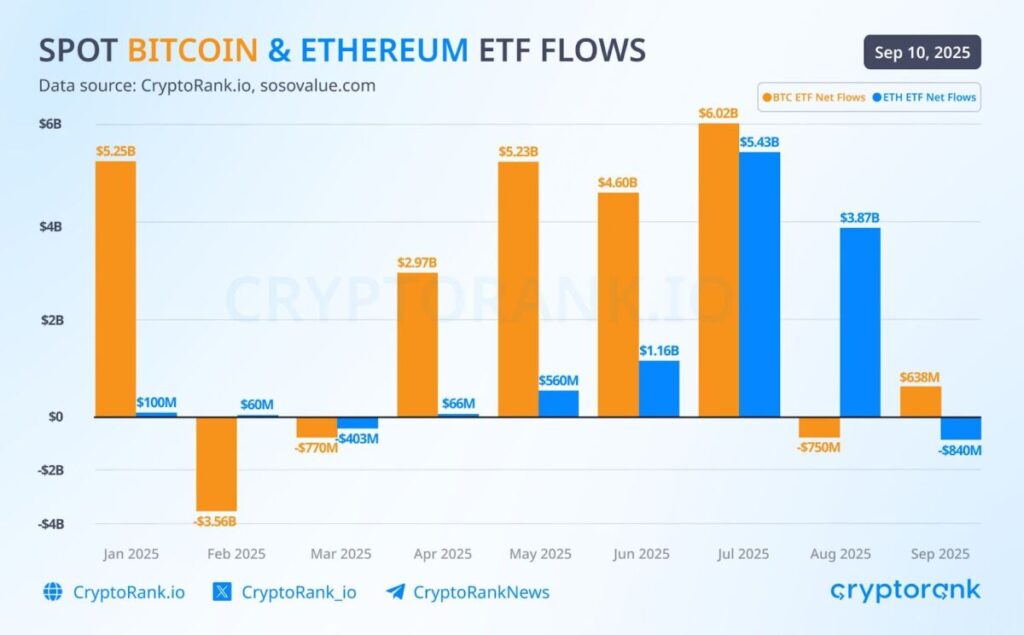

This week, capital has started flowing back into Bitcoin-ETF. If the influx continues in the coming days, the price may rise to $115,000. However, as it approaches this psychological mark, crypto will inevitably face strong resistance.

Since the beginning of 2025, the net inflow of funds into the BTC ETF amounted to $16 billion. During the same period, Ethereum-ETF spot crypto funds attracted $10 billion. But in September, Ether-focused ETFs faced an outflow of $840 million, while Bitcoin funds managed to attract $638 million.

Leading digital currency is also being acquired by investment and software companies. In total, they have accumulated about 11% of BTC turnover.

3. The Fed may stimulate a new Bitcoin rally

Next week, a decision is expected from the U.S. Federal Reserve regarding the interest rate. Experts agree that the regulator will lower it by 0.25%.

The easing of monetary policy will create conditions for the inflow of capital into risky assets. The most attractive instruments for investors in this case will be the shares of IT companies and digital currencies.

Bitcoin usually shoots up after the Federal Reserve’s decision to cut the interest rate.

According to analysts’ estimates, part of the traders’ capital will be redistributed in favor of Bitcoin and altcoins after the easing of monetary policy. In this situation, the leading digital currency will be able to overcome resistance in the range of $113,000 to $114,000 and jump to $116,000.

Moreover, some observers do not exclude that in the case of a bull run, the result of the new rally will be reaching $119,000.

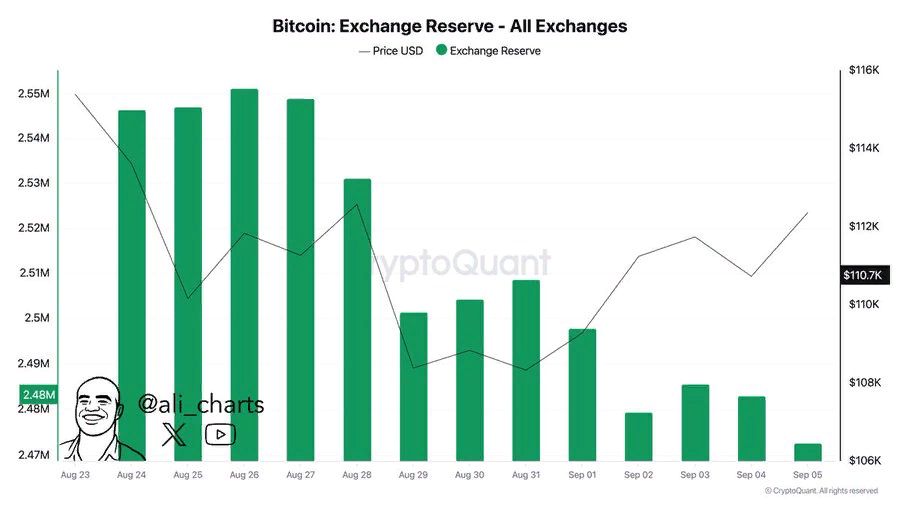

The reduction of the BTC exchange balance should also contribute to the increase in the asset’s value. According to CryptoQuant, 79,000 BTC left trading platforms in August amounting to $8.87 billion.

At the beginning of autumn, there was a strengthening trend of crypto outflow from exchange addresses. As of September 11, 2.473 million BTC were stored on trading platforms, and over the past 24 hours, this volume decreased by 0.1%.

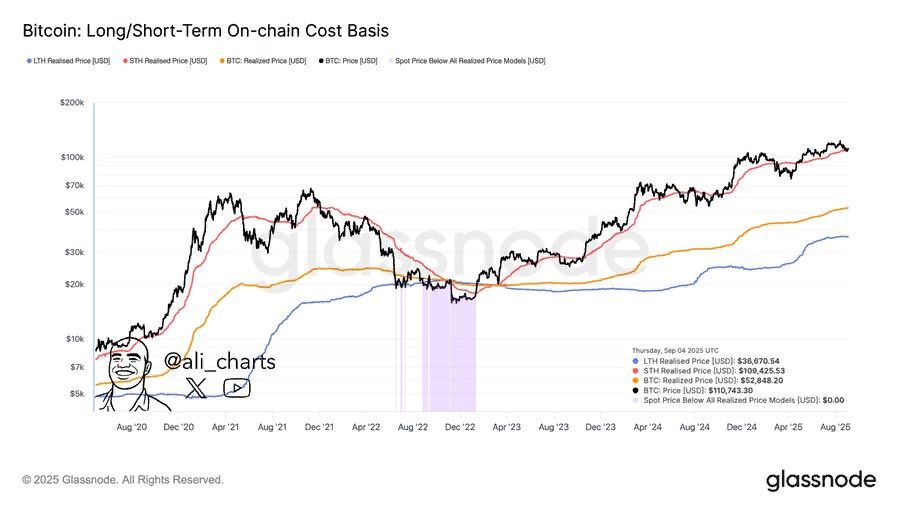

It should be noted that for short-term investors, the average purchase price is $109,400 per coin.

For long-term investors who bought crypto more than a year ago, this price is $36,700.

Therefore, it cannot be ruled out that holders will once again turn to selling after BTC attempts to resume its expansion and approaches $120,000. However, such rapid growth in the coming weeks is unlikely, considering the decline in institutional crypto purchases.

CryptoQuant notes, What if in November of last year, the company Strategy (MicroStrategy) acquired 134,000 coins, while in August this volume decreased to 3,700 BTC.

Institutional demand has decreased, which led to a weakening of Bitcoin’s volatility. The reduction in the amplitude of cryptocurrency fluctuations is also aided by a decline in the number of transactions on the blockchain.

Disclaimer: This information is not investment advice, tax advice, legal, financial, accounting, consulting, or any other services related to these matters, nor is it a recommendation to buy, sell, or hold any assets. MEXC Education provides information solely for informational purposes and is not investment advice. Please ensure that you fully understand all risks and exercise caution when investing. The platform is not responsible for users’ investment decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up