Introduction

In 2021, the crypto world was rocked by a rug pull worth $2 billion- yes, you heard that right! Thodex- a Turkish cryptocurrency exchange, suddenly closed its doors and disappeared with investors’ funds, leaving them with no way to access their assets.

Thodex was founded in 2017 by Faruk Fatih Ozer, who had promised to make the exchange the largest in Turkey. The exchange had gained significant popularity in the country, with over 390,000 users registered on the platform.

However, on April 21, 2021, Thodex suspended trading and withdrawals, citing an external attack on the platform. Shortly afterward, the exchange’s website went offline, and they deleted the social media accounts.

Investors soon realized that their funds were trapped on the platform, and they had no way to access them. The Turkish authorities launched an investigation into Thodex, and Ozer was arrested in Albania while attempting to flee the country.

It was later revealed that Thodex had been experiencing financial difficulties, with the exchange owing over $100 million to its users. The company had also been accused of market manipulation and fraud, with reports of fake trading volume and insider trading.

The Thodex incident highlights the danger of rug pulls, a type of crypto scam that has become increasingly common in recent years.

What is Rug Pull?

A rug pull is a scam where a cryptocurrency or NFT developer hypes a project to attract investor money, only to suddenly shut down or disappear, taking investor assets with them. The name comes from the idiom “to pull the rug out” from under someone, leaving the victim off-balance and scrambling.

Rug pulls have increased as decentralized finance (DeFi) attracts more investors to the crypto space. In the first six weeks of 2023, there were at least 11 rug pulls, resulting in the theft of a combined total of more than $14 million, according to Comparitech’s crypto scam database.

In this article, we’ll explore the different types of rug pulls, hard pull vs. soft pull, the legality of rug pull, and most importantly, how to avoid becoming a victim. Let’s dig!

Types of Rug Pulls

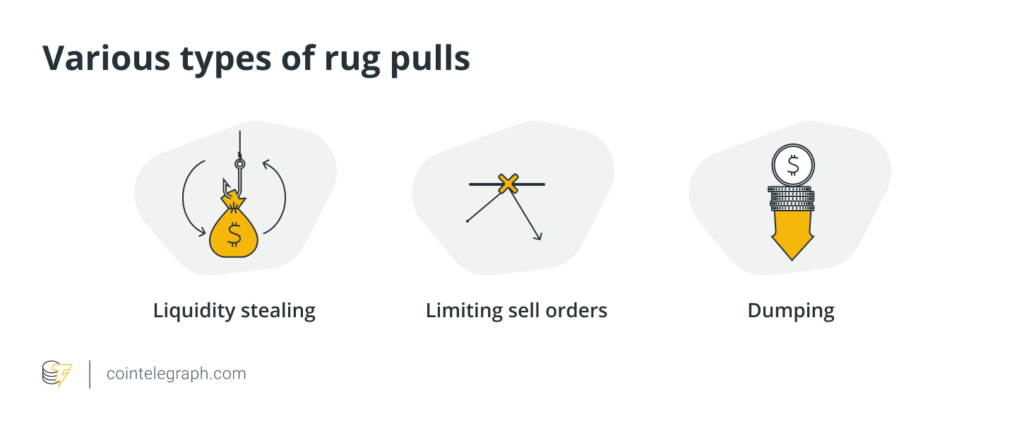

All Rug pulls typically fall into one of these three categories:

1. Liquidity Stealing

In a liquidity-stealing rug pull, the developers of a project remove the liquidity from the trading pool, making it impossible for investors to sell their tokens. This type of rug pull typically comes in projects with low liquidity, where a small amount of selling pressure can have a significant impact on the price.

To execute a liquidity-stealing rug pull, developers usually remove the liquidity from decentralized exchanges (DEXs) or automated market makers (AMMs) such as Uniswap or PancakeSwap. This means that there is no liquidity available for traders to buy or sell tokens, and investors are left holding worthless assets.

2. Limiting Sell Order

In a limiting sell order rug pull, the developers limit the number of tokens that can be sold at any given time, preventing investors from cashing out. This type of rug pull is often seen in projects with low trading volume, where a large sell order can cause the price to plummet.

To execute a limiting sell order rug pull, developers typically place a large sell order on a centralized exchange, such as Binance or Coinbase, causing the price to drop. They may also place a limit on the number of tokens that can be sold in a single transaction, making it difficult for investors to sell their holdings.

3. Dumping

In a dumping rug pull, the developers or insiders sell their tokens en masse. This causes the price to plummet and leaves investors with worthless assets. This type of rug pull often happens in projects with high trading volume, where a large sell order can cause a significant price drop.

To execute a dumping rug pull, developers or insiders typically hold a large number of tokens and sell them all at once, causing a massive sell-off. This is achievable on centralized or decentralized exchanges, and the sudden drop in price can cause panic selling, further exacerbating the price drop.

Hard Pull vs. Soft Pull

Rug pulls can also be categorized as hard pulls or soft pulls. A hard pull involves stealing funds outright, while a soft pull involves manipulating the market to make investors lose money.

Hard pulls are typically more straightforward and involve outright theft. In a hard pull, developers or insiders may steal funds from a project, exchange, or investors’ wallets, leaving them with no recourse to recover their assets.

Soft pulls, on the other hand, are more insidious and involve manipulating the market to make investors lose money. Soft pulls may involve tactics such as fake news, market manipulation, or insider trading, which can be more difficult to detect.

Are Crypto Rug Pulls Legal?

You might be wondering if this is even necessary or if you think that all rug pull is illegal, well if you had that thought, you are wrong! Some rug pulls are unethical but not illegal. The legality of rug pulls varies depending on the circumstances. In some cases, rug pulls may constitute fraud or theft and can result in criminal charges. However, in many cases, the developers of a project can simply disappear without facing any consequences.

The lack of regulation in the cryptocurrency space makes it challenging to prosecute rug pullers or recover stolen funds. Investors must exercise caution when investing in cryptocurrency projects and do their due diligence to avoid becoming victims of scams.

How to Avoid a Rug Pull in Crypto

6 clear signs to watch out for before trading that token:

1. Unknown or Anonymous Developers

One of the most significant red flags in a cryptocurrency project is unknown or anonymous developers. Before investing, always research the team behind the project and make sure they have a track record of successful projects. What is the track record of the developers? Are they popular in the Crypto space? Investors should also be skeptical of new and faked social media profiles. The quality of the project’s whitepaper, website, and media contributes a large factor in determining the legality of a token.

If the developers are unknown or have no online presence, it’s best to stay away.

2. Liquidity Locking

Liquidity locking is a process where developers lock up a certain amount of tokens in a smart contract to ensure that there is enough liquidity to support the market. It’s important to check if liquidity has been locked, and for how long. The longer the lockup period, the better. Ideally, liquidity should be locked for at least six months, but longer lockup periods provide greater security. Additionally, third-party lockers provide more peace of mind compared to developers locking up liquidity. It’s also important to check the percentage of liquidity that has been locked. Anything less than 50% can be a red flag.

3. Limits on Sell Order

Limiting sell orders is another red flag in a cryptocurrency project. If a project has a limit on the number of tokens that can be sold, it’s a sign that the developers may be planning to execute a rug pull by manipulating the market. One of the best ways to test this is to purchase a small amount of the token and try to sell it off. If there are problems offloading your recent purchase, the project is likely to be a scam.

4. Skyrocketing Price Movement with Limited Token Order:

If a project’s token price is rapidly increasing with limited token orders, it’s a red flag that the developers may be manipulating the market. Always do your research and check the trading volume and liquidity of a project before investing.

5. Suspiciously High Yields:

High yields are often a sign of a potential scam. If a project promises high returns on investment with little or no risk, it’s best to stay away. Always do your research and invest in projects with realistic returns. Investors skeptical about a coin’s price movement can use a coin explorer to check the number of coin holders.

6. External Audit:

If a project doesn’t have an external audit, it’s a red flag that the developers may be hiding something. An external audit can provide an independent assessment of the project’s code and help investors make an informed decision.

Bottomline

Conducting thorough due diligence is crucial before making any investment in the cryptocurrency market. Although it may not guarantee the avoidance of every scam, it significantly increases the likelihood of identifying red flags and avoiding bad deals. It’s essential to take your time and research extensively to make informed decisions. Moreover, before investing in any risky crypto project, it’s crucial to understand the project’s fundamentals and why you believe it will yield positive returns. By being diligent and informed, investors can protect their hard-earned money from potential rug pulls and other scams in the cryptocurrency market.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! You can learn more about cryptocurrency industry news. There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Get up to $10,000 Bonus!