Introduction:

Cycle Networkis a groundbreakingbridge-less cross-chainliquidity aggregation network, designed to address the most persistent challenges in a multi-chain ecosystem: liquidity fragmentation and complex cross-chain interactions. As an innovative platform supporting all blockchains (including L1, L2, EVM, and non-EVM networks), Cycle Network represents a paradigm shift from traditional bridge-based architectures to a more complex, secure, and user-friendly approach to cross-chain liquidity management.

Key Takeaways

- Cycle Network is a bridge-less cross-chain liquidity aggregation protocol, supporting all major L1, L2, EVM, and non-EVM blockchains, addressing the issue of liquidity fragmentation.

- Employing chain abstraction and ZK-Rollup technology, enabling secure and efficient cross-chain communication, enhancing user experience and network performance.

- Use cases encompass DeFi, institutional asset management, and cross-chain trading of RWA assets, catering to the needs of a future multi-chain ecosystem.

1. Core challenges facing multi-chain liquidity

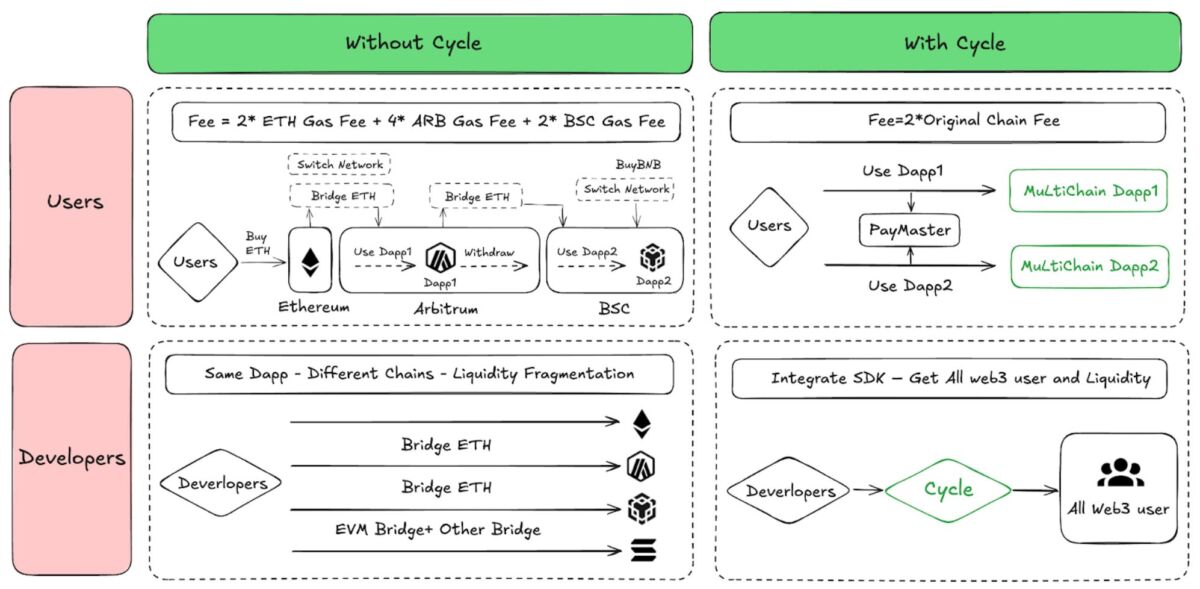

The current blockchain ecosystem is characterized by a growing number of first-layer and second-layer networks, each with unique advantages in transaction speed, cost, and functionality. However, this surge poses significant challenges for users and developers:

1.1 Limitations of traditional cross-chain bridging

Security vulnerabilities: Traditional bridges have become a primary target for hackers, resulting in losses of billions of dollars due to bridge vulnerabilities in recent years.

Liquidity fragmentation: Assets are trapped within specific blockchain networks, limiting their utility.

Complexity of user experience: Users must navigate multiple interfaces and manage different wallet connections.

High transactioncosts: Transaction fees across multiple networks, plus bridging fees, make cross-chain operations too expensive.

Settlement delays: Traditional bridges often require long confirmation periods, sometimes taking hours or even days.

2. Revolutionary solutions of Cycle Network

2.2 Chain abstraction technology

At the core of Cycle Network’s innovation is itschain abstractiontechnology, which creates a unified computational layer above various blockchain networks. This abstraction layer enables seamless interactions between different chains without users or applications needing to understand the underlying complexity of cross-chain operations.,它创建了一个位于各个区块链网络之上的统一计算层。这个抽象层实现了不同链之间的无缝交互,无需用户或应用程序理解跨链操作的底层复杂性。

The chain abstraction approach offers several key advantages:

- Unified user experience: Users can interact with applications and assets across multiple chains through a single interface.

- Simplicity for developers: Developers can build applications utilizing assets and functionalities across multiple chains.

- Enhanced security: By eliminating traditional bridge architectures, Cycle Network reduces the attack surface.

2.2 Bridge-less architecture design

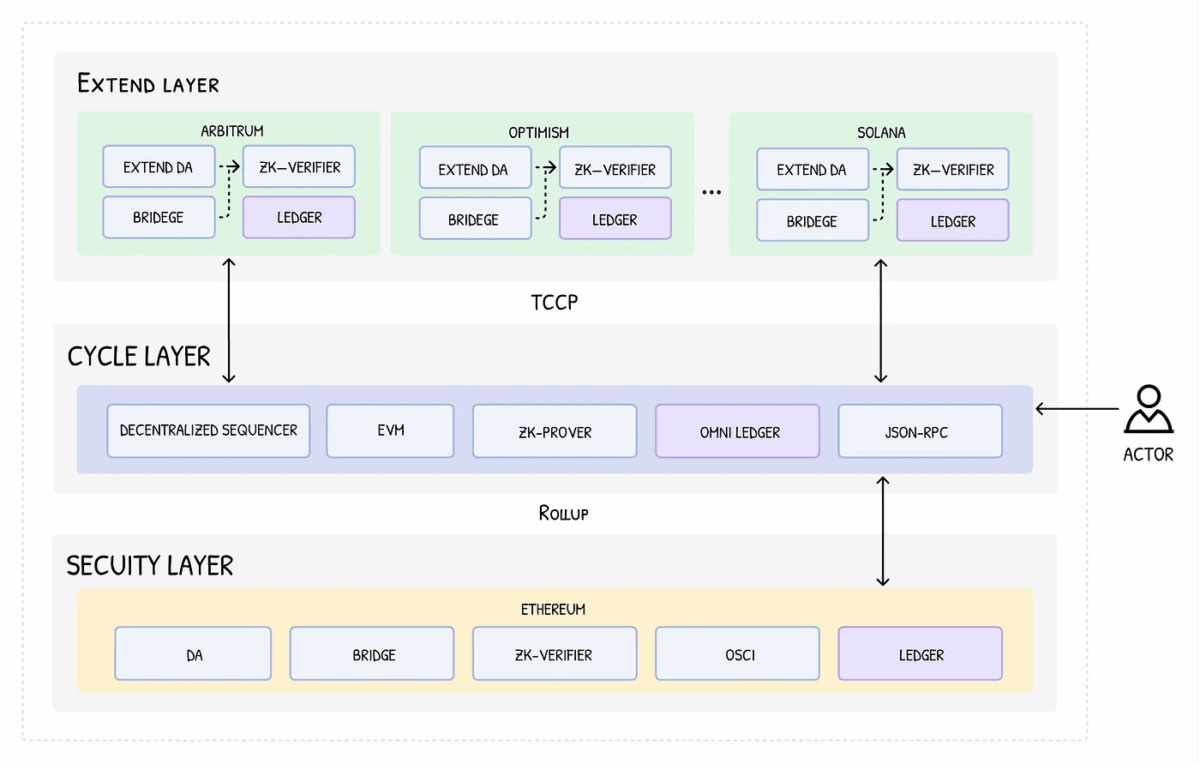

Cycle Network leveragesmulti-chain zk-rollup technologyto expand traditional one-to-one native bridging between L1 and L2 into a complete connection supporting comprehensive blockchain interaction network. This bridge-less approach fundamentally changes the execution of cross-chain operations.

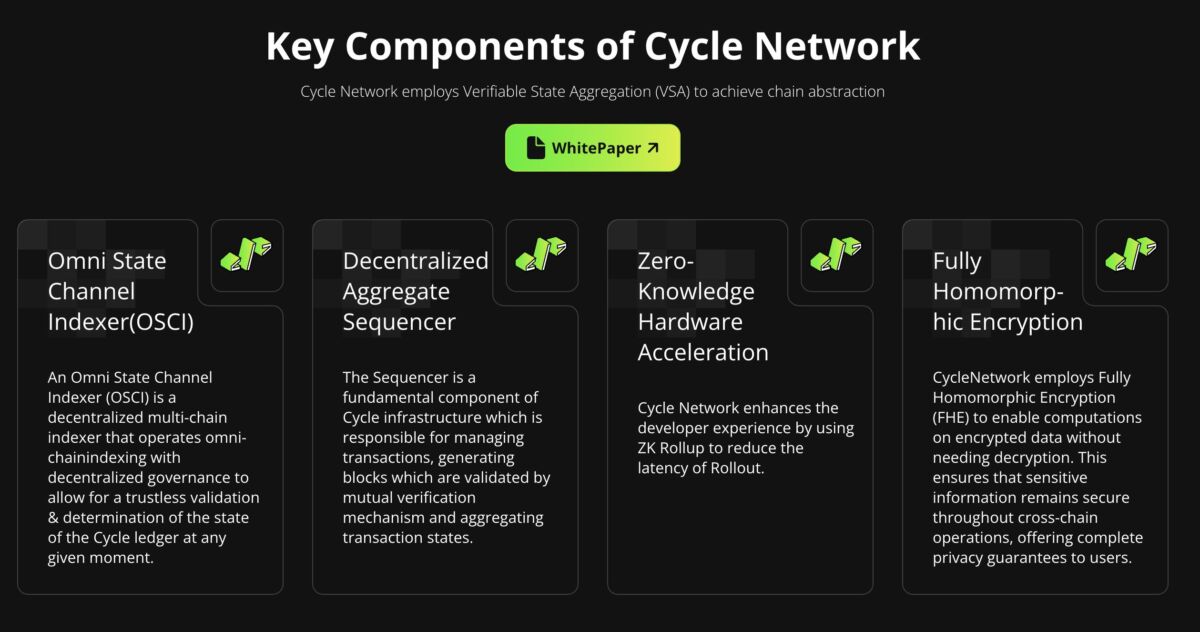

2.3 Aggregator sequencer technology

A bridge-less aggregated liquidity network for all blockchains based on aggregator sequencers and chain abstraction. Built on the aforementioned principles, Cycle Network uses ZK-Rollup technology to create a secure communication infrastructure, achieving a seamless integration experience with the Omni Ledger.

Aggregator sequencers serve as the central coordinating mechanism for cross-chain operations, managing transaction ordering and ensuring state consistency across all connected networks.

2.4 Zero-knowledge proof integration

Cycle Network utilizes advancedzero-knowledge (ZK) rollup technologyto ensure the security and verifiability of cross-chain operations:

- Scalability: ZK-rollups can handle thousands of transactions per second.

- Privacy protection: Zero-knowledge proofs allow transaction validation without revealing sensitive transaction details.

- Instant finality: ZK proofs provide immediate cryptographic assurance of transaction validity.

- costsEfficiency: Significantly reduces costs by batching multiple transactions into a single proof.

2.5 Verifiable Status Aggregation (VSA)

ThroughVerifiable Status Aggregation (VSA), Cycle Network supports cross-chain liquidity abstraction without bridges, enabling secure and trustless interactions between networks like Bitcoin and EVM-compatible blockchains. VSA represents one of Cycle Network’s most innovative technological contributions to the blockchain space.

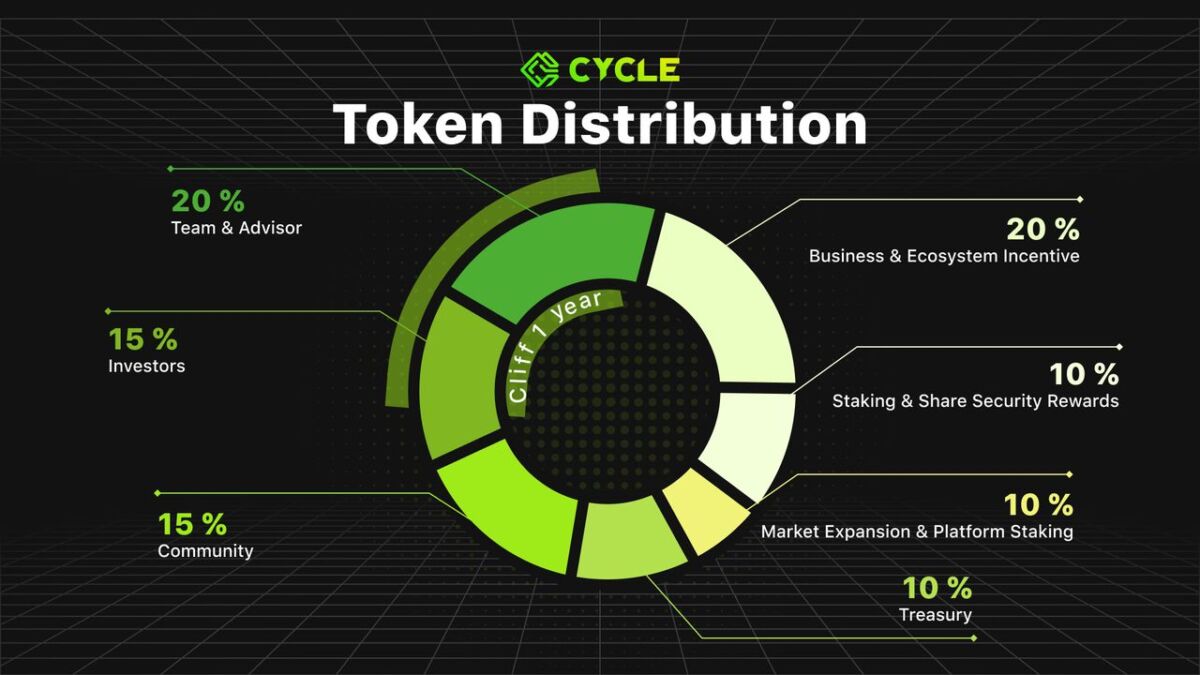

3. CYC Token: Utility and Economic Model

The CYC token serves as the native utility token within the Cycle Network ecosystem, playing a critical role in network operation, governance, and incentive alignment.

3.1 Core Utility Functions

Platform payments and transaction fees

- SDK usage fee: Developers integrating the Cycle Network SDK pay fees using CYC tokens

- Cross-chain transaction fees: Users pay transaction fees in CYC tokens when performing cross-chain operations

- Premium services: Advanced features within the ecosystem require payment in CYC tokens

Liquidity incentives and rewards

- Liquidity mining: Users providing liquidity to the Cycle Network cross-chain pool receive CYC token rewards

- Yield optimization: The platform automatically optimizes cross-chain liquidity deployment to maximize returns

- Long-term incentive alignment: CYC token rewards encourage long-term participation in the network

Network security and validation

- Validator rewards: Network validators receive CYC token rewards for processing transactions and maintaining network security

- Slashing protection: Validators must stake CYC tokens as collateral

- Symbiotic protocol integration: Protecting a broader security ecosystem through integration with the Symbiotic protocol

3.2 CYC’s Token Economic Model

| Allocation objects | Allocation ratio | Release mechanism |

| Team and advisors | 20% | 12-month cliff period followed by 48 months of linear unlocking after TGE |

| Investors | 15% | 12-month cliff period followed by 24-36 months of linear unlocking after TGE |

| Treasury | 10% | 6-month cliff period followed by 48 months of unlocking, release pace decided by governance voting |

| Market expansion and platform staking | 10% | For project TGE and subsequent platform collaborations and liquidity expansion |

| Business and ecological incentives | 20% | Released based on contribution to Cycle Network; allocations determined by community voting after voting system is enabled |

| Community | 15% | Rewards for users contributing income to the Cycle network: released biannually, fully unlocked after 3 years |

| Staking and shared security rewards | 10% | Used for network security incentives after TGE, linear release over 60 months |

4. Actual Application Scenarios of Cycle Network

4.1 Decentralized Finance (DeFi) Applications

Cross-chain lending: Users can borrow assets on one chain using collateral from another chain

Multi-chain yield farming: Yield farmers can optimize returns by automatically deploying capital

Arbitrage opportunities: Traders can exploit price differences of the same asset across different chains

4.2 Enterprise and Institutional Applications

Fund management: Institutional users can manage multi-chain fund operations through a single interface

Payment processing: Businesses can accept payments in any supported cryptocurrency

Supply chain finance: Managing complex supply chain financing arrangements across multiple blockchain networks

4.3 Real World Asset (RWA) Integration

Real estate tokenization: Tokenized real estate assets can be traded and managed across multiple chains

Commodity trading: Tokenized commodities can be traded more efficiently across different blockchain networks

Carbon credits: Environmental assets such as carbon credits can be managed and traded across multiple chains

5. Strategic Partnerships of Cycle Network

5.1 Allora Network Partnership

Cycle Network collaborates withAllora Networkto focus on combining the benefits of bridge-less and seamless liquidity with smart decision-making to achieve:

- AI-driven liquidity optimization

- Smart risk management

- Predictive analytics capabilities

5.2 RISE Chain Integration

与The partnership with RISE Chain focuses on:的合作关系专注于:

- High-frequency trading support: transfers with millisecond accuracy

- Institutional Infrastructure: Enterprise-level Performance and Reliability

- Scalability Enhancement: Improving the Overall Throughput and Efficiency of Cycle Network

5.3 Integration of Berachain and Manta Network

Through the integration withBerachain和Manta NetworkCycle Network demonstrates its ability to support emerging blockchain ecosystems while maintaining its non-bridge architecture.

6. Conclusion

Cycle Network represents a significant advancement in blockchain interoperability and cross-chain infrastructure. By eliminating traditional bridging and implementing complex chain abstraction techniques, the platform addresses many key challenges that limit the growth and adoption of multi-chain applications.

The project’s technological innovations, including its non-bridge architecture, ZK-rollup integration, and verifiable state aggregation, position it as a leader in next-generation cross-chain infrastructure. The well-designed utility and value accumulation mechanisms of the CYC token create a sustainable economic model.

As the blockchain ecosystem continues to evolve towards a multi-chain future, infrastructure platforms like Cycle Network will play a crucial role in enabling seamless interactions and value transfers, defining the next generation of decentralized applications and financial systems.

Reading Recommendation:

What is ZKWASM? A panoramic interpretation from technical principles to token mechanisms

What is ZeroBase? Redefining a new paradigm of Web3 privacy with zero-knowledge proofs

Disclaimer: This material does not provide any advice regarding investment, taxation, legal, financial, accounting, consulting or any other related services, nor does it constitute any advice to buy, sell, or hold any assets. MEXC Newbie Academy provides information for reference only and does not constitute any investment advice. Please ensure you are fully aware of the risks involved and invest cautiously; the users’ investment actions are not related to this site.

Join MEXC and Get up to $10,000 Bonus!