Summary: According to the cryptocurrency exchange MEXC, the price of the ENA token is expected to rise from a low of 0.22 USDT to 0.85 USDT between June 2025 and August 2025, with a maximum increase of nearly 300%, far exceeding the price increase of Bitcoin during the same period.

Key Points:

- The price of the ENA token is expected to rise from a low of 0.22 USDT to 0.85 USDT between June 2025 and August 2025, with a maximum increase of nearly 300%.

- ENA is the native governance token of the Ethena protocol, which creates a decentralized synthetic US dollar (USDe) through a unique Delta-neutral strategy.

- In addition to spot and contract trading, MEXC frequently launches activities related to ENA and USDe, such as trading competitions and staking opportunities, providing users with additional earning opportunities.

According to the cryptocurrency exchange MEXC,the price of the ENA tokenis expected to rise from a low of 0.22 USDT to 0.85 USDT between June 2025 and August 2025, with a maximum increase of nearly 300%, far exceeding theprice increase of Bitcoin. This has inevitably attracted more investors’ attention, and this article will start from the definition and use of the ENA token and its potential reasons for price increases, combined with detailed steps on how to trade ENA tokens on MEXC, providing a comprehensive and clear guide.

1. What is Ethena?

EthenaThe project aims to provide a cryptocurrency native currency solution that does not rely on traditional banking systems, with its core product being the synthetic US dollarUSDe. USDe is pegged to the US dollar at a 1:1 ratio, and its stability is maintained through a complex financial strategy called ‘Delta Hedging’. This strategy ensures the stability of the USDe value by hedging the risk of price fluctuations of the collateralized crypto assets (such as Ethereum and Bitcoin).

Unlike traditional stablecoins such as USDT or USDC, USDe is not directly backed by fiat currency, but is a synthetic US dollar supported by crypto assets and corresponding short futures positions. The Ethena protocol also launched ‘Internet Bonds’, a savings tool denominated in USD that combines the yield from staking Ethereum with the spread in the derivatives market, providing users with earning opportunities. Holders of ENA tokens can participate in governance, voting on the future development direction of the project. The Ethena project was founded by Guy Young in 2023 to address the urgent need for a decentralized, stable, and scalable monetary foundation in the crypto world.

2. What is the ENA token?

2.1 Definition of the ENA token

ENA is the native governance token of the Ethena protocol, representing an important breakthrough in the DeFi field of synthetic dollar innovation. The Ethena protocol creates a decentralized synthetic us dollar (USDe) through a unique Delta-neutral strategy, providing a new stablecoin solution for the cryptocurrency market. The ENA token not only carries governance functions for the protocol but also is a direct beneficiary of the value growth of the entire Ethena ecosystem.

2.2 Basic Information of the ENA token

Basic Parameters

- Full Token Name: Ethena (ENA)

- Token Type: ERC-20 Governance Token

- Total Supply: 15,000,000,000 ENA

- Initial Circulation: 1,425,000,000 ENA

- Issuance Date: April 2, 2024

- Contract Address: 0x57e114b691db790c35207b2e685d4a43181e6061

2.3 Core Functions of the ENA Token

- Governance: Holders can participate in the governance voting of the Ethena protocol.

- Incentives: Can be used for staking, liquidity incentives, etc.

- Ecosystem Applications: Used in the Ethena protocol and its partner DApps.

USDe Stability Mechanism: Maintains value stability through derivatives hedging rather than relying on US dollar reserves (similar to decentralized stablecoins, but with different mechanisms).

2.4 Technical Foundation of the ENA Token

The ENA token is typically issued based on blockchain technology, which may be:

- ERC-20 Token (Ethereum Network): ENA can leverage Ethereum’s smart contract ecosystem to build and launch quickly.

- BEP-20 Token (Binance Smart Chain): If the ENA token is based on BSC, it may have lower transaction fees and faster transaction speeds.

- Independent Public Chain: ENA may be a native token of a completely new blockchain network, supporting the operation of decentralized applications (DApps) in its ecosystem.

3. Reasons for the rise in ENA token prices

The significant recent increase in ENA token prices can be attributed to a combination of several factors:

3.1 Strategic airdrops and successful Shard Campaign:

Ethena Labs successfully incentivized the community through an airdrop of 750 million ENA tokens (5% of the total supply) to early users, quickly expanding its market capitalization. The ‘Shard Campaign’ they held before the token launch also attracted a large number of participants through a points system, laying the foundation for ENA’s market demand and value.

3.2 Listing on major exchanges:

The listing of ENA on several major cryptocurrency exchanges such asMEXCgreatly increased its liquidity and accessibility, attracting a large number of traders and investors.

3.3 Positive market sentiment and strategic partnerships:

The overall optimistic sentiment in the cryptocurrency market provides a favorable environment for ENA’s rise. Meanwhile, Ethena’s strategic partnerships with several well-known DeFi projects have enhanced its ecosystem, attracting more users and liquidity, thereby increasing its visibility and token demand.

3.4 Project fundamentals and innovative mechanisms:

Ethena’s unique ‘Internet bond’ concept and the mechanism through Delta hedging to maintain the stability of USDe are seen as solutions to the ‘impossible triangle’ problem in the stablecoin field (i.e., the difficulty of simultaneously achieving price stability, capital efficiency, and decentralization). This innovative design has attracted a lot of attention and capital inflow.

3.5 Totallocked value (TVL) and open interest surge:

Ethena’s total locked value (TVL) and open interest (Open Interest) have both recently reached historical highs, reflecting the strong market interest and capital inflow into the project, which directly drove the rise in ENA prices.

4. How to trade ENA tokens on MEXC?

As a globally leading cryptocurrency exchange, MEXC provides users with convenient ENA token trading services. Below are the detailed steps to trade ENA tokens on MEXC:

4.1 Register a MEXC account and complete identity verification (KYC):

- Visitthe official MEXC website or Download the App。

- Register an account using a mobile number or email address.

- Complete identity verification (KYC) as required by the platform to ensure account security and unlock all trading features.

4.2 Deposit or fund your MEXC account:

- Before trading ENA, you need to deposit funds into your MEXC account.

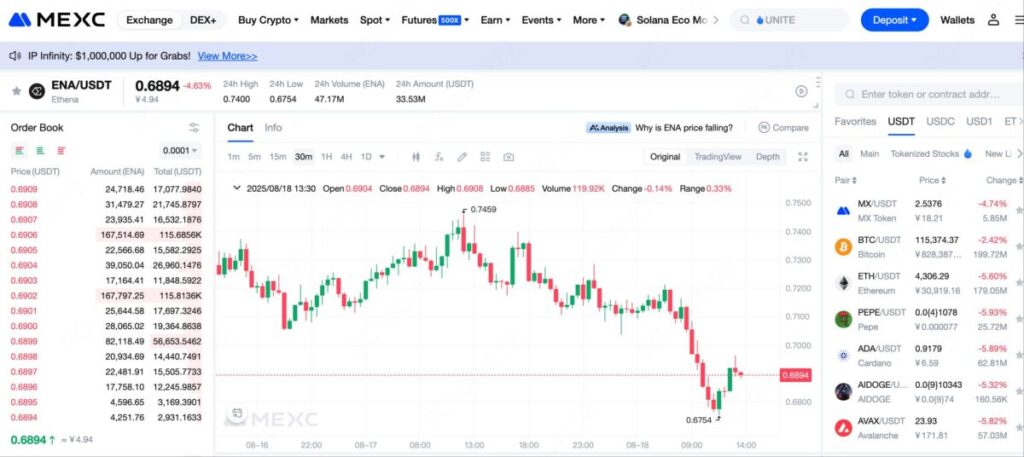

- MEXC supports purchasing stablecoins like USDT, USDC with fiat currency or transferring cryptocurrencies from other wallets or exchanges. The ENA/USDTtrading pair is one of the most common trading pairs, with a trading volume exceeding $122 million in the last 24 hours.

4.3 Spot trading of ENA on MEXC:

- Log into your MEXC account and click on ‘Spot Trading’ in the top navigation bar.

- In the trading page’s search box, enter ‘ENA’ to find theThe ENA/USDTrelevant trading pairs.

- After entering the trading interface, you can choose to place a ‘Market Order’ or ‘Limit Order’ to buy.

- Market Order: Execute the trade immediately at the current market best price.

- Limit Order: Set your desired purchase price, and the order will be executed automatically when the market price reaches your set price.

- Input the amount of ENA you wish to buy or the amount of USDT you wish to use for purchasing, then click the ‘Buy ENA’ button to complete the transaction.

4.4 For ENA contract trading on MEXC:

- Log into your MEXC account and click on ‘Contract Trading’ in the top navigation bar.

- In the trading page’s search box, enter ‘ENA’ to find theENAUSDTorENAUSDCtrading pairs.

- After entering the trading interface, you can choose to place a ‘Market Order’ or ‘Limit Order’ to buy.

- Market Order: Execute the trade immediately at the current market best price.

- Limit Order: Set your desired purchase price, and the order will be executed automatically when the market price reaches your set price.

- MEXC contracts now support users trading ENA perpetual contracts with USDT and USDC, whereENAUSDTthe trading pair supports 1-200x leverage,ENAUSDCthe trading pair supports 1-125x leverage, allowing users to adjust based on their trading preferences.

In addition to the spot and contract trading mentioned above, MEXC frequently launches activities related to ENA and USDe, such astrading competitions and staking to earn coins, providing users with additional profit opportunities. Investors can follow MEXC’s official announcements for the latest information.

5. Conclusion

The ENA token, as the core governance token of the Ethena protocol, has demonstrated unique investment value in the synthetic dollar track.

Through the MEXC exchange, investors can conveniently and securely participate in ENA token trading, enjoying professional trading tools and services. Whether for long-term investment or short-term trading, it is essential to base actions on thorough research and reasonable risk management.

Successful ENA investment requires an in-depth understanding of the Ethena protocol, sensitivity to market changes, and strict adherence to risk management strategies. With the ongoing development of the DeFi ecosystem and the increasing demand for stablecoins, the ENA token possesses good long-term investment potential, making it worthy of investors’ attention and research.

Remember, cryptocurrency investments carry high risks, and investors should make cautious decisions based on their individual circumstances, never investing more than they can afford to lose.

Join MEXC and Get up to $10,000 Bonus!

Sign Up