Summary:

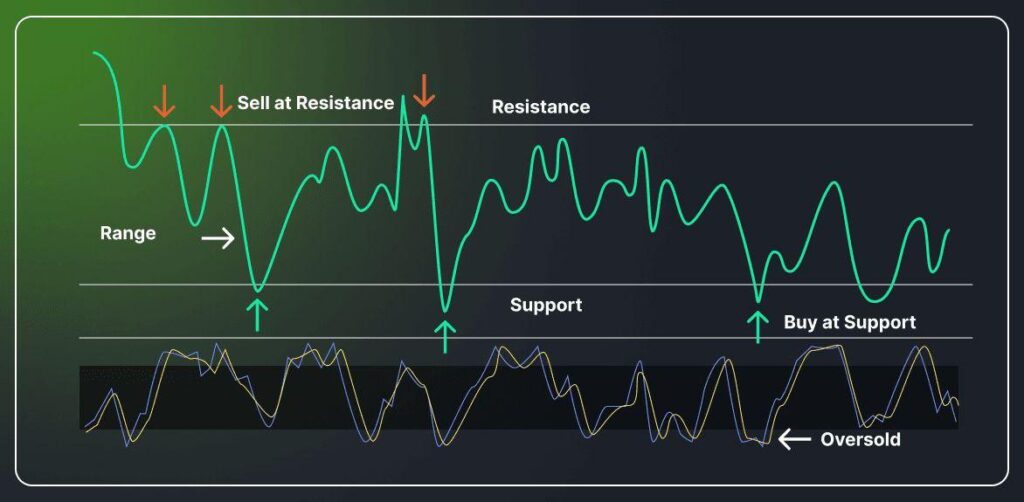

- What it is: Range trading is a strategy where a cryptocurrency’s price moves between a defined high and low. Traders buy near the low (support) and sell near the high (resistance), profiting from the oscillations within that range.

- How it works: This strategy relies on technical analysis to identify a price range. By recognizing that prices will repeatedly bounce between support (the “floor”) and resistance (the “ceiling”), traders execute multiple small trades instead of one large position.

1.What Is the Range Trading Strategy?

Range trading is a straightforward yet powerful trading strategy. In simple terms, it means trading a cryptocurrency when its price is bouncing between a consistent high and a consistent low. If you imagine price as a ping-pong ball, range trading is like watching that ball bounce between the floor and the ceiling. The “floor” is the support level (the low price where buyers consistently step in), and the “ceiling” is the resistance level (the high price where sellers repeatedly push the price down).

In practice, range trading involves buying low and selling high within a defined range. For example, if Bitcoin has been trading between $105,000 and $115,000 for weeks, a range trader would buy near $105k (support) and sell near $115k (resistance), potentially repeating this process multiple times. Unlike trend traders, range traders aren’t looking for a major breakout to $130k or a drop to $90k – they’re profitably playing the oscillation game within the established boundaries.

This strategy rests on the concept of mean reversion – the idea that price will revert back toward the middle of the range rather than start a new trend. It’s similar to a rubber band: pull it too far up (to resistance) and it snaps back down; pull it too far down (to support) and it snaps back up. Range traders aim to capture those snap-back movements.

2.How Does the Range Trading Strategy Work?

Range trading works by systematically exploiting predictable highs and lows on a chart. Here’s how to implement this strategy in practice:

2.1 Identify the Trading Range

First, locate a market that’s moving sideways with no strong up or down trend. The price should repeatedly bounce between two levels. You typically want at least two touches at the high and two at the low to confirm a range. For example, if Ethereum has hit around $2,600 twice and dipped to $2,400 twice over several weeks, that suggests a $2,400–$2,600 range.

Drawing horizontal lines on the chart at those levels helps visualize the trading channel clearly.

2.2 Plan Entries at Support

Once you identify the support (bottom) and resistance (top) of the range, plan to buy near support. You might set a buy order slightly above the support price – if support is $2,400, you could place a bid at $2,410. This buffer accounts for the fact that price sometimes just misses the exact level.

Oscillator indicators like RSI can provide additional confirmation: if RSI shows the asset is oversold at the support zone, it’s a positive signal that support is likely to hold and a bounce could follow.

2.3 Plan Exits at Resistance

Similarly, determine your sell point near resistance. If the identified ceiling is $2,600, you might set your sell order at $2,590 or $2,585 – just below the peak to increase the probability your order fills before the crowd of sellers at $2,600.

2.4 Set Stop-Loss Orders

This is critical for capital protection. No range lasts forever, and sometimes a breakout will break through support or resistance decisively. Always place a stop-loss just outside the range to limit losses if the range breaks.

For a $2,400-$2,600 range:

- Buy at $2,410 with stop-loss at $2,380

- Sell at $2,590 with stop-loss at $2,620

2.5 Avoid Trading in the Middle

Discipline requires avoiding trades in the middle of the range. The middle is a no-man’s land where price could move either direction, making the risk/reward ratio unattractive. If the range is $2,400–$2,600 and the price is $2,500 (mid-range), buying there leaves you with only $100 potential gain to the top but $100 potential loss to the bottom.

3.When to Use Range Trading Strategy

Not every market environment suits range trading. This strategy works best under specific conditions:

3.1 Ideal Market Conditions

Sideways or Consolidating Markets: Range trading thrives when markets lack a strong trend. If Bitcoin is in a clear bull trend (making higher highs consistently) or a definitive bear trend (repeatedly making lower lows), range trading tactics will fail. Look for sideways movement – often after a significant move up or down, markets pause and consolidate horizontally.

Moderate Volatility: The volatility level matters significantly. Excessive volatility makes ranges erratic or short-lived. Too little volatility creates ranges so tight that profits barely cover trading costs. Seek balanced volatility – enough price movement to create profitable swings, but not so much that levels don’t hold.

Clear Support and Resistance Levels: Only deploy range trading when you can clearly identify support and resistance. If a chart resembles a chaotic zigzag with no obvious horizontal levels, it’s probably not suitable for range trading.

3.2 Time Frame Considerations

Range trading is flexible across different time frames:

- Day traders might use hourly or 15-minute charts for intraday oscillations

- Swing traders might focus on 4-hour or daily charts where ranges persist for weeks

- Choose a time frame that matches your trading style and availability

3.3 Asset Selection

Not all cryptocurrencies range equally well:

- Large-cap coins (BTC, ETH) often exhibit cleaner ranges due to higher institutional participation

- High-volume pairs provide better liquidity for executing orders near desired levels

- Low market cap tokens may be too volatile or news-driven to maintain consistent ranges

4.Risks and Drawbacks of Range Trading

No strategy is without risks. Range trading has specific challenges traders must understand and manage:

4.1 Major Risks

False Breakouts (Fakeouts): The biggest risk is when price briefly breaks above resistance or below support, triggering stop-losses, then immediately reverses back into the range. This can result in losses on both the initial trade and the subsequent whipsaw movement.

Real Breakouts: Eventually, every range ends. When a genuine breakout occurs and you’re positioned for the range to continue, losses can accumulate quickly. This emphasizes the importance of properly placed stop-losses.

Opportunity Cost: While focusing on small range movements, you might miss larger trending opportunities in other assets. Your capital is committed to capturing 5-8% moves while another cryptocurrency trends 30-50% higher.

Psychological Challenges: Sideways markets can be mentally taxing. The lack of excitement may lead to overtrading out of boredom. Additionally, range trading requires contrarian thinking – buying when price drops toward support and selling when it rises toward resistance, which can feel uncomfortable.

4.2 Risk Management Strategies

- Use audited and established trading platforms

- Avoid concentrating too much capital in single range trades

- Diversify across multiple time frames and assets

- Monitor range health continuously using volume and momentum indicators

- Maintain discipline with predetermined entry and exit rules

5.Tips for Successful Range Trading

To maximize range trading effectiveness, consider these proven practices:

5.1 Essential Risk Management

Always Use Stop-Loss and Take-Profit Orders: Predefined stop-losses protect capital when trades go against you, while take-profit orders lock in gains without second-guessing. MEXC’s platform allows setting both simultaneously when entering trades, providing automated risk management.

Position Sizing and Capital Management: Risk only a small percentage of your capital on each range trade. Since range trading often involves multiple trades over time, you cannot afford one loss to eliminate all previous gains.

5.2 Technical Analysis Tools

Use Indicators for Confirmation: Technical indicators can enhance range trading success:

- RSI, Stochastic, or CCI: Flash “overbought” at range tops and “oversold” at range bottoms

- Bollinger Bands: Price hitting the upper band often coincides with resistance, lower band with support

- Volume indicators: Confirm whether support/resistance levels are likely to hold

Platform Tools: MEXC advanced charting tools allow drawing support/resistance lines and setting price alerts for key levels, ensuring you don’t miss trading opportunities.

5.3 Execution Strategy

Leverage Carefully: While leverage can amplify profits from range movements, it equally amplifies losses and increases the chance of premature stop-outs from minor price fluctuations.

Automate Strategically: For well-established ranges, consider using MEXC’s grid trading features to automatically buy and sell at predetermined levels within the range.

Quality Data and Tools: Ensure you’re using reliable charting platforms and real-time data. MEXC provides professional-grade charts and the ability to practice strategies in demo environments before risking real capital.

6.Historical Context: Where Range Trading Originated

Range trading isn’t a modern cryptocurrency invention – it’s rooted in classical trading wisdom that predates Bitcoin by centuries. Long before digital assets existed, stock and commodity traders observed that markets often move in cycles of consolidation, with prices surging or dropping then plateauing as buyers and sellers reach temporary equilibrium.

Technical analysis pioneers like Richard Wyckoff in the early 20th century extensively studied trading ranges, often calling them accumulation or distribution phases depending on whether they preceded upward or downward moves. The fundamental principle of buying near support and selling near resistance was likely practiced by traders on historical exchanges, from Japanese rice markets to early stock exchanges.

In cryptocurrency markets, range trading gained prominence as the space matured. During Bitcoin’s early years, price action was often extremely volatile with dramatic surges and crashes. As crypto became more mainstream and institutional participation increased, periods of sideways consolidation became more common and predictable.

Today, range trading is considered essential knowledge for well-rounded cryptocurrency traders, blending traditional technical analysis techniques with the unique characteristics of 24/7 digital asset markets.

7.Strategic Implementation on MEXC

MEXC provides comprehensive tools for implementing range trading strategies effectively:

7.1Platform Advantages

Advanced Order Types: MEXC supports limit orders, stop-loss orders, and take-profit orders that are essential for disciplined range trading execution.

Grid Trading Features: For established ranges, MEXC’s automated grid trading can systematically buy and sell at predetermined intervals within the range.

Professional Charting: Access to institutional-grade charts with drawing tools for marking support and resistance levels.

Risk Management Tools: Real-time portfolio monitoring and risk assessment features help manage multiple range trading positions.

7.2 Getting Started

Practice First: Use MEXC’s demo trading features to test range trading strategies without risking real capital

Start Small: Begin with small position sizes to gain experience with range identification and execution

Focus on Major Pairs: Start with BTC/USDT or ETH/USDT pairs that typically have cleaner ranges and better liquidity

Monitor Performance: Track your range trading results to identify what works and what needs improvement

8.Conclusion

Range trading can be an excellent approach for traders who master its principles. It instills patience, reinforces the fundamental concept of buying low and selling high, and can generate steady profits when markets are consolidating. The strategy transforms seemingly boring sideways price action into structured trading opportunities.

Before deploying real capital, practice extensively using demo accounts or paper trading to refine your range identification skills and execution timing. Range trading is almost an art form in converting market calmness into opportunity.

Remember that successful range trading requires:

- Disciplined identification of clear support and resistance levels

- Strict adherence to risk management rules

- Patience to wait for proper setups

- The wisdom to recognize when ranges are ending and trends beginning

Next time you observe your preferred cryptocurrency moving sideways, don’t dismiss it as boring price action. That consolidation might be signaling an excellent opportunity to deploy range trading strategies profitably.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up