Reserve right (RSR/USDT – Trade it here) is a governance token on the Reserve network that allows users to vote for or decline suggestions. These votes, in turn, help define the governing body’s mode of governance (either centralized or arbitrarily decentralized).

What is RSR used for?

As opposed to RSV, RSR is quite unstable and is mainly used in maintaining the value of RSV. Given a situation where the value of RSV drops below the $1 threshold, users purchase extra RSV at discounted rates via smart contracts sold. After they buy more RSR at a trade ratio of 1 RSV:1 USD, RSV’s price shoots back up.

In a situation where the value surges above the $1 target constant, excess RSV is sold and swapped for RSR or other tokenized assets, pushing RSV’s value back to the expected $1 mark.

The RSR token is used to revive the market when the value of assets owned by the Reserve protocol falls to levels that threaten the existence of RSV. This causes an increase in the supply of RSV, which leads to a drop in the demand for RSR. The Reserve vault serves as RSV’s storage platform.

Core Features of RSR

Dual-Token System

This system comprises the Reserve Rights token and the Reserve stablecoin, interlinked by an arbitrage system comprising two main processes: minting and stability. These techniques proffer remedies to the problems caused by inflation and hyperinflation.

No Third-Party Interference

Because of its varied asset backing, Reserve Rights is completely shielded from government legislation, interference, rulings, and functions.

Real-Life Application

The Reserve Rights platform solves a pressing need in society by providing protection of assets, stability, ease of transactions, and financial security to people and businesses in areas hit by inflation.

Asset-Supported Currency

Another distinctive characteristic of this platform is the use of smart contracts to regulate stablecoin distribution, which is then substantiated using a basket of cryptocurrency. This is in sharp contrast to several other stablecoins which are backed up by fiat currencies under the strict supervision of a stablecoin issuer.

How does RSR work?

The Reserve Rights protocol is built on the Ethereum blockchain. One of its primary focuses is to beat volatility and sustain a stablecoin called RSV. The team has devised a dual-token stablecoin protocol that comprises two components:

- RSV (Reserve stablecoin)

- RSR (Reserve Rights token)

RSV is pegged to the U.S. dollar, so it must consistently sustain its circa $1 value. The Reserve protocol achieves this in a very innovative way.

When the RSV token drops below $1, the protocol is triggered into buying more RSV, pulling the price back to $1 on exchange sites. In the event that the RSV token rises above $1, the protocol automatically sells excess or newly minted RSV, bringing the price back down to $1.

RSV is used frequently in daily transactions, and Reserve strives to maintain the $1 threshold, while RSR functions as an investment that primarily helps conserve the fixed value of the RSV. Reserve stablecoin is remotely substantiated by assets called collateral tokens. All these investments are kept together by what is recognized as the Reserve smart contract.

Tokenmics of RSR

Reserve Rights (RSR) is an ERC-20 token that will serve two main purposes for the Reserve Protocol: insuring Reserve stablecoins (RTokens) through staking and governing them through proposing & voting on changes to their configuration.

Total Supply — 100 billion RSR tokens

Circulating Supply — 13.1 billion (13% of total supply)

Market Capitalization — $233 million

Reserve Rights (RSR) serves the main purpose of serving as the Reserve Protocol’s governance token. We believe that RTokens will have to evolve over time in order to continue to optimally serve both the RToken holders & the RSR stakers

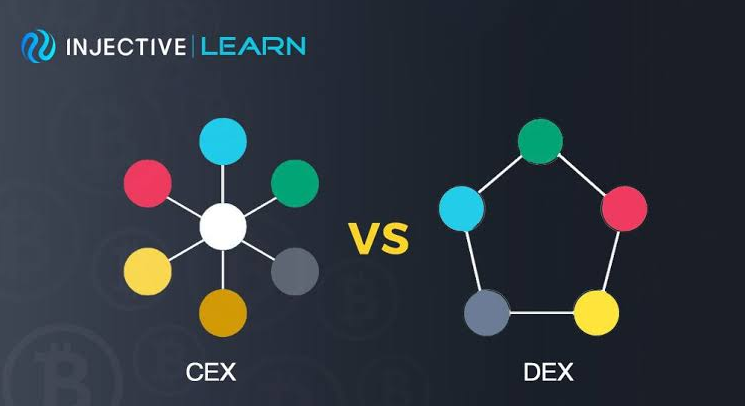

Each RToken can have its own governance system, and we encourage RToken creators to experiment with different governance models they think are appropriate for their RToken. We expect most RToken governance systems to be decentralized, where the amount of RSR one holds relates to the voting power one has over that RToken (but not necessarily the simple token voting system that gets used in many cryptocurrency projects that exist today).

Who are the founders of RSR?

RSR was founded by Nevin Freeman, the CEO of the Reserve project and a successful entrepreneur who co-founded three companies. The project’s other cofounder is Matt Elder, who takes on the role of CTO and previously worked for Google, app search engine Quixey, and the Linux Standard Base.

Recent RSR Token Price & Performance

Since listed on MEXC in 2022, COTI reached the highest price (ATH) of 0.008814 USDT, and the lowest price was 0.005094 USDT during the past 30 days.

How to buy RSR Token?

You can buy RSR on MEXC following the steps:

- Log in to your MEXC account and click [Trade]. Click on [Spot].

- Search “RSR” using the search bar to see the available trading pairs. Take RSR/USDT as an example.

- Scroll down and go to the [Spot] box. Enter the amount of RSR you want to buy. You can choose from opening a Limit order, a Market order, or a Stop-limit order. Take Market order as an example. Click [Buy RSR] to confirm your order. You will find the purchased RSR in your Spot Wallet.

Interested in crypto like RSR?

MEXC lists moonshot and provides access to trading of major crypto coins like RSR. Keep an eye on our listings in Innovation and Assessment zones and major tokens in the Main Zone – we have more great projects to come! Also, visit the hot projects section to find more hot tokens that were listed already. If you want to know more about crypto trading, visit MEXC Academy.

Join MEXC and Get up to $10,000 Bonus!

Sign Up